Mississippi Today

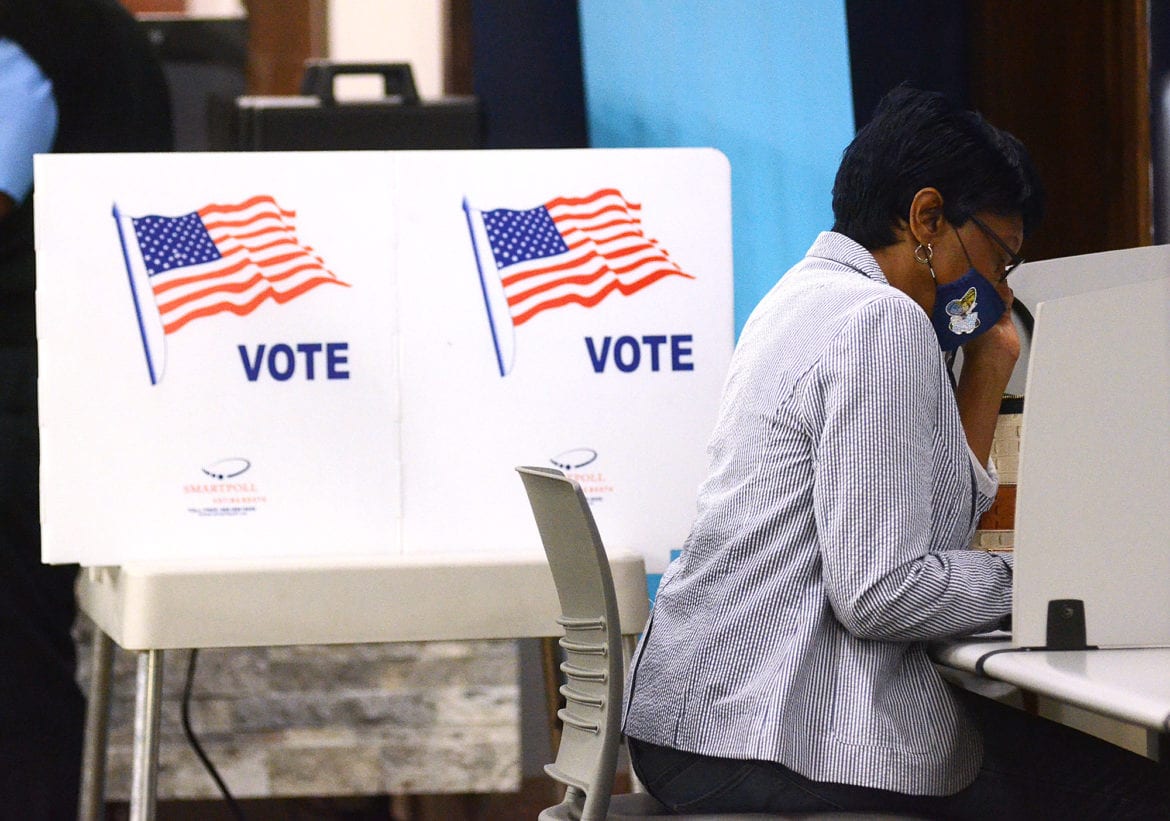

Voter purge, military rights, ballot harvesting: Where several Mississippi election bills stand

Voter purge, military rights, ballot harvesting: Where several Mississippi election bills stand

Mississippi lawmakers, in the final two weeks of the 2023 legislative session, will hammer out details of a major election bill that could, among other things, give state officials power to purge “inactive” voters from the registered voter rolls.

Two other major election bills have already passed and await signature or veto from Gov. Tate Reeves.

Mississippi Today compiled an update below of the bill that’s still alive and summaries of the two bills that have already been sent to the governor.

House Bill 1310

The Senate has stripped from an elections bill a House provision that restored voting rights to military veterans convicted of felonies.

The provision restoring suffrage to veterans who had completed their sentence was removed t in the Senate Elections Committee chaired by Sen. Jeff Tate, R-Meridian. The bill still provides a mechanism to remove registered voters from the rolls if they do not vote within a specified period of time or perform other functions related to their voter registration, such as responding to jury duty.

While the Senate removed the language giving the right to vote back to veterans, that language remains alive in the process as House and Senate leaders try to hammer out the differences between the two chambers on House Bill 1310.

But it is unlikely that the House leadership will try during the negotiations process to have the provision restoring voting rights to military veterans included in the final version of the bill. While the amendment restoring voting rights for veterans offered by Rep. Tommy Reynolds, D-Water Valley, was approved overwhelmingly by the full membership during a floor vote, it was opposed by House leaders.

Rep. Brent Powell, R-Brandon, is the lead author on the legislation and will be one of the leaders working to hammer out a difference between the House and Senate versions of the bill. He said the Senate contends the language granting voting rights to veterans is unconstitutional, though it has long been the policy of the Legislature and never challenged that voting rights could be restored to large groups of people, such as veterans, without changing the felony disenfranchisement language in the Mississippi Constitution. After World War II the Legislature did just that — restore voting rights to veterans — without amending the constitution.

“I will ask them (Senate negotiators) about it, but I am not really for it,” said Powell, who opposed restoring voting rights to veterans convicted of felonies when it was offered on the House floor.

Mississippi is one of a handful of states — fewer than 10 — that do not restore the right to vote to all people convicted of a felony at some point after they complete their sentence. A challenge to the felony disenfranchisement provision of the Mississippi Constitution is pending before the U.S. Supreme Court.

The portion of the bill that House and Senate leaders support would have the potential to remove registered voters from the poll books. Under the provision, people who do not vote during a two-year period will be placed on an inactive list and can only vote via affidavit, meaning election officials must take action to officially accept the ballot before it can be counted. To regain unencumbered voting rights, the person would have to take affirmative action, such as returning a confirmation card or responding to jury duty or voting during the next two years. If they do none of those things during the two-year period, they are removed from the rolls and must re-register to vote.

As the bill was debated, many Democrats and a handful of Republicans expressed reservations about removing people from the rolls for not voting. Sen. David Jordan, D-Greenwood, said legislative leaders were taking drastic action to remove people from the rolls without providing any examples of the voter fraud they were trying to prevent.

“The right to vote includes the right not to vote,” said Sen. David Blount, D-Jackson.

Tate said, “Every vote is precious. So one fraudulent vote is just as bad (or) as precious as one (good) vote. What we want to do is clean up the voter rolls. When we have people on the rolls by name only and they are not actually living there, that is a vessel for fraud. And yes, there is voter fraud. What this does is give our local election officials another tool to clean up their rolls.”

Sen. Hob Bryan, D-Amory, said there are many people who are on the rolls, but only vote on occasion.

He pointed out a predominantly African American precinct in Amory where normally between 400 and 500 people vote. But in 2008 when Barack Obama was running for president more than 800 turned out to vote in the election where an African American was elected president for the first time in the nation’s history.

“How could you tell those people they are not allowed to vote?” he asked. Bryan added he is sure the same phenomenon in different precincts happened when Donald Trump was on the ballot. He said there are registered voters who do not vote because they are not enamored by the candidates on the ballot, but they should not be denied the right to vote when they are excited by someone on the ballot.

He said the bill had the potential to hurt people who are registered and eligible to vote, but only do so sporadically.

The bill also gives Secretary of State Michael Watson the authority to perform election audits and submit reports in all 82 counties during two election cycles — the 2023 statewide election and 2024 presidential election.

Senate Bill 2358

Two other election bills already are heading to the governor, who is expected to sign them into law.

Senate Bill 2358, authored by Tate, would prohibit the practice of a third party collecting a voter’s absentee ballot and delivering it to a clerk’s office or voting precinct. In some states, this practice has become widespread and supporters of the ban say it opens the process to election fraud by campaign operatives harvesting absentee ballots.

But opponents of the measure, mostly Democrats in both chambers, said it’s aimed at voter suppression and is a solution looking for a problem that doesn’t exist in Mississippi. They also raised concerns it would stifle voting by the military, elderly people, people in nursing homes or disabled people who more often vote absentee.

If signed into law, the bill would only allow U.S. Postal Service or common carriers; election workers doing their official duties; or family, household members or caregivers of the absentee voter to deliver ballots.

Slightly different versions of the measure had passed the House 73-44, and Senate 37-15, on mostly party line votes.

Rep. Willie Bailey, D-Greenville, attempted to kill the bill with a motion on the House floor, saying, “This is a bad bill, people.”

“This is oppressing people’s rights to vote in a democracy,” Bailey said. “This is making innocent people criminals … Everybody stands up here and salutes any time you say military, but then this is going to hurt the military, senior citizens and disabled … What is wrong with us?”

House Bill 1306

A measure that passed Wednesday would prohibit people from being on the ballot for elected office in Mississippi if they have failed to file campaign finance reports. House Bill 1306 would require a candidate to have filed any required campaign finance reports for the last five years in order to be eligible to be on the ballot.

The measure also included a provision prohibiting any unauthorized person from requesting an absentee ballot for someone else — making it a voter fraud crime punishable by a fine of $500 to $5,000 or being jailed up to a year. This provision drew much debate before the House voted 73-37 to send it to the governor. The Senate had passed it 52-0.

Rep. John Hines, D-Greenville, questioned whether this measure is “an attempt to railroad people in nursing homes or who are disabled” or otherwise unable to get their own absentee ballot from voting. He questioned whether a nursing home director could get absentee ballots from a county clerk for residents of the home.

House Elections Chairman Price Wallace, R-Mendenhall, responded, “That is not the intent of this bill,” and said that if nursing home residents requested a director or other caregiver get them a ballot there would be no problem. “But if that person running that nursing home does that without them asking for it, it’s fraudulent.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Mississippi Today

‘You’re not going to be able to do that anymore’: Jackson police chief visits food kitchen to discuss new public sleeping, panhandling laws

Diners turned watchful eyes to the stage as Jackson Police Chief Joseph Wade took to the podium. He visited Stewpot Community Services during its daily free lunch hour Thursday to discuss new state laws, which took effect two days earlier, targeting Mississippians experiencing homelessness.

“I understand that you are going through some hard times right now. That’s why I’m here,” Wade said to the crowd. “I felt it was important to come out here and speak with you directly.”

Wade laid out the three bills that passed earlier this year: House Bill 1197, the “Safe Solicitation Act,” HB 1200, the “Real Property Owners Protection Act” and HB 1203, a bill that prohibits camping on public property.

“Sleeping and laying in public places, you’re not going to be able to do that anymore,” he said. “There’s a law that has been passed that you can’t just set up encampments on public or private properties where it’s a public nuisance, it’s a problem.”

The “Real Property Owners Protection Act,” authored by Rep. Brent Powell, R-Brandon, is a bill that expedites the process of removing squatters. The “Safe Solicitation Act,” authored by Rep. Shanda Yates, I-Jackson, requires a permit for panhandling and allows people to be charged with a misdemeanor if they violate this law. The offense is punishable by a fine not to exceed $300 and an offender could face up to six months in jail. Wade said he’s currently working with his legal department to determine the best strategy for creating and issuing permits.

“We’re going to navigate these legal challenges, get some interpretations, not only from our legal department, but the Attorney General’s office to ensure that we are doing it legally and lawfully, because I understand that these are citizens,” he said. “I understand that they deserve to be treated with respect, and I understand that we are going to do this without violating their constitutional rights.”

Wade said the Jackson Police Department is steadily fielding reports of squatters in abandoned properties and the law change gives officers new power to remove them more quickly. The added challenge? Figuring out what to do with a person’s belongings.

“These people are carrying around what they own, but we are not a repository for all of their stuff,” he said. “So, when we make that arrest, we’ve got to have a strategic plan as to what we do with their stuff.”

Wade said there needs to be a deeper conversation around the issues that lead someone to becoming homeless.

“A lot of people that we’re running across that are homeless are also suffering from medical conditions, mental health issues, and they’re also suffering from drug addiction and substance abuse. We’ve got to have a strategic approach, but we also can’t log jam our jail down in Raymond,” Wade said.

He estimates that more than 800 people are currently incarcerated at the Raymond Detention Center, and any increase could strain the system as the laws continue to be enforced.

“I think there’s layers that we have to work through, there’s hurdles that we are going to overcome, but we’ve got to make sure that we do it and make sure that my team and JPD is consistent in how we enforce these laws,” Wade said.

Diners applauded Wade after he spoke, in between bites of fried chicken, salad, corn and 4th of July-themed packaged cakes. Wade offered to answer questions, but no one asked any.

Rev. Jill Buckley, executive director of Stewpot, said that the legislation is a good tool to address issues around homelessness and community needs. She doesn’t want to see people who are homeless be criminalized, but she also wants communities to be safe.

“I support people’s right to self determine, and we can’t impose our choices on other people, but there are some cases in which that impinges on community safety, and so to the extent that anyone who is camping or panhandling or squatting and is a danger to themselves and others, of course, I fully support that kind of law. I don’t support homelessness being criminalized as such,” Buckley said.

Many of the people Wade addressed while they ate Thursday said they have housing, don’t panhandle, and shouldn’t be directly impacted by the legislation. But Marcus Willis, 42, said it would make more sense if elected officials wanted to combat the negative impacts of homelessness that they help more people secure employment.

“There ain’t enough jobs,” said Willis, who was having lunch with his girlfriend Amber Ivy.

The two live in an apartment together nearby on Capitol Street, where Ivy landed after her mother, whom Ivy had been living with, suffered a stroke and lost the property. Similarly, Willis started coming to eat at Stewpot after his grandmother, whose house he used to visit for lunch, passed away.

Willis holds odd jobs – cutting grass, home and auto repair – so the income is inconsistent, and every opportunity for stable employment he said he’s found is outside of Jackson in the suburbs. The couple doesn’t have a car.

Making rent every month usually depends on their ability to find someone to help chip in, said Ivy, who is in recovery from substance abuse. She said she’s watched problems surrounding homelessness grow over the years in Jackson. Ivy grew up near Stewpot and has lived in various neighborhoods across the city – except for the times she moved out of state when things got too rough.

“There was just moments where I just had to leave,” Ivy said. “Sometimes if you hit a slump here, there’s almost no way for you to get out of it.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post 'You're not going to be able to do that anymore': Jackson police chief visits food kitchen to discuss new public sleeping, panhandling laws appeared first on mississippitoday.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Right

This article primarily reports on new laws in Jackson, Mississippi, targeting public sleeping, panhandling, and squatting, focusing on statements by Police Chief Joseph Wade and community perspectives. The coverage presents the legislative measures—authored by Republican and independent lawmakers—with a tone that emphasizes law enforcement challenges and community safety, reflecting a conservative approach to homelessness as a public order issue. While it includes voices concerned about criminalization and the need for social support, the overall framing centers on law enforcement and property protection. The article maintains factual reporting without overt editorializing but leans slightly toward a center-right perspective by highlighting legal enforcement as a solution.

Mississippi Today

Medicaid cuts could be devastating for the Delta and the rest of rural America

Note: This story first published in Stateline, which is part of States Newsroom, the nation’s largest state-focused nonprofit news organization.

LAKE PROVIDENCE, La. — East Carroll Parish sits in the northeastern corner of Louisiana, along the winding Mississippi River. Its seat, Lake Providence, was a thriving agricultural center of the Delta. Now, the town is a shell of its former self. Charred and dilapidated buildings dot the small city center. There are a few gas stations, a handful of restaurants — and little to no industry.

Mayor Bobby Amacker, 79, says at one point “you couldn’t even walk down the street” in Lake Providence’s main business district because “there were so many people.”

“It’s gone down tremendously in the last 50 years,” said Amacker, a Democrat. “The town, it looks like it’s drying up. And it’s almost unstoppable, as far as I can tell.”

Now, East Carroll residents stand to lose even more. Like many people in Louisiana, they received a lifeline when the state expanded Medicaid to more low-income adults in 2016. Expansion drove Louisiana’s uninsured rate to the lowest in the Deep South, at 8% in 2023 for working-age adults, according to state data, despite it having the highest poverty rate in the U.S. that year.

This week, both chambers of Congress approved President Donald Trump’s “big, beautiful” tax and spending bill. It includes more than $1 trillion in cuts to Medicaid, the joint state-federal health insurance program for poor families and individuals, to help pay for tax cuts that mostly benefit the rich. The legislation would cause 11.8 million more Americans to become uninsured by 2034, according to the Congressional Budget Office.

The bill includes new work rules for Medicaid recipients and would require them to verify their eligibility more frequently. It also would limit a financing strategy that states have used to boost Medicaid payments to hospitals.

Republicans say enrollees are taking advantage of the Medicaid program and getting benefits when they shouldn’t be. They say the program costs too much and states are not paying their fair share.

The Delta region, which includes communities in both Louisiana and Mississippi, would suffer under such large cuts. But in Louisiana — where almost half of the state depended on Medicaid in 2023, the Louisiana Department of Health reported — the cuts could be ruinous. Louisiana could lose up to $35 billion in federal Medicaid support over the next decade, according to KFF, a health policy research group. Mississippi, which never expanded Medicaid, could still lose up to $5 billion.

Residents are watching with apprehension, fear and, sometimes, anger, wondering how Congress could be so blind to how much they are struggling.

“If they take that away from us and everyone that really needs it, that’s going to be bad,” said Sherila Ervin, who lives 20 minutes up the road from Lake Providence in Oak Grove and has Medicaid coverage.

Medicaid work requirements and other health care provisions in the bill ignore the reality of living in poorer rural communities, where people struggle to find the jobs, transportation and internet access required to meet the rules, according to interviews with people and providers in the Delta region.

Even though Louisiana and Mississippi have taken very different approaches to Medicaid — one expanded eligibility under the 2010 Affordable Care Act and the other didn’t — both rely heavily on the program to sustain access to medical care for all their residents.

On a hot summer day in June, Ervin walks into the bare-bones 99-cent store in downtown Lake Providence. As she looks over some clothing, she says she’s heard about the potential Medicaid cuts. But she hadn’t heard about the work requirements, and is shocked they’re even on the table.

“I don’t like that. I don’t think they should put a stipulation on that,” Ervin says, exasperated that she would have to report her work hours. It’s hard enough as it is, she says, to thrive in this community.

READ MORE: In the Deep South, health care fights echo civil rights battles

Ervin, 58, has been working at Oak Grove High School in the cafeteria, serving hot plates to children for two decades. She says it’s one of the good, steady jobs available in this area, but her income is only around $1,500 per month.

Ervin’s job offers health benefits, but she can’t afford the premiums on her salary. She relies on Medicaid for care, including medications for her high blood pressure.

In East Carroll Parish, around 46.5% of people live below the poverty level, meaning the area is overwhelmingly poor, at over four times the national poverty rate, with a median income of $28,321. For Black households, the figure is a mere $16,690.

Expansion was a lifeline for people such as Ervin. Louisiana offers Medicaid to people who earn below 138% of the federal poverty line — currently about $22,000 a year for an individual.

“Sometimes you can work, but then when you work, you still can’t pay to get help,” Ervin said.

It’s a similar economic situation an hour away across the river. Poverty is about three times the national rate in Washington County, Mississippi, where residents in the city of Greenville lament the consequences of not being able to avoid destructive medical debt, which can keep them stuck in a cycle of gig work and of living paycheck to paycheck.

Greenville, the county seat, is among the fastest-shrinking cities in the U.S. It’s still one of the larger rural cities in Mississippi, with coffee shops, restaurants, hotels, a regional hospital and several big-box stores. But the downtown has just a few small businesses and a bank, and residents say jobs are hard to find.

Greenville resident April McNair, 45, remembers giving birth 17 years ago, long before Mississippi extended postpartum Medicaid to a full year. She had Medicaid coverage during pregnancy, but was kicked off shortly after giving birth, despite having post-delivery complications.

The result was a trip to the emergency room and a $2,500 bill she couldn’t cover. Right after giving birth, McNair looked for work. She said potential employers often told her that she was overqualified because she had a master’s degree.

“I had to kind of figure out how to make my ends meet,” McNair said. “I ended up with a significant bill, all because I did not have Medicaid.”

McNair feels like Mississippi leaders are making a mistake by continuing to reject full Medicaid expansion.

“That’s a selfish move. To me, they’re selfish,” McNair said, adding that now she’s worried for neighbors in Louisiana who may lose the lifeline she wishes she had.

“God forbid, hypothetically speaking, what if one of them meets their demise because of this bill that [Congress] passed?”

Hard to thrive

Mississippi experienced its first taste of equalized access to medicine in the late 1960s.

Delta Health Center, the first federally funded health center in the nation, opened during the peak of the Civil Rights Movement in the all-Black town of Mound Bayou, about an hour north of Greenville. The center vowed to care for anyone regardless of race or ability to pay in a region plagued with poverty, poor health and discrimination — and continues to do so to this day.

It was a significant opportunity for generations of African Americans who had gone without health care, in a place where people had no access to clean drinking water, running sewage systems or even food, said Robin Boyles, chief program planning and development officer at Delta Health Center.

But it wasn’t easy for the clinic to mobilize support, even though it was clearly needed. Before its opening, it faced pushback from politicians and even doctors. In a 1966 clipping from a local newspaper, the white-owned Bolivar Commercial, the editorial board railed against the new clinic, saying it would “lead further to socialized medicine.”

The situation is certainly better in Mississippi and Louisiana than it was in the 1960s, but critics say the Medicaid cuts could reverse hard-fought progress.

People who live in the Delta are fiercely proud of their communities, but conditions there make it hard to thrive.

Black residents, who are the overwhelming majority, have had a particularly hard time. After the Civil War, many were relegated to sharecropping of cotton and corn for subsistence. Meanwhile, an elite white class of plantation owners and investors amassed enormous amounts of wealth.

A 2001 report from the U.S. Commission on Civil Rights described the area as one with “limited economic resources; inadequate employment opportunities; insufficient decent, affordable housing; and poor quality public schools.”

“We have a lot of patients that are one health issue away from either being out of a job or being bankrupt because of a trip to the emergency room,” said Dr. Brent Smith, a physician at a primary care clinic at Delta Health System in Greenville.

Even some of the most vulnerable people, such as new moms in Mississippi, still struggle to get basic care, in part because the state has left billions of dollars in federal funding for Medicaid expansion on the table, said Dr. Lakeisha Richardson, an OB-GYN at Delta Health System.

“There are a lot of maternal [care] deserts in Mississippi where women have to travel 60 miles or more just to get prenatal care and just to get to the closest hospital for delivery,” Richardson said. “And I don’t see that getting any better in Mississippi and in rural areas.”

Richardson says nearly all her patients are working moms, many of whom would really benefit from having Medicaid expansion.

“America doesn’t realize that there are people out here struggling for no reason of their own,” she said.

That’s why Medicaid expansion in Louisiana in 2016, much like the community health center movement in Mississippi, was a bright spot in the rural South, said Smith.

“Louisiana expanded Medicaid, a surprising move in the South to see any state expand,” Smith said. “They saw it for what it was, which was a very real opportunity to assist this specific group of patients.”

In Mississippi, 20 rural hospitals are at immediate risk of closure, according to a recent report, more than double the number at risk in Louisiana. In many cases, Medicaid is the largest and most reliable payer for rural hospitals. While Louisiana’s overall uninsured rate plummeted to 8.3% by 2023, in Mississippi it was 10.5%.

“Unlike a lot of our Southern peers, we have not had the same level of closures of facilities,” said Courtney Foster, senior policy adviser for Medicaid, with the nonprofit Invest in Louisiana.

“Medicaid was like a real lifeline for people in transition. Oftentimes it was people who had lost their jobs and were just looking to get back on their feet.”

Now, the new work and reporting requirements could put that progress at risk.

In East Carroll Parish, finding a job — let alone a good-paying one with health benefits — is difficult, says Rosie Brown, executive director at the East Carroll Community Action Agency, a nonprofit that helps low-income people with their rent and utility bills. Many of the jobs available in town pay minimum wage, just $7.25 an hour.

Brown loves living in Lake Providence; this is where her family is. She doesn’t want to move but wishes the government would invest more in her community — not take away benefits that help people who are hanging on by a thread.

“We have one bank. We have one supermarket,” she said. “Transportation isn’t easy either.”

Local infrastructure is so limited, she’s even heard of some people charging residents $20 for a ride to Walmart. Some people have to hitch a ride an hour away to go to work, she said.

“There’s nowhere to go,” Brown said.

Dominique Jones works at the local library, where she helps roughly 75 to 85 people per month apply for programs such as Medicaid and food assistance. Many of the residents she helps don’t have access to the internet or even a computer, a real barrier for people who’d be required to report their working hours to state Medicaid officials.

“This town right here is made up of a lot of old people that need Medicaid and Medicare. And without it, they wouldn’t have any kind of health care at all,” Mayor Amacker said.

Even a job in local government in Lake Providence doesn’t offer affordable health insurance.

Nevada Qualls, 25, sits across from Amacker’s office. She earns just $12 an hour as a cashier at city hall. The low pay means she qualifies for Medicaid expansion coverage, which is good because she can’t afford the premiums for private insurance.

“I feel like there should be a higher threshold for people that can get Medicaid, because they’re still struggling,” she said.

At the 99-cent store, school district worker Ervin wonders whether state and federal leaders understand what it’s like to live in her community, urging them to visit and see for themselves.

“They want to do stuff for the rich people that’s already rich,” she said. “What are they doing? It’s almost like there’s no common sense with them.”

‘The tremble factors’

While leaders in the U.S. Senate were working into the night this past weekend debating Trump’s tax and spending bill, Greenville resident Jennifer Morris was praying for the pain to stay away.

Morris, 44, has hemicrania continua, a headache disorder that causes constant pain on one side of her head. There’s no underlying trigger and no cure. Her doctors help her keep the pain to a minimum with regular treatments that include dozens of injections into her head.

“It doesn’t take the pain away,” she said during a late-night gathering in Greenville’s Greater Mount Olivet Missionary Baptist Church in June. “It does reduce the pain so that I’m able to function. But it’s rough.”

Morris is worried about the looming Medicaid cuts. She qualifies for Mississippi Medicaid because her condition counts as a disability, and she depends on the coverage to afford her medications.

Morris’ Medicaid may be safer than that of her Delta neighbors in Lake Providence, as some of the most dramatic Medicaid changes being considered — such as work requirements — target Medicaid expansion states only.

But Mississippi could be hurt by a provision in the Senate bill that would target a strategy states have used to boost the Medicaid dollars they get from the federal government.

Mississippi could see a major hit to its Medicaid funds, which “would be a tremendous decrease in revenue for the state,” harming “services and access to care,” says Mitchell Adcock, executive director at the Center for Mississippi Health Policy.

“It would be just the opposite of expansion. It would be a contraction for the Medicaid program in the state,” he said.

Leonard Favorite, a pastor who was attending the same event at Mount Olivet Church, as Morris, says he grew up on a plantation in Louisiana and worked his way out of poverty by joining the Air Force. This type of journey is hard, he said, when you’re already starting from so far behind. He thinks the “big, beautiful bill” will create more roadblocks for poor people.

READ MORE: Glaucoma-related vision loss is often preventable, but many can’t afford treatment

“You have people who are already living below the poverty line and they will certainly be submerged into poverty at unspeakable levels,” said Favorite, 70.“ That seems to be the trend of this administration from the point of view of looking from the outside.

“Poor people are beginning to feel the tremble factors of an administration that caters toward the rich.”

National researchers estimate that up to 132,000 Louisianans who gained health insurance under expansion could lose it under work rules.

But national reports that rely on census data likely underestimate the potential Medicaid losses. For example, while 2023 census data show 47% of East Carroll Parish was on Medicaid, state health data reviewed by Stateline and Public Health Watch suggests the number is more like 64%. Similarly statewide, census data showed about a third of Louisianans were on Medicaid. State data shows that percentage is closer to 46.5%.

Experts such as Joan Alker at the Georgetown Center for Children and Families say the undercounts nationally are a well-known issue among researchers, but it’s difficult to correct because the quality of state reporting can be so uneven.

State Medicaid funding is also at risk. For years, both Mississippi and Louisiana have relied on revenue generated through a financing tool — known as a provider tax — to draw down more federal dollars and boost Medicaid reimbursements to providers. But congressional Republicans hope to limit states’ ability to collect those taxes.

Depending on how Congress restricts provider taxes, Mississippi could lose hundreds of millions in federal Medicaid funding, crucial in a state with such a high uninsured rate, said Richard Roberson, president and CEO of the Mississippi Hospital Association.

“It’s unavoidable that when you’re taking that much money out of the system, that there’s not going to be some repercussions felt even in non-Medicaid expansion states like Mississippi,” Roberson said.

Last week, the Louisiana Hospital Association signed a statement calling the package of Medicaid cuts before Congress “historic in their devastation.”

From her small, sunny office in East Carroll Parish, nurse Jennifer Newton can’t understand the attacks on Medicaid.

Newton, who grew up one parish over in West Carroll, is executive director of the Family Medical Clinic, a community health center in Lake Providence and one of the few health providers in town. She says 50% of the clinic’s patients have Medicaid insurance.

Newton has worked in health care in the area for decades and watched as Medicaid expansion made it possible for more patients to access and afford health care they desperately needed, including preventive services. “It’s absolutely helped,” she said. “Absolutely.”

In 2015, the year before Louisiana expanded Medicaid, the uninsured rate among working-age adults in East Carroll Parish was nearly 35%. By 2021, that number was 12.7%.

“Why are we going back?” Newton asked. “We’ve made so much progress.”

Republican supporters of work requirements, including Louisiana representative and U.S. House Speaker Mike Johnson, argue they will encourage people to find jobs and ensure Medicaid goes to people who need it most. But according to KFF, a majority of Louisiana adults with Medicaid — 69% — already work.

Brian Blase, president of the Paragon Health Institute, a conservative policy group that is working with Republicans to formulate Medicaid cuts, is not concerned about eligible people losing coverage, as has happened under previous work requirement efforts. He says the bill has built in exceptions for certain people and requirements “can be met by not just work,” so “concerns seem pretty overstated.”

Medicaid recipients also can meet the requirement by volunteering or attending school for 80 hours per month.

“It’s hard for me to understand that there are areas in the country where there’s not jobs. There’s always work to be done,” Blase told Stateline. Blase said he believes Medicaid is “the government conditioning welfare for able-bodied working-age adults.”

But advocates and experts predict East Carroll, where internet access is notoriously bad, would experience results similar to when Arkansas instituted Medicaid work requirements in 2018: People disenrolled because of lack of awareness and confusion over the policy, as well as paperwork errors — not because they weren’t working enough.

“Unless the beneficiary can navigate that red tape, they’re going to lose coverage and become uninsured,” said Benjamin Sommers, a health economist at Harvard T.H. Chan School of Public Health.

Data shows Arkansas’ experiment did not increase employment, Sommers said, and instead led to more people reporting medical debt and delaying care because of cost.

‘Take a step back’

People in the Delta — where the legacy of government neglect and discrimination are all around — want politicians to visit their towns and see the barriers people face trying to improve their lives and stay healthy.

“People spent their lives uninsured,” said Amy Hale, a nurse practitioner at East Carroll Medical clinic. “Medicaid expansion allowed them to get in here and be treated.”

Lake Providence residents are scared they may find themselves in a similar situation as McNair and other people across the river in Greenville: working, uninsured, and too poor to access health care.

Recent estimates show up to 317,000 Louisianans could lose Medicaid health insurance under Trump’s tax bill. Nearly 33,000 in Mississippi.

“People are actually trying,” McNair said. “I really wish [lawmakers] would look at it from a different lens. What if it was their kid? Or they didn’t have the salaries they have now and your baby is ill. … Like really take a step back and think about what it is that you’re doing.”

This story is part of “Uninsured in America,” a project led by Public Health Watch that focuses on life in America’s health coverage gap and the 10 states that haven’t expanded Medicaid under the Affordable Care Act.

Stateline reporter Shalina Chatlani can be reached at schatlani@stateline.org. Public Health Watch reporter Kim Krisberg can be reached at kkrisberg@publichealthwatch.org.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post Medicaid cuts could be devastating for the Delta and the rest of rural America appeared first on mississippitoday.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

The article presents a clear perspective sympathetic to low-income and rural communities affected by Medicaid cuts. It highlights the hardships faced by residents in Louisiana’s and Mississippi’s Delta regions, emphasizing poverty, limited job opportunities, and the critical role Medicaid plays in health access. While it reports Republicans’ arguments for work requirements and cost control, the language and framing focus more on the negative consequences of cuts and the struggles of vulnerable populations. This tone and focus suggest a center-left bias, favoring expanded social safety nets and critical of policies perceived to harm the poor.

Mississippi Today

Mother calls for man exonerated of raping and murdering her child to go free

Prosecutors fighting the release of death row inmate Jimmie Duncan after a judge found him “factually innocent” of raping and murdering 23-month-old Haley Oliveaux are “not speaking for Haley’s family,” her mother says.

Speaking publicly for the first time, Allison Layton Statham called for Duncan to go free in a July 22 bail hearing. “This innocent man is on death row,” she told Mississippi Today. “Justice needs to be done.”

In April, a judge threw out Duncan’s conviction, questioning their conclusions and citing the failures of his court-appointed counsel.

Prosecutors have appealed the judge’s decision and are fighting his release on bail, saying Duncan poses both a flight risk and “a safety risk to not only the victim’s family, but also the general public.”

Statham disagreed and said she wants all of the evidence, including a sealed video of a bite-mark expert examining her child’s body, made available so that everyone can know the truth. “Authorities are still wanting to bury the truth,” she said. “What they did was railroad him.”

READ MORE: A March 2025 Verite News and ProPublica investigation into the Jimmie Duncan conviction

For a long time, Haley’s paternal aunt, Jennifer Berry, awaited word of Duncan’s execution, she said. “We’ve mourned quite a few people in our family, and we have never mourned like we mourned when that child died.”

Since talking with a documentary filmmaker in February and digging into the case, she believes he should go free. “I’ve been in turmoil since realizing this,” she said. “He’s a young man who was falsely accused of a crime he didn’t commit.”

She has petitioned prosecutors, the attorney general and the governor for a meeting but has yet to receive a reply.

The judge’s dismissal marks at least 10 wrongful convictions involving pathologist Dr. Steven Hayne, who has since died, or bite-mark expert Michael West, who once claimed he matched a suspect’s teeth to a half-eaten bologna sandwich. Eight of these wrongful convictions happened in Mississippi.

In 1994, the American Board of Forensic Odontology suspended West for a year for overstating credentials and misidentifying bite marks, and a dozen years later, he was forced to resign from the American Board of Forensic Pathology.

In 2008, the state of Mississippi barred Hayne from doing autopsies. He once wrote in his autopsy report about removing and examining a victim’s ovaries. The problem? The victim was male.

That same year, Levon Brooks and Kennedy Brewer were exonerated after spending a combined 30 years in prison. West’s bite-mark testimony helped convict Brooks of the rape-murder of a 3-year-old girl in Noxubee County. When another 3-year-old girl was raped and killed, West gave bite-mark testimony that helped lead to a death sentence for Brewer.

DNA discovered the truth: a serial killer had raped and murdered both girls. He confessed to his crimes, and Brooks and Brewer were freed.

It remains unknown how many other wrongful convictions these experts may have played a role in. Hayne once said he conducted up to 30,000 autopsies in Mississippi. West has said he analyzed more than 300 bite marks and investigated more than 5,000 deaths. He no longer believes bite marks should be used in court and did not respond to requests for comment on the dismissal of Duncan’s conviction.

Berry felt compelled to come forward now and call for a review of each case in Louisiana and Mississippi involving these discredited experts, she said. “Every case they put their fingers on needs to be reopened and examined.”

‘I wasn’t going to lie for them’

On the morning of Dec. 18, 1993, Statham said as she left for work Oliveaux was bouncing on her bed, tossing her “moo cow” in the air. She said she left her daughter in the care of the 25-year-old Duncan, whom she loved and had been living with for several months.

Duncan, who has maintained his innocence for more than three decades, told police he made Oliveaux oatmeal for breakfast and put her in the bathtub, where the water measured less than 3.5 inches. While doing dishes, he said he heard a noise and found her face down in the water. He said he grabbed her out of the tub and ran next door. The neighbors, paramedics and doctors were unable to save the life of Oliveaux, who had suffered recent seizures.

When Statham said she arrived at the emergency room, Duncan was distraught, apologizing over and over. Police charged Duncan with negligent homicide.

At the hospital, when West Monroe Police Detective Chris Sasser examined the body and saw the girl’s anus dilated and “laying open,” he concluded she “had been sodomized,” according to the police report. “It was a horrible sight.”

Rather than use a nearby pathologist, then-District Attorney Jerry Jones had the girl’s body transported two hours away to Mississippi for Hayne to do the autopsy. After the pathologist examined Oliveaux, he called in West to examine suspected bite marks.

Video captures West’s initial examination, starting at 9:35 p.m. He mentions a bruise on her left elbow, possible abrasions and contusions, and visible diaper rash. No mark can be seen on her cheek, and West makes no mention of one.

Twenty minutes later, Hayne telephoned Detective Sasser and said at about the time of the child’s death, she suffered lacerations and penetration to the anus, which the pathologist attributed to sexual assault, as well as multiple contusions to multiple surfaces on the body and lacerations and contusions to the scalp, according to the police report.

Hayne also said there were adult bite marks on the child made at or about the time of death and asked for the suspect’s dental molds.

After receiving this information, Sasser contacted a prosecutor, and the charge was upgraded to first-degree murder, which can carry a death penalty in Louisiana.

After the molds arrived the next day, the video resumed. West can be seen jamming a mold of Duncan’s teeth into the child’s cheek. West identified these as bite marks belonging to the suspect.

Hayne did the autopsy. He concluded that Haley’s death was a homicide, that her injuries suggested she had been sexually assaulted at or about the time of her death and that she had been forcibly drowned.

Other pathologists questioned Hayne’s conclusions. A rape kit came back negative. The Louisiana State Crime Lab tested Duncan’s clothing, the child’s clothing and her bath toys for any seminal fluid. There was none.

In the days following her daughter’s death, Statham said prosecutors called her into their office. She said they asked her if her daughter ever said or implied that Duncan wanted her to suck his penis like a baby bottle.

She told Mississippi Today that her toddler daughter could hardly speak. “She could say, ‘I want burgers,’ or ‘I want M&Ms,’” she said.

After she told them no, she said they replied, “If you don’t tell the truth, you could be implicated.”

She was 21 at the time. “My baby died, and the man I loved had been hauled off,” she said. “It was very intimidating. I was scared. But I wasn’t going to lie for them.”

Months later, police got a statement from jail inmate Michael Cruse. He quoted Duncan as saying the baby pointed at his penis and he said “something about a bottle or bobble.” Cruse later testified that Duncan said he blacked out and when he came to, he was trying to have sex with the baby and killed her because he “couldn’t get the baby to be quiet.”

To demonstrate his innocence, Duncan took a polygraph test. He reportedly showed no deception when he said he didn’t kill the child or hold her head underwater. Jurors never heard this, because polygraphs are inadmissible as evidence.

By the time the trial began in 1998, much of the important physical evidence was gone. The rape kit had been lost. So had Hayne’s autopsy slides. Samples of her blood that no one had tested for toxicology — a standard practice for autopsies — had been destroyed. So had Hayne’s detailed reports on his slides.

All that experts had available to examine were Hayne’s autopsy report and a few photos of the child’s body and injuries.

In his opening remarks at the 1998 murder trial, the district attorney said Duncan “rode that baby like a bull” and “in a sexual frenzy … bit her behind the ear … bit her elbow … She screamed, and she died in a bathtub full of water so bloody you couldn’t see the bottom.”

With West’s credentials now under question, prosecutors relied on another expert, who looked at West’s photos and identified Duncan as the one who made bite marks on the child. That expert didn’t see West’s video. Neither did the defense experts. Neither did the jury.

Hayne backed up the prosecution theory that Duncan drowned the child to cover up his sexual assault. He told jurors the bruise on her head was “consistent with a digit, such as a thumb or finger, pressing down on the back of the head.”

Asked if the child could have suffered a seizure, Hayne said no because “the brain showed no sign of seizure activity.”

Hayne testified that the child wouldn’t have survived her anal injuries, and another doctor told jurors there would have been so much blood, it would be like someone having their head cut off.

But police never found a drop of blood anywhere in the house, never found any evidence of cleaning. The detective later said if there had been any blood or semen at the scene, they would have discovered it.

Hayne testified that fragmented tomato, pickle and onion were in the child’s stomach, but no oatmeal — a detail prosecutors seized on as proof that Duncan concocted this cover story to conceal his horrific crime.

When police arrived, they found oatmeal in the kitchen, in the bathtub and on Duncan’s clothing. The neighbor saw uncooked oatmeal when he cleared Oliveaux’s throat before performing CPR.

The prosecutors told jurors the uncooked oatmeal was proof he planted it.

The jury convicted Duncan and sentenced him to death.

‘Bad medicine, bad science and bad lawyering’

Tucker Carrington, who wrote a book on Hayne and West with journalist Radley Balko, “The Cadaver King and the Country Dentist,” said the Louisiana case bears similarities to the case of Jeffrey Havard, convicted of capital murder for allegedly raping and killing an infant in Natchez in 2002, thanks to Hayne’s testimony.

Havard has said he was bathing his girlfriend’s 6-month-old baby, Chloe Britt, when she slipped from his hands and hit her head on the toilet.

But as in Duncan’s case, law enforcement officers thought the baby had been sexually assaulted. At trial, a parade of doctors and nurses testified about anal rips and tears they saw, describing the worst anal trauma they had seen, and prosecutors called Havard a monster.

The autopsy report, however, showed no such damage, only anal dilation and a small contusion. The rape kit came back negative.

Despite that, Hayne’s testimony backed the prosecution’s theory of sexual assault, and Havard was sentenced to Mississippi’s death row.

After examining the case, renowned pathologist Dr. Michael Baden concluded that Britt’s injuries were consistent with her being accidentally dropped and that she wasn’t sexually assaulted. “Dilation of the anus occurs normally in children when they die as muscles relax and when seen by a casual observer can be misinterpreted as evidence of perimortem penetration,” he said.

Other pathologists agreed with Baden that the anal dilation had been misread as abuse, and in 2014, Hayne told a reporter he didn’t believe a rape took place. He said the anal contusion could have resulted from a bowel movement.

He originally testified that the baby had died from shaken baby syndrome. Now he said he didn’t believe that was true because science had since determined such conclusions were flawed.

At least 37 people have been exonerated in shaken baby cases after being wrongly imprisoned, according to the National Registry of Exonerations.

After a three-day hearing where the defense called Hayne to testify, the trial judge reduced Havard’s sentence from death to life. His appeal for freedom is now pending in U.S. District Court.

Havard’s lawyer, Graham Carner of Jackson, said the case is filled with “bad medicine, bad science and, frankly, bad lawyering.”

After a three-day hearing where the defense called Hayne to testify, the trial judge reduced Havard’s sentence from death to life. His appeal for freedom is now pending in U.S. District Court.

“Innocence is different than not guilty, and innocence is different than you didn’t get a fair trial,” Carner said, “but I believed as soon as I dug into Jeffrey’s case that he was an innocent man and I believe that to this day.”

‘Science, like law, evolves over time’

The damage that Hayne and West have done to Mississippi is immense, said former state Supreme Court Justice Oliver Diaz Jr., and he is stunned the state has never reviewed their cases for possible wrongful convictions.

“They operated in Mississippi for years unchecked,” he said. “Mississippi used Hayne as the state medical examiner, even though he did not meet the statutory qualifications.”

Hayne’s testimony helped convict Tyler Edmonds, who was just 13 when he falsely confessed that he and his half-sister had both killed her husband. He said she had told him she would “fry,” but he would go unpunished.

At trial, Hayne testified that the fatal wound was consistent with two people pulling the trigger, saying, “I can’t exclude one [shooter], but I think that would be less likely.”

The Mississippi Court of Appeals concluded such testimony was scientifically unfounded: “You cannot look at a bullet wound and tell whether it was made by a bullet fired by one person pulling the trigger or by two persons pulling the trigger simultaneously.”

Diaz said Hayne’s testimony prompted him to dig deeper. “Two hands on a trigger? You don’t have to do any research to know that’s ridiculous,” he said. “That’s what led me to look at Hayne closer.”

What he found was disturbing. He didn’t realize Hayne was essentially acting as state medical examiner, but he wasn’t a board-certified pathologist.

Diaz wound up writing a scathing dissent centered on the pathologist that prompted other justices to change their minds, he said. “As science, like the law, evolves over time, one generation’s expert is another’s quack.”

He now regrets the first vote he cast on the high court, a death penalty case that relied on the words of Hayne and West, he said. “Based upon their testimony, my first Supreme Court vote was to execute an innocent man, Kennedy Brewer.”

He and other justices later supported the dismissal of Brewer’s conviction, and his last opinion called for the end of the death penalty. “It’s not a workable system when errors like this can take place,” he said. “No matter how careful we are, we’re going to vote to execute innocent people.”

What the jury never heard

In November 1993, Statham brought her daughter twice to the hospital for seizures after she stopped breathing. One doctor suggested she could be suffering from Stevens-Johnson Syndrome, a potentially life-threatening reaction, often to medication, that can cause lesions in the mouth and the genital area. The disease can also cause seizures.

Nearly three weeks before her death, a chest of drawers fell on Haley, who suffered three skull fractures and a subdural hematoma that caused her to spend six days in the hospital. Duncan and Statham told child social services that she had been climbing to reach her piggy bank.

But the jury never heard about this serious injury because of a deal that Duncan’s original lawyers made with prosecutors.

Pathologists say it’s critical to know everything possible about a person’s medical history before drawing conclusions about a death. Testimony shows police knew Oliveaux’s medical history, but it remains unclear if Hayne knew that history before concluding she had been raped and killed.

In a six-day hearing last September, two pathologists called Hayne’s conclusions unfounded, said they saw no evidence of a rape or homicide, and believed Haley drowned accidentally, perhaps after suffering a seizure.

In one sworn statement, former jail inmate Michael Lucas said he heard Duncan tell Cruse that he didn’t kill the toddler. An investigator testified that Cruse now admits he lied at the 1998 trial because he wanted leniency for the felony he was facing.

Duncan’s lawyers told those at the hearing that they planned to show West’s video involving Haley, warning that it was graphic and disturbing. An excerpt of that video had first surfaced in 2009 when the Reason website published it. The video appalled many in the legal and forensic science communities.

The video showed West jamming, dragging and scraping Duncan’s dental mold across the child’s body dozens of times. Some of those in the courtroom gasped, some covered their eyes, and others, including Duncan, wiped away tears.

After seeing the video, Lowell Levine, past president of the American Board of Forensic Odontology, called what West did “fraud.”

In 2009, the National Academy of Sciences concluded there was no basis in science for forensic odontologists to conclude a person is “the biter” to the exclusion of all other suspects.

Adam Freeman, past president of the American Board of Forensic Odontology, testified that the bite marks identified on Haley weren’t bite marks at all. He called these determinations “junk science” that can’t be defended scientifically.

In 2015, he helped conduct a study on the reliability of bite marks. In all but a few cases, board-certified dentists couldn’t even agree if they were looking at a bite mark. As a result, he resigned from leadership in protest and stopped doing any bite-mark analysis.

Nationwide, at least 34 wrongful convictions have occurred since 1989 because of bite marks, six of them in Mississippi that all involve West, according to the National Registry of Exonerations.

Dr. Robert Bux, who served as chief medical examiner for the El Paso County Coroner’s Office in Colorado Springs, questioned how Hayne could say the child’s injuries matched shoving her face underwater.

If that were so, “I’d expect to see injuries on the front part of her body, particularly on her forehead or nose, cheeks, anterior parts of shoulders, anterior parts of the knees,” said Bux, who helped investigate Pat Tillman’s death in Afghanistan.

The autopsy showed lacerations to the anus. Bux said these could have been caused by an infection, a diaper rash, a hard stool or vigorous washing. “There’s no way to know. You have to look at it microscopically, and it wasn’t looked at,” he said.

Up until 2007 or so, people believed anal dilation proved sexual abuse, he said. “A dilated anus means nothing. We saw it all the time in adults and children.”

The lack of blood at the scene suggests something other than a violent assault, he said. “It’s absolutely bloodless. I mean where is the blood in the sink? Where’s the blood on the victim?”

He rejected the claim by Hayne that the child stopped bleeding because she was dead. Blood gives way to gravity, he said. “It’ll come out drip, drip, drip, so, you’re going to see it, and you’re going to see it for hours, and you’re going to see it for days. I don’t think you can just wash that off because it’s going to continue to ooze after she’s dead.”

Her death appears to be “a tragic accident of drowning,” he said. “I don’t see any evidence to me that would support that it was forced.”

She drowned, possibly because she suffered another seizure, he said, “but I can’t prove that because Hayne didn’t do any investigation that would help us on that.”

Hayne’s lack of research and examination prompted Duncan’s lawyers to twice ask for the exhumation of Oliveaux’s body before the 1998 trial. The judge denied the requests.

Her mother said if her daughter’s body needs to be exhumed to answer any questions, she supports that. “It might give us some answers to what happened then,” Statham said.

If prosecutors win their appeal, Duncan would remain on death row and face execution. ProPublica and Verite News reported that Duncan’s bid for freedom has become more urgent with Louisiana Gov. Jeff Landry pushing for executions. In March, Louisiana held its first execution in 15 years, using nitrogen oxide to put Jessie Hoffman Jr. to death.

If Duncan faced another trial, jurors would hear a much different story, his lawyers said. “Rather than the State’s sensational story of pure horror — including rape, biting, blackouts, a panicked forcible drowning, and a cover-up involving massive quantities of blood that Mr. Duncan, cold and calculating, cleaned up before seeking help for the child — the jury would instead hear the true story: Haley tragically but accidentally drowned in the bathtub.”

After the 1998 trial, Statham spiraled downward. She could have survived her daughter’s death, but surviving this horror story proved nearly impossible, she said.

Duncan’s conviction didn’t just destroy his life, she said. “All of our families were destroyed by this. We’re still collateral damage in this.”

Catherine Legge is an award-winning documentary filmmaker who lives in Toronto. Formerly executive producer of original video for GEM, she also spent two decades traveling around the world as a documentary director at CBC. Her indie films under her banner Play Nice Productions have been shown in 250+ countries including “The Unsolved Murder of Beverly Lynn Smith,” “Met While Incarcerated/From Prison With Love,” and “Billion Dollar Caribou.” Her current film and podcast “The Murder That Never Happened” takes place on death row in Louisiana.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post Mother calls for man exonerated of raping and murdering her child to go free appeared first on mississippitoday.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Centrist

The article reports on the legal case of Jimmie Duncan without taking a partisan stance, focusing on facts, court proceedings, and statements from both supporters and prosecutors. It presents perspectives from the victim’s family members advocating for Duncan’s release and from prosecutors opposing it, as well as critiques of forensic experts involved. The language is measured and fact-based, avoiding emotive or loaded terms that suggest ideological bias. The article highlights systemic issues in forensic science and wrongful convictions but does so through documented evidence and expert opinions, maintaining a neutral tone overall.

-

News from the South - Louisiana News Feed6 days ago

Attorneys who run public defender offices replaced amid contract turmoil

-

News from the South - Alabama News Feed6 days ago

Gov. Kay Ivey expected to name Alabama parole board pick in coming days

-

News from the South - Georgia News Feed6 days ago

Officials report average eagle nesting season in coastal Georgia, nearly 200 eaglets fledged statewide

-

Local News7 days ago

Mississippi’s new seafood labeling law takes effect July 1

-

News from the South - Florida News Feed7 days ago

US Senate after overnight debate unable to gain enough votes yet to pass GOP megabill

-

News from the South - Arkansas News Feed3 days ago

Real-life Uncle Sam's descendants live in Arkansas

-

News from the South - Kentucky News Feed6 days ago

In small-town Kentucky, finding ‘all the more reason to resist’

-

Mississippi Today6 days ago

Trump nominates Baxter Kruger, Scott Leary for Mississippi U.S. attorney posts