News from the South - Florida News Feed

“YOU ARE NOT HELPING” | Florida man asks FEMA members about their Helene response

SUMMARY: The speaker demands that contractors assist local residents and resolve ongoing issues. They insist on accountability and request the names and ID pictures of the contractors involved. The urgency is underscored by stating that the matter will escalate to the governor’s office if necessary. The speaker emphasizes that assistance must be provided to the residents and insists on action being taken to ensure their needs are met, expressing frustration over the lack of support they’ve received so far. They assert their determination to pursue the issue until it reaches the appropriate authorities for the residents’ benefit.

A Sunset Beach resident said that while he was walking back to his home to bring in supplies, items he left behind in his truck were stolen. As we were trying to get information, David Crump saw two members of FEMA and asked them questions about their response.

News from the South - Florida News Feed

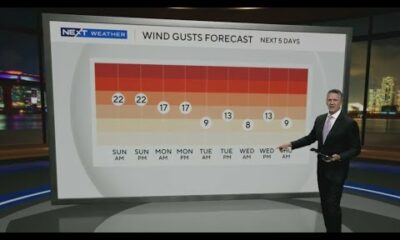

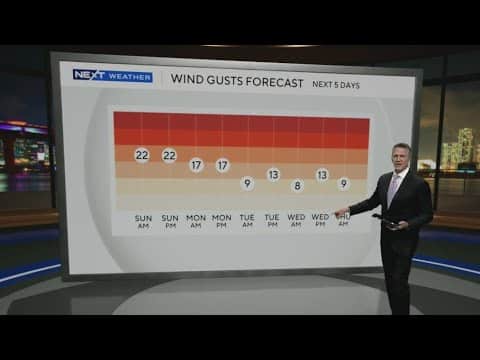

South Florida 11 p.m. Weather Forecast 4/20/2025

SUMMARY: The South Florida weather forecast for April 20, 2025, indicates a warm, breezy start to the week. Although wind speeds are expected to diminish, there remain red flags for high rip current risks and small craft advisories, particularly from Key West to West Palm Beach. Today’s gusts reached over 30 mph, pushing water along the coast. Overnight temperatures will drop to the mid-70s, with daytime highs around 84°F. While the breeze persists, it will calm midweek before returning by the weekend with a slight chance of showers. Overall, warm weather will continue throughout the week.

CBS News Miami’s NEXT Weather Meteorologist Dave Warren says to expect windy conditions to continue throughout Monday, bringing rough waters near the beach.

News from the South - Florida News Feed

New insurance company enters Florida market ahead of hurricane season

SUMMARY: A new insurance company, Patriot Select Property and Casualty Insurance, has entered the Florida market just before hurricane season, becoming the 12th company to do so since recent legislative reforms aimed at improving the industry. Florida’s Insurance Information Institute spokesman, Mark Friedlander, noted this expansion could lead to lower rates for consumers, with reports of reductions up to 50% on premiums. Founded by industry veterans with nearly $30 million in capital, Patriot Select aims to stabilize the previously unstable Florida insurance market, where many customers faced non-renewals. Consumers are encouraged to review their coverage annually for better options.

The post New insurance company enters Florida market ahead of hurricane season appeared first on www.news4jax.com

News from the South - Florida News Feed

Anti-Trump resistance sees another leader in Van Hollen as Democrats’ leadership carousel turns

SUMMARY: Maryland Senator Chris Van Hollen has become a prominent figure in the resistance against Donald Trump’s presidency. His recent trip to El Salvador to meet with Kilmar Abrego Garcia, who was wrongly deported, drew attention to the case and energized anti-Trump sentiment. While praised by some Democrats, Van Hollen’s actions faced criticism, particularly from Republicans, who attacked his focus on immigration and accused him of prioritizing illegal immigrants over U.S. citizens. Despite facing opposition, Van Hollen emphasized the importance of defending constitutional rights, asserting that depriving one person of rights endangers everyone’s freedoms.

The post Anti-Trump resistance sees another leader in Van Hollen as Democrats’ leadership carousel turns appeared first on www.clickorlando.com

Note: The following is not part of the original article, but is provided as a service to our readers –Staff Editor

Political Bias Assessment: This article reflects a Center-Left political leaning, focusing on progressive viewpoints and supporting actions against the Trump administration. It critiques some Democratic leaders while emphasizing the importance of defending constitutional rights. The tone remains moderate, presenting both criticism and support within the broader political debate.

-

News from the South - Alabama News Feed6 days ago

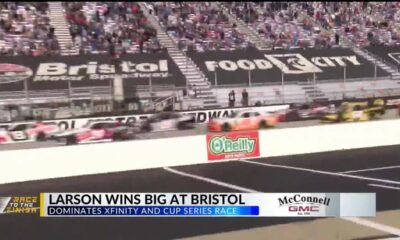

News from the South - Alabama News Feed6 days agoFoley man wins Race to the Finish as Kyle Larson gets first win of 2025 Xfinity Series at Bristol

-

News from the South - Alabama News Feed7 days ago

News from the South - Alabama News Feed7 days agoFederal appeals court upholds ruling against Alabama panhandling laws

-

News from the South - Missouri News Feed3 days ago

News from the South - Missouri News Feed3 days agoDrivers brace for upcoming I-70 construction, slowdowns

-

News from the South - North Carolina News Feed5 days ago

News from the South - North Carolina News Feed5 days agoFDA warns about fake Ozempic, how to spot it

-

News from the South - Virginia News Feed5 days ago

News from the South - Virginia News Feed5 days agoLieutenant governor race heats up with early fundraising surge | Virginia

-

News from the South - Arkansas News Feed7 days ago

News from the South - Arkansas News Feed7 days agoTwo dead, 9 injured after shooting at Conway park | What we know

-

Mississippi Today4 days ago

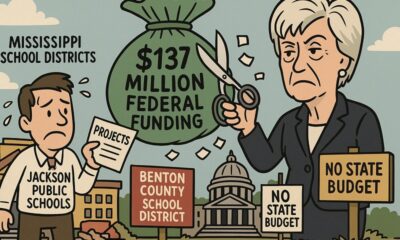

Mississippi Today4 days agoSee how much your Mississippi school district stands to lose in Trump’s federal funding freeze

-

News from the South - Missouri News Feed5 days ago

News from the South - Missouri News Feed5 days agoAbandoned property causing issues in Pine Lawn, neighbor demands action