Mississippi Today

Senate kills Mississippi ballot initiative without a vote

Senate kills Mississippi ballot initiative without a vote

The Senate on Thursday let a measure that would restore voters’ right to sidestep the Legislature and put measures on a statewide ballot die without taking a vote.

“After yesterday, I spoke to my colleagues and the colleagues I spoke to did not show enough support to do this this year,” said Senate Accountability Efficiency and Transparency Chairman John Polk, R-Hattiesburg. “… We have a representative form of government that has worked for a long time, and I know of no senator who will not accept constituents’ calls, emails or visits if they have an issue we need to deal with. I believe in our representative form of government, and voters every four years have the opportunity to change who represents them.”

Polk said there were too many differences between versions of the measure the Senate and House had passed to be ironed out in the final days of this year’s legislative session. Thursday was a deadline day for senators to take up the measure, and inaction killed the legislation.

Polk said that despite recent polling that shows strong voter support for reinstating the initiative process, he doesn’t believe the right to ballot initiative is top of mind for most Mississippians. He said he noticed this last week when he talked with constituents at a veterinarian’s office back home. They gave him a litany of issues they saw as important, Polk said.

“You know what was not on that list?” Polk said. “Ballot initiative.”

A similar measure died in the Legislature without a final vote last year, after the state Supreme Court in 2021 shot down the ballot initiative right Mississippi voters had for three decades.

Lt. Gov. Delbert Hosemann, who oversees the Senate, initially declined comment after the Senate adjourned Thursday, indicating he was busy and “not right now.” Polk, speaking to media, said that Hosemann had been “very vocal in wanting a ballot initiative” but lets his chairman make their own decisions.

Hosemann later sent out a written statement: “I have consistently said I am in favor of an initiative process in Mississippi. I trust the voters of the state, both in who they elect to office and on policy matters. A number of Republicans in the Senate have a different opinion on the initiative issue. This is the legislative process and we will continue that process.”

But many political observers and supporters of restoring the initiative had questioned Hosemann’s support for it, given he assigned the measure to Polk’s committee again this year after Polk had publicly voiced misgivings about reinstating ballot initiative.

READ MORE:Is ballot initiative a ‘take your picture off the wall’ issue for lawmakers?

Many Mississippians were angry when the state’s high court stripped voters of this right in 2021. This was in a ruling on a medical marijuana initiative voters had overwhelmingly passed, taking matters in hand after lawmakers had dallied for years on the issue. Legislative leaders were quick at the time with vows they would restore this right to voters, fix the legal glitches that prompted the Supreme Court to rule it invalid. Many lawmakers said they support the right.

Rep. Zakiya Summers, D-Jackson, said she was stunned to hear the Senate let the measure die Thursday without inviting more debate with the House on a compromise version. She disagrees with Polk about it not being a big issue with voters.

“My constituents think it’s necessary,” Summers said. “… People have issues they believe we are not addressing or listening to them on, like early voting, Medicaid expansion. Those are issues Mississippians are concerned about and when we don’t bring them to the forefront because of politics, they need to have this right to address them. Now we have to wait another year to do this.”

READ MORE:Bill restoring ballot initiative remains alive, though some say it ‘stifles’ Mississippi voters

The House and Senate versions of the measure, which would have required ratification by voters in November, differed. But both would have greatly restricted voters’ right to ballot initiative compared to the process that had been in place since 1992. Many supporters of restoring the right have been angered about legislative leaders’ proposals to date. In the House, most Democrats despite supporting restoration of the right voted “present” on the House version they found it so restrictive.

The Senate position on the initiative would require the signatures of at least 240,000 registered voters to place an issue on a statewide ballot. The House version would require about 106,000, nearer the previous threshold required for the last 30 years.

Under both proposals, the Legislature by a simple majority vote could change or repeal an initiative approved by the electorate. Unlike the previous process voters had for decades, voters could only pass or change state laws, not the state constitution.

Polk said he “could not get close to” agreeing on the lower number of signatures in the House proposal, and doubted the House would agree to his higher threshold. He said the House also had made a change he found untenable that he just noticed in recent days: It removed a prohibition on using a ballot initiative to change Mississippi’s position as a “right to work” state, which generally keeps labor unions weak in such states.

“That was disturbing to me,” Polk said.

A recentMississippi Today/Siena College pollshows Mississippi voters across the spectrum want their right to put issues directly on a statewide ballot restored.

The poll showed 72% favor reinstating ballot initiative, with 12% opposed and 16% either don’t know or have no opinion. Restoring the right garnered a large majority among Democrats, Republicans, independents and across all demographic, geographic and income lines.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Mississippi Today

Speaker White wants Christmas tree projects bill included in special legislative session

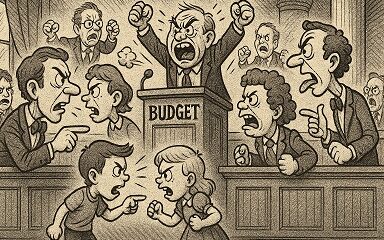

House Speaker Jason White sent a terse letter to Lt. Gov. Delbert Hosemann on Thursday, saying House leaders are frustrated with Senate leaders refusing to discuss a “Christmas tree” bill spending millions on special projects across the state.

The letter signals the two Republican leaders remain far apart on setting an overall $7 billion state budget. Bickering between the GOP leaders led to a stalemate and lawmakers ending their regular 2025 session without setting a budget. Gov. Tate Reeves plans to call them back into special session before the new budget year starts July 1 to avoid a shutdown, but wants them to have a budget mostly worked out before he does so.

White’s letter to Hosemann, which contains words in all capital letters that are underlined and italicized, said that the House wants to spend cash reserves on projects for state agencies, local communities, universities, colleges, and the Mississippi Department of Transportation.

“We believe the Senate position to NOT fund any local infrastructure projects is unreasonable,” White wrote.

The speaker in his letter noted that he and Hosemann had a meeting with the governor on Tuesday. Reeves, according to the letter, advised the two legislative leaders that if they couldn’t reach an agreement on how to disburse the surplus money, referred to as capital expense money, they should not spend any of it on infrastructure.

A spokesperson for Hosemann said the lieutenant governor has not yet reviewed the letter, and he was out of the office on Thursday working with a state agency.

“He is attending Good Friday services today, and will address any correspondence after the celebration of Easter,” the spokesperson said.

Hosemann has recently said the Legislature should set an austere budget in light of federal spending cuts coming from the Trump administration, and because state lawmakers this year passed a measure to eliminate the state income tax, the source of nearly a third of the state’s operating revenue.

Lawmakers spend capital expense money for multiple purposes, but the bulk of it — typically $200 million to $400 million a year — goes toward local projects, known as the Christmas Tree bill. Lawmakers jockey for a share of the spending for their home districts, in a process that has been called a political spoils system — areas with the most powerful lawmakers often get the largest share, not areas with the most needs. Legislative leaders often use the projects bill as either a carrot or stick to garner votes from rank and file legislators on other issues.

A Mississippi Today investigation last year revealed House Ways and Means Chairman Trey Lamar, a Republican from Sentobia, has steered tens of millions of dollars in Christmas tree spending to his district, including money to rebuild a road that runs by his north Mississippi home, renovate a nearby private country club golf course and to rebuild a tiny cul-de-sac that runs by a home he has in Jackson.

There is little oversight on how these funds are spent, and there is no requirement that lawmakers disburse the money in an equal manner or based on communities’ needs.

In the past, lawmakers borrowed money for Christmas tree bills. But state coffers have been full in recent years largely from federal pandemic aid spending, so the state has been spending its excess cash. White in his letter said the state has “ample funds” for a special projects bill.

“We, in the House, would like to sit down and have an agreement with our Senate counterparts on state agency Capital Expenditure spending AND local projects spending,” White wrote. “It is extremely important to our agencies and local governments. The ball is in your court, and the House awaits your response.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

Mississippi Today

Advocate: Election is the chance for Jackson to finally launch in the spirit of Blue Origin

Editor’s note: This essay is part of Mississippi Today Ideas, a platform for thoughtful Mississippians to share fact-based ideas about our state’s past, present and future. You can read more about the section here.

As the world recently watched the successful return of Blue Origin’s historic all-women crew from space, Jackson stands grounded. The city is still grappling with problems that no rocket can solve.

But the spirit of that mission — unity, courage and collective effort — can be applied right here in our capital city. Instead of launching away, it is time to launch together toward a more just, functioning and thriving Jackson.

The upcoming mayoral runoff election on April 22 provides such an opportunity, not just for a new administration, but for a new mindset. This isn’t about endorsements. It’s about engagement.

It’s a moment for the people of Jackson and Hinds County to take a long, honest look at ourselves and ask if we have shown up for our city and worked with elected officials, instead of remaining at odds with them.

It is time to vote again — this time with deeper understanding and shared responsibility. Jackson is in crisis — and crisis won’t wait.

According to the U.S. Census projections, Jackson is the fastest-shrinking city in the United States, losing nearly 4,000 residents in a single year. That kind of loss isn’t just about numbers. It’s about hope, resources, and people’s decision to give up rather than dig in.

Add to that the long-standing issues: a crippled water system, public safety concerns, economic decline and a sense of division that often pits neighbor against neighbor, party against party and race against race.

Mayor Chokwe Antar Lumumba has led through these storms, facing criticism for his handling of the water crisis, staffing issues and infrastructure delays. But did officials from the city, the county and the state truly collaborate with him or did they stand at a distance, waiting to assign blame?

On the flip side, his runoff opponent, state Sen. John Horhn, who has served for more than three decades, is now seeking to lead the very city he has represented from the Capitol. Voters should examine his legislative record and ask whether he used his influence to help stabilize the administration or only to position himself for this moment.

Blaming politicians is easy. Building cities is hard. And yet that is exactly what’s needed. Jackson’s future will not be secured by a mayor alone. It will take so many of Jackson’s residents — voters, business owners, faith leaders, students, retirees, parents and young people — to move this city forward. That’s the liftoff we need.

It is time to imagine Jackson as a capital city where clean, safe drinking water flows to every home — not just after lawsuits or emergencies, but through proactive maintenance and funding from city, state and federal partnerships. The involvement of the U.S. Environmental Protection Agency in the effort to improve the water system gives the city leverage.

Public safety must be a guarantee and includes prevention, not just response, with funding for community-based violence interruption programs, trauma services, youth job programs and reentry support. Other cities have done this and it’s working.

Education and workforce development are real priorities, preparing young people not just for diplomas but for meaningful careers. That means investing in public schools and in partnerships with HBCUs, trade programs and businesses rooted right here.

Additionally, city services — from trash collection to pothole repair — must be reliable, transparent and equitable, regardless of zip code or income. Seamless governance is possible when everyone is at the table.

Yes, democracy works because people show up. Not just to vote once, but to attend city council meetings, serve on boards, hold leaders accountable and help shape decisions about where resources go.

This election isn’t just about who gets the title of mayor. It’s about whether Jackson gets another chance at becoming the capital city Mississippi deserves — a place that leads by example and doesn’t lag behind.

The successful Blue Origin mission didn’t happen by chance. It took coordinated effort, diverse expertise and belief in what was possible. The same is true for this city.

We are not launching into space. But we can launch a new era marked by cooperation over conflict, and by sustained civic action over short-term outrage.

On April 22, go vote. Vote not just for a person, but for a path forward because Jackson deserves liftoff. It starts with us.

Pauline Rogers is a longtime advocate for criminal justice reform and the founder of the RECH Foundation, an organization dedicated to supporting formerly incarcerated individuals as they reintegrate into society. She is a Transformative Justice Fellow through The OpEd Project Public Voices Fellowship.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.![]()

Mississippi Today

On this day in 1959, students marched for integrated schools

April 18, 1959

About 26,000 students took part in the Youth March for Integrated Schools in Washington, D.C. They heard speeches by Martin Luther King Jr., A. Phillip Randolph and NAACP leader Roy Wilkins.

In advance of the march, false accusations were made that Communists had infiltrated the group. In response, the civil rights leaders put out a statement: “The sponsors of the March have not invited Communists or communist organizations. Nor have they invited members of the Ku Klux Klan or the White Citizens’ Council. We do not want the participation of these groups, nor of individuals or other organizations holding similar views.”

After the march, a delegation of students went to present their demands to President Eisenhower, only to be told by his deputy assistant that “the president is just as anxious as they are to see an America where discrimination does not exist, where equality of opportunity is available to all.”

King praised the students, saying, “In your great movement to organize a march for integrated schools, you have awakened on hundreds of campuses throughout the land a new spirit of social inquiry to the benefit of all Americans.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.![]()

-

Mississippi Today6 days ago

Mississippi Today6 days agoOn this day in 1873, La. courthouse scene of racial carnage

-

Local News6 days ago

Local News6 days agoAG Fitch and Children’s Advocacy Centers of Mississippi Announce Statewide Protocol for Child Abuse Response

-

Mississippi Today6 days ago

Mississippi Today6 days agoLawmakers used to fail passing a budget over policy disagreement. This year, they failed over childish bickering.

-

Local News6 days ago

Local News6 days agoSouthern Miss Professor Inducted into U.S. Hydrographer Hall of Fame

-

News from the South - Alabama News Feed4 days ago

News from the South - Alabama News Feed4 days agoFoley man wins Race to the Finish as Kyle Larson gets first win of 2025 Xfinity Series at Bristol

-

News from the South - Alabama News Feed4 days ago

News from the South - Alabama News Feed4 days agoFederal appeals court upholds ruling against Alabama panhandling laws

-

News from the South - North Carolina News Feed7 days ago

News from the South - North Carolina News Feed7 days agoHelene: Renewed focus on health of North Carolina streams | North Carolina

-

Our Mississippi Home7 days ago

Our Mississippi Home7 days agoFood Chain Drama | Our Mississippi Home