Mississippi News

Mississippi wants to dole out tax dollars as venture capital to startups. What could go wrong?

Mississippi wants to dole out tax dollars as venture capital to startups. What could go wrong?

Mississippi lawmakers are considering getting into the venture capital business, using your tax dollars to float startup businesses.

What could go wrong?

Well, if history is any guide — plenty. The last time the state tried this, millions of dollars were misspent and stolen, no new businesses got started, somebody went to prison, and the state spent years trying to untangle what went wrong.

Taxpayers would’ve been better off if someone had taken their money down to the boats and played craps with it.

First, the new proposal: With the American Rescue Plan Act, Congress earmarked $10 billion to reauthorize the State Small Business Credit Initiative. This initiative was first created in 2010 after the Great Recession, and funded with $1.5 billion in federal tax dollars to help stimulate small business entrepreneurship through loans and investments.

FOLLOW THE MONEY: Our full tracking of Mississippi’s historic influx of federal cash

Mississippi got about $13 million back then and, like many other states, just created small business loan programs. Some states also used the money for venture capital, but Mississippi did not in part because it was a relatively small amount and also in part because of its past massive boondoggle mentioned above — but more on that later.

Now, Mississippi is set to receive about $52 million. And the Mississippi Development Authority is asking lawmakers to give the agency authority to stand up a private nonprofit and create a venture capital fund with part of the money. It’s asking for this authority because, as MDA’s Chief Operating Officer Jamie Miller explained to lawmakers, “the state constitution does not allow the state to have an equity interest in a private businesses.”

The plan would be for the new nonprofit venture to get some private venture capitalists to also pitch in, find the next Google or Amazon being cooked up in someone’s garage in Toomsuba, give it money to get rolling and bingo — we’re in the money.

Now, for the history: With business leaders long lamenting the lack of venture capital floating around Mississippi, lawmakers in 1994 decided to help out, under the auspices of MDA’s predecessor agency. They approved $20 million in borrowing, and the creation of a private nonprofit to funnel the borrowed tax dollars to Magnolia Venture Capital Corporation.

But by 1997, Magnolia Venture had blown about $4.5 million on overhead including what an investigation would deem “questionable and extravagant” spending by its CEO and board. The CEO — later convicted of fraud and money laundering — had paid himself $747,000 in salary and bonuses over 18 months, and awarded companies he owned or was affiliated with $1.2 million.

Magnolia did not help a single startup get started up, and its only capital investment was $600,000 to an already existing company. The loan private investor Magnolia suckered in promptly pulled out, and the state was left holding the bag on millions of dollars in interest payments.

When the latest proposal for MDA to stand up a venture capital (also known as “risk” capital, for good reason) got pitched at the Capitol, many folks who’d been around more than a minute immediately thought of Magnolia Venture.

But MDA Interim Director Laura Hipp said these are different times, and the ARPA funds would be subject to both federal and state scrutiny light years beyond that of the mid-1990s. A new program would require the federal venture dollars be matched with private investment (but the Magnolia Venture scheme ostensibly did, too) and MDA would closely monitor the workings of the new venture capital venture.

The proposal was offered in two “mirror” bills, Senate Bill 2772 and House Bill 1164. The House version was passed on to the full chamber by the Ways and Means committee last week with little discussion and no debate. But in the Senate, after much debate and some reminiscing about Magnolia Venture, the Finance Committee stripped out the venture capital/private nonprofit language before sending it to the full Senate.

The Senate debate over the bill created somewhat strange bedfellows. Both Sen. David Blount, D-Jackson, and Sen. Chris McDaniel, R-Ellisville — often at odds politically — decried the venture capital proposal as a bad idea.

Both shared the sentiment that the state “should not be in the business of picking winners and losers” by handing out tax dollars to fund speculative startup businesses.

Blount reminded his colleagues of Magnolia Venture, “a giant scandal that resulted in millions of dollars squandered.”

“The state has enough to do without getting into the venture capital business,” Blount said. “We ended up with a scandal before … Who would run this nonprofit? Would their salaries be public information, their records? Would they be subject to open meetings laws? Bid laws? … Are you familiar with Magnolia Venture Capital? Why should we do that again?”

McDaniel said such a program would “invite not only unfair competition, but corruption and cronyism.”

“I would never mean to imply anything improper or irregular is happening at MDA,” McDaniel said, “but if you look at history, any time government gets involved in private business affairs like this, you end up with misspending, strong arming, cronyism and corruption … Government creating an environment for growth, that’s one thing, and that usually means government getting out of the way, not risking the taxpayers’ capital.”

McDaniel said that, beyond the venture capital proposal, he has concerns over other parts of MDA’s plans to use the ARPA money earmarked for small business growth.

“My understanding is that some of the businesses could receive loan forgiveness up to 60% of the loans with this program,” McDaniel said. “We would be incentivizing reckless decisions and investing by businesses, with the damage falling back on the taxpayers. A loan with up to 60% forgiveness is probably a self-fulfilling prophecy.”

Blount said: “Venture capital is by definition making risky investments. That’s not our job.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Mississippi News

Events happening this weekend in Mississippi: April 18-20

SUMMARY: This weekend (April 18-20), Mississippi offers a variety of events for all ages. In Jackson, enjoy Food Truck Friday, a jazz concert, free outdoor movie screenings, and multiple exhibitions including “Of Salt and Spirit” and “Hurricane Katrina: Mississippi Remembers.” For family fun, there’s an Easter Egg Hunt at the Ag Museum and “Bunnies & Butterflies” at MCM. Natchez features the Spring Pilgrimage, Lafayette’s 200th anniversary celebration, and a farmers market. In the Pine Belt, highlights include Live at Five, a Spring Candle-Making Workshop, and Easter events at the Hattiesburg Zoo. Don’t miss the Bluff City Block Party and more!

The post Events happening this weekend in Mississippi: April 18-20 appeared first on www.wjtv.com

Mississippi News

Events happening this weekend in Mississippi: April 11-13

SUMMARY: This weekend in Mississippi (April 11-13), enjoy a variety of events across the state. Highlights include the Eudora Welty Birthday Bash in Jackson, Trivia Night at the Mississippi Museum of Natural Science, and Boots & Bling Fundraiser in Natchez. For family fun, check out the Bunny Bonanza in Jackson or the Easter Egg Hunt in Clinton. The Natchez Concours d’Elegance Car Show and Stranger Than Fiction Film Festival offer cultural experiences, while the 12th Annual Dragon Boat Regatta in Ridgeland and the Hub City Classic Car Show in Hattiesburg provide exciting activities for all ages.

The post Events happening this weekend in Mississippi: April 11-13 appeared first on www.wjtv.com

Mississippi News

Ole Miss women get pair of double-doubles and roll to 83-65 March Madness win over Ball State

SUMMARY: Mississippi coach Yolett McPhee-McCuin found solace in returning to a different arena in Waco, Texas, following a disappointing previous tournament experience. The No. 5 seed Ole Miss Rebels redeemed themselves with an 83-65 victory over 12th-seeded Ball State in the NCAA Tournament’s first round. Starr Jacobs led the Rebels with 18 points and 11 rebounds, while Kennedy Todd-Williams and Madison Scott each scored 15 points. Ole Miss dominated rebounding, leading 52-32, and will face fourth-seeded Baylor next. Coach McPhee-McCuin noted the team’s evolution since their last visit and the significance of playing in Texas, where Jacobs feels at home.

The post Ole Miss women get pair of double-doubles and roll to 83-65 March Madness win over Ball State appeared first on www.wjtv.com

-

News from the South - Alabama News Feed6 days ago

News from the South - Alabama News Feed6 days agoFoley man wins Race to the Finish as Kyle Larson gets first win of 2025 Xfinity Series at Bristol

-

News from the South - Alabama News Feed7 days ago

News from the South - Alabama News Feed7 days agoFederal appeals court upholds ruling against Alabama panhandling laws

-

News from the South - North Carolina News Feed5 days ago

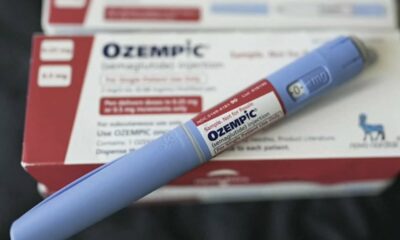

News from the South - North Carolina News Feed5 days agoFDA warns about fake Ozempic, how to spot it

-

News from the South - Virginia News Feed5 days ago

News from the South - Virginia News Feed5 days agoLieutenant governor race heats up with early fundraising surge | Virginia

-

News from the South - Missouri News Feed3 days ago

News from the South - Missouri News Feed3 days agoDrivers brace for upcoming I-70 construction, slowdowns

-

News from the South - Missouri News Feed5 days ago

News from the South - Missouri News Feed5 days agoAbandoned property causing issues in Pine Lawn, neighbor demands action

-

News from the South - Oklahoma News Feed4 days ago

News from the South - Oklahoma News Feed4 days agoThursday April 17, 2025 TIMELINE: Severe storms Friday

-

News from the South - Arkansas News Feed7 days ago

News from the South - Arkansas News Feed7 days agoTwo dead, 9 injured after shooting at Conway park | What we know