Mississippi Today

On this day in 1968

On this day in 1968

March 18, 1968

Martin Luther King Jr. wept at what he saw in Marks, Mississippi. He came as part of his Poor People’s Campaign, visiting impoverished places in the nation.

Tears came to his eyes when he saw a teacher slicing a single apple to feed lunch to students, along with crackers. He also saw hundreds of Black children walking the street without shoes. He encouraged those in Marks and the rest of the poor across the nation to come with him to Washington, D.C., so they could force the nation’s leaders to think about those affected by poverty.

“We ought to come in mule carts, in old trucks, any kind of transportation people can get their hands on,” he said. “People ought to come to Washington, sit down if necessary in the middle of the street and say, ‘We are here; we are poor; we don’t have any money; you have made us this way … and we’ve come to stay until you do something about it.’”

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

Mississippi Today

Former elections official explains federal law not needed to keep noncitizens from voting

Editor’s note: This essay is part of Mississippi Today Ideas, a platform for thoughtful Mississippians to share fact-based ideas about our state’s past, present and future. You can read more about the section here.

The Safeguard American Voter Eligibility Act (SAVE Act) has been rolling around the halls of Congress for at least two years now. With the Democrats in control of the Senate and Joe Biden in the White House, it just could not build up enough steam to get over the proverbial hill, but this year is a different matter.

So, the question again is what is it and do we really need it? At its most simple level the act would require voters to provide documentary proof of citizenship at the time of registration. Sound simple enough – we don’t want undocumented immigrants voting, right?

Lend me your eyes for just a few moments and allow me to give you a few comments from the perspective of a retired election administrator (14 years’ experience) from a mid-sized county in Mississippi. Ensuring only citizens can vote is important, but there are more cost-effective ways of doing this. For instance, how many of you have renewed your Mississippi Drivers License for the one that has “Real ID”? You had to produce a certified copy of your birth certificate, didn’t you? Not to get too far into the weeds here, but the Secretary of State’s SEMS (Statewide Election Management System) already communicates electronically with the Department of Public Safety.

Why burden the voters, who would have to find their birth certificate, and the voter registration staff, who would have to handle and verify yet another document? There’s a high likelihood that the information already resides in a state system, which is where voter registration is designed to be managed – not at the federal level anyway.

It is already a felony to vote if you’re not a citizen. Layering on this requirement will result in an unfunded mandate, when what could be helpful from the federal government is sharing of data.

I spent my first 10 years as an election commissioner acting more like a cop, trying to enforce the law. Once a new commissioner was elected (Republican by the way) and came into the office asking a startling question: why aren’t we encouraging people to register to vote? Why are we only purging voters? At first, I said, well, because that’s our job – purging, voter roll maintenance. But then I went back to the U.S. Constitution – something every American should read at least once a year. Voting is an enumerated right. We need to ask ourselves why we would ever even consider doing anything to make it harder for people to exercise that precious right?

Let’s address the law of unintended consequences for a moment. If people aren’t registered, they can’t vote. The SAVE Act will make it harder for people to register – when you move your aging mother, father, aunt, uncle, across state lines to live with you, think about how difficult it’s going to be to get them registered to vote. For married women whose last name is not the same as is on their birth certificate – it’s no longer a simple matter for them to register to vote if the SAVE Act passes.

So, as we continue to bemoan the low turnout numbers in local elections, just remember everything we do that makes it more difficult will further discourage voters. I could bore you with statistics that show how astonishingly low voting by noncitizens really is. Like so many other issues of the day, people are getting worked up with no real facts on the table to justify the outrage. All I can offer is my opinion based on my experience – the SAVE Act seeks to fix something that just ain’t broke. Do we need the SAVE Act? No, we do not.

Trudy Berger served 14 years on the Pike County Election Commission and six years as a member of the Election Commissioners’ Association of Mississippi.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

Mississippi Today

Jackson teens ‘Take the Lead’ and the mic, confronting mayoral hopefuls about youth issues

Javion Shed is nervous about his first time as a moderator. The Murrah High School senior looks the part, dressed in a blue suit with a Murrah pin on his lapel. As he takes to the stage, 11 Jackson mayoral candidates look to him expectantly as they wait for the questions to begin.

On Thursday, teenagers from high schools across Jackson Public School District gathered in the Forest Hill Auditorium for the “Teens Take the Lead” Mayoral Candidate Forum. The forum was Shed’s idea, something born out of a desire to get his peers more civically engaged.

“We’re the age group that oftentimes, we don’t vote, or sometimes we say, ‘My one vote doesn’t matter, or I’m just the 1%,’ but it does matter,” Shed said. “Voting is an essential power that you have as an individual living right here in our capital city, and your vote can impact so much more than what you think.”

Shed coordinated with the school district to host the event, but much of the credit is due to his perseverance. He said he emailed, called and texted with most of the candidates.

“Far too often we don’t get the chance or we don’t have the space to voice our opinions or to say, ‘OK. I want to ask the candidate this question,’” Shed said. “Eighteen is the group where students don’t particularly vote in the municipal elections, because we feel like what they say doesn’t concern me. My vote doesn’t count. I don’t have a voice. It’s not going to impact me, and the truth is it will impact you later and greater down the road.”

Shed prepared his questions based on what his peers were most concerned about: the failing water system, youth crime and changing the narrative that JPS schools are unsafe or of poor quality.

“It gave students a fresh perspective on all candidates, and they got to kind of tune in, ask their own set of questions, and they got to get a different perspective and a different outlook on the Jackson mayoral race,” Shed said.

When student representatives from schools around the city had their chance to ask questions, most were centered around justice and gun violence. Others touched on mental health, infrastructure and creating community spaces for teenagers.

“What are some thoughts and ideas you have to improve school funding, so we have better environments for our scholars?” one Murrah student asked independent candidate Rodney DePriest.

The contractor and businessman respond with an answer about reducing crime and improving infrastructure, saying, “Without that, we will not have the jobs we need to grow a tax base. We wouldn’t have the job we need for the young people in this room to be able to have an internship, to find out the value of work and the dignity that comes with it.”

JPS Superintendent Errick L. Greene said he’s proud of Shed and his JPS scholars for taking the lead on becoming more engaged with voting and the elections.

“It wasn’t something that was on our radar, or something that we were intending to do, but when the idea came to me, I jumped on it and said, absolutely. It’s something that I’d support,” Greene said.

Malaya Tyler, who attends JPS-Tougaloo Early College, said this forum gave her an opportunity to hear from candidates as she makes her decision of who to cast a ballot for in her first election.

“As a person who is voting on April 1st, it was a great opportunity for me to see each candidate and see their plans and hear what they had to bring to the city,” Tyler said.

She said she was concerned about infrastructure and higher education, as she’s on the cusp of heading to college.

“Internships are a big thing for me and different job opportunities, just trying to see where I want to go with my future, so I feel like that was a big part for me,” she said.

But one student said he felt some of the candidates didn’t directly respond to the questions.

“I just feel as if you are a potential mayor of the city of Jackson, if you can’t give a straight answer then it’s kind of like hard for me to understand your clear vision for the future for me and for students in Jackson Public Schools and people who plan to stay in Jackson,” said Charles Travis, a student at Callaway High School and Jackson Middle College.

Travis voted for the first time last year in the presidential elections, but he said that local elections matter just as much.

“My peers should understand a bigger picture of all elections,” Travis said. “It can affect you directly or indirectly. They should think about their family members, their fellow peers in the classroom and their future as citizens in the United States.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

Mississippi Today

Domestic violence deaths reflect families’ loss and grief

It was like seeing the writing on the wall and waiting for the worse to happen.

Family members and friends said they saw signs of physical, mental and other domestic abuse, and searched for ways to keep their loved ones safe: home security, a trip out of town, a firearm.

Some of the individuals experiencing the abuse turned to the legal system by seeking a protection order. Others looked for a way out of the harmful relationship.

But despite best efforts, some of those relationships ended in death.

Over 300 Mississippians have died from domestic violence homicides since 2020, according to an analysis by Missisisppi Today of data from the Gun Violence Archive, the Gun Violence Memorial, news articles, court records and obituaries.

That number includes not just those who experienced the abuse and those who perpetrated it, but also collateral harm to children, other adults and law enforcement caught in the crossfire. But it doesn’t reflect those who bear the pain and loss – children growing up without a parent, parents burying their child.

That has driven some survivors to become advocates and spread awareness about domestic violence.

It has touched people like Renata Flot-Patterson who lost her daughter and grandson in 2021 in Biloxi, and has gone on to organize domestic violence benefit concerts and helped create a mural that honors them.

And Tara Gandy who is teaching others about signs of abuse after her daughter’s death in 2022 in Waynesboro.

And Elisha Webb Coker, who as a teenager watched her mother experience abuse at the hands of partners and die in front of their Jackson home.

“It’s because the system is just the system,” the Gulfport resident said about the need for change around how domestic violence is addressed in the state.

“My mother was murdered in 1999,” Webb Coker said. “It’s still the same.”

The Mississippi Coalition Against Domestic Violence, which represents shelters, advocates and other support for survivors and victims, is backing efforts to study domestic violence deaths, with the hopes of building a better network to help people stay safe and prevent future deaths.

What started out as a pair of bills has come down to one, Senate Bill 2886. Lawmakers will need to agree on a final proposal in conference by the end of the month and then pass both chambers before it can reach the governor’s desk.

It’s an effort that some families of domestic violence homicide victims believe can lay out patterns of abuse and responses to it and show missed opportunities to step in.

At the Gulf Coast Center for Nonviolence in Biloxi, several women directly impacted by domestic violence homicide spoke to Mississippi Today. The center is supporting the legislation and has support services including a homicide survivors program.

Prince charming turned into a monster

In the wake of her daughter and grandson’s deaths, Flot-Patterson is left with questions: Why didn’t police intervene when her daughter’s former partner had served time for aggravated domestic assault? Why didn’t the hospital hold him for a mental evaluation when he threatened his child’s life?

She would like the state to pass a law that would take threats to a child’s life seriously and require the person who makes the threat – including a parent – to undergo a mental health evaluation. Flot-Patterson would name it “Brixx’s Law.”

Her daughter Keli Mornay and her 7-month-old grandson, Brixx, were both of her babies: Mornay was the youngest of her four children and at the time Brixx was the youngest grandchild.

Mornay had a beautiful personality and poured herself into helping others, sometimes putting them before herself, her mother said. She was family-oriented and fiercely proud of her children: Brixx and his older brothers.

It was that nature that drew her into problematic relationships.

Mornay met Byrain Johnson and liked that he was older and had his own children and grandchildren. He was a hard worker who showed signs of being a good man, and Mornay wanted to help him become a better person, Flot-Patterson said.

Within two months, the relationship began to go downhill and Johnson changed, Flot-Patterson said, noting earlier signs of abuse: the time he broke Mornay’s laptop. Another time he kicked down her bathroom door and took her clothes. It escalated to threats of violence and physical abuse.

“He was like the prince charming at first and then he turned into the monster that basically ruined everybody’s lives in my circle,” Flot-Patterson said.

In February 2020 during the drive home from a trip, Johnson and Mornay argued and he beat her and left bruises, cuts and broken teeth, Flot-Patterson said. But it was her daughter who was charged with domestic violence and spent a night in jail – charges brought by Johnson, according to court records shared with Mississippi Today.

In a domestic abuse protective order Johnson filed against Mornay, he listed a number of allegations, including violence and how she filed false charges against him. A judge denied the order because Johnson did not prove the allegations.

Mornay’s charge was dropped after her parents took her to the hospital and additional information was submitted to police, including pictures of Mornay’s injuries, Flot-Patterson said.

That night in jail, Mornay was given a pregnancy test and learned she was expecting.

Flot-Patterson remembers telling her that a child would tie her to Johnson for life. Her family and friends already feared for her safety. But Mornay said a child is what she needed to get her life back on track.

“She said, ‘This baby is going to ground me.’ Those were her words,” Flot-Patterson said.

Yvonne Del Rio met Mornay in 2018 when she relocated to the Coast after divorcing a partner who she said abused her physically, emotionally and financially for over 20 years.

She said Mornay’s personality and smile radiated like sunshine, and they became close. Del Rio was also concerned about how Johnson treated her and was scared for Mornay’s safety when her friend shared her pregnancy.

As threats to Mornay’s safety escalated, her family helped her get security cameras and locks at her home.

When Brixx was several months old, Mornay went to court and was awarded joint custody with her as the primary, custodial parent.

A few weeks before their deaths, police came to Mornay’s home where Johnson had showed up uninvited, assaulted her in front of her infant and 10-year-old son and yelled at the boy.

Johnson then left with Brixx, and police and others had to negotiate with Johnson, who over the phone threatened to kill himself and the infant, before police detained Johnson and returned Brixx to Mornay, court documents state.

Police took Johnson to the hospital because of the threats he made, but Mornay told Flot-Patterson he was released without a mental evaluation or arrest.

“Me and my family have had enough and are terrified of what he may do next,” Mornay hand wrote in a May 28, 2021, petition for a domestic abuse protection order in Harrison County.

“His behavior is extremely violent and out of control.”

Mornay’s parents helped arrange for her and her sons to leave for Utah. The older boys would stay with their father and Mornay and Brixx would stay with some of her childhood friends.

The court approved an emergency protective order and within a week, it was served to Johnson.

Days later on June 6, 2021, Flot-Patterson remembers seeing a missed call from her 14-year-old grandson. She tried to reach him, but didn’t get an answer, so Flot-Patterson tried calling Mornay’s phone.

Instead of her daughter on the other end, it was Johnson, who had broken into Mornay’s home. He told Flot-Patterson he killed her daughter and that he and the children would be dead.

Flot-Patterson and her husband raced to Mornay’s Biloxi home. Police found her dead from a gunshot wound and Johnson was dead after turning the gun on himself, but not before shooting Brixx. The baby was still alive and rushed to the hospital but died before he could be transported out of state for more intensive care.

Mornay’s older sons had run from the home to safety and called 911.

“When she died, I said, ‘This baby grounded you.’ That’s the first thing that came to mind when the police told me she was dead,” Flot-Patterson recalled.

In 2021, at least 50 other people died in domestic violence incidents across the state.

Flot-Patterson learned more about the abuse Momay endured through pictures on her daughter’s phone, the text messages she sent and journal entries.

Years later Flot-Patterson still has questions about how the situation Mornay was in was allowed to escalate until it was deadly.

Johnson served nearly six months for aggravated domestic violence against another person, according to Harrison County jail records. Why didn’t police arrest him each time they were called to Mornay’s with that charge on his record? Flot-Patterson asks.

Why wasn’t Johnson held at the hospital and given a mental health evaluation after making threats to his son’s life and his own, she wonders.

During grief, Flot-Patterson dove into sharing her daughter’s story and raising the issue of domestic violence, including organizing concerts to benefit the Gulf Coast Center for Nonviolence and establishing a foundation in Mornay’s name.

She is at the point now that whatever she can do to bring awareness and education about domestic violence, she will do it. Flot-Patterson has had conversations with survivors and met families of other domestic violence homicide victims.

“This is surreal, and I’m not the only one,” she said about meeting other families who lost someone to domestic violence. “I’m not the only one suffering.”

Memories of her daughter is all she has left

Joslin Napier didn’t want to be treated differently as she lived with sickle cell disease. The condition took a toll on her body when she became pregnant and gave birth to her son in 2019.

“She wouldn’t let her sickle cell stop her,” her mother, Tara Gandy, said. “The thing I thought was going to hurt her the most was not what hurt her.”

Chance Jones, an ex-partner, faces a capital murder charge for shooting Napier on Oct. 4, 2022, while in commission of a burglary. His indictment came on the year anniversary of her death, according to court records.

He has also been indicted for aggravated domestic violence for an incident in June 2022, when he pointed a gun at Napier and stomped on her head, according to court records. An indictment came Oct. 12, 2022 – less than a week after Napier’s death.

Napier is among the nearly 40 people who died in 2022 in domestic violence incidents in Mississippi.

Gandy declined to comment about her daughter’s case that is set to go to trial in May.

Prosecutors plan to present to the jury evidence of domestic violence allegations Napier made against Jones to give the jury “a full picture of the circumstances” around her death, according to an August 2024 filing.

The state noted six times when police were called to Napier’s home about Jones within a span of six months.

When she ended the relationship in April 2022, Napier told police Jones came to her home in the early hours of the morning, banged on the door and threatened to hurt her. He broke in through the front door, flipped over her nail salon tables and shelves and took her car keys.

Napier took action, filing for a protective order against him and purchasing a firearm, court records state.

Jones was also arrested twice, in May and August 2022, accused of violating the protection order.

Gandy said there was a lot of guilt and grief their family had to face, and they continue to navigate her loss.

Napier, the only girl of her family, was a butterfly who made you feel welcomed, said Gandy. She taught herself how to do makeup and nails professionally and was in the process of getting her nail technician license.

Napier was also a loyal friend who saw the good in others – something Gandy said she taught her daughter. Like her mother, she also saw potential in others and often fell in love with that potential.

Gandy has let the pain of her daughter’s death push her into purpose. She has been spreading awareness about domestic violence, joining groups and sharing tools and resources – all of which she wished she had access to earlier to help Napier.

She’s also a domestic abuse survivor herself and uses that experience to help others.

“So I keep my daughter’s memories alive, because those are the things that I have left,” Gandy said.

‘I feel like the system failed us’

The loss from domestic violence widens with the inclusion of family violence.

Webb Coker remembers her mother, Patrice, as a smart, strong woman who taught her so much. She was a parent, but also a best friend.

Patrice Webb worked to support her family while also pursuing her dreams: to become a nurse and help people with mental health issues.

She was killed in Jackson Sept. 24, 1999 by her partner, Gregory Ephfrom, who hit her on the head, pushed her out of his car and ran her over on Powers Avenue.

Webb Coker said her mother’s death shattered the lives of her and her younger sister and brother, who were spread across the country to live with their fathers and other family members.

Looking back, she said there were missed opportunities to intervene. Her mother sought help for the domestic abuse and shared with family members, including Webb Coker, that she was scared.

“I feel like the system failed us,” Webb Coker said.

Ephrom was initially charged with first degree murder, according to Clarion Ledger stories in 1999, but weeks later that charge was reduced to manslaughter.

He pleaded guilty to a reduced sentence and received 10 years, with most of it suspended. Webb’s family thought he had served at least a year, but WLBT reported last year that he was in jail for four days.

Webb Coker was upset, but she wanted to use her grief and anger to advocate for victims of domestic violence and sexual assault, which she has experienced herself in relationships.

She is studying to become a nurse, following in her mother’s footsteps.

Webb Coker’s children ask about their grandmother and like to hear stories about her.

But it’s also been an opportunity to teach them about domestic violence and dating violence, especially because she has a 21-year-old son and five girls ranging in age from 8 to 18. Some of the older children witnessed former partners abuse Webb Coker.

“The red flags: I have to pay attention to this time,” she said.

‘These people make choices … that impact us’

Domestic violence doesn’t always involve intimate partners. Sometimes it can be between family members.

Van Marske‘s death came at the hands of his son, Noble, in September 2021. Noble, who is now 45, pleaded guilty to second degree murder and tampering with physical evidence in 2023 and is serving a 20-year sentence.

Marsha Schmitt carries around a folded program from Van Marske’s funeral service because she likes the picture of him. It’s a reminder of her younger brother who was a woodworker, carpenter and fisherman. He was someone she depended on.

He brought his adult son to live with him when Noble was battling addiction and having other troubles, Schmitt said.

But over the years, Noble Marske began to threaten his father. She knew her brother was scared and was trying to get his son to move out of the house, and he tried to file a restraining order. Schmitt said that was not successful, and her brother was told he could not get one because Noble lived with him.

In Mississippi, family members related by blood or marriage who currently or previously lived together can apply for a domestic abuse protection order.

“(But) my brother never believed up to the end that he would actually do it,” Schmitt said about her nephew’s threats against his father.

Van Marske went missing after Labor Day, and nearly a week later authorities searched a marsh area in Harrison County – where Noble Marske told police his father went fishing – and found Van Marske buried in a shallow grave.

In a statement given in court during her nephew’s guilty plea, Schmitt said he does not deserve to be called “Noble” because of what he did. She added, during an interview with Mississippi Today, that Noble was her mother’s name and she doesn’t believe her nephew is worthy of it.

“He chose, and that’s what’s important here,” Schmitt said about her nephew’s actions.

“These people choose. And we have to remember that their choices impact us.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

-

News from the South - South Carolina News Feed7 days ago

News from the South - South Carolina News Feed7 days agoLost in the Fire: The flames took her brother and left her homeless

-

News from the South - Alabama News Feed4 days ago

News from the South - Alabama News Feed4 days agoA midweek cold front moves through Alabama with a freeze likely after spring officially begins

-

News from the South - North Carolina News Feed6 days ago

News from the South - North Carolina News Feed6 days agoHundreds gather to remember 17-year-old killed in Raleigh

-

News from the South - Florida News Feed6 days ago

News from the South - Florida News Feed6 days agoTornadoes, wildfires and blinding dust sweep across U.S. as massive storm leaves at least 32 dead

-

News from the South - Louisiana News Feed4 days ago

News from the South - Louisiana News Feed4 days agoIssues found with federal grants to Louisiana homeland security office | Louisiana

-

News from the South - Georgia News Feed7 days ago

News from the South - Georgia News Feed7 days agoDesjavae Conway accused of several crimes

-

News from the South - Louisiana News Feed7 days ago

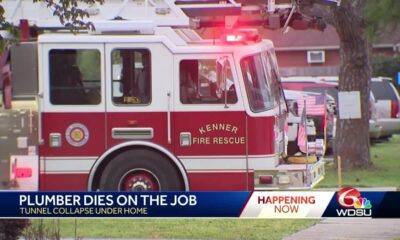

News from the South - Louisiana News Feed7 days agoPlumber dies while working under Kenner house

-

News from the South - Oklahoma News Feed4 days ago

News from the South - Oklahoma News Feed4 days agoOklahoma City man says social security benefits terminated without warning or explanation