News from the South - Missouri News Feed

Missouri lawmakers raise concerns about long waits in jail for court-ordered mental health care

by Clara Bates, Missouri Independent

February 17, 2025

Leaders of Missouri’s public defender system urged lawmakers on Monday to take action to reduce the growing number of people languishing in jails across the state who are in need of mental health treatment.

As of last month, 418 people were in Missouri jails waiting to be transferred to a state mental health bed, up from around 300 at this time last year. The average wait time was 14 months, with some held longer than the maximum sentence for the crime for which they were charged.

These are Missourians who were arrested but found incompetent to stand trial and ordered into treatment designed to restore their ability to have their day in court. Competency restoration generally includes medication treatment and therapy.

Missourians waiting in jail for court-ordered mental health care reaches all-time high

The Missouri House Health and Mental Health Committee spent most of an informational hearing Monday addressing the Department of Mental Health’s competency restoration program, with a presentation by Mary Fox, the director of the Missouri State Public Defender system, and Annie Legomsky, who runs the state public defense system’s holistic defense services program.

“When somebody sits in a jail unmedicated and uncared for,” Fox said, “their mental health can get worse and so bad that they can never be cured.”

Legomsky and Fox urged changes to state law to increase court referrals to community-based treatment, instead of holding those charged with nonviolent, low-level offenses in jail for months.

“If we could figure out a way to take care of more of these folks in the community,” Fox said,”we’re not only saving the state money in the competence restoration process, but we’re setting them up for success when they return to the community.”

The state can’t create beds overnight, Fox said.

“And until we can either create the community restoration and let folks receive the treatment that way or create the beds, we don’t have a quick solution to the problem,” she said.

Many of the public defender’s office’s clients who are found incompetent have schizophrenia, intellectual disabilities or are on the autism spectrum, Fox said.

The legislature in 2023 passed a law giving the department the authority to provide treatment on an outpatient basis if the person could be safely released and wasn’t charged with a dangerous felony. But the department told The Independent last month that only two people have participated in the program so far.

The state also passed a law giving the department of mental health the ability to treat people within jails. The programs have been slow to get up and running, and three counties are in their early days of getting the programs started, the department told The Independent.

Legomsky said Monday that solution is “not ideal” since “the jail is not a therapeutic environment.”

The hearing was designed to inform lawmakers, not to discuss any particular legislation.

Several of the legislators serving on the committee expressed concern with the waitlist.

“We just don’t have enough beds, that’s the answer,” said state Rep. David Dolan, a Republican of Sikeston “We don’t have enough beds, and restoration within county jails is very hit and miss.”

State Rep. Tony Harbison, a Republican of Arcadia, said small counties are footing the bill, since counties are responsible for paying for jail stays.

“Fourteen months — we’re already spending a lot of money,” he said.

Legomsky estimated that the state would save around $480 in savings per day to do community-based competency restoration as opposed to the hospital setting, not to mention the cost savings for counties currently housing those individuals in jails.

One client, Fox said, was a 78-year-old woman with dementia who tossed lit matches in a laundromat waste basket — but was held in jail for a year, waiting for a mental health bed.

State Rep. Jo Doll, a Democrat of St. Louis, responded: “Where’s the common sense part of that? How does someone, how do you all these people see this person day after day and let someone sit there for a year?”

A handful of lawmakers asked about the potential for a public-private partnership, and whether private hospitals could be included. The public defenders said that would be a question for the department of mental health.

Others asked about states that do things better. Legomsky said Washington state limits the wait time to 14 days, and recommended time limits be established in Missouri statute.

“Even closer to 30 days would be a huge improvement over 14 months,” she said.

Other recommendations included increasing funding for community crisis care, housing and substance use disorder treatment — wraparound services to help people become competent and remain healthy, Legomsky said. The state could also make community-based treatment the presumption for those charged with low-level, nonviolent offenses. She said the public defenders estimate around 80% of those on the waitlist are charged with low-level, nonviolent offenses, and could be treated on an outpatient basis.

“We’re on the same side as the prosecutors, the sheriffs, the courts,” Legomsky said. “I think we all just want to find a solution.”

YOU MAKE OUR WORK POSSIBLE.

Missouri Independent is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Missouri Independent maintains editorial independence. Contact Editor Jason Hancock for questions: info@missouriindependent.com.

The post Missouri lawmakers raise concerns about long waits in jail for court-ordered mental health care appeared first on missouriindependent.com

News from the South - Missouri News Feed

Illinois family desperate for answers after man goes missing in Mississippi River

SUMMARY: An Illinois family is urgently seeking answers after 52-year-old Shane Bear fell into the Mississippi River while being chased by police over the Stan Musial Veterans Memorial Bridge on Wednesday night. The family fears that the search efforts have slowed and that their loved one may still be alive. Bear, who had mental health struggles and outstanding warrants, was reportedly attempting to climb under the bridge when he slipped and fell into the river. Illinois State Police, alongside the Coast Guard and local fire departments, have conducted aerial and boat searches, but the family demands more thorough efforts.

An Illinois family is demanding police do more after they said their loved one fell into the Mississippi River.

They said it happened as he was being chased by police Wednesday night over the Stan Musial Veterans Memorial Bridge.

St. Louis News: FOX 2 covers news, weather, and sports in Missouri and Illinois. Read more about this story or see the latest updates on our website https://FOX2Now.com

Follow FOX 2 on social media:

YouTube: https://www.youtube.com/FOX2Now

Facebook: https://www.facebook.com/FOX2Now/

Twitter: https://twitter.com/FOX2Now/

Instagram: https://www.instagram.com/fox2now/

TikTok: https://tiktok.com/@fox2now

SnapChat: https://www.snapchat.com/add/fox2now

News from the South - Missouri News Feed

Missouri health department announces first measles case of 2025

by Clara Bates, Missouri Independent

April 18, 2025

Missouri’s first confirmed measles case of the year involves a child in Taney County, the health department announced Friday afternoon.

The child’s vaccination status “has not yet been verified,” according to the press release.

The child, who is not a Missouri resident, was visiting Taney County and was diagnosed “soon after arrival,” Lisa Cox, spokesperson for the Department of Health and Human Services, said in a press release.

Taney County is in southwest Missouri, and its largest city is Branson.

“Exposure is believed to be limited, and known contacts have been identified and contacted,” Cox said, adding that the state is supporting Taney County’s health department to investigate possible exposure.

The case is “associated with recent international travel,” Cox said.

Measles is a highly-contagious virus the country declared eliminated 25 years ago, but that has resurged with falling vaccination rates.

“For those unvaccinated or those unsure of their vaccination status, now is the time to review records and get caught up if needed,” Dr. George Turabelidze, state epidemiologist with DHSS, said in the press release.

The percent of Missouri kindergarteners fully vaccinated against measles, mumps and rubella has declined over the last several years, from 95% in the 2019-2020 school year to 91% in the 2023-2024 school year, in public schools, per DHHS data. In private schools, the drop has been even larger, from 92% to 85% in the same period.

Nationally, there are at least 800 reported cases of measles across 25 states, according to Center for Disease Control data as of Friday. That doesn’t include Missouri’s case, Cox said, because the state received lab test results Thursday night, after the federal reporting deadline for this week.

That is the highest number for a single year since 2019 and is still growing.

The majority of measles infections nationally have been reported in a West Texas outbreak. There have been two confirmed deaths, both in Texas.

Kansas has reported 37 cases, possibly linked to the Texas outbreak.

There are outbreaks in Canada and Mexico, too, and several states have reported isolated cases as the result of international travel.

At the same time, the federal government has cut grant funding set aside for the Missouri Department of Health and Senior Services to encourage vaccinations, according to St. Louis Public Radio.

GET THE MORNING HEADLINES.

Missouri Independent is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Missouri Independent maintains editorial independence. Contact Editor Jason Hancock for questions: info@missouriindependent.com.

The post Missouri health department announces first measles case of 2025 appeared first on missouriindependent.com

News from the South - Missouri News Feed

Be Our Guest to Cocina Latina with traditional Mexican dishes!

SUMMARY: Cocina Latina is preparing for a Cinco de Mayo celebration with traditional Mexican dishes. Chef Mighty Sec has created a vibrant menu featuring tacos, margaritas, nachos, and more. Guests can enjoy an array of flavorful dishes, including French fries, tacos, and a signature sandwich inspired by Texas. The event is set to take place on May 3rd, and attendees can purchase gift certificates at a special price. It’s a great opportunity to savor delicious food and celebrate with festive drinks, including the popular skinny margarita. For more details, visit their website for ticket information.

Named one of St. Louis Post-Dispatch’s top 100 restaurants in 2022, Cocina Latina is bringing classic dishes everyone loves—from chimichangas, fajitas, enchiladas and more!

-

Mississippi Today6 days ago

Mississippi Today6 days agoLawmakers used to fail passing a budget over policy disagreement. This year, they failed over childish bickering.

-

Mississippi Today6 days ago

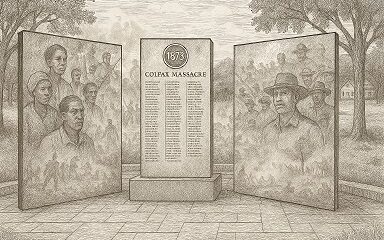

Mississippi Today6 days agoOn this day in 1873, La. courthouse scene of racial carnage

-

Local News7 days ago

Local News7 days agoAG Fitch and Children’s Advocacy Centers of Mississippi Announce Statewide Protocol for Child Abuse Response

-

Local News6 days ago

Local News6 days agoSouthern Miss Professor Inducted into U.S. Hydrographer Hall of Fame

-

News from the South - Alabama News Feed4 days ago

News from the South - Alabama News Feed4 days agoFoley man wins Race to the Finish as Kyle Larson gets first win of 2025 Xfinity Series at Bristol

-

News from the South - Alabama News Feed5 days ago

News from the South - Alabama News Feed5 days agoFederal appeals court upholds ruling against Alabama panhandling laws

-

News from the South - North Carolina News Feed7 days ago

News from the South - North Carolina News Feed7 days agoHelene: Renewed focus on health of North Carolina streams | North Carolina

-

News from the South - Florida News Feed7 days ago

News from the South - Florida News Feed7 days agoSevere weather has come and gone for Central Florida, but the rain went with it