News from the South - Florida News Feed

Insurance regulators struggle to explain why stunning 2022 report wasn’t made public

Insurance regulators struggle to explain why stunning 2022 report wasn’t made public

by Mitch Perry, Florida Phoenix

March 14, 2025

Florida lawmakers peppered the state’s sitting and former insurance commissioners for three hours on Friday to demand answers about why they didn’t bring immediate attention to a 2022 report detailing money transfers from Florida insurers to out-of-state affiliates.

At the time, Florida property insurers were pleading for legislative reforms because of liabilities from major storms and excessive litigation. Nevertheless, they were paying billions of dollars to affiliated companies, the document found.

The Florida Office of Insurance Regulation (OIR) commissioned the report, prepared by Risk and Regulatory Consulting, in 2020 and it was published in March 2022, several months before a special legislative session made it harder to sue insurance companies.

House Speaker Daniel Perez called Friday’s meeting of the House Insurance & Banking Subcommittee following a bombshell Tampa Bay Times story about that report, which found that insurers who were claiming financial ruin after Hurricane Irma in 2017 and Hurricane Michael in 2018 had paid $680 million in dividends to shareholders while simultaneously funneling billions to affiliated companies.

The report showed that 53 insurers reported a total of $61 million in net income, while their affiliates, known as MGAs (managing general agents), reported $14 billion in income.

Hillsborough County Republican Susan Valdes asked David Altmaier, who was insurance commissioner at the time the report was commissioned, whether he found the disclosure alarming.

“Red flags”

“It certainly raised some red flags, which is why it was important for us to determine whether or not this was accurate,” Altmaier said.

Lawmakers pressed Altmaier and his successor, Michael Yaworsky, about why the office never made the report public. Their response was that it was in draft form and not ready for general release.

“A draft is a very real thing to us, and it is an indication that it is not a completed product,” Yaworsky told the committee.

Under further questioning, Yaworsky mentioned discussions that concluded sometime later in 2022 between the OIR and Rise & Regulatory Consulting “to perfect the document.” He said he didn’t know the details, adding that his office was dealing with between six or seven companies at the time that had gone through insolvency, as well as investigating other insurance companies.

“I think it’s possible that they were simply overwhelmed,” he said.

Speaking under oath, Altmaier said the office had become aware of transfers with affiliated companies in 2014, but it wasn’t until 2021 that they were able to get legislation passed that specifically authorized them to investigate the affiliate payments.

“Even before we got this draft report, the office was very mindful that this allegation was out there. We were very mindful that we needed to increase our authority to answer these types of questions, not just for you but for your constituents and our consumers and all kinds of other stakeholders,” he said.

Altmaier wasn’t able to answer why, if he thought the report was so important, he didn’t follow up when the OIR received it in 2022.

“Hindsight being 20/20, there’s probably some opportunities where I could have poked a little bit to make sure that this work was continuing. But, as the commissioner said, we were dealing with a lot,” Altmaier said.

Pinellas County GOP Rep. Adam Anderson asked to what extent can excessive affiliate fees affect policyholders’ premiums?

“There is a factor in there that is fees that you pay to your affiliates,” Altmaier replied. “If that’s being done correctly, then that’s a reasonable fee to have in the rates. One of the reasons why this work was so important to us was, if this is being abused, then it can have detrimental impact on policyowner premiums. The challenge is, we didn’t fully answer that question during my tenure,” he said.

Yaworsky, who served as chief of staff to Altmaier between 2017 and 2021, was named Insurance Commissioner in early 2023. He said it wasn’t until late last year that he was even aware of the report.

That prompted several members of the committee to ask why he didn’t share the information from the report when appearing before lawmakers since then. They wanted to know whether the affiliate payments were directly responsible for the escalating property insurance rates that have become the single most important issue to Floridians, according to multiple polls taken over the last year.

Yaworsky pushed back, disputing that the transfers explain why some carriers have become insolvent or closed their businesses in Florida.

Insurers continue to blame excessive litigation

“I think the problem at its crux with companies is pretty easy to demonstrate — that it was … due primarily to litigation, but also natural catastrophes and the cost of reinsurance,” he said. “The companies went broke because rates simply could not be raised fast enough to accommodate that, and the market did not exist to support that. There’s not a lot of evidence that MGA fees or affiliate entity fees were the proximate cause of any insolvency.”

Also at the center of the discussion was what is considered a “fair and reasonable” amount for those companies send to their associated groups. The state of Florida to this day does not have a defined standard in law about what is fair and reasonable.

The Tampa Bay Times made a public information request to see the report in 2022, yet did not receive it until late last year. Several committee members questioned what led to that delay. “There was so much going on in 2022 that this did not take the priority,” Yaworsky said. “That’s a plausible explanation for what happened here.”

Some lawmakers reacted with disgust.

“Our purpose here today is to find out if insurance companies have been allegedly ripping the citizens of Florida off. Why rates are so high? We want to find that out. And this report’s the state’s attempt at determining the answer to that,” said Palm Beach Republican Mike Caruso.

“Yet it’s still in draft form. It’s only seven pages long. It deals with data from 2017 to 2019. Today’s 2025. And I find it, as a legislator, that’s outrageous that we’re getting something that’s so antiquated and so full of flaws.”

Caruso and other lawmakers asked whether the office plans an updated report. That remains uncertain at this time, although committee chair Brad Yeager said after the meeting that he believed lawmakers would push to make that happen.

The report cost $150,000 and was paid for by a trust fund within the OIR, and not from taxpayer money.

The future

In his State of the State address last week, Florida Gov. Ron DeSantis proclaimed that the state’s homeowners’ insurance market is finally seeing some stability, noting 130,000 new private policies over the past year and that Florida had the lowest increase in rates of all 50 states.

However, the Tampa Bay Times reported earlier this week that the vast majority of the almost 1 million policyholders with state-backed Citizens Property Insurance Corp. will pay higher rates beginning on June 1. Known as the property insurer of last resort, it remains the largest in the state in terms of the number of policies written.

YOU MAKE OUR WORK POSSIBLE.

Florida Phoenix is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Florida Phoenix maintains editorial independence. Contact Editor Michael Moline for questions: info@floridaphoenix.com.

The post Insurance regulators struggle to explain why stunning 2022 report wasn’t made public appeared first on floridaphoenix.com

News from the South - Florida News Feed

South Florida 11 p.m. Weather Forecast 4/19/2025

SUMMARY: The South Florida weather forecast for 4/19/2025 anticipates a breezy Easter Sunday, with warm temperatures in the mid-70s to start the day. Although radar shows some bird activity and minimal moisture, only a stray coastal shower is possible. Expect continued warm and windy conditions into Monday, with drier air moving in. Calmer weather is forecast for Tuesday and Wednesday, but breezy conditions will return later in the week, potentially increasing rain chances, though overall moisture remains low. A high rip current risk exists along the beaches, with choppy waters in the Atlantic. Temperatures are expected to remain in the mid-80s.

CBS News Miami’s NEXT Weather Meteorologist Dave Warren says to expect a breezy Easter Sunday as winds blow through much of South Florida on Saturday night.

News from the South - Florida News Feed

Roman Reigns endorses President Trump, CM Punk tears into Elon Musk

SUMMARY: In this episode of Going Ringside, the discussion revolves around WWE’s WrestleMania 41 and coinciding political comments from its stars. Roman Reigns sparked controversy with his Vanity Fair interview, expressing support for President Trump while acknowledging disagreements with him. This comment generated significant attention. Shortly after, CM Punk criticized Elon Musk on a podcast, addressing allegations related to a hand gesture Musk made, which some interpreted as a Nazi salute. The WWE, traditionally cautious about political matters, finds itself exploring new territory, given its ties to high-profile political figures and events.

The post Roman Reigns endorses President Trump, CM Punk tears into Elon Musk appeared first on www.news4jax.com

News from the South - Florida News Feed

FIU police says agreement with ICE is for the best; faculty disagree

by Jay Waagmeester, Florida Phoenix

April 19, 2025

Florida International University’s police chief believes the university community would be best served by the department signing an agreement with U.S. Immigration and Customs Enforcement, although the faculty is uneasy.

During a Faculty Senate special meeting Friday, interim President Jeanette Nuñez, the former lieutenant governor, and FIU Police Department Chief Alexander Casas fielded questions from faculty members about what a 287(g) agreement with ICE will mean for students and faculty, particularly ones fearing detainment.

Under the agreement, FIUPD officers could act as immigration enforcement officials to question and detain people they suspect are in the country without authorization.

“If we have to deliver someone, we’re the ones you want to do it, because it will be done in the most FIU way, the most Panther way, we can think of,” Casas said.

Casas signed the agreement with ICE, as have several other university police departments in the state, and is awaiting a response from the federal agency before officers can begin training. When it’s signed, Casas said, he will choose his “best officers” to be trained.

“If I don’t sign that agreement, we open the door for other agencies who are on this agreement, whether they’re federal agencies in power to do so or state agencies directed by our governor or local agencies that have agreed,” Casas said.

Casas told faculty he wants his department to have a say in how immigration enforcement goes at the South Florida institution.

“Once I deliver someone to Krome or turn them over to ICE, you’re right, I lose control. But, absent this agreement, I don’t even have input. At the very least, once they execute it, at least now I have input and my officers do have a little say in what could be the outcome,” Casas said.

“If it has to happen because there’s a warrant in the system, who do you want interacting with you? God, I hope you say it’s me,” Casas said.

Nuñez said she spoke at length with Faculty Senate Chair Noël Barengo earlier in the week after he reached out. She added that she wants to make sure she is “constantly addressing concerns.”

Faculty Senate members were not so convinced. Florida universities have made national news for signing the agreement with ICE.

Students live in fear for their ability to remain in the United States, faculty members said. One professor shared about a student who is not a citizen who came to him worried after receiving a parking ticket.

Juan Gómez, director of the Carlos Costa Immigration Human Rights Clinic at FIU, said students have approached him to say they are afraid to look up items on their computer. Some, in abusive relationships, are afraid to call police.

“I don’t know the status of any of our students. PD does not have access to any of that information,” Casas said, adding that his department has to follow FERPA, the Family Educational Rights and Privacy Act.

GET THE MORNING HEADLINES.

Casas said he did not get a call from the governor encouraging him to seek a 287(g) agreement; instead, he approached Nuñez after conversations with other law enforcement convinced him it “really is with our best interest at heart.”

Faculty senators approved a resolution opposing the agreement, saying it “goes against the university’s values of truth in the pursuit, generation, dissemination, and application of knowledge, freedom of thought and expression, and respect for diversity and dignity of the individual.” The resolution called for the university to withdraw.

Well into the two-hour meeting, Philip Carter, an FIU professor, remained unconvinced.

“It’s been good to hear you,” Carter said. “I haven’t heard anything that convinces me that this is a good agreement. It still sounds like a really bad agreement. I still worry about the safety of our students on campus who fear for their status and their safety. I worry, frankly, about all of us, I worry about faculty, I worry that there’s a slippery slope beneath us.”

Nuñez stressed that visa revocations and ICE agreements are different but sometimes get conflated. FIU has no control over visa revocations, she said.

Earlier this week, FIU confirmed to the Phoenix that 18 students have had their visas revoked since Jan. 1. The University of Florida told the Phoenix that eight visas have been revoked; Florida State University, three.

Alana Greer, director of Community Justice Project, said the FIU 287(g) is “deeply unprecedented” and the “agenda behind relaunching these 287(g)’s is specifically engineered to break trust, to tear apart our communities and to get us to see our neighbors, our peers, our students as ‘other.’”

Greer referenced her involvement with a story the Phoenix reported on Thursday, when 20-year-old Juan Carlos Lopez-Gomez, a U.S. citizen, was arrested by a Florida Highway Patrol trooper as an “unauthorized alien” and held for ICE.

YOU MAKE OUR WORK POSSIBLE.

Florida Phoenix is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Florida Phoenix maintains editorial independence. Contact Editor Michael Moline for questions: info@floridaphoenix.com.

The post FIU police says agreement with ICE is for the best; faculty disagree appeared first on floridaphoenix.com

-

Mississippi Today7 days ago

Mississippi Today7 days agoLawmakers used to fail passing a budget over policy disagreement. This year, they failed over childish bickering.

-

Mississippi Today7 days ago

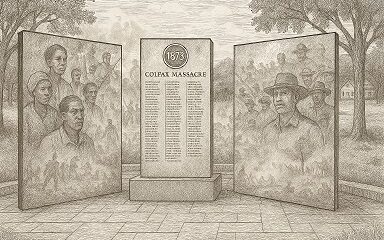

Mississippi Today7 days agoOn this day in 1873, La. courthouse scene of racial carnage

-

Local News7 days ago

Local News7 days agoSouthern Miss Professor Inducted into U.S. Hydrographer Hall of Fame

-

News from the South - Alabama News Feed5 days ago

News from the South - Alabama News Feed5 days agoFoley man wins Race to the Finish as Kyle Larson gets first win of 2025 Xfinity Series at Bristol

-

News from the South - Alabama News Feed6 days ago

News from the South - Alabama News Feed6 days agoFederal appeals court upholds ruling against Alabama panhandling laws

-

News from the South - Texas News Feed7 days ago

News from the South - Texas News Feed7 days ago1 dead after 7 people shot during large gathering at Crosby gas station, HCSO says

-

News from the South - Florida News Feed7 days ago

News from the South - Florida News Feed7 days agoJacksonville University only school with 2 finalist teams in NASA’s 2025 Human Lander Challenge

-

News from the South - Missouri News Feed7 days ago

News from the South - Missouri News Feed7 days agoInsects as food? ‘We are largely ignoring the largest group of organisms on earth’