Mississippi Today

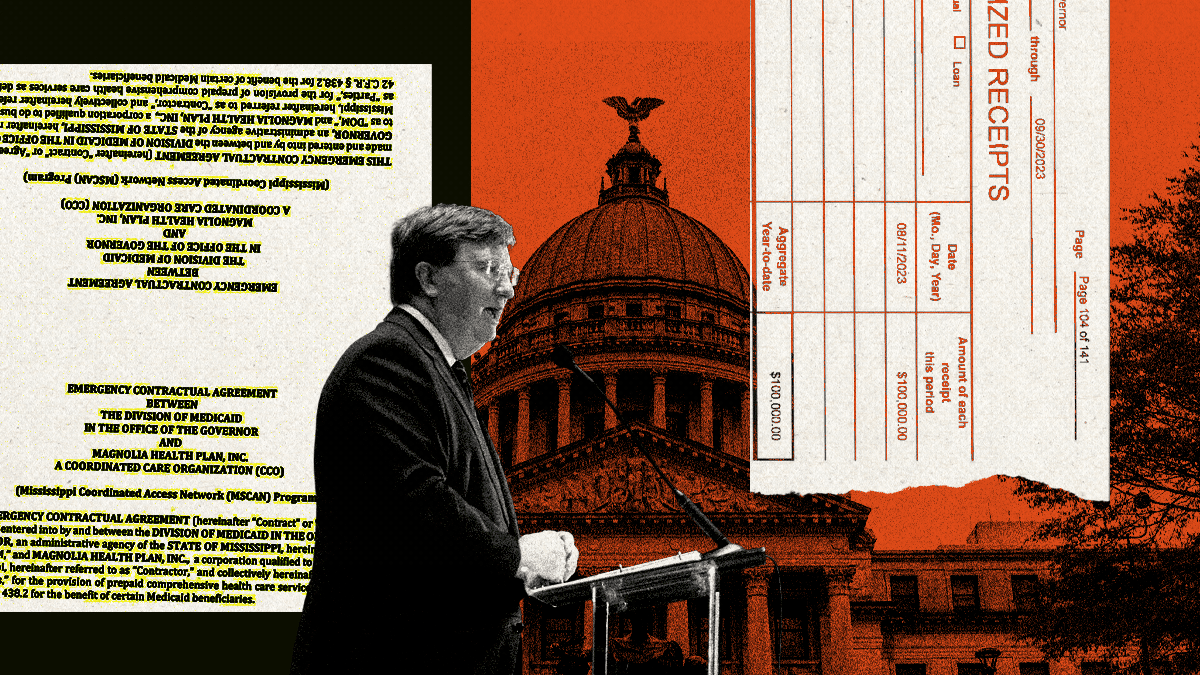

Gov. Tate Reeves’ top political donors received $1.4 billion in state contracts from his agencies

Gov. Tate Reeves’ top campaign contributors netted $1.4 billion in state contracts or grants from agencies the governor oversees, a Mississippi Today investigation found.

Of the 88 individual or corporate donors who have given Reeves’ campaigns at least $50,000, Mississippi Today identified 15 donors whose companies received a total of $1.4 billion in state contracts or grants since he took office in 2020.

The investigation reveals how private companies, whose executives routinely donate large sums to politicians, can rake in hundreds of millions in Mississippi taxpayer funds while having the ear of powerful elected officials.

Reeves, one of the most prolific political fundraisers in state history, has set numerous annual and office-specific campaign donation records. But he’s been criticized by Republican and Democratic opponents as transactional — a politician who helps those who directly help him.

The $1.4 billion total in state contracts identified by Mississippi Today does not include dozens of additional contracts the Reeves donors have received from state agencies not led by the governor. For example, the Mississippi Department of Transportation awarded the governor’s top donors at least $552 million since 2020.

The total also doesn’t include millions in incentives and tax breaks many of his top donors have received, and it doesn’t include any state contracts that Reeves donors who have given less than $50,000 may have received.

READ MORE: How we reported our investigation into state contracts awarded to Gov. Tate Reeves’ top donors

Unlike many other states, Mississippi has no general “pay-to-play” prohibition, restrictions or special reporting requirements for campaign contributions from people or companies doing business with state government.

In fact, it’s common for owners or executives of companies that reap millions of dollars a year from Mississippi taxpayers to be among the largest donors to the state’s top public officials.

And it’s not just Reeves.

The governor’s campaign has accused his Democratic challenger Brandon Presley, who has served 15 years on the Public Service Commission, of illegally accepting campaign contributions from companies that had business before the commission. One company highlighted in Reeves’ public complaints gave Presley at least $16,500 in campaign donations.

Presley did vote to grant the company approval for a project, but he and others — including one of his Republican colleagues on the commission — maintain accepting the contributions did not violate state law.

READ MORE: Solar company’s donations to Brandon Presley appear legal. But should he have accepted them?

Examples of donors whose companies received state contracts

Centene

The second largest campaign donor to Reeves is also the single largest state contract recipient — and one that recently had to settle a lawsuit claiming it overcharged state agencies.

Centene, a St. Louis-based health care company that ranks 25th on the Forbes list of top 500 companies, is the nation’s largest Medicaid managed care company. Through its subsidiary company Magnolia Health, it is the recipient of a $1.2 billion managed care contract.

Centene LLC has contributed $318,000 during Reeves’ political campaigns, including a single check for $100,000 in 2023. The Centene PAC has contributed another $44,000 over the course of Reeves’ career.

In 2022, Centene was among three companies selected by Reeves’ Division of Medicaid to continue to provide managed care services to Medicaid patients. The contracts were awarded through a blind bidding process. It is estimated the total cost of the latest Centene contract is around $1.2 billion, though those numbers are fluid based on various factors, such as the number of people enrolled in Medicaid.

Magnolia, the Centene subsidiary, has a long relationship with the Mississippi Medicaid program. Since 2017, Magnolia has received state contracts totaling more than $9 billion. Those contracts were awarded before Reeves was governor, though they came while he was lieutenant governor and serving as the presiding officer of the Senate.

Centene received its most recent contract extension after settling a lawsuit filed in 2021 by the state of Mississippi. That settlement — $55 million — came after state Auditor Shad White and Attorney General Lynn Fitch accused another Centene company of overcharging the state for prescription drugs for Medicaid patients.

In 2022, after the Centene lawsuit settlement, Republican state Rep. Becky Currie of Brookhaven offered and passed a House amendment that would have prohibited Centene from receiving another state contract. While the amendment passed the House, it died later in the legislative process.

“I am doing away with doing business with the company who took $55 million of our money that was supposed to be spent on the poor, the sick, the elderly, the mentally ill, the disabled,” Currie said of the Centene contract at the time. “Last year in 2021, Centene brought in a $126 billion profit. They are in other states, that’s not just from us. But that’s all taxpayers’ money. They don’t make anything, they don’t take care of anybody, they don’t do anything, they just get taxpayers’ money from states.”

Centene officials did not respond to requests for comment.

READ MORE: See who has donated to Tate Reeves from 2003-2023

Rob Wells and YoungWilliams

Rob Wells, the CEO of Ridgeland-based YoungWilliams law firm that receives one of the state’s largest contracts, has contributed at least $173,500 individually to Reeves going back through his political career.

Since Reeves was elected governor, the Mississippi Department of Human Services, which Reeves oversees directly, awarded YoungWilliams a $135 million state contract to collect child support payments.

In late 2020, Mississippi Today published a story revealing Wells’ contributions to Reeves and other politicians as well as questions about YoungWiliams’ contract with the state. After the article was published, Wells stopped donating individually to Reeves. But he has still found a way to get his personal political contributions to the governor.

Wells donated $120,000 to a newly formed political action committee called the MS Build PAC, according to records filed with the Secretary of State. The PAC has since diverted at least $80,000 of its funds to Reeves’ campaign.

And before Reeves’ governorship, when the Department of Human Services was overseen by former Gov. Phil Bryant, YoungWilliams had received a $58 million state contract.

Reeves was presiding over the Senate as lieutenant governor when legislation was passed to allow the child support program to be privatized, thus opening the door for the contracts received by YoungWiliams.

According to the Transparency Mississippi web page, the latest YoungWilliams contract was awarded through a competitive bidding process.

Wells did not respond to requests for comment.

Neil Forbes and Horne LLP

Neil Forbes, one of Reeves’ top political donors, is the managing partner of Horne LLP, a Ridgeland-based accounting firm that has dozens of contracts with numerous state agencies.

Since Reeves was elected governor, Horne has received at least $13 million in contracts from agencies Reeves directly oversees.

When COVID-19 gripped the state and gutted the economy, the Mississippi Department of Employment Services was overrun with unemployment requests. The federal government had appropriated millions to Mississippi and other states to supplement their own existing unemployment funds. With tens of thousands of Mississippians out of work and a huge pot of money available to assist them, the state’s employment agency needed help.

In April 2020, Forbes, on behalf of Horne, signed a $10 million contract with MDES to establish a call center and workflows to help the state with the surge of unemployment requests. Forbes signed a second contract with MDES in April 2021 that was worth $2.2 million for the same purpose.

In both cases, Reeves signed emergency orders allowing the state’s employment agency to enter into no-bid, emergency contracts with Horne. Outside those two COVID-related contracts, Horne also received an additional $455,000 in state contracts from other agencies Reeves oversees.

Forbes, who was made a managing partner of Horne in 2021, had never donated to Reeves’ campaigns before the massive COVID-era contracts came. But on Aug. 25, 2021, Forbes cut Reeves a first campaign check for $2,500. The next month, in September 2021, Forbes wrote Reeves a $10,000 check. In two separate checks in 2022, Forbes wrote another $20,000 to the governor.

Then in February of 2023, just two weeks after Presley announced he would challenge Reeves’ bid for reelection, Forbes wrote Reeves a $25,000 check.

While Forbes began writing checks to the governor, so did his wife. Avery Forbes wrote Reeves a $5,000 check in July 2022 — also her first to the governor. And on April 27, 2023, she wrote Reeves a $25,000 check.

In total, the Forbeses, who had never given to Reeves before Neil Forbes became managing partner at Horne in 2021, have given the governor’s campaign $87,500 in contributions.

Neil Forbes did not respond to requests for comment.

Covington Civil & Environmental

Covington Civil and Environmental, an engineering consultant firm with offices in Gulfport and Mobile, is one of Reeves’ largest donors.

The company has donated more than $66,000 to his campaigns. Company officials and related LLC’s have also given thousands more to Reeves.

Covington, despite having little experience at the time in environmental restoration, garnered contracts worth $36 million from former Gov. Phil Bryant’s administration from the state’s $2.2 billion settlement over the Deepwater Horizon oil disaster in 2010.

Under Reeves’ administration, Covington has gotten $792,000 in contracts, including a $500,000 no-bid contract from Reeves’ Department of Finance and Administration to help supervise the state’s federally funded broadband internet expansion efforts.

Covington did not respond to requests for comment.

Other states limit political donations from contractors

Some states, including California, Connecticut, Hawaii, Kentucky, New Jersey, Ohio, South Carolina and West Virginia, have prohibitions or strict limits on campaign donations by government contractors to politicians. Others, including Maryland, New Mexico, Pennsylvania and Rhode Island have special campaign donation reporting requirements for companies and their officers who contribute to candidates.

In the early 2000s, numerous states and large cities considered or enacted pay-to-play restrictions or prohibitions. Often these were in reaction to scandals or corruption.

But since the 2010 U.S. Supreme Court Citizens United ruling, there has been less of a push for such limitations. In that case the high court held First Amendment freedom of speech prohibits the government from restricting independent expenditures by corporations on behalf of political campaigns. Some state courts followed suit. For example, in Colorado, a constitutional amendment passed by voters prohibiting sole-source state contractors and their families from contributing to campaigns was struck down as unconstitutional by the state’s Supreme Court.

Reform supporters say unregulated political contributions present a real danger of corruption, or at least the appearance of corruption, in government contracting. Opponents of such laws say prohibitions or restrictions on campaign contributions by government contractors limit their freedom of speech.

Mississippi’s campaign finance, lobbying and ethics laws and reporting requirements are notably weak, and contained in a piecemeal patchwork of confusing — and some conflicting — laws passed over many years. But even if Mississippi had stricter campaign finance laws, it’s unclear who might enforce them.

The secretary of state’s office and Ethics Commission have for years said they lack enforcement or investigative authority. The secretary of state’s office is responsible for receiving campaign finance reports but serves mainly as a repository, with no real investigative or enforcement authority. The Ethics Commission, after some changes to laws in recent years, appears to have some authority, but it’s unclear.

“It’s a mess,” state Ethics Commission Director Tom Hood said recently of Mississippi’s campaign finance laws. “Changes (to the law) have been made multiple times over multiple years, and it’s like trying to put together a jigsaw puzzle that doesn’t fit.”

Attorney General Lynn Fitch, as the state’s top law officer, runs the only state agency with clear authority to investigate and prosecute campaign finance violations. But Fitch, like her recent predecessors, has shown little interest in investigating or prosecuting complaints and enforcing campaign finance laws.

Mississippi attorney general actions on campaign finances or lobbying over the years have been so rare that, when they do happen, they bring outcry of selective enforcement.

Most often, campaign finance violations go unchecked, leaving the state political system open to the corrosive influence of special interest money.

Mississippi’s system also lacks transparency. For instance, unlike all neighboring states, Mississippi’s campaign finance reports are not electronically searchable. They are PDF files, and some politicians still submit hand-written reports. One in recent years submitted hers in calligraphy.

Mississippi allows politicians (except some judges) to take unlimited campaign contributions from individuals, LLCs and PACs. While there is a $1,000-a-year limit on corporate donations, this is easily sidestepped by corporate officers or lobbyists donating large amounts.

State lawmakers for many years have been loath to enact meaningful reform, transparency or oversight of the intersection of politics and money. This leaves the door wide open for corruption.

Numerous complaints about Mississippi money in politics

This year’s statewide campaign cycle has seen numerous complaints about alleged campaign finance violations, in several races besides the gubernatorial one. Earlier this year, out-of-state dark money groups pumped more than $1.4 million into the Republican primary race for Mississippi lieutenant governor, in support of unsuccessful GOP candidate Chris McDaniel. Incumbent Lt. Gov. Delbert Hosemann filed legal complaints with the AG’s office.

There have been other questions about Public Service Commission candidate campaign finances this election cycle. PSC candidates face stricter campaign finance laws, enacted by state lawmakers years ago after past scandals and corruption with the utility regulating authority. PSC candidates are prohibited from taking contributions from officers of public utilities whose rates the commission sets.

The Magnolia Tribune in June questioned a donation to gubernatorial candidate Presley from a regulated utility. Presley returned the $500 donation, saying it was mistakenly accepted. The publication also questioned donations to Presley and Central District Public Service Commissioner Brent Bailey from a law firm that represents the PSC, with its fees paid by Entergy, a regulated power company.

Both Bailey and Presley have denied their questioned contributions fall under the PSC campaign finance prohibition. A solar company that donated to Presley is threatening to sue Reeves over ads he is running saying its donations to Presley were illegal.

In the Southern District PSC race, challenger Wayne Carr — who defeated incumbent Republican Commissioner Dane Maxwell in the primary — claimed Maxwell took $18,000 in illegal contributions from PSC-regulated utilities or affiliates and failed to report thousands in campaign spending. Maxwell denied any wrongdoing, but returned some of the donations, saying he unknowingly accepted some he shouldn’t have.

The complaints of legally questionable spending and reporting prompted calls for Fitch to investigate, and for reform in state campaign finance laws.

Both incumbent Republicans Hosemann and Secretary of State Michael Watson have vowed to push campaign finance reform in the 2024 Legislature. Presley has made such reform a main plank in his platform during his 2023 gubernatorial campaign.

One area that will likely be debated by lawmakers is what elected official or agency would investigate and enforce campaign finance complaints and regulations. In numerous other states, ethics commissions or special commissions oversee such operations. In some states, elected officials such as secretaries of state have such responsibility.

Hood recently said he’s not pushing lawmakers for large increases in funding or authority for the Mississippi’s Ethics Commission. But he would like for laws and responsibilities to be clearer, particularly with campaign finance issues.

“Somebody needs to have clear authority and responsibility to enforce the law — that would be a good first step,” Hood said.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Mississippi Today

Derrick Simmons: Monday’s Confederate Memorial Day recognition is awful for Mississippians

Editor’s note: This essay is part of Mississippi Today Ideas, a platform for thoughtful Mississippians to share fact-based ideas about our state’s past, present and future. You can read more about the section here.

Each year, in a handful of states, public offices close, flags are lowered and official ceremonies commemorate “Confederate Memorial Day.”

Mississippi is among those handful of states that on Monday will celebrate the holiday intended to honor the soldiers who fought for the Confederacy during the Civil War.

But let me be clear: celebrating Confederate Memorial Day is not only racist but is bad policy, bad governance and a deep stain on the values we claim to uphold today.

First, there is no separating the Confederacy from the defense of slavery and white supremacy. The Confederacy was not about “states’ rights” in the abstract; it was about the right to own human beings. Confederate leaders themselves made that clear.

Confederate Vice President Alexander Stephens declared in his infamous “Cornerstone Speech” that the Confederacy was founded upon “the great truth that the negro is not equal to the white man.” No amount of revisionist history can erase the fact that the Confederacy’s cause was fundamentally rooted in preserving racial subjugation.

To honor that cause with a state holiday is to glorify a rebellion against the United States fought to defend the indefensible. It is an insult to every citizen who believes in equality and freedom, and it is a cruel slap in the face to Black Americans, whose ancestors endured the horrors of slavery and generations of systemic discrimination that followed.

Beyond its moral bankruptcy, Confederate Memorial Day is simply bad public policy. Holidays are public statements of our values. They are moments when a state, through official sanction, tells its citizens: “This is what we believe is worthy of honor.” Keeping Confederate Memorial Day on the calendar sends a message that a government once committed to denying basic human rights should be celebrated.

That message is not just outdated — it is dangerous. It nurtures the roots of racism, fuels division and legitimizes extremist ideologies that threaten our democracy today.

Moreover, there are real economic and administrative costs to shutting down government offices for this purpose. In a time when states face budget constraints, workforce shortages and urgent civic challenges, it is absurd to prioritize paid time off to commemorate a failed and racist insurrection. Our taxpayer dollars should be used to advance justice, education, infrastructure and economic development — not to prop up a lost cause of hate.

If we truly believe in moving forward together as one people, we must stop clinging to symbols that represent treason, brutality and white supremacy. There is a legislative record that supports this move in a veto-proof majority changing the state Confederate flag in 2020. Taking Confederate Memorial Day off our official state holiday calendar is another necessary step toward a more inclusive and just society.

Mississippi had the largest population of enslaved individuals in 1865 and today has the highest percentage of Black residents in the United States. We should not honor the Confederacy or Confederate Memorial Day. We should replace it.

Replacing a racist holiday with one that celebrates emancipation underscores the state’s rich African American history and promotes a more inclusive understanding of its past. It would also align the state’s observances with national efforts to commemorate the end of slavery and the ongoing pursuit of equality.

I will continue my legislative efforts to replace Confederate Memorial Day as a state holiday with Juneteenth, which commemorates the freedom for America’s enslaved people.

It’s time to end Confederate Memorial Day once and for all.

Derrick T. Simmons, D-Greensville, serves as the minority leader in the state Senate. He represents Bolivar, Coahoma and Washington counties in the Mississippi Senate.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post Derrick Simmons: Monday's Confederate Memorial Day recognition is awful for Mississippians appeared first on mississippitoday.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Left-Leaning

This article argues against the celebration of Confederate Memorial Day, stating it glorifies a racist and failed rebellion that is harmful to societal values. It critiques the holiday as a symbol of white supremacy and advocates for replacing it with Juneteenth to honor emancipation. The language used, such as referring to the Confederate cause as “moral bankruptcy,” and the call to replace the holiday reflects a progressive stance on social justice and racial equality, common in left-leaning perspectives. Additionally, the writer urges action for inclusivity and justice, positioning the argument within modern liberal values.

Mississippi Today

On this day in 1903, W.E.B. Du Bois urged active resistance to racist policies

April 27, 1903

W.E.B. Du Bois, in his book, “The Souls of Black Folk,” called for active resistance to racist policies: “We have no right to sit silently by while the inevitable seeds are sown for a harvest of disaster to our children, black and white.”

He described the tension between being Black and being an American: “One ever feels his twoness, — an American, a Negro; two souls, two thoughts, two unreconciled strivings; two warring ideals in one dark body, whose strength alone keeps it from being torn asunder.”

He criticized Washington’s “Atlanta Compromise” speech. Six years later, Du Bois helped found the NAACP and became the editor of its monthly magazine, The Crisis. He waged protests against the racist silent film “The Birth of a Nation” and against lynchings of Black Americans, detailing the 2,732 lynchings between 1884 and 1914.

In 1921, he decried Harvard University’s decisions to ban Black students from the dormitories as an attempt to renew “the Anglo-Saxon cult, the worship of the Nordic totem, the disenfranchisement of Negro, Jew, Irishman, Italian, Hungarian, Asiatic and South Sea Islander — the world rule of Nordic white through brute force.”

In 1929, he debated Lothrop Stoddard, a proponent of scientific racism, who also happened to belong to the Ku Klux Klan. The Chicago Defender’s front page headline read, “5,000 Cheer W.E.B. DuBois, Laugh at Lothrup Stoddard.”

In 1949, the FBI began to investigate Du Bois as a “suspected Communist,” and he was indicted on trumped-up charges that he had acted as an agent of a foreign state and had failed to register. The government dropped the case after Albert Einstein volunteered to testify as a character witness.

Despite the lack of conviction, the government confiscated his passport for eight years. In 1960, he recovered his passport and traveled to the newly created Republic of Ghana. Three years later, the U.S. government refused to renew his passport, so Du Bois became a citizen of Ghana. He died on Aug. 27, 1963, the eve of the March on Washington.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.![]()

Mississippi Today

Jim Hood’s opinion provides a roadmap if lawmakers do the unthinkable and can’t pass a budget

On June 30, 2009, Sam Cameron, the then-executive director of the Mississippi Hospital Association, held a news conference in the Capitol rotunda to publicly take his whipping and accept his defeat.

Cameron urged House Democrats, who had sided with the Hospital Association, to accept the demands of Republican Gov. Haley Barbour to place an additional $90 million tax on the state’s hospitals to help fund Medicaid and prevent the very real possibility of the program and indeed much of state government being shut down when the new budget year began in a few hours. The impasse over Medicaid and the hospital tax had stopped all budget negotiations.

Barbour watched from a floor above as Cameron publicly admitted defeat. Cameron’s decision to swallow his pride was based on a simple equation. He told news reporters, scores of lobbyists and health care advocates who had set up camp in the Capitol as midnight on July 1 approached that, while he believed the tax would hurt Mississippi hospitals, not having a Medicaid budget would be much more harmful.

Just as in 2009, the Legislature ended the 2025 regular session earlier this month without a budget agreement and will have to come back in special session to adopt a budget before the new fiscal year begins on July 1. It is unlikely that the current budget rift between the House and Senate will be as dramatic as the 2009 standoff when it appeared only hours before the July 1 deadline that there would be no budget. But who knows what will result from the current standoff? After all, the current standoff in many ways seems to be more about political egos than policy differences on the budget.

The fight centers around multiple factors, including:

- Whether legislation will be passed to allow sports betting outside of casinos.

- Whether the Senate will agree to a massive projects bill to fund local projects throughout the state.

- Whether leaders will overcome hard feelings between the two chambers caused by the House’s hasty final passage of a Senate tax cut bill filled with typos that altered the intent of the bill without giving the Senate an opportunity to fix the mistakes.

- Whether members would work on a weekend at the end of the session. The Senate wanted to, the House did not.

It is difficult to think any of those issues will rise to the ultimate level of preventing the final passage of a budget when push comes to shove.

But who knows? What we do know is that the impasse in 2009 created a guideline of what could happen if a budget is not passed.

It is likely that parts, though not all, of state government will shut down if the Legislature does the unthinkable and does not pass a budget for the new fiscal year beginning July 1.

An official opinion of the office of Attorney General Jim Hood issued in 2009 said if there is no budget passed by the Legislature, those services mandated in the Mississippi Constitution, such as a public education system, will continue.

According to the Hood opinion, other entities, such as the state’s debt, and court and federal mandates, also would be funded. But it is likely that there will not be funds for Medicaid and many other programs, such as transportation and aspects of public safety that are not specifically listed in the Mississippi Constitution.

The Hood opinion reasoned that the Mississippi Constitution is the ultimate law of the state and must be adhered to even in the absence of legislative action. Other states have reached similar conclusions when their legislatures have failed to act, the AG’s opinion said.

As is often pointed out, the opinion of the attorney general does not carry the weight of law. It serves only as a guideline, though Gov. Tate Reeves has relied on the 2009 opinion even though it was written by the staff of Hood, who was Reeves’ opponent in the contentious 2019 gubernatorial campaign.

But if the unthinkable ever occurs and the Legislature goes too far into a new fiscal year without adopting a budget, it most likely will be the courts — moreso than an AG’s opinion — that ultimately determine if and how state government operates.

In 2009 Sam Cameron did not want to see what would happen if a budget was not adopted. It also is likely that current political leaders do not want to see the results of not having a budget passed before July 1 of this year.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

-

SuperTalk FM6 days ago

SuperTalk FM6 days agoNew Amazon dock operations facility to bring 1,000 jobs to Marshall County

-

News from the South - Missouri News Feed2 days ago

News from the South - Missouri News Feed2 days agoMissouri lawmakers on the cusp of legalizing housing discrimination

-

News from the South - Alabama News Feed6 days ago

News from the South - Alabama News Feed6 days agoPrayer Vigil Held for Ronald Dumas Jr., Family Continues to Pray for His Return | April 21, 2025 | N

-

News from the South - Florida News Feed6 days ago

News from the South - Florida News Feed6 days agoTrump touts manufacturing while undercutting state efforts to help factories

-

Mississippi Today7 days ago

Mississippi Today7 days ago‘Trainwreck on the horizon’: The costly pains of Mississippi’s small water and sewer systems

-

News from the South - Texas News Feed7 days ago

News from the South - Texas News Feed7 days agoMeteorologist Chita Craft is tracking a Severe Thunderstorm Warning that's in effect now

-

News from the South - Virginia News Feed7 days ago

News from the South - Virginia News Feed7 days agoTaking video of military bases using drones could be outlawed | Virginia

-

News from the South - Florida News Feed6 days ago

News from the South - Florida News Feed6 days agoFederal report due on Lumbee Tribe of North Carolina’s path to recognition as a tribal nation