Mississippi Today

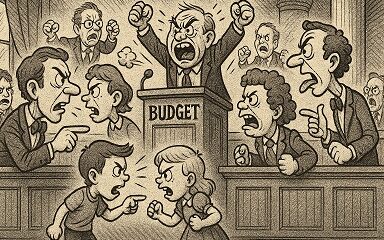

Governor, legislative leaders deadlock on how much money the state has to spend next year

Recently reelected Gov. Tate Reeves and legislative leaders could not agree Wednesday on an official estimate of how much money will be available as they begin setting next year’s state budget.

Reeves said he supports a higher revenue estimate because that would make it easier for legislators to approve his proposal to eliminate state income taxes during the 2024 session.

“For those of us very interested in cutting taxes during this legislative session, arbitrarily lowering the number for no apparent reason hurts our ability to justify those tax cuts,” Reeves told the legislative leaders, including newly reelected Lt. Gov. Delbert Hosemann and outgoing House Speaker Philip Gunn. “I am a very strong proponent of cutting taxes during this session. I am going to be regardless of what this number is.”

Normally, the fall meeting of the governor and the 14 members of the Legislative Budget Committee is a routine event and adopting an estimate is pro forma. But such was not the case Wednesday morning as it soon became apparent Reeves was blindsided by his Republican legislative colleagues. They wanted to adopt a revenue estimate $117.8 million less than recommended by the group of five state financial experts whose recommendations are normally rubber-stamped by the politicians.

Reeves said he believed he was attending the meeting to adopt the recommendation of the experts of projected revenue $7.64 billion for the upcoming fiscal year. Instead, the committee members approved the lower number, the same estimate as for the current budget year.

“I guess I am kind of caught off guard. I did not anticipate there would be a change,” Reeves said.

Rep. Angela Cockerham, I-Magnolia, was the only member of the Budget Committee not to vote for the lower estimate.

Mississippi law mandates that the governor and members of the Legislative Budget Committee agree on a revenue estimate as a starting point in developing a state budget during the upcoming session. In 2002, then-Gov. Ronnie Musgrove and the committee did not agree on an estimate.

It is likely legislators will start work on a budget based on the estimate adopted by the budget committee members Wednesday. And importantly, state law allows committee members to meet at the end of the session to revise the estimate from the fall meeting they have with the governor.

In other words, the impact of Wednesday’s deadlock is most likely symbolic, highlighting the focus Reeves plans to place on eliminating the income tax during the 2024 session. In 2022, the Legislature passed a $525 million income tax cut phased in over four years. Reeves wants to fully eliminate the income tax, which accounts for about one-third of the state general fund revenue.

READ MORE: State revenue slows as phase-in of income tax cuts begins

House Pro Tem Jason White, R-West, who is expected to succeed Gunn as speaker, said he was supporting the lower revenue estimate, but that did not mean that the House would not be working to cut taxes during the 2024 session.

“I think that (cutting taxes) is the aim of most of the people around this table,” White said. “… I anticipate the House will be back with an income tax cut plan sometime in the very near future.”

Reeves told Hosemann he would support the lower estimate if he would say he anticipated the Senate passing an income tax cut during the upcoming session. Hosemann presides over the Senate.

“We anticipate there will be tax relief this year,” Hosemann responded. “Now whether that is grocery tax (sales tax on food) income tax or other taxes, I can’t tell you that because … I don’t vote. They (senators) all vote. Whether I say it doesn’t make much difference.”

Hoseman said the Senate has passed tax cuts in the past and said there is no reason to think that will change going forward.

But he did say the lower estimate should be adopted because revenue for the past two months has been lower than the official estimate approved for the current budget year. If revenue falls too far below the estimate, the governor and-or Legislature would be forced to make cuts or dip into reserve funds to make mid-year adjustments.

State Economist Corey Miller, who is on the group of five state financial experts who provide a consensus estimate to the politicians, testified at the meeting that the anticipation is that the state economy will slow in 2024 and 2025, though, chances of a national recession are low.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Mississippi Today

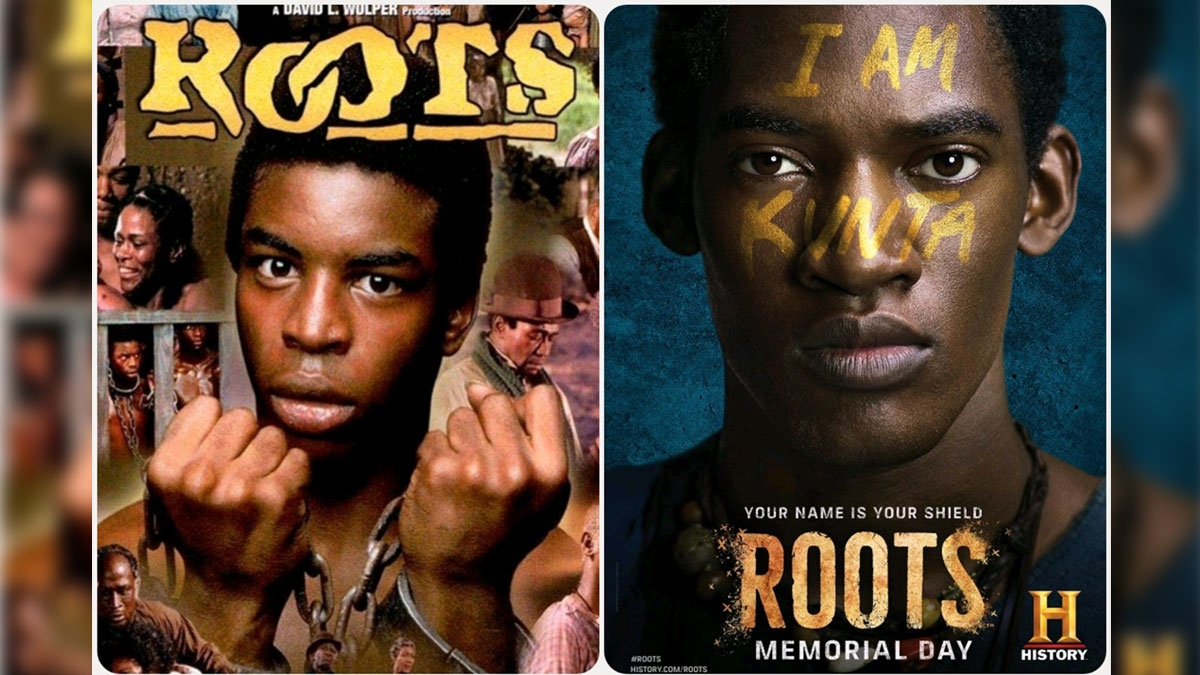

On this day in 1977, Alex Haley awarded Pulitzer for ‘Roots’

April 19, 1977

Alex Haley was awarded a special Pulitzer Prize for “Roots,” which was also adapted for television.

Network executives worried that the depiction of the brutality of the slave experience might scare away viewers. Instead, 130 million Americans watched the epic miniseries, which meant that 85% of U.S. households watched the program.

The miniseries received 36 Emmy nominations and won nine. In 2016, the History Channel, Lifetime and A&E remade the miniseries, which won critical acclaim and received eight Emmy nominations.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.![]()

Mississippi Today

Speaker White wants Christmas tree projects bill included in special legislative session

House Speaker Jason White sent a terse letter to Lt. Gov. Delbert Hosemann on Thursday, saying House leaders are frustrated with Senate leaders refusing to discuss a “Christmas tree” bill spending millions on special projects across the state.

The letter signals the two Republican leaders remain far apart on setting an overall $7 billion state budget. Bickering between the GOP leaders led to a stalemate and lawmakers ending their regular 2025 session without setting a budget. Gov. Tate Reeves plans to call them back into special session before the new budget year starts July 1 to avoid a shutdown, but wants them to have a budget mostly worked out before he does so.

White’s letter to Hosemann, which contains words in all capital letters that are underlined and italicized, said that the House wants to spend cash reserves on projects for state agencies, local communities, universities, colleges, and the Mississippi Department of Transportation.

“We believe the Senate position to NOT fund any local infrastructure projects is unreasonable,” White wrote.

The speaker in his letter noted that he and Hosemann had a meeting with the governor on Tuesday. Reeves, according to the letter, advised the two legislative leaders that if they couldn’t reach an agreement on how to disburse the surplus money, referred to as capital expense money, they should not spend any of it on infrastructure.

A spokesperson for Hosemann said the lieutenant governor has not yet reviewed the letter, and he was out of the office on Thursday working with a state agency.

“He is attending Good Friday services today, and will address any correspondence after the celebration of Easter,” the spokesperson said.

Hosemann has recently said the Legislature should set an austere budget in light of federal spending cuts coming from the Trump administration, and because state lawmakers this year passed a measure to eliminate the state income tax, the source of nearly a third of the state’s operating revenue.

Lawmakers spend capital expense money for multiple purposes, but the bulk of it — typically $200 million to $400 million a year — goes toward local projects, known as the Christmas Tree bill. Lawmakers jockey for a share of the spending for their home districts, in a process that has been called a political spoils system — areas with the most powerful lawmakers often get the largest share, not areas with the most needs. Legislative leaders often use the projects bill as either a carrot or stick to garner votes from rank and file legislators on other issues.

A Mississippi Today investigation last year revealed House Ways and Means Chairman Trey Lamar, a Republican from Sentobia, has steered tens of millions of dollars in Christmas tree spending to his district, including money to rebuild a road that runs by his north Mississippi home, renovate a nearby private country club golf course and to rebuild a tiny cul-de-sac that runs by a home he has in Jackson.

There is little oversight on how these funds are spent, and there is no requirement that lawmakers disburse the money in an equal manner or based on communities’ needs.

In the past, lawmakers borrowed money for Christmas tree bills. But state coffers have been full in recent years largely from federal pandemic aid spending, so the state has been spending its excess cash. White in his letter said the state has “ample funds” for a special projects bill.

“We, in the House, would like to sit down and have an agreement with our Senate counterparts on state agency Capital Expenditure spending AND local projects spending,” White wrote. “It is extremely important to our agencies and local governments. The ball is in your court, and the House awaits your response.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

Mississippi Today

Advocate: Election is the chance for Jackson to finally launch in the spirit of Blue Origin

Editor’s note: This essay is part of Mississippi Today Ideas, a platform for thoughtful Mississippians to share fact-based ideas about our state’s past, present and future. You can read more about the section here.

As the world recently watched the successful return of Blue Origin’s historic all-women crew from space, Jackson stands grounded. The city is still grappling with problems that no rocket can solve.

But the spirit of that mission — unity, courage and collective effort — can be applied right here in our capital city. Instead of launching away, it is time to launch together toward a more just, functioning and thriving Jackson.

The upcoming mayoral runoff election on April 22 provides such an opportunity, not just for a new administration, but for a new mindset. This isn’t about endorsements. It’s about engagement.

It’s a moment for the people of Jackson and Hinds County to take a long, honest look at ourselves and ask if we have shown up for our city and worked with elected officials, instead of remaining at odds with them.

It is time to vote again — this time with deeper understanding and shared responsibility. Jackson is in crisis — and crisis won’t wait.

According to the U.S. Census projections, Jackson is the fastest-shrinking city in the United States, losing nearly 4,000 residents in a single year. That kind of loss isn’t just about numbers. It’s about hope, resources, and people’s decision to give up rather than dig in.

Add to that the long-standing issues: a crippled water system, public safety concerns, economic decline and a sense of division that often pits neighbor against neighbor, party against party and race against race.

Mayor Chokwe Antar Lumumba has led through these storms, facing criticism for his handling of the water crisis, staffing issues and infrastructure delays. But did officials from the city, the county and the state truly collaborate with him or did they stand at a distance, waiting to assign blame?

On the flip side, his runoff opponent, state Sen. John Horhn, who has served for more than three decades, is now seeking to lead the very city he has represented from the Capitol. Voters should examine his legislative record and ask whether he used his influence to help stabilize the administration or only to position himself for this moment.

Blaming politicians is easy. Building cities is hard. And yet that is exactly what’s needed. Jackson’s future will not be secured by a mayor alone. It will take so many of Jackson’s residents — voters, business owners, faith leaders, students, retirees, parents and young people — to move this city forward. That’s the liftoff we need.

It is time to imagine Jackson as a capital city where clean, safe drinking water flows to every home — not just after lawsuits or emergencies, but through proactive maintenance and funding from city, state and federal partnerships. The involvement of the U.S. Environmental Protection Agency in the effort to improve the water system gives the city leverage.

Public safety must be a guarantee and includes prevention, not just response, with funding for community-based violence interruption programs, trauma services, youth job programs and reentry support. Other cities have done this and it’s working.

Education and workforce development are real priorities, preparing young people not just for diplomas but for meaningful careers. That means investing in public schools and in partnerships with HBCUs, trade programs and businesses rooted right here.

Additionally, city services — from trash collection to pothole repair — must be reliable, transparent and equitable, regardless of zip code or income. Seamless governance is possible when everyone is at the table.

Yes, democracy works because people show up. Not just to vote once, but to attend city council meetings, serve on boards, hold leaders accountable and help shape decisions about where resources go.

This election isn’t just about who gets the title of mayor. It’s about whether Jackson gets another chance at becoming the capital city Mississippi deserves — a place that leads by example and doesn’t lag behind.

The successful Blue Origin mission didn’t happen by chance. It took coordinated effort, diverse expertise and belief in what was possible. The same is true for this city.

We are not launching into space. But we can launch a new era marked by cooperation over conflict, and by sustained civic action over short-term outrage.

On April 22, go vote. Vote not just for a person, but for a path forward because Jackson deserves liftoff. It starts with us.

Pauline Rogers is a longtime advocate for criminal justice reform and the founder of the RECH Foundation, an organization dedicated to supporting formerly incarcerated individuals as they reintegrate into society. She is a Transformative Justice Fellow through The OpEd Project Public Voices Fellowship.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.![]()

-

Mississippi Today7 days ago

Mississippi Today7 days agoLawmakers used to fail passing a budget over policy disagreement. This year, they failed over childish bickering.

-

Mississippi Today7 days ago

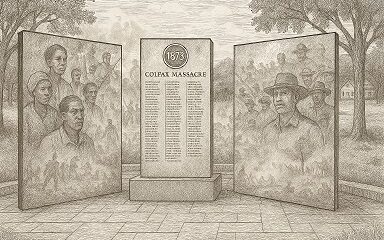

Mississippi Today7 days agoOn this day in 1873, La. courthouse scene of racial carnage

-

Local News6 days ago

Local News6 days agoSouthern Miss Professor Inducted into U.S. Hydrographer Hall of Fame

-

News from the South - Alabama News Feed5 days ago

News from the South - Alabama News Feed5 days agoFoley man wins Race to the Finish as Kyle Larson gets first win of 2025 Xfinity Series at Bristol

-

News from the South - Alabama News Feed5 days ago

News from the South - Alabama News Feed5 days agoFederal appeals court upholds ruling against Alabama panhandling laws

-

News from the South - Alabama News Feed7 days ago

News from the South - Alabama News Feed7 days agoBellingrath Gardens previews its first Chinese Lantern Festival

-

News from the South - Texas News Feed7 days ago

News from the South - Texas News Feed7 days ago1 dead after 7 people shot during large gathering at Crosby gas station, HCSO says

-

News from the South - Florida News Feed6 days ago

News from the South - Florida News Feed6 days agoJacksonville University only school with 2 finalist teams in NASA’s 2025 Human Lander Challenge