Mississippi News

Gunn and Hosemann remain at an impasse on tax cuts

Philip Gunn and Delbert Hosemann remain at an impasse on tax cuts

The Mississippi Senate passed a new tax cut bill Tuesday, the day after the House passed its newest version of a bill to eliminate the state income tax.

Both Republican-led chambers billed their changes this week as compromise. But the two are not openly negotiating and appear to mainly be communicating through press conferences hyping their own plans and criticizing the other’s and sending dueling bills back and forth.

The two chambers remain far apart on tax cuts as the 2022 legislative session enters its final three weeks. The impasse threatens to hinder setting a budget, spending billions of federal pandemic stimulus and other work. It also raises the specter of an extended or special session into the summer.

Republican Speaker Philip Gunn and his House leadership are set on eliminating, not just cutting, personal income taxes. But Republican Lt. Gov. Delbert Hosemann and his Senate leadership believe that’s too risky and propose smaller tax cuts, rebates and suspension instead. House leaders say the Senate plan is a half measure. Senate leaders say the House is being foolhardy trying to eliminate one-third of state revenue during uncertain economic times.

After a public speech at the Capitol on Tuesday, Gunn — flanked by dozens of House members — called for Hosemann and Senate leaders to “get into a room and talk with us about this” to come up with a deal. But Gunn also made clear he’s dug-in on “elimination of the income tax, without further legislative action required, and as quickly as possible.”

Gunn also called for Republican Gov. Tate Reeves, who is currently out of state, to throw his full support behind the House plan. “(Reeves) has said he supports eliminating the income tax, and this is the only measure to do that,” Gunn said.

“This is the opportunity of a lifetime, ladies and gentlemen,” Gunn said in his Capitol speech. “… This is the opportunity to do something right now that we will never have again in our lifetimes.”

READ MORE: 5 things to know about the Great Mississippi Tax Cut Battle of 2022

But Senate leaders have countered that there should be plenty of opportunities down the road to cut or eliminate taxes — depending on what the economy does.

“This is very fragile right now, and we are at risk — with Ukraine, inflation …” Hosemann said.

On Monday, Hosemann held a press conference where he announced a proposal to suspend the state’s 18.4-cents-a-gallon gasoline tax for six months and expansion of the Senate’s income tax cuts, but not elimination.

“We need both meaningful and sustainable tax reform,” Hosemann said.

While some Democrats in both chambers are voting for the tax cut bills, others question whether tax cuts are in order for a state with so many needs in roads, water and sewerage and education.

“It just seems like we’re stumbling backwards into the future, trying to impress somebody with tax cuts, when we need to be doing so many other things,” said Sen. David Jordan, D-Greenwood.

READ MORE: Tax cut battle continues: Hosemann wants to pause gas tax, House overhauls its plan

Here are highlights of the House and Senate’s latest proposals on taxes. To see earlier iterations of the plans, click here.

The House tax plan

- Eliminate the state personal income tax, through exemptions, over years. It would start with exempting $25,000 in income for individuals, $50,000 for married couples — down from its previous proposal of first-year exemptions of $40,000 and $80,000 respectively. The first year the plan would cut about $700 million from the state budget, eventually increasing to about $1.5 billion.

- Phasing out the rest of the income tax using a “growth trigger” of 1.6% a year. This means state revenue over 1.6% growth would be used to buy down the income tax. This buy-down would be capped at $150 million a year, meaning money collected over that amount would stay in the state budget. Previously, the House growth trigger was at 1.5% with no cap. The latest proposal would take about 15 years to eliminate the income tax, up from about 10 years in its previous proposal.

- No sales tax increase. The House has since last year pushed for sales tax increases to go along with its income tax elimination. But this week it dropped that part of its proposal.

- Reducing the grocery tax more slowly, from 7% to 4% at a quarter point a year.

- No car tag reduction. The House had proposed cutting car tag fees in half, using state funds to subsidize local governments who levy most of the fees on car tags. House leaders said the Senate opposed this, so they dropped it, despite it being popular with constituents.

- Setting aside $500 million in state funds to cover any budget shortfalls “out of an abundance of caution” and to allay Senate concerns that the House plan would sink the budget.

The Senate tax plan

- Reduction of the state’s top, 5% tax bracket to 4.6% over four years, then elimination of the lower 4% tax bracket over the next four years after that. Originally, the Senate had proposed only the phase out of the 4% bracket. The new, eight-year Senate tax plan would cost about $439 million a year when totally implemented.

- Suspending the state’s 18.4-cents-per-gallon gasoline tax for six months, using about $215 million in tax dollars on hand to reimburse the Mississippi Department of Transportation, which uses the gas tax for roads, bridges, and matching federal dollars. House leaders said Mississippians would probably barely notice such a break with gas prices currently so high.

- Reduction of the state grocery tax from 7% to 5%, starting in July.

- Up to a 5%, one-time income tax rebate in 2022 for those who paid taxes. The rebates would range from $100 to $1,000, for a one-time coast of about $130 million.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Mississippi News

Ole Miss women get pair of double-doubles and roll to 83-65 March Madness win over Ball State

SUMMARY: Mississippi coach Yolett McPhee-McCuin found solace in returning to a different arena in Waco, Texas, following a disappointing previous tournament experience. The No. 5 seed Ole Miss Rebels redeemed themselves with an 83-65 victory over 12th-seeded Ball State in the NCAA Tournament’s first round. Starr Jacobs led the Rebels with 18 points and 11 rebounds, while Kennedy Todd-Williams and Madison Scott each scored 15 points. Ole Miss dominated rebounding, leading 52-32, and will face fourth-seeded Baylor next. Coach McPhee-McCuin noted the team’s evolution since their last visit and the significance of playing in Texas, where Jacobs feels at home.

The post Ole Miss women get pair of double-doubles and roll to 83-65 March Madness win over Ball State appeared first on www.wjtv.com

Mississippi News

Events happening this weekend in Mississippi: March 21-23

SUMMARY: This weekend (March 21-23), Mississippi offers a range of exciting events. Highlights include Hal’s Marching MALfunction Second Line Stomp and Jessie Robinson’s blues performance in Jackson, as well as the Natchez Food & Wine Festival and the Natchez Little Theatre’s production of *This Side of Crazy*. There are also numerous exhibitions like *Of Salt and Spirit: Black Quilters in the American South* in Jackson and *Gold in the Hills* in Vicksburg. Other events include the 48th Annual Crawfish Classic Tennis Tournament in Hattiesburg, karaoke nights in Laurel, and a variety of family-friendly activities across the state.

The post Events happening this weekend in Mississippi: March 21-23 appeared first on www.wjtv.com

Mississippi News

Events happening this weekend in Mississippi: March 14-16

SUMMARY: This weekend (March 14-16) in Mississippi offers a variety of events. In Jackson, iconic saxophonist Boney James performs at the convention center, while the JXN Food & Wine festival showcases culinary talents. The LeFleur Museum District hosts a “Week of Wonder,” and several exhibitions, including “Of Salt and Spirit,” celebrate Black quilters. Natchez features the Spring Pilgrimage tours, a reenactment of Annie Stewart’s story, and a St. Patrick’s Day celebration. In Hattiesburg, comedian Rob Schneider performs, and various events like a St. Patrick’s Day pub crawl and a talent show will take place throughout the area.

The post Events happening this weekend in Mississippi: March 14-16 appeared first on www.wjtv.com

-

News from the South - Florida News Feed7 days ago

News from the South - Florida News Feed7 days agoFamily mourns death of 10-year-old Xavier Williams

-

News from the South - Alabama News Feed5 days ago

News from the South - Alabama News Feed5 days agoSevere storms will impact Alabama this weekend. Damaging winds, hail, and a tornado threat are al…

-

News from the South - Alabama News Feed5 days ago

News from the South - Alabama News Feed5 days agoUniversity of Alabama student detained by ICE moved to Louisiana

-

News from the South - Louisiana News Feed6 days ago

News from the South - Louisiana News Feed6 days agoSeafood testers find Shreveport restaurants deceiving customers with foreign shrimp

-

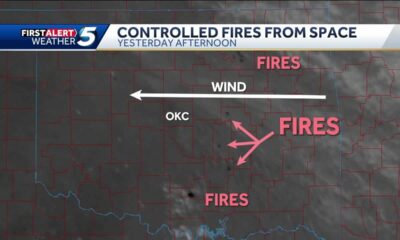

News from the South - Oklahoma News Feed3 days ago

News from the South - Oklahoma News Feed3 days agoTornado watch, severe thunderstorm warnings issued for Oklahoma

-

News from the South - Oklahoma News Feed7 days ago

News from the South - Oklahoma News Feed7 days agoWhy are Oklahomans smelling smoke Wednesday morning?

-

News from the South - West Virginia News Feed6 days ago

News from the South - West Virginia News Feed6 days agoRoane County Schools installing security film on windows to protect students

-

News from the South - Florida News Feed6 days ago

News from the South - Florida News Feed6 days agoPeanut farmer wants Florida water agency to swap forest land