(The Center Square) — Tax revenues for March in Mississippi were up nearly 17% over the pre-session estimate, as an additional $87 million was collected.

The report by the Legislative Budget Office showed that tax revenues for the fiscal year, which will end June 30, were up 3.51% compared with estimates, adding $178.9 million in revenue to the state’s balance sheet and 0.03% above the collections at this point last year. The fiscal 2024 estimate is $7.52 billion.

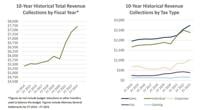

Ten-year historical total revenue collections and by tax type graphs issued by the Mississippi Legislative Budget Office.

As for the year to date, sales tax revenues (nearly $2.1 billion) were up 3.4%, gaining an additional $68.9 million over the year before, when $2.03 billion was collected.

Use of e-commerce in Mississippi continues to grow, as revenues from the state’s 7% use tax on all out-of-state sales grew 3.58% compared to the same time last year. In fiscal 2023, those revenues were $293.9 million, compared to $304.4 million this year, an increase of $10.5 million.

With recent income tax cuts passed by lawmakers, the state’s personal income revenues continue to plummet, down 10.07% compared to the year before. The state took in $1.65 billion in 2023 compared to $1.49 billion this year, a reduction of $166.6 million.

Corporate income tax collections were also down compared to the same period last year, falling 5.01%. In fiscal 2023, the state collected $569.5 million compared to $540.9 million this year, a decrease of $28.5 million.

Tobacco and beer taxes and revenue from the state’s distribution of wine and liquor were also down slightly (0.59%) compared to the same period last year. Last year, the state collected $194.7 million while collecting $193.6 million this year, a decrease of $1.14 million.

Gaming tax revenues were also down by 5.3%. In fiscal 2023 up to March, the state collected $121.6 million, compared to $115.2 million, a drop of $6.44 million.

Tax revenue from the state’s medical marijuana program also took a plunge, down 13.23% compared to the year before. In fiscal 2023, the program took in $7.43 million compared to $6.44 million this year, a decrease of $982,868.