News from the South - Missouri News Feed

Plan to shift from income tax to sales tax advances to Missouri Senate

Plan to shift from income tax to sales tax advances to Missouri Senate

by Rudi Keller, Missouri Independent

February 19, 2025

A plan to make Missouri dependent on sales tax for general revenue by eliminating the income tax is heading to the state Senate for debate after a party-line committee vote on Wednesday.

Two proposals — one to immediately change the state income tax to a flat tax of 4% and another a proposed constitutional amendment to allow the transition to sales taxes for revenue — make up the package intended to keep Republicans’ campaign promise to eliminate the state income tax.

If the constitutional amendment passes, it would put the income tax on the path to elimination.

The fiscal note for the flat-tax bill forecasts an immediate reduction in state revenues of about $661 million and projects it will be 2067 or later before the income tax disappears.

The two proposals were each approved Wednesday on a 5-2 vote in the Senate Economic and Workforce Development Committee, with all Republicans in support and Democrats opposed.

Democratic state Sen. Barbara Washington of Kansas City said she’s worried about the impact of the immediate tax cut.

“I don’t see a clear plan as to how we make this money up,” Washington said.

Missouri House votes on party lines to eliminate income tax on capital gains

The income tax is a tax on productivity, and shifting taxes to other areas will help the economy, said Republican state Sen. Ben Brown of Washington, chairman of the committee and sponsor of the two bills.

“That has a more negative impact in our society than taxes in other areas,” Brown said of the income tax.

The top marginal rate for Missouri’s income tax has declined from 6% in 2015 to 4.7% this year under a design to slowly cut it as revenue increases that began with legislation passed in 2014.

Two future tax cuts, to a 4.5% rate, are already in state law and will take effect if general revenue growth hits targets.

Income tax remains the single largest portion of state general revenue, with the individual income tax contributing 65% and the corporate income tax about 7% of the $13.4 billion received in fiscal 2024.

The tax cut bill passed in 2014 also began indexing state tax brackets, which had not been changed since the 1930s, for inflation. The top tax rate applies to taxable income of more than $8,900, which is about $23,500 in total income when the standard deduction is included.

The tie between the two measures takes effect after the switch to a flat tax and a statewide vote.

The constitutional proposal, intended to be on a ballot by November 2026, would create a mechanism for limiting the growth in state spending and directing revenue in excess of the cap to a special fund dedicated to income tax reduction.

When the special fund holds at least $120 million, the state income tax rate would be cut by one-tenth of a percentage point. In years when the reduction is authorized, every additional $60 million in the fund would add a rate cut of one-twentieth of a percentage point.

If both conditions were met for the first reduction, the rate would fall from 4% to 3.85%.

While every Republican on the committee voted for the measures, at least one showed he’s nervous about the key revenue-raising portion of the proposal — an expanded sales tax.

State Sen. Kurtis Gregory of Marshall said he couldn’t go along with any proposal that repealed sales tax exemptions enjoyed by farmers. Farmers don’t pay sales tax on fertilizer, fuel for farm vehicles and a host of other products.

“I don’t know where that sales tax rate is going to end up, but I’m just instantly looking at some of this and folks are going to be seeing a $50 to maybe $60 an acre increase in cost of production of row crops,” Gregory said.

The constitutional amendment does not directly repeal any sales tax exemption, Brown said.

“I don’t see anything that would be impacted one way or another by this bill,” he said.

It does repeal a 2016 initiative, placed on the ballot by Missouri Realtors, that barred lawmakers from imposing sales tax on any market transaction “that was not subject to sales, use or similar transaction-based tax on January 1, 2015.”

Along with preventing any effort to tax services such as mechanic’s labor or tax accounting, the amendment protected from repeal exemptions to the sales tax on tangible goods in law at the time, such as prescription drugs and the general revenue portion of sales tax on groceries.

Retail sales in Missouri are taxed at 4.225% for state purposes — 3% for general revenue, 1% for public schools, 0.125% for the Department of Conservation and 0.1% for state parks and soil conservation. Local option sales taxes are in addition to the state tax and push the total rate in some areas above 10%.

Brown’s proposal would allow a state tax of up to 4% — 3.775% for general revenue and schools plus the conservation and parks taxes. The tax would be applied to “all sellers for the privilege of selling tangible personal property or rendering taxable services at retail in this state” and take effect with the signing of a bill expanding sales tax to items exempted prior to Jan. 1, 2015.

The constitutional amendment does target one service with a special, higher tax. Lobbying firms would be required to pay a 6% sales tax on top of the general sales tax of up to 4%.

Missouri Realtors, who have shown substantial financial strength in campaigns, will oppose any effort to weaken the provisions added to the constitution in 2016, said Bobbi Howe, president of the Realtors

“Adding new taxes to services Missourians use every day,” Howe said, “is not sound policy and it unfairly impacts those least able to pay.”

YOU MAKE OUR WORK POSSIBLE.

Missouri Independent is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Missouri Independent maintains editorial independence. Contact Editor Jason Hancock for questions: info@missouriindependent.com.

The post Plan to shift from income tax to sales tax advances to Missouri Senate appeared first on missouriindependent.com

News from the South - Missouri News Feed

LIVE: Trump announces sweeping ‘reciprocal’ tariffs

SUMMARY: On April 2, 2025, President Trump announced sweeping “reciprocal” tariffs intended to promote U.S. manufacturing and punish unfair trade practices. Dubbed “Liberation Day,” the tariffs target allies and adversaries alike, affecting autos, steel, aluminum, pharmaceuticals, and more. While the White House projects $600 billion in annual revenue, economists warn of rising costs, recession risks, and global trade tensions. Critics argue the tariffs are a massive, unilateral tax hike on American families. Allies like the EU and Canada are preparing retaliatory measures. The lack of clarity has fueled uncertainty among businesses and investors, despite continued White House confidence in the strategy.

The post LIVE: Trump announces sweeping 'reciprocal' tariffs appeared first on fox2now.com

News from the South - Missouri News Feed

Val Kilmer, ‘Top Gun’ and Batman star with an intense approach, dies at 65

SUMMARY: Val Kilmer, the versatile actor known for iconic roles like Iceman in “Top Gun” and Jim Morrison in “The Doors,” has died at 65 from pneumonia. Surrounded by family, he passed away in Los Angeles, following a battle with throat cancer that required two tracheotomies. Kilmer was celebrated for his intense method acting, often immersing himself in roles, but this earned him a reputation for being difficult on set. His career, which peaked in the 1990s, included notable films such as “Tombstone” and “Heat.” He is survived by his children, Mercedes and Jack, and leaves a legacy marked by artistry and complexity.

The post Val Kilmer, 'Top Gun' and Batman star with an intense approach, dies at 65 appeared first on fox2now.com

News from the South - Missouri News Feed

Bill would increase Missouri secretary of state’s role in initiative petition process

by Natanya Friedheim, Missouri Independent

April 2, 2025

In the spring of 2023, efforts were underway to put the question of restoring abortion access to Missouri voters. Abortion-rights supporters geared up to collect the roughly 171,000 signatures required to put a constitutional amendment on the ballot.

Per the state’s initiative petition process, then-Secretary of State Jay Ashcroft wrote a summary of their proposed constitutional amendment. A staunch abortion opponent then running for governor, Ashcroft drafted the first part of his summary of the petition to say: “Do you want to amend the Missouri Constitution to: allow for dangerous, unregulated, and unrestricted abortions, from conception to live birth.”

It was not what the drafters had in mind. They took him to court — and won.

A judge nixed Ashcroft’s summary and wrote a new one.

A Republican-sponsored bill that has cleared the state Senate and received a House committee hearing Tuesday would make it more difficult for judges to rewrite a secretary of state’s ballot summary.

“To me this is a gross overstepping of the judiciary branch,” state Sen. Rick Brattin, a Harrisonville and the bill sponsor, said at Tuesday’s hearing.

In Brattin’s opinion, shared by opponents to abortion rights, the courts wrote a summary slanted in favor of the initiative petition that would become Amendment 3, ultimately passed by voters last November.

Senate Bill 22 allows a group to appeal the secretary of state’s summary. The court can make recommendations, but the secretary of state must revise the language within seven days

If the court finds that summary unfair, the secretary gets five days to write another draft. This process can happen one last time, and upon third revision the secretary gets just three days. Only then, if the court still finds the summary unfair, can a judge rewrite it. The back-and-forth process must take place on a set timeline prior to the general election.

Brattin’s original bill eliminated the court’s ability to rewrite a ballot summary, he said at the committee hearing, but he worked with Senate Democrats to amend it.

“This was (a) compromise,” Brattin said.

For opponents of the bill, the timeline would make it nearly impossible to oppose the secretary of state’s ballot language. The process would need to play out more than 70 days before the election.

“If the time runs out, the challenge is extinguished, and it seems to me like whatever the last language is would stand, even if the court still thinks it’s not fair,” said state Rep. Eric Woods, a Kansas City Democrat.

Sam Lee, a veteran anti-abortion lobbyist, argued courts can expedite cases related to an election. He spoke on behalf of Campaign Life Missouri and testified in support of the measure along with a representative from Missouri Right to Life.

Groups including the League of Women Voters of Missouri, the American Civil Liberties Union of Missouri, the Missouri Voter Protection Coalition, Missouri Jobs with Justice Voter Action and the Missouri AFL-CIO testified in opposition to the measure. Many voters echoed Woods’ concerns about the feasibility of the proposed timeline.

“What if today our Secretary of State was a Democrat?” asked Ron Berry, a lobbyist for Missouri Jobs with Justice and a former staffer for Democratic Secretary of State Robin Carnahan. “Would we be here today discussing this bill?”

This story originally appeared in the Columbia Missourian. It can be republished in print or online.

Missouri Independent is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Missouri Independent maintains editorial independence. Contact Editor Jason Hancock for questions: info@missouriindependent.com.

The post Bill would increase Missouri secretary of state’s role in initiative petition process appeared first on missouriindependent.com

-

Mississippi Today19 hours ago

Mississippi Today19 hours agoPharmacy benefit manager reform likely dead

-

News from the South - Alabama News Feed6 days ago

News from the South - Alabama News Feed6 days agoSevere storms will impact Alabama this weekend. Damaging winds, hail, and a tornado threat are al…

-

News from the South - Alabama News Feed5 days ago

News from the South - Alabama News Feed5 days agoUniversity of Alabama student detained by ICE moved to Louisiana

-

News from the South - Oklahoma News Feed4 days ago

News from the South - Oklahoma News Feed4 days agoTornado watch, severe thunderstorm warnings issued for Oklahoma

-

News from the South - Louisiana News Feed7 days ago

News from the South - Louisiana News Feed7 days agoSeafood testers find Shreveport restaurants deceiving customers with foreign shrimp

-

News from the South - West Virginia News Feed7 days ago

News from the South - West Virginia News Feed7 days agoRoane County Schools installing security film on windows to protect students

-

News from the South - Virginia News Feed5 days ago

News from the South - Virginia News Feed5 days agoYoungkin removes Ellis, appoints Cuccinelli to UVa board | Virginia

-

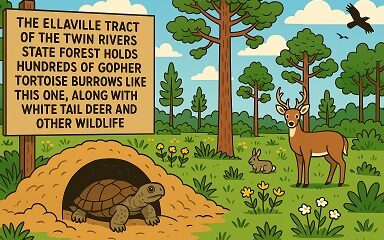

News from the South - Florida News Feed6 days ago

News from the South - Florida News Feed6 days agoPeanut farmer wants Florida water agency to swap forest land