Mississippi Today

Lawsuit to officially outlaw abortion in Mississippi may not have standing at the state Supreme Court

Two high-profile cases in recent years where the Mississippi Supreme Court limited standing to pursue lawsuits could impact the hot button issue of abortion that some believe could be speeding toward the state’s highest court.

Based on those landmark rulings by the Supreme Court, the never-ending saga continues: Mississippi is simultaneously a state where abortions are technically legal but also where medical providers make no effort to perform abortions.

A group of conservative doctors — Mississippi members of the American Association of Pro-Life Obstetricians and Gynecologists — filed a lawsuit asking the courts to overturn a 1998 ruling by the Mississippi Supreme Court saying the state constitution provides a right to an abortion based on privacy.

In October, Hinds County Chancellor Crystal Wise Martin said the physicians did not have the right to file the lawsuit because they could not prove they were harmed by the 1998 ruling. In legal parlance, Wise Martin found the physicians did not have standing to bring the lawsuit.

Attorney Aaron Rice, who represents the physicians, said he intends to file an appeal to the Mississippi Supreme Court asking that the Hinds County chancellor’s ruling be overturned.

But it can be argued that the two recent landmark rulings by the Mississippi Supreme Court seem to give credence to Wise Martin’s ruling. In a 2020 case, the Mississippi Supreme Court famously reversed past rulings and said state lawmakers did not have standing to sue the governor challenging his partial veto authority of appropriations bills.

And earlier this year, a Supreme Court majority ruled that the Parents for Public Schools organization did not have the authority to sue challenging the constitutionality of a legislative decision to send public funds to private schools.

In the education funding case, Northern District Supreme Court Justice Robert Chamberlin, writing for the majority, ruled that Parents for Public Schools did not have standing to bring the lawsuit because the group “failed to sufficiently demonstrate an adverse impact that it suffers differently from the general public.” In essence, a party must prove it will endure a specific harm in order to file a lawsuit challenging an action.

In a dissenting opinion, Central District Justice Leslie King asked, “This case begs the question: if parents of public school children are not sufficiently adversely impacted to challenge this government action, who is?”

Every case is different. Perhaps Rice and the physicians can present an argument that makes enough distinctions on the issue of standing to succeed before the high court. But based on a lay reading of the standing rulings, it appears that the physicians have a tough row to hoe.

The doctors argue that because of the 1998 state Supreme Court ruling, they run the risk of being punished if they refuse to help a patient obtain an abortion. But Hinds County Chancellor Wise Martin wrote that the conservative physician group “acknowledged that it is not aware of any instance where a member physician has been disciplined or decertified…for refusing to provide abortion services.”

The judge added that under state Supreme Court precedent, “the potential” of something occurring, such as disciplinary action, is not enough reason to file a lawsuit.

Granted, this is all a bit convoluted since everyone knows Mississippi is the state that filed the lawsuit that led to the U.S. Supreme Court overturning Roe v. Wade and the national right to an abortion.

State politicians constantly tout their leadership in overturning Roe v. Wade. When the U.S. Supreme Court overturned Roe v. Wade, Mississippi already had laws on the books outlawing abortion in most instances.

But then, someone realized that there was this pesky 1998 state Supreme Court ruling that found that the Mississippi Constitution provided the right to an abortion.

And, of course, people learned in 9th grade civics that the constitution as interpreted by the highest court in the land trumps a measly old law passed by a legislative body.

But then a funny thing happened. As the Mississippi Supreme Court moved slowly to rule on whether the 1998 ruling should be reversed, the state’s abortion providers packed up and left the state and decided not to pursue a case asking the state Supreme Court to rule on the case.

There is no doubt that the abortion providers could prove standing because they are indeed being harmed by the state laws.

But the abortion providers are not asking the state’s highest court to rule. They seemed satisfied with the current state of perpetual limbo on the issue.

If the doctors follow through with their commitment to take the case to the Mississippi Supreme Court, those past rulings limiting who has standing will no doubt be at the heart of discussion.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

Mississippi Today

On this day in 1898

Feb. 22, 1898

Frazier Baker, the first Black postmaster of the small town of Lake City, South Carolina, and his baby daughter, Julia, were killed, and his wife and three other daughters were injured when a lynch mob attacked.

When President William McKinley appointed Baker the previous year, local whites began to attack Baker’s abilities. Postal inspectors determined the accusations were unfounded, but that didn’t halt those determined to destroy him.

Hundreds of whites set fire to the post office, where the Bakers lived, and reportedly fired up to 100 bullets into their home. Outraged citizens in town wrote a resolution describing the attack and 25 years of “lawlessness” and “bloody butchery” in the area.

Crusading journalist Ida B. Wells wrote the White House about the attack, noting that the family was now in the Black hospital in Charleston “and when they recover sufficiently to be discharged, they) have no dollar with which to buy food, shelter or raiment.

McKinley ordered an investigation that led to charges against 13 men, but no one was ever convicted. The family left South Carolina for Boston, and later that year, the first nationwide civil rights organization in the U.S., the National Afro-American Council, was formed.

In 2019, the Lake City post office was renamed to honor Frazier Baker.

“We, as a family, are glad that the recognition of this painful event finally happened,” his great-niece, Dr. Fostenia Baker said. “It’s long overdue.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

Mississippi Today

Memorial Health System takes over Biloxi hospital, what will change?

by Justin Glowacki with contributions from Rasheed Ambrose, Javion Henry, McKenna Klamm, Matt Martin and Aidan Tarrant

BILOXI – On Feb. 1, Memorial Health System officially took over Merit Health Biloxi, solidifying its position as the dominant healthcare provider in the region. According to Fitch Ratings, Memorial now controls more than 85% of the local health care market.

This isn’t Memorial’s first hospital acquisition. In 2019, it took over Stone County Hospital and expanded services. Memorial considers that transition a success and expects similar results in Biloxi.

However, health care experts caution that when one provider dominates a market, it can lead to higher prices and fewer options for patients.

Expanding specialty care and services

One of the biggest benefits of the acquisition, according to Kristian Spear, the new administrator of Memorial Hospital Biloxi, will be access to Memorial’s referral network.

By joining Memorial’s network, Biloxi patients will have access to more services, over 40 specialties and over 100 clinics.

“Everything that you can get at Gulfport, you will have access to here through the referral system,” Spear said.

One of the first improvements will be the reopening of the Radiation Oncology Clinic at Cedar Lake, which previously shut down due to “availability shortages,” though hospital administration did not expand on what that entailed.

“In the next few months, the community will see a difference,” Spear said. “We’re going to bring resources here that they haven’t had.”

Beyond specialty care, Memorial is also expanding hospital services and increasing capacity. Angela Benda, director of quality and performance improvement at Memorial Hospital Biloxi, said the hospital is focused on growth.

“We’re a 153-bed hospital, and we average a census of right now about 30 to 40 a day. It’s not that much, and so, the plan is just to grow and give more services,” Benda said. “So, we’re going to expand on the fifth floor, open up more beds, more admissions, more surgeries, more provider presence, especially around the specialties like cardiology and OB-GYN and just a few others like that.”

For patient Kenneth Pritchett, a Biloxi resident for over 30 years, those changes couldn’t come soon enough.

Pritchett, who was diagnosed with congestive heart failure, received treatment at Merit Health Biloxi. He currently sees a cardiologist in Cedar Lake, a 15-minute drive on the interstate. He says having a cardiologist in Biloxi would make a difference.

“Yes, it’d be very helpful if it was closer,” Pritchett said. “That’d be right across the track instead of going on the interstate.”

Beyond specialty services and expanded capacity, Memorial is upgrading medical equipment and renovating the hospital to improve both function and appearance. As far as a timeline for these changes, Memorial said, “We are taking time to assess the needs and will make adjustments that make sense for patient care and employee workflow as time and budget allow.”

Unanswered questions: insurance and staffing

As Memorial Health System takes over Merit Health Biloxi, two major questions remain:

- Will patients still be covered under the same insurance plans?

- Will current hospital staff keep their jobs?

Insurance Concerns

Memorial has not finalized agreements with all insurance providers and has not provided a timeline for when those agreements will be in place.

In a statement, the hospital said:

“Memorial recommends that patients contact their insurance provider to get their specific coverage questions answered. However, patients should always seek to get the care they need, and Memorial will work through the financial process with the payers and the patients afterward.”

We asked Memorial Health System how the insurance agreements were handled after it acquired Stone County Hospital. They said they had “no additional input.”

What about hospital staff?

According to Spear, Merit Health Biloxi had around 500 employees.

“A lot of the employees here have worked here for many, many years. They’re very loyal. I want to continue that, and I want them to come to me when they have any concerns, questions, and I want to work with this team together,” Spear said.

She explained that there will be a 90-day transitional period where all employees are integrated into Memorial Health System’s software.

“Employees are not going to notice much of a difference. They’re still going to come to work. They’re going to do their day-to-day job. Over the next few months, we will probably do some transitioning of their computer system. But that’s not going to be right away.”

The transition to new ownership also means Memorial will evaluate how the hospital is operated and determine if changes need to be made.

“As we get it and assess the different workflows and the different policies, there will be some changes to that over time. Just it’s going to take time to get in here and figure that out.”

During this 90-day period, Erin Rosetti, Communications Manager at Memorial Health System said, “Biloxi employees in good standing will transition to Memorial at the same pay rate and equivalent job title.”

Kent Nicaud, President and CEO of Memorial Health System, said in a statement that the hospital is committed to “supporting our staff and ensuring they are aligned with the long-term vision of our health system.”

What research says about hospital consolidations

While Memorial is promising improvements, larger trends in hospital mergers raise important questions.

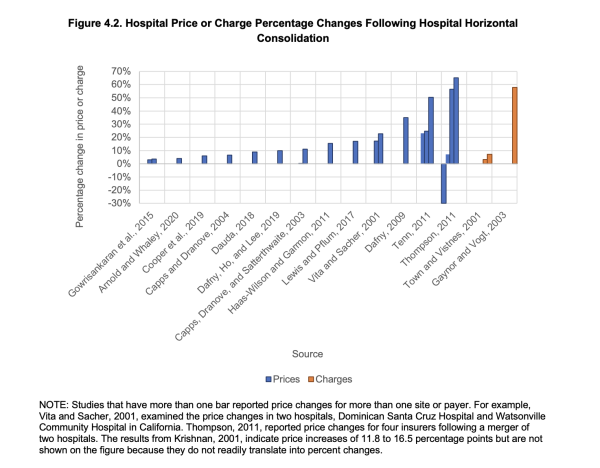

Research published by the Rand Corporation, a nonprofit, nonpartisan research organization, found that research into hospital consolidations reported increased prices anywhere from 3.9% to 65%, even among nonprofit hospitals.

The impact on patient care is mixed. Some studies suggest merging hospitals can streamline services and improve efficiency. Others indicate mergers reduce competition, which can drive up costs without necessarily improving care.

When asked about potential changes to the cost of care, hospital leaders declined to comment until after negations with insurance companies are finalized, but did clarify Memorial’s “prices are set.”

“We have a proven record of being able to go into institutions and transform them,” said Angie Juzang, Vice President of Marketing and Community Relations at Memorial Health System.

When Memorial acquired Stone County Hospital, it expanded the emergency room to provide 24/7 emergency room coverage and renovated the interior.

When asked whether prices increased after the Stone County acquisition, Memorial responded:

“Our presence has expanded access to health care for everyone in Stone County and the surrounding communities. We are providing quality healthcare, regardless of a patient’s ability to pay.”

The response did not directly address whether prices went up — leaving the question unanswered.

The bigger picture: Hospital consolidations on the rise

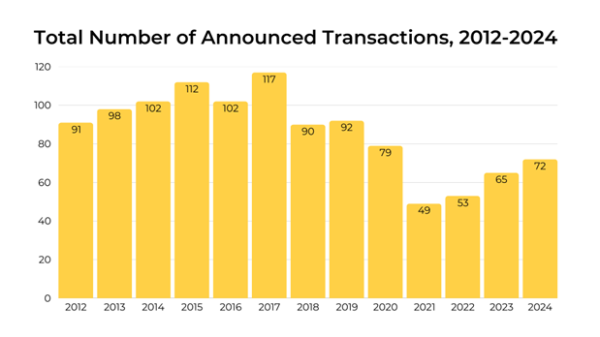

According to health care consulting firm Kaufman Hall, hospital mergers and acquisitions are returning to pre-pandemic levels and are expected to increase through 2025.

Hospitals are seeking stronger financial partnerships to help expand services and remain stable in an uncertain health care market.

Source: Kaufman Hall M&A Review

Proponents of hospital consolidations argue mergers help hospitals operate more efficiently by:

- Sharing resources.

- Reducing overhead costs.

- Negotiating better supply pricing.

However, opponents warn few competitors in a market can:

- Reduce incentives to lower prices.

- Slow wage increases for hospital staff.

- Lessen the pressure to improve services.

Leemore Dafny, PhD, a professor at Harvard and former deputy director for health care and antitrust at the Federal Trade Commission’s Bureau of Economics, has studied hospital consolidations extensively.

In testimony before Congress, she warned: “When rivals merge, prices increase, and there’s scant evidence of improvements in the quality of care that patients receive. There is also a fair amount of evidence that quality of care decreases.”

Meanwhile, an American Hospital Association analysis found consolidations lead to a 3.3% reduction in annual operating expenses and a 3.7% reduction in revenue per patient.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

Mississippi Today

Adopted people face barriers obtaining birth certificates. Some lawmakers point to murky opposition from judges

When Judi Cox was 18, she began searching for her biological mother. Two weeks later she discovered her mother had already died.

Cox, 41, was born in Gulfport. Her mother was 15 and her father didn’t know he had a child. He would discover his daughter’s existence only when, as an adult, she took an ancestry test and matched with his niece.

It was this opaque family history, its details coming to light through a convergence of tragedy and happenstance, that led Cox to seek stronger legal protections for adopted people in Mississippi. Ensuring adopted people have access to their birth certificates has been a central pillar of her advocacy on behalf of adoptees. But legislative proposals to advance such protections have died for years, including this year.

Cox said the failure is an example of discrimination against adopted people in Mississippi — where adoption has been championed as a reprieve for mothers forced into giving birth as a result of the state’s abortion ban.

“A lot of people think it’s about search and reunion, and it’s not. It’s about having equal rights. I mean, everybody else has their birth certificate,” Cox said. “Why should we be denied ours?”

Mississippi lawmakers who have pushed unsuccessfully for legislation to guarantee adoptees access to their birth certificate have said, in private emails to Cox and interviews with Mississippi Today, that opposition comes from judges.

“There are a few judges that oppose the bill from what I’ve heard,” wrote Republican Sen. Angela Hill in a 2023 email.

Hill was recounting opposition to a bill that died during the 2023 legislative session, but a similar measure in 2025 met the same fate. In an interview this month, Hill said she believed the political opposition to the legislation could be bound up with personal interest.

“Somebody in a high place doesn’t want an adoption unsealed,” Hill said. “I don’t know who we’re protecting from somebody finding their birth parents,” Hill said. “But it leads you to believe some people have a very strong interest in keeping adoption records sealed. Unless it’s personal, I don’t understand it.”

In another 2023 email to Cox reviewed by Mississippi Today, Republican Rep. Lee Yancey wrote that some were concerned the bill “might be a deterrent to adoption if their identities were disclosed.”

The 2023 legislative session was the first time a proposal to guarantee adoptees access to their birth certificates was introduced under the state’s new legal landscape surrounding abortion.

In 2018, Mississippi enacted a law that banned most abortions after 15 weeks. The state’s only abortion clinic challenged the law, and that became the case that the U.S. Supreme Court used in 2022 to overturn Roe v. Wade, its landmark 1973 ruling that established a nationwide right to abortion.

Roe v. Wade had rested in part on a woman’s right to privacy, a legal framework Mississippi’s Solicitor General successfully undermined in Dobbs v. Jackson Women’s Health Organization. Before that ruling, anti-abortion advocates had feared allowing adoptees to obtain their birth certificates could push women toward abortion rather than adoption.

Abortion would look like a better option for parents who feared future contact or disclosure of their identities, the argument went. With legal access to abortion a thing of the past in Mississippi, Cox said she sees a contradiction.

“Mississippi does not recognize privacy in that matter, as far as abortions and all that. So if you don’t acknowledge it in an abortion setting, how can you do it in an adoption setting?” Cox said. “You can’t pick and choose whether you’re going to protect my privacy.”

Opponents to legislation easing access to birth certificates for adoptees have also argued that such proposals would unfairly override previous affidavits filed by birth parents requesting privacy.

The 2025 bill, proposed by Republican Rep. Billy Calvert, would direct the state Bureau of Vital Records to issue adoptees aged 21 and older a copy of their original birth certificate.

The bill would also have required the Bureau to prepare a form parents could use to indicate their preferences regarding contact from an adoptee. That provision, along with existing laws that guard against stalking, would give adoptees access to their birth certificate while protecting parents who don’t wish to be contacted, Cox said.

In 2021, Cox tried to get a copy of her birth certificate. She asked Lauderdale County Chancery Judge Charlie Smith, who is now retired, to unseal her adoption records. The Judge refused because Cox had already learned the identity of her biological parents, emails show.

“With the information that you already have, Judge Smith sees no reason to grant the request to open the sealed adoption records at this time,” wrote Tawanna Wright, administrator for the 12th District Chancery Court in Meridian. “If you would like to formally file a motion and request a hearing, you are certainly welcome to do so.”

In her case and others, judges often rely on a subjective definition of what constitutes a “good cause” for unsealing records, Cox said. Going through the current legal process for unsealing records can be costly, and adoptees can’t always control when and how they learn the identity of their biological parents, Cox added.

After Cox’s biological mother died, her biological uncle was going through her things and came across the phone number for Cox’s adoptive parents. He called them.

“My adoptive mom then called to tell me the news — just hours after learning I was expecting my first child,” Cox said.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

-

News from the South - Louisiana News Feed2 days ago

News from the South - Louisiana News Feed2 days agoJeff Landry’s budget includes cuts to Louisiana’s domestic violence shelter funding

-

News from the South - North Carolina News Feed6 days ago

News from the South - North Carolina News Feed6 days agoModest drops in some North Carolina prices under Trump | North Carolina

-

News from the South - Texas News Feed7 days ago

News from the South - Texas News Feed7 days agoA developer bought up 70 properties on a historically Black street. The community doesn't know what's next

-

News from the South - Arkansas News Feed6 days ago

News from the South - Arkansas News Feed6 days agoTiming out the incoming winter weather

-

News from the South - Arkansas News Feed7 days ago

News from the South - Arkansas News Feed7 days agoFrigid Sunday conditions in Northwest Arkansas

-

News from the South - Oklahoma News Feed5 days ago

News from the South - Oklahoma News Feed5 days agoRemains of Aubrey Dameron found, family gathers in her honor

-

News from the South - Kentucky News Feed7 days ago

News from the South - Kentucky News Feed7 days agoEight die in flooding across Kentucky as rescues continue, governor warns of ‘wild weather week’

-

News from the South - North Carolina News Feed2 days ago

News from the South - North Carolina News Feed2 days agoBills from NC lawmakers expand gun rights, limit cellphone use