Mississippi Today

Poll: Grocery tax cut more popular than income tax cut

Poll: Grocery tax cut more popular than income tax cut

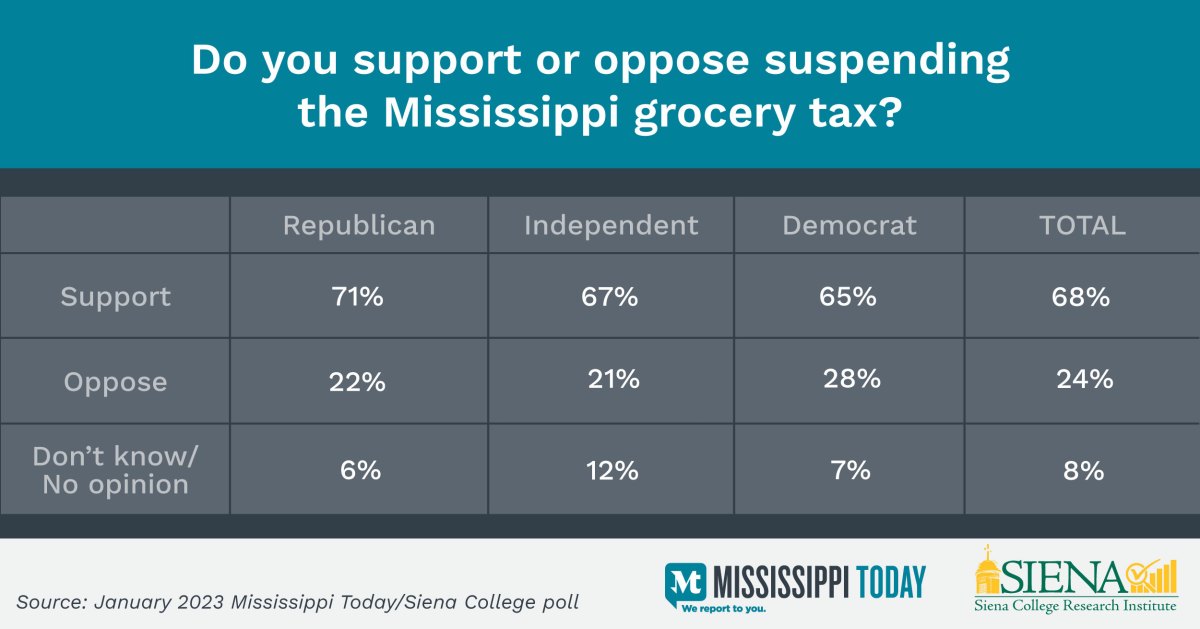

More Mississippians would prefer not to pay the 7% sales tax on groceries than not to pay the state income tax, according to a recent poll from Mississippi Today/Siena College.

The poll, conducted Jan. 3-8, found 68% of respondents favor suspending the grocery tax, while 24% oppose ending the grocery tax.

“The cost of food is high enough already,” Hinds County resident and poll respondent Lucinda Robinson told Mississippi Today. “We need some relief.”

Robinson said she does not believe it is right to tax necessities like food and milk.

“Eggs are so expensive that I just eat the chicken,” she said.

Mississippi’s 7% tax on most retail items is one of the nation’s highest. In addition, most states either have a lower sales tax on groceries than on other items, or they just exempt groceries from being taxes altogether. Mississippi levies the full 7% on groceries.

Editor’s note: Poll methodology and crosstabs can be found at the bottom of this story.Click hereto read more about our partnership with Siena College Research Institute.

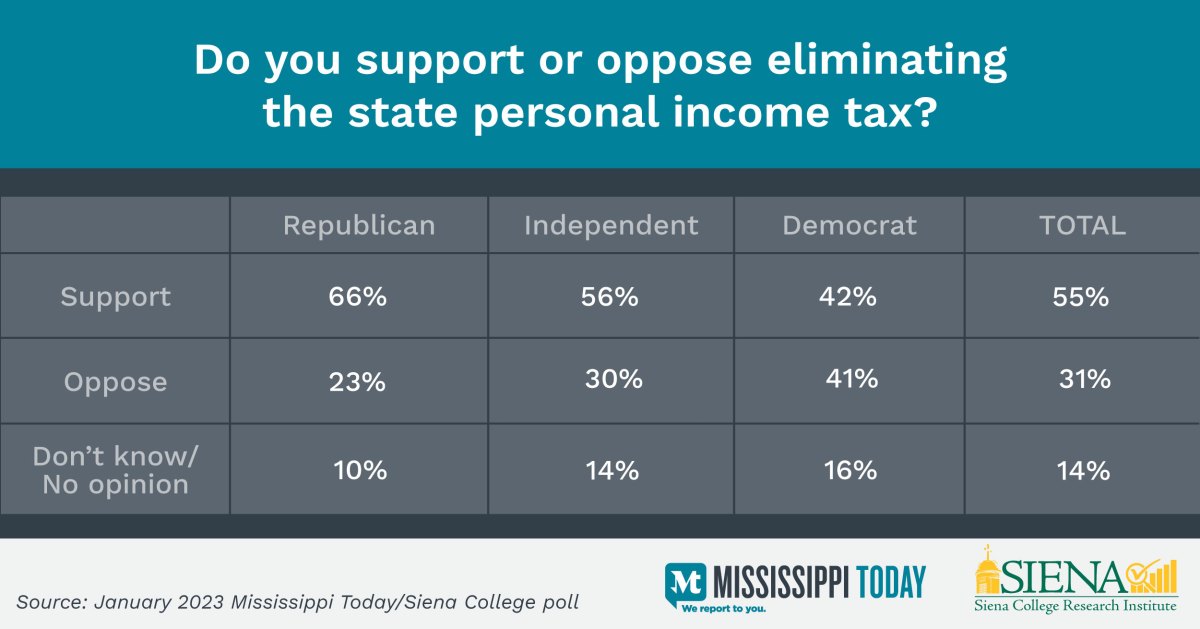

Alternatively, a 55% majority of respondents support eliminating the state personal income tax, while 31% oppose eliminating it.

A reduction in the state income tax already is underway based on previously passed legislative action. And Gov. Tate Reeves, Speaker Philip Gunn and others have advocated for the complete elimination in 2023 of the income tax, which currently generates about one-third of the state general fund revenue.

“We need economic development. The way to attract people to move here is to eliminate the income tax,” said DeSoto County resident Brad Dickey, who was a poll participant. “It is as great way to do it.”

Dickey, who is an engineer working in Memphis, said young people move to other state that do not have an income tax such as Tennessee, instead of locating in Mississippi.

When asked about the state’s high grocery tax, Dickey said, “We have to have some money to provide services. I think there is more support to eliminate the income tax than to eliminate the grocery tax.

“I understand the grocery tax is regressive,” he said. “If they could get rid of both, that would be fine. But we have to have some money from somewhere.”

The poll did not ask respondents to consider how the elimination of a state revenue stream, whether from the income tax or from the grocery tax, would impact the services provided by the Mississippi government.

But some poll respondents told Mississippi Today they do not believe they are getting many services for their taxes anyway.

Poll respondent Ester Jones of Jones County said the state should eliminate both.

“If they are not going to support the schools with the money, they should just do away with it and allow the parents to support their children,” she said.

Jones said she believes it is unfair to force poor people to pay a tax on their groceries. She said the state of Texas does not have a sales tax on groceries and also has no income tax.

By a significant margin, Black Mississippians would rather not pay the grocery tax than the income tax. Their support for the suspension of the grocery tax is 60% to 29%, with 11% not answering or having no opinion, while their support for the elimination of the income tax is 44% in favor to 38% opposed.

White Mississippians also were more supportive of suspending the grocery tax — 74% to 19%, compared to 62% to 27% for the income tax.

Republicans support suspending the grocery tax 71% to 22%, while Democrats do 65% to 28%, and independents do 67% to 21%.

On the income tax, Democrats favor elimination by a narrow 42% to 41% margin. Two-thirds (66%) of Republicans support elimination of the income tax, while 23% of Republican oppose it. Independents support income tax elimination 56% to 30%.

“In my situation I pay a tremendous amount of property taxes. I pay a lot of incomes taxes, too,” said Sam Rosenthal of Indianola who described himself as a landlord. “I don’t want to be taxed out of business. I am overwhelmed with taxes.

“I feel like every time I turn around I am paying some type of tax whether property, income or some type of assessment,” Rosenthal said. “I would love to see the elimination of that.”

He said he also does not like the grocery tax, but added, “If had to choose I would rather pay the grocery tax. I am a realist. I know the state has to have money.”

Another poll question attempt to gauge support for a one-time rebate to taxpayers as many other states have done. That idea garnered 51% support and was opposed by 41%. Democrats supported the one-time rebate 73% to 21%, while Republicans and independents opposed them by narrower margins.

Lt. Gov. Delbert Hosemann and many in the Senate leadership have advocated to use some of the current surplus the state has to provide taxpayers a one-time payment.

The Mississippi Today/Siena College Research Institute poll of 821 registered voters was conducted Jan. 8-12 and has an overall margin of error of +/- 4.6 percentage points. Siena has an‘A’ rating inFiveThirtyEight’s analysis of pollsters.

Click here for complete methodology and crosstabs relevant to this story.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Did you miss our previous article…

https://www.biloxinewsevents.com/?p=204600

Mississippi Today

Trump order threatens funding for Miss. colleges, cultural centers

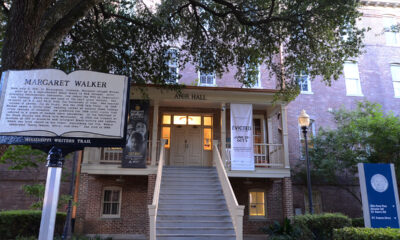

For nearly three decades, a little-known federal agency has provided millions of dollars in support and funding to Mississippi’s colleges and universities museums, to libraries and to cultural institutions, including the Margaret Walker and COFO Civil Rights Center at Jackson State University.

In 2011, the state’s largest historically Black university’s cultural center and museum, received a $48,000 grant from the Institute of Museum and Libraries Services. The grant paid for staff to travel and learn about the historical preservation work from larger museums and institutions across the country.

“That grant was my professional development,” Robert Luckett, director of the cultural center said. “It was so important and has been foundational for all of the work we’ve done at Jackson State for the last fifteen, sixteen years.”

But, Jackson State isn’t the only Mississippi college that has benefitted from funds from IMLS, and the federal agency has flowed millions of dollars in grants to the state.

In 2022, Mississippi State University received a $74,000 grant to fund its Office of Museum Services and a $50,000 grant from the American Rescue Plan for Museums and Libraries to train and hire students from underserved communities to assist with biological collection and conservation. That same year, Northwest Mississippi Community College received $33,000 from the agency to support a series of community engagement discussions for students around racial injustice, mental health and stress in the post COVID-19 pandemic.

In 2020, Hinds Community College Utica’s campus received a $101,000 grant from IMLS’s Museums Grants for African American History and Culture to establish an oral history project for Black rural Mississippians and provided technology and equipment to record stories for residents who couldn’t make it to the campus museum. The federal agency also awarded $500,000 to the University of Mississippi through its Save America’s Treasures program and in 2010 a $450,000 grant to its Modern Political Archives to preserve and digitize 3,800 audio and visual recordings.

The Margaret Walker Center, which houses oral histories, manuscripts, book collections and history archives of Black Mississippians, and operates as the Black Studies Institute for Jackson State University, has been a cornerstone of cultural development for students.

Now, with an executive order from President Donald Trump, which led the federal agency’s nearly 70 employees to be placed on administrative leave last week, the future of the Margaret Walker Center’s work remains unclear.

The move to shut down IMLS comes weeks after President Donald Trump signed an executive order to scale down six other federal agencies to “the minimum presence,” according to The Washington Post.

The agency’s funding, which is less than one percent of the federal budget, has dolled out millions of dollars to museums, libraries and institutions. But, in states like Mississippi, where access to traditional resources and support for cultural institutions may be near to none or nonexistent, the agency’s funding has been essential in providing tools to do important work, Luckett said.

Out of the eight full-time staff members at the cultural center, two staff and a graduate fellow who works to digitize the historical archives is funded by subgrants of IMLS through the Smithsonian Institute, another national cultural institution facing cuts by the Trump administration. These jobs on the digital humanities staff could be in jeopardy.

Earlier this year, Luckett said his team applied for another grant from IMLS to pay for their renovation project of Ayer Hall, the oldest building on Jackson State University’s campus and home to the Margaret Walker Center. The grant funding will provide support for staff to move its collections into a safe environment.

Luckett said the cultural center was supposed to be notified in June if they receive the grant. But, with the changes to the agency, he’s unsure of what comes next.

“We don’t have the funding to do this,” Luckett said. “We’ll be back to square one.”

Other cultural institutions and organizations across the state such as the Mississippi Humanities Council, which currently has 35 open subgrants to various state colleges and universities, were reeling after hearing a major defunding announcement.

In a late night email, the organization learned their grant through the National Endowment of Humanities had been terminated. The national organization has provided more than 400 grants in Mississippi, including colleges in the state.

Sweeping cuts at IMLS and the National Endowment of Humanities threaten the future of established museum and library programs at local colleges from panels, literary festivals, history tours, youth education workshops and other public programs.

“In [Mississippi] our greatest strength is our history and culture,” Stuart Rockoff, executive director of the Mississippi Humanities Council, said. “Our grants and our programs have helped highlight that especially in smaller towns and rural areas of our state.”

The state’s cultural organization doled out various grants to Mississippi’s public universities and colleges, including a $8,400 grant to the Margaret Walker Center last year, which held a panel discussion on local activism in reflection to Mississippi’s civil rights movement history.

Luckett said protecting the state’s historical collections and providing access to them are key components for the curriculum for students at Jackson State University to engage in scholarship and research.

“These skills are not politicized,” Luckett said. “These are important learning tools for any student of any discipline.”

While it’s easy to ignore the federal agency being closed, the outside impact that such a small agency has on the country is remarkable, Luckett added.

“These are public servants doing these jobs, who are committed and who aren’t willing to get rich,” Luckett said. “This assault on IMLS is something we should all be worried about.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.![]()

The post Trump order threatens funding for Miss. colleges, cultural centers appeared first on mississippitoday.org

Mississippi Today

Mississippi lawmakers end 2025 session unable to agree (or even meet about) state budget: Legislative recap

Infighting between Mississippi’s Republican House and Senate legislative leaders reached DEFCON 4 as the 2025 legislative session sputtered to a close last week.

Lawmakers gaveled out unable to set a $7 billion state budget — their main job — or to even agree to negotiate. Gov. Tate Reeves will force them back into session sometime before the end of the fiscal year June 30. At a press conference last week, the governor assured he would do so but did not give a timetable, other than saying he plans to give lawmakers some time to cool off.

The crowning achievement of the 2025 session was passage of a tax overhaul bill a majority of legislators accidentally voted for because of errors in its math. House leaders and the governor nevertheless celebrated passage of the measure, which will phase out the state individual income tax over about 14 years, more quickly trim the sales tax on some groceries to 5% raise the tax on gasoline by 9 cents a gallon, then have automatic gas tax increases thereafter based on the cost of road construction.

The error in the Senate bill accidentally removed safeguards that chamber’s leadership wanted to ensure the income tax would be phased out only if the state sees robust economic growth and controls spending.

The rope-a-dope the House used with the Senate errors to pass the measure also stripped a safeguard House leaders had wanted: a 1.5 cents on the dollar increase in the state’s sales tax, which would have brought it to 8.5%. House leaders said such an increase was needed to offset cutting more than $2 billion from the state’s $7 billion general fund revenue by eliminating the income tax, and to ensure local governments would be kept whole.

Reeves was nonplussed about the flaws in the bill he signed into law (at one point denying there were errors in it) and called it “One big, beautiful bill,” borrowing a phrase from President Donald Trump.

Quote of the Week

“Quite frankly, I think it’s chicken shit what they did.” — Gov. Tate Reeves, at a press conference last week when asked his thoughts about the Senate rejecting his nomination of Cory Custer, Reeves’ deputy chief of staff, to serve as four-year term on the board of Mississippi Public Broadcasting.

Full Legislative Coverage

What happened (or didn’t) in the rancorous 2025 Mississippi Legislative session?

Mississippi Today’s political team unpacks the just ended — for now — legislative session, that crashed at the end with GOP lawmakers unable to pass a budget after much infighting among Republican leaders. The crowning achievement of the session, a tax overhaul bill, was passed by accident and full of major errors and omissions. Listen to the podcast.

Gov. Tate Reeves, legislative leaders tout tax cut, but for some, it could be a tax increase

Many of those retirees who do not pay an income tax under state law and other Mississippians as well will face a tax increase under this newly passed legislation touted by Reeves and others. Read the column.

Trump administration slashes education funding. Mississippi leaders and schools panic

Mississippi schools and the state education system are set to lose over $137 million in federal funds after the U.S. Department of Education halted access to pandemic-era grant money, state leaders said this week. Read the story.

Gov. Tate Reeves says he’ll call Mississippi lawmakers back in special session after they failed to set budget

Gov. Tate Reeves on Thursday said he will call lawmakers into a special session to adopt a budget before state agencies run out of money later in the summer and hinted he might force legislators to consider other measures. Read the story.

GOP-controlled Senate rejects governor’s pick for public broadcasting board. Reeves calls it ‘chicken s–t’

The Senate on Wednesday roundly rejected the nomination of Cory Custer, Reeves’ deputy chief of staff, to serve a four-year term on the board of directors of Mississippi Public Broadcasting, the statewide public radio and television network. Reeves reacted to the Senate’s vote on Thursday, calling it “chicken shit.” Read the story.

Early voting proposal killed on last day of Mississippi legislative session

Mississippi will remain one of only three states without no-excuse early voting or no-excuse absentee voting. Read the story.

Mississippi Legislature ends 2025 session without setting a budget over GOP infighting

The House on Wednesday voted to end what had become a futile legislative session without passing a budget to fund state government, for the first time in 16 years. The Senate is expected to do the same on Thursday. Read the story.

Mississippi Legislature approves DEI ban after heated debate

Mississippi lawmakers have reached an agreement to ban diversity, equity and inclusion programs and a list of “divisive concepts” from public schools across the state education system, following the lead of numerous other Republican-controlled states and President Donald Trump’s administration. Read the story.

Fear and loathing: Legislative session crashes with lawmakers unable to set a budget because of Republican infighting

Republican Lt. Gov. Delbert Hosemann and other Senate leaders on Saturday excoriated the Republican House leadership, after the House didn’t show up for what was supposed to be “conference weekend” to haggle out a $7 billion budget. Read the story.

‘We’ll go another year’ without relief: Pharmacy benefit manager reform likely dead

Hotly contested legislation that aimed to increase the transparency and regulation of pharmacy benefit managers appeared dead in the water Tuesday after a lawmaker challenged the bill for a rule violation. Read the story.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post Mississippi lawmakers end 2025 session unable to agree (or even meet about) state budget: Legislative recap appeared first on mississippitoday.org

Mississippi Today

On this day in 1909, Matthew Henson reached the North Pole

April 6, 1909

Matthew Henson reached the North Pole, planting the American flag. Traveling with the Admiral Peary Expedition, Henson reportedly reached the North Pole almost 45 minutes before Peary and the rest of the men.

“As I stood there on top of the world and I thought of the hundreds of men who had lost their lives in the effort to reach it, I felt profoundly grateful that I had the honor of representing my race,” he said.

While some would later dispute whether the expedition had actually reached the North Pole, Henson’s journey seems no less amazing.

Born in Maryland to sharecropping parents who survived attacks by the KKK, he grew up working, becoming a cabin boy and sailing around the world.

After returning, he became a salesman at a clothing store in Washington, D.C., where he waited on a customer named Robert Peary. Pearywas so impressed with Henson and his tales of the sea that he hired him as his personal valet.

Henson joined Peary on a trip to Nicaragua. Impressed with Henson’s seamanship, Peary made Henson his “first man” on the expeditions that followed to the Arctic. When the expedition returned, Peary drew praise from the world while Henson’s contributions were ignored.

Over time, his work came to be recognized. In 1937, he became the first African-American life member of The Explorers Club. Seven years later, he received the Peary Polar Expedition Medal and was received at the White House by President Truman and later President Eisenhower.

“There can be no vision to the (person) the horizon of whose vision is limited by the bounds of self,” he said. “But the great things of the world, the great accomplishments of the world, have been achieved by (people with) … high ideals and … great visions. The path is not easy, the climb is rugged and hard, but the glory at the end is worthwhile.”

Henson died in 1955, and his body was re-interred with full military honors at Arlington National Cemetery. The U.S. Postal Service featured him on a stamp, and the U.S. Navy named a Pathfinder class ship after him. In 2000, the National Geographic Society awarded him the Hubbard Medal.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.![]()

-

Mississippi Today6 days ago

Mississippi Today6 days agoPharmacy benefit manager reform likely dead

-

News from the South - Alabama News Feed7 days ago

News from the South - Alabama News Feed7 days ago'I think everybody's concerned': Mercedes-Benz plant eyeing impact of imported vehicle tariffs

-

News from the South - Florida News Feed6 days ago

News from the South - Florida News Feed6 days agoFlorida special election results: GOP keeps 2 U.S. House seats in Florida

-

News from the South - South Carolina News Feed4 days ago

News from the South - South Carolina News Feed4 days agoSouth Carolina clinic loses funding due to federal changes to DEI mandates

-

News from the South - Kentucky News Feed5 days ago

News from the South - Kentucky News Feed5 days ago3 killed in fiery Lexington crash temporarily shuts down portion of New Circle Road

-

Mississippi Today6 days ago

Mississippi Today6 days agoRole reversal: Horhn celebrates commanding primary while his expected runoff challenger Mayor Lumumba’s party sours

-

News from the South - Louisiana News Feed7 days ago

News from the South - Louisiana News Feed7 days agoMother turns son's tragedy into mental health mission

-

News from the South - Alabama News Feed6 days ago

News from the South - Alabama News Feed6 days agoWill Alabama Lawmakers Cut Taxes on Overtime Pay or Groceries? | April 1, 2025 | News 19 at 6 p.m.