News from the South - Missouri News Feed

Republicans vow action after judge’s ruling allows abortion to resume in Missouri

Republicans vow action after judge’s ruling allows abortion to resume in Missouri

by Anna Spoerre, Missouri Independent

February 17, 2025

Fifty years of anti-abortion laws in Missouri have been struck down as unconstitutional over the last two months, culminating Friday with a Jackson County judge blocking clinic licensing requirements.

Three days later, Republican lawmakers and anti-abortion activists gathered outside Planned Parenthood locations across the state to say they have no intention of retreating.

“I’m here to tell you the Missouri supermajority of Republicans will not stand for this,” said state Sen. Mary Elizabeth Coleman, an Arnold Republican and one of the architects of the legislation that made Missouri the first state to outlaw abortion in June 2022 after Roe v. Wade was overturned.

“There will be another option to vote,” she predicted Monday, “so that people understand this is not going to continue in the state of Missouri.”

Coleman said Attorney General Andrew Bailey is expected to appeal Jackson County Circuit Court Judge Jerri Zhang’s decision, though none was filed as of Monday afternoon. A spokeswoman for the attorney general’s office did not respond to a request for comment.

In the meantime, a Planned Parenthood clinic in Kansas City on Saturday performed the first elective abortion since voters overturned Missouri’s abortion ban by passing Amendment 3 in November.

Missouri Republicans have filed three dozen bills seeking to either repeal or rein in Amendment 3. So far, the House has prioritized a proposed constitutional amendment that would reinstate an abortion ban but create exceptions for survivors of rape and incest, as long as they report the crime to police.

Senate Democrats have threatened to filibuster any effort to overturn the voter-approved amendment legalizing abortion.

In addition to GOP lawmakers seeking to put abortion back on the statewide ballot, Coleman said a group of attorneys is separately working on a citizen-led initiative petition “in case the legislature doesn’t get that through.”

Missouri prison nursery opens to bipartisan fanfare with goal of keeping mothers with babies

Zhang’s Friday ruling blocked the state’s licensing requirement for abortion clinics that providers said had prevented them from restoring access to the procedure following Amendment 3’s passage.

Zhang called the licensing requirement “discriminatory” because “it does not treat services provided in abortion facilities the same as other types of similarly situated health care, including miscarriage care.”

During a hearing last month, Zhang asked Planned Parenthood’s attorneys how clinics would be regulated if the licensing requirements in place through the Missouri Department of Health and Senior Services.

Eleanor Spottswood, an attorney with Planned Parenthood, said that like other outpatient practices, the facility would not require a license, but the providers would need to meet their own professional licensing requirements through the Missouri Board of Healing Arts.

Republicans and anti-abortion advocates argued Monday that the license requirements — along with a spate of other regulations Zhang previously blocked in response to Amendment 3 — ensured the safety of women and babies.

“We are going to spend every second and every dollar and every resource to make sure that Missourians understand what is happening,” Coleman said. “There are no health and safety regulations.”

On Monday afternoon, three people held signs vigil outside the Planned Parenthood clinic in Kansas City where two days earlier a patient underwent a surgical abortion — the first performed in Missouri since 2022.

“It’s a sad day today because abortion has resumed in Missouri,” said the Rev. James V. Johnston Jr., bishop of the Catholic Diocese of Kansas City-St. Joseph, as he stood outside in sub-freezing temperatures, wearing a March for Life stocking cap. “My hope is that our lawmakers will see this as a matter of justice.”

Several yards down the sidewalk, two clinic escorts bundled in thick layers beneath their bright vests stood at the entrance to the parking lot. They held colorful umbrellas, offered to patients as a way to cover their faces and their identities from any passers-by.

A similar scene played out 245 miles to the east at the Planned Parenthood clinic in St. Louis’ Central West End.

“This is the real agenda of Planned Parenthood, to put the destruction of human life over the safety and well being of women,” Brian Westbrook, executive director of Coalition Life, told reporters as about half a dozen anti-abortion protesters stood behind him. “They are not fighting for women. They are fighting to remove every possible check on their harmful, deadly Business.”

Westbrook said Monday kicked off a 6-day “intense prayer and fasting vigil” outside the St. Louis clinic. Coalition Life also restarted its sidewalk counseling efforts, partnering with Women’s Care Connect, a pregnancy resource center in Maryland Heights that he said also provides “abortion pill reversal.”

Neither surgical nor medication abortions have begun again at the St. Louis location, Nick Dunne, with Planned Parenthood Great Rivers, said Monday.

“This,” Coleman said, “Is not a fight that ends ever.”

GET THE MORNING HEADLINES.

Missouri Independent is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Missouri Independent maintains editorial independence. Contact Editor Jason Hancock for questions: info@missouriindependent.com.

The post Republicans vow action after judge’s ruling allows abortion to resume in Missouri appeared first on missouriindependent.com

News from the South - Missouri News Feed

Illinois family desperate for answers after man goes missing in Mississippi River

SUMMARY: An Illinois family is urgently seeking answers after 52-year-old Shane Bear fell into the Mississippi River while being chased by police over the Stan Musial Veterans Memorial Bridge on Wednesday night. The family fears that the search efforts have slowed and that their loved one may still be alive. Bear, who had mental health struggles and outstanding warrants, was reportedly attempting to climb under the bridge when he slipped and fell into the river. Illinois State Police, alongside the Coast Guard and local fire departments, have conducted aerial and boat searches, but the family demands more thorough efforts.

An Illinois family is demanding police do more after they said their loved one fell into the Mississippi River.

They said it happened as he was being chased by police Wednesday night over the Stan Musial Veterans Memorial Bridge.

St. Louis News: FOX 2 covers news, weather, and sports in Missouri and Illinois. Read more about this story or see the latest updates on our website https://FOX2Now.com

Follow FOX 2 on social media:

YouTube: https://www.youtube.com/FOX2Now

Facebook: https://www.facebook.com/FOX2Now/

Twitter: https://twitter.com/FOX2Now/

Instagram: https://www.instagram.com/fox2now/

TikTok: https://tiktok.com/@fox2now

SnapChat: https://www.snapchat.com/add/fox2now

News from the South - Missouri News Feed

Missouri health department announces first measles case of 2025

by Clara Bates, Missouri Independent

April 18, 2025

Missouri’s first confirmed measles case of the year involves a child in Taney County, the health department announced Friday afternoon.

The child’s vaccination status “has not yet been verified,” according to the press release.

The child, who is not a Missouri resident, was visiting Taney County and was diagnosed “soon after arrival,” Lisa Cox, spokesperson for the Department of Health and Human Services, said in a press release.

Taney County is in southwest Missouri, and its largest city is Branson.

“Exposure is believed to be limited, and known contacts have been identified and contacted,” Cox said, adding that the state is supporting Taney County’s health department to investigate possible exposure.

The case is “associated with recent international travel,” Cox said.

Measles is a highly-contagious virus the country declared eliminated 25 years ago, but that has resurged with falling vaccination rates.

“For those unvaccinated or those unsure of their vaccination status, now is the time to review records and get caught up if needed,” Dr. George Turabelidze, state epidemiologist with DHSS, said in the press release.

The percent of Missouri kindergarteners fully vaccinated against measles, mumps and rubella has declined over the last several years, from 95% in the 2019-2020 school year to 91% in the 2023-2024 school year, in public schools, per DHHS data. In private schools, the drop has been even larger, from 92% to 85% in the same period.

Nationally, there are at least 800 reported cases of measles across 25 states, according to Center for Disease Control data as of Friday. That doesn’t include Missouri’s case, Cox said, because the state received lab test results Thursday night, after the federal reporting deadline for this week.

That is the highest number for a single year since 2019 and is still growing.

The majority of measles infections nationally have been reported in a West Texas outbreak. There have been two confirmed deaths, both in Texas.

Kansas has reported 37 cases, possibly linked to the Texas outbreak.

There are outbreaks in Canada and Mexico, too, and several states have reported isolated cases as the result of international travel.

At the same time, the federal government has cut grant funding set aside for the Missouri Department of Health and Senior Services to encourage vaccinations, according to St. Louis Public Radio.

GET THE MORNING HEADLINES.

Missouri Independent is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Missouri Independent maintains editorial independence. Contact Editor Jason Hancock for questions: info@missouriindependent.com.

The post Missouri health department announces first measles case of 2025 appeared first on missouriindependent.com

News from the South - Missouri News Feed

Be Our Guest to Cocina Latina with traditional Mexican dishes!

SUMMARY: Cocina Latina is preparing for a Cinco de Mayo celebration with traditional Mexican dishes. Chef Mighty Sec has created a vibrant menu featuring tacos, margaritas, nachos, and more. Guests can enjoy an array of flavorful dishes, including French fries, tacos, and a signature sandwich inspired by Texas. The event is set to take place on May 3rd, and attendees can purchase gift certificates at a special price. It’s a great opportunity to savor delicious food and celebrate with festive drinks, including the popular skinny margarita. For more details, visit their website for ticket information.

Named one of St. Louis Post-Dispatch’s top 100 restaurants in 2022, Cocina Latina is bringing classic dishes everyone loves—from chimichangas, fajitas, enchiladas and more!

-

Mississippi Today6 days ago

Mississippi Today6 days agoLawmakers used to fail passing a budget over policy disagreement. This year, they failed over childish bickering.

-

Mississippi Today6 days ago

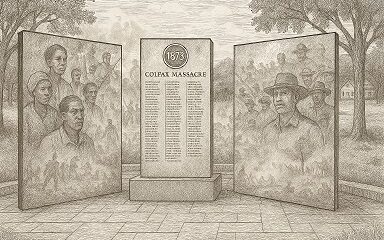

Mississippi Today6 days agoOn this day in 1873, La. courthouse scene of racial carnage

-

Local News7 days ago

Local News7 days agoAG Fitch and Children’s Advocacy Centers of Mississippi Announce Statewide Protocol for Child Abuse Response

-

Local News6 days ago

Local News6 days agoSouthern Miss Professor Inducted into U.S. Hydrographer Hall of Fame

-

News from the South - Alabama News Feed4 days ago

News from the South - Alabama News Feed4 days agoFoley man wins Race to the Finish as Kyle Larson gets first win of 2025 Xfinity Series at Bristol

-

Our Mississippi Home7 days ago

Our Mississippi Home7 days agoFood Chain Drama | Our Mississippi Home

-

News from the South - North Carolina News Feed7 days ago

News from the South - North Carolina News Feed7 days agoHelene: Renewed focus on health of North Carolina streams | North Carolina

-

News from the South - Alabama News Feed5 days ago

News from the South - Alabama News Feed5 days agoFederal appeals court upholds ruling against Alabama panhandling laws