Mississippi Today

Lt. Gov. Hosemann unveils $326 million ‘sustainable, cautious’ tax cut plan

Republican Lt. Gov. Delbert Hosemann on Wednesday unveiled a $326 million tax cut package that reduces the state income tax and the sales tax on groceries and raises the gasoline tax to fund road work.

The plan is more austere than the overhaul the House has proposed. That plan would eliminate the individual income tax in Mississippi over the next decade, raise sales taxes and create a new indexed gasoline tax. The House plan would be a net tax cut of $1.1 billion.

Flanked by Republican senators, Hosemann said the Senate plan would cut taxes over the next four years while allowing the Legislature to spend tax dollars on core government functions such as public education.

“This needs to be sustainable,” Hosemann said. “A conservative approach to tax reform. Now, just to do things for one year doesn’t mean it’s sustainable. This needs to be sustainable.”

Senate leaders at a Wednesday press conference with Hosemann used the terms “measured, careful, cautious and responsible” when explaining details of the Senate plan.

Hosemann said the Senate plan would within four years reduce Mississippi’s individual income tax to 2.99%, the lowest rate in the nation of states that collect income taxes.

READ MORE: Speaker White frustrated by ‘crickets’ from Senate on tax plan

Legislation for the plan has not yet been filed, but if passed, the proposal would reduce the state’s 7% sales tax on grocery items to 5% in July 2026.

Municipalities currently receive a portion of the state tax collected from grocery sales. Hosemann said the Senate plan would make municipalities whole and allow them to collect the revenue they would typically receive from the state.

The plan also raises the state’s 18.4-cents-a-gallon gasoline excise by three cents each year over the next three years, eventually resulting in a 27.4 cents per gallon gas tax at completion. The gas tax funds highway infrastructure maintenance and new infrastructure projects. The House plan would create a new 5% sales tax on top of the current excise, which at current rates would cost consumers more at the pump than the Senate plan.

Hosemann’s plan reduces the state’s flat 4% income tax to 2.99% over four years, a component that’s likely to set up a major debate with the House.

The announcement comes after the House passed a plan last month that eliminates the income tax over a decade, cuts the state grocery tax and raises sales taxes and gasoline taxes.

House Speaker Jason White, a Republican from West, has made income tax elimination his top priority this legislative session. He told reporters that even though there were a lot of differences between the House and Senate tax plans, he applauded the Senate for introducing a tax cut plan to allow the two chambers to potentially negotiate a final proposal.

Last week, White had criticized Hosemann and the House for not having presented a detailed plan, and legislation, with the three-month legislative session nearing the midway point.

“I’m glad they’re in the ballgame,” White said of the Senate plan Wednesday. “They’re in the ballgame, so we’ve got a chance. Mississippians have a chance at a tax cut if the Senate’s in the game, so that’s a positive.”

Hosemann said he and his Senate leadership “took our time, to run proformas and make sure this works the way we intend it.”

If the Legislature passes a final tax cut plan, it will head to Republican Gov. Tate Reeves’ desk for consideration. Reeves has encouraged lawmakers to pass legislation to eliminate the income tax, but it remains unclear if he would sign a tax cut package into law that does not fully eliminate the income tax.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

Mississippi Today

On this day in 1960

On this day in 1960

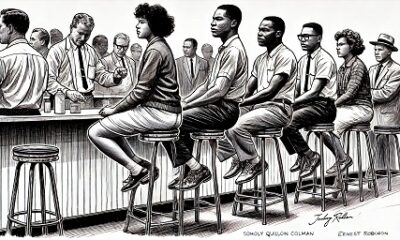

March 16, 1960

Inspired by the Greensboro sit-in a month earlier, Black students staged sit-ins at whites-only lunch counters in eight downtown stores in Savannah, Georgia.

Students Carolyn Quilloin Coleman, Joan Tyson Hall and Ernest Robinson stepped into Levy’s Department Store, shopping before entering the segregated Azalea Room. The server ordered them to leave, but they attempted to order anyway. Police hauled them to jail, where they sang, “We Shall Overcome.”

Robinson recalled looking at his hand where he scrawled the words of a Psalm: “Yea, though I walk through the valley of the shadow of death, I will fear no evil: for thou art with me; thy rod and thy staff they comfort me.”

“That verse uplifted us,” Coleman told the Savannah Morning News. “We were very familiar with what had happened to Emmett Till, a 14-year-old student who was killed in Mississippi for allegedly whistling at a White girl across the street. While we thought that we were safe in Savannah, we knew that anything could happen.”

In response, Black leaders W.W. Law, Hosea Williams and Eugene Gadsden organized a boycott of city businesses and led voter registration drives that brought changes to city government. Seven months later, Savannah repealed its ordinance requiring segregated lunch counters. The boycott continued until all facilities were desegregated in October 1963.

Months later, Martin Luther King Jr. arrived to hail the passing of Jim Crow ways. The Levy’s Department Store building now houses the Savannah College of Art and Design’s Jen Library, and a historic marker now honors the students’ fight for freedom.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

Mississippi Today

The quiet part out loud: Mississippi political leaders tolerate tax burden on poor

The quiet part out loud: Mississippi political leaders tolerate tax burden on poor

Former Gov. Haley Barbour finally said the quiet part out loud.

During a recent speech to the Mississippi State University Stennis Institute of Government and Capitol Press Corps, the former two-term governor and master communicator said taxing groceries was a good thing because everybody has to eat.

Barbour reasoned that it is important for all people to have skin in the game — to pay taxes — because “otherwise, they will vote to pave the streets with gold if they don’t have to pay anything.”

Various conservative politicians and other policymakers espouse the Barbour philosophy that a tax on food is fair and necessary. To ensure that poor people pay taxes, too, they advocate for a grocery tax that absorbs a much greater percentage of the income of low income families.

The quiet part out loud is a reference to the fact that as governor from 2004 until 2012, Barbour blocked legislative efforts to eliminate the grocery tax and offset that lost revenue, at least in part by increasing the tax on cigarettes. Barbour vetoed two bills in 2006: one to eliminate the highest in the nation 7% tax on food and the other to cut in half the levy on groceries.

Veto messages are where governors articulate their reasoning for opposing legislation. In neither veto of the grocery tax cut bills did the governor talk about “fairness.”

Instead, he talked about the fact that the combination of cutting or eliminating the grocery tax and increasing the cigarette tax was not revenue neutral. The legislation, Barbour argued at the time, would produce less revenue for the state.

He maintained that it sent the wrong message to cut taxes at a time when he was going to Congress to try to secure federal funds to help with the recovery from the devastation caused by Hurricane Katrina. And in fairness to the governor, Hurricane Katrina was the seminal event of Barbour’s tenure as governor and one of the seminal events in the state’s history, and his ability to obtain those funds was paramount for the success of the Gulf Coast and south Mississippi.

So it is fair to say Katrina was heavy on Barbour’s mind in 2006 when the Legislature sent him the bills to cut the grocery tax.

It is clear, though, that Mississippi’s political leadership still has similar views as Barbour on the grocery tax. Since Barbour has left office, there have been two major reductions in the income tax: one in 2016 when Phil Bryant was governor and another in 2022 when Tate Reeves was governor.

There has been no cut in the grocery tax during that time.

This year the Senate proposes another major cut in the income tax and a reduction in the grocery tax from 7 cents to 5 cents on every dollar purchase of groceries.

There are efforts by the House leadership and Reeves to completely eliminate the income tax. In addition, the House tax cut plan essentially would trim the grocery tax to 5.5%. The House plan in most instances also would raise the sales tax on most other retail items from 7% to 8.5%.

And there are retail items other than groceries that most all people need. After all, most everyone, including poor people who might not pay an income tax, must buy clothes, household utensils and numerous other retail items that under the House plan would cost more because of the increase in the sales tax.

In short, there are many opportunities other than the grocery tax to collect taxes from poor people.

But just to recap:

• Only 12 states tax food like Mississippi does.

• Mississippi not only has the highest state-imposed tax on food, but also has one of the country’s highest sales taxes on other retail items.

• Mississippi has one of the lowest income taxes in the country and it is getting even lower thanks to the 2022 tax cut that is still being phased in.

The aforementioned tax structure results in Mississippi’s low-wage earners paying a greater percentage of their income in state and local taxes than do the state’s more affluent residents, a 2024 study found.

The report by the Institute of Taxation and Economic Policy found that Mississippi has the nation’s 19th-most regressive tax system where low-income residents are forced to pay a larger percentage of their income in taxes than the state’s wealthier citizens.

The study shows the income tax is the only component of the Mississippi tax system that requires the wealthy to pay more than the poor.

And even though Mississippi has the nation’s highest percentage of poor people, the quiet part that needs to be told louder is that our leaders are working to make the tax structure even more regressive.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

Mississippi Today

At least 3 dead in Mississippi after likely tornadoes sweep through the state

At least 3 dead in Mississippi after likely tornadoes sweep through the state

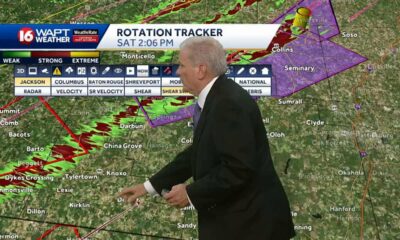

Violent tornadoes ripped through parts of the U.S. this weekend, killing at least three people in Mississippi and damaging several communities across the Magnolia State.

Two separate likely tornadoes hit Walthall County on Saturday afternoon, killing three people near Darbun along Bethlehem Loop Road, according to the county’s Emergency Management Director Royce McKee.

Walthall County Sheriff Kyle Breland told WLBT there are also injuries, collapsed homes, and trees blocking roadways in the county.

The National Weather Service in Jackson on Saturday afternoon had issued a tornado emergency for two separate tornadoes that moved through Walthall County. That rare official designation of a “large and dangerous tornado” continued into Marion, Lawrence and Jefferson Davis counties. Numerous other tornado warnings were issued before storms cleared out of the state by Saturday late afternoon.

Before sunrise early Saturday morning, a likely tornado ripped through the Elliott community in Grenada County, destroying several homes and damaging other buildings. No fatalities were reported in that storm.

“All of a sudden, it got like a freight train,” Robert Holman told FOX Weather of the Elliott storm. “Then all of a sudden, we just heard stuff just falling all on the house.”

The storms knocked out power to about 25,000 people across the state.

Though Mississippi was in the Saturday bullseye for the tornado outbreak, the same storm system affected much of the U.S. over the weekend.

The number of fatalities increased after the Kansas Highway Patrol reported eight people died in a highway pileup caused by a dust storm in Sherman County Friday. At least 50 vehicles were involved.

Missouri recorded more fatalities than any other state as it withstood scattered twisters overnight that killed at least 12 people, authorities said. The deaths included a man who was killed after a tornado ripped apart his home.

“It was unrecognizable as a home. Just a debris field,” said Coroner Jim Akers of Butler County, describing the scene that confronted rescuers. “The floor was upside down. We were walking on walls.”

Dakota Henderson said he and others rescuing people trapped in their homes Friday night found five dead bodies scattered in the debris outside what remained of his aunt’s house in hard-hit Wayne County, Missouri.

“It was a very rough deal last night,” he said Saturday, surrounded by uprooted trees and splintered homes. “It’s really disturbing for what happened to the people, the casualties last night.”

Henderson said they rescued his aunt from a bedroom that was the only room left standing in her house, taking her out through a window. They also carried out a man who had a broken arm and leg.

Officials in Arkansas said three people died in Independence County and 29 others were injured across eight counties as storms passed through the state.

“We have teams out surveying the damage from last night’s tornadoes and have first responders on the ground to assist,” Arkansas Gov. Sarah Huckabee Sanders said on X.

She and Georgia Gov. Brian Kemp declared states of emergency. Kemp said he was making the declaration in anticipation of severe weather moving in later Saturday.

On Friday, meanwhile, authorities said three people were killed in car crashes during a dust storm in Amarillo in the Texas Panhandle.

Tornadoes hit amid storm outbreak

The Storm Prediction Center said fast-moving storms could spawn twisters and hail as large as baseballs on Saturday, but the greatest threat would come from winds near or exceeding hurricane force, with gusts of 100 miles per hour possible.

Significant tornadoes continued to hit Saturday. The regions at highest risk stretch from eastern Louisiana and Mississippi through Alabama, western Georgia and the Florida panhandle, the center said.

Bailey Dillon, 24, and her fiance, Caleb Barnes, watched a massive tornado from their front porch in Tylertown, Mississippi, about half a mile (0.8 km) away as it struck an area near Paradise Ranch RV Park.

They drove over afterward to see if anyone needed help and recorded a video depicting snapped trees, leveled buildings and overturned vehicles.

“The amount of damage was catastrophic,” Dillon said. “It was a large amount of cabins, RVs, campers that were just flipped over — everything was destroyed.”

Paradise Ranch reported on Facebook that all its staff and guests were safe and accounted for, but Dillon said the damage extended beyond the ranch itself.

“Homes and everything were destroyed all around it,” she said. “Schools and buildings are just completely gone.”

Some of the imagery from the extreme weather has gone viral.

Tad Peters and his dad, Richard Peters, had pulled over to fuel up their pickup truck in Rolla, Missouri, Friday night when they heard tornado sirens and saw other motorists flee the interstate to park.

“Whoa, is this coming? Oh, it’s here. It’s here,” Tad Peters can be heard saying on a video. “Look at all that debris. Ohhh. My God, we are in a torn …”

His father then rolled up the truck window. The two were headed to Indiana for a weightlifting competition but decided to turn around and head back home to Norman, Oklahoma, about six hours away, where they encountered wildfires.

Wildfires elsewhere in the Southern Plains threatened to spread rapidly amid warm, dry weather and strong winds in Texas, Kansas, Missouri and New Mexico.

A blaze in Roberts County, Texas, northeast of Amarillo, quickly blew up from less than a square mile (about 2 square kilometers) to an estimated 32.8 square miles (85 square kilometers), the Texas A&M University Forest Service said on X. Crews stopped its advance by Friday evening.

About 60 miles (90 kilometers) to the south, another fire grew to about 3.9 square miles (10 square kilometers) before its advance was halted in the afternoon.

High winds also knocked out power to more than 200,000 homes and businesses in Texas, Oklahoma, Arkansas, Missouri, Illinois, Indiana and Michigan, according the website poweroutage.us.

Extreme weather encompasses a zone of 100 million people

The deaths came as a massive storm system moving across the country unleashed winds that triggered deadly dust storms and fanned more than 100 wildfires.

Extreme weather conditions were forecast to affect an area home to more than 100 million people. Winds gusting up to 80 mph (130 kph) were predicted from the Canadian border to Texas, threatening blizzard conditions in colder northern areas and wildfire risk in warmer, drier places to the south.

The National Weather Service issued blizzard warnings for parts of far western Minnesota and far eastern South Dakota starting early Saturday. Snow accumulations of 3 to 6 inches (7.6 to 15.2 centimeters) were expected, with up to a foot (30 centimeters) possible.

Winds gusting to 60 mph (97 kph) were expected to cause whiteout conditions.

Evacuations were ordered in some Oklahoma communities as more than 130 fires were reported across the state. Nearly 300 homes were damaged or destroyed. Gov. Kevin Stitt said at a Saturday news conference that some 266 square miles (689 square kilometers) had burned in his state.

The State Patrol said winds were so strong that they toppled several tractor-trailers.

Experts said it’s not unusual to see such weather extremes in March.

Mississippi Today editors contributed to this Associated Press report. Bruce Shipkowski reported from Toms River, New Jersey. Julie Walker reported from New York. Rebecca Reynolds contributed from Louisville, Kentucky. Jeff Roberson in Wayne County, Missouri, Eugene Johnson in Seattle and Janie Har in San Francisco contributed.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

-

Mississippi Today7 days ago

Mississippi Today7 days agoMississippians honor first Black lawmaker since Reconstruction

-

News from the South - Oklahoma News Feed5 days ago

News from the South - Oklahoma News Feed5 days agoLong Story Short: Bill to Boost Rural Mental Health and Diversion Programs Advances

-

News from the South - North Carolina News Feed6 days ago

News from the South - North Carolina News Feed6 days agoLumbee tribe may finally receive long-sought federal recognition

-

News from the South - Florida News Feed6 days ago

News from the South - Florida News Feed6 days agoHeavy rain, gusty winds expected in Central Florida

-

News from the South - Oklahoma News Feed5 days ago

News from the South - Oklahoma News Feed5 days agoBlood stain leads to 2 arrests in 1997 Oklahoma cold case

-

News from the South - Missouri News Feed6 days ago

News from the South - Missouri News Feed6 days agoSt. Louis forecast: Temperatures warm up this week

-

News from the South - Alabama News Feed5 days ago

News from the South - Alabama News Feed5 days agoCannabis cultivator celebrates Alabama licensing ruling

-

Mississippi Today3 days ago

Mississippi Today3 days agoOn this day in 1965