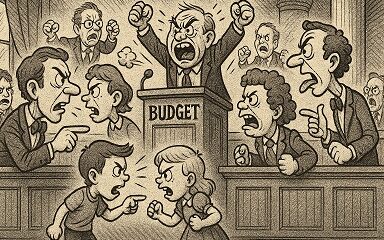

(The Center Square) – A new report says demand outstripping supply is behind expensive housing costs in Tennessee.

The Sycamore Institute analyzed the Volunteer State’s housing challenges, from high costs to demand. The demand comes from an increase in domestic migration, said Brian Straessle, executive director of the organization, in an interview with The Center Square.

Tennessee’s population grew by 541,000 between 2010 and 2020 and many of those residents came from other states. The state’s population grew by another 315,000 between 2020 and 2024, according to the report.

Many of those new residents came from areas with higher median incomes and home prices.

“When the amount of money trying to buy something is growing faster than the supply of that thing, it tends to push up the price of the product,” Straessle said. “And that is what happened in communities all across this state.”

The increase in housing prices was not limited to the state’s larger counties, the report said. Davidson County, home to Nashville, experienced a loss of residents to neighboring counties.Those counties saw an increase in housing costs as well.

“Federal tax data show that those moving into many Middle Tennessee counties had higher average incomes than those moving out,” the report said. “This means some areas experienced regional dispersals of both population and wealth.”

More than a quarter of Tennessee households were considered “cost-burdened,” paying more than 30% of their income on housing costs in 2023. Home prices across the state have risen, with the highest increase in middle Tennessee which experienced a 5.9% increase from 2019 to 2023. Davidson County has the highest percentage of cost-burdened residents at 33%. Johnson County, in the northeast corner of the state, has the lowest at 14%.

Just 33% of Tennessee residents rent a home but a higher percentage of them are cost-burdened, according to the report.

The state’s housing supply has not kept up with the demands of an increased population. Real estate agents have a term called “months supply” that is a comparison of those looking for residences compared to the inventory, according to the report.

“Generally, six months’ supply is the sweet spot for housing markets to appreciate at a consistent rate,” the report said. “After bottoming out in 2011, a slow increase in new housing production eventually contributed to 2013-2014’s solid 6.4 months’ supply. Then, it fell all the way to 1.7 months’ supply in 2021. In other words, the number of people looking to buy a home and the number of homes for sale each month was just above a 1 to 1 ratio throughout 2021, despite increased housing production.”

The data available is “constrained” and may not tell the entire story behind the state’s housing situation, the Sycamore Institute said.

“For example, available data limits detailed local analysis, housing buzzwords don’t always have clear definitions, and some housing choices aren’t well understood,” the organization said.