(The Center Square) − Louisiana college athletes could soon get a state income tax break on money earned through name, image, and likeness deals under a new bill filed for the 2025 legislative session.

House Bill 166, introduced by Rep. Dixon McMakin, R-East Baton Rouge, would allow student-athletes enrolled in Louisiana public and state-supported private colleges to deduct their NIL compensation from their state taxable income if signed into law by Gov. Jeff Landry.

“We we want to try to level the playing field and keep our best and brightest in our state,” Dixon said in an interview, noting that Alabama, Texas and Georgia have also introduced similar legislation.

The deduction would apply only to earnings tied directly to participation in college sports — excluding endorsements for alcohol, tobacco, gambling or other restricted categories.

If enacted, the law would apply to income earned beginning Jan. 1, 2026. The Louisiana Department of Revenue would be tasked with setting the rules for implementation.

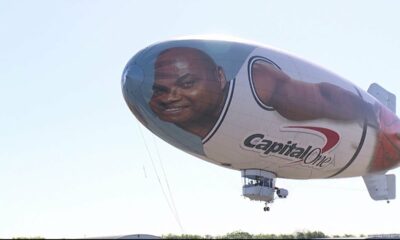

The proposal comes as college athletics navigates a complex and often chaotic NIL landscape, shaped by a patchwork of inconsistent state laws and the absence of a national framework.

NIL became part of the NCAA landscape in July 2021, when collectives were allowed to start paying players. A settlement is likely to be reworked in a federal case that would govern how the NCAA distributes NIL funds in the future and will have to outlay $2.75 billion to athletes who competed before the practice became official.

Without federal legislation, athletes face varying rules across state lines—raising questions of fairness, compliance, and long-term support for students juggling sports, school and brand deals.