News from the South - Florida News Feed

Fed goes with half-point interest rate cut. What that means for you | Quickcast

SUMMARY: In today’s CBS News Miami Quickcast, the Federal Reserve is expected to cut interest rates for the first time in over four years, aiming to lower borrowing costs and prevent a recession. Miami is experiencing heat and storms, with temperatures rising into the 90s. A fire in a Miami Beach high-rise was caused by a charging electric scooter, though no injuries occurred. Jalisa Hill pleads not guilty to orchestrating her grandparents’ murder. Sean “Diddy” Combs faces serious charges, including sex trafficking. Meanwhile, a solar panel canopy was unveiled in Fort Lauderdale, part of efforts to increase renewable energy in the community.

In today’s Quickcast:

The mortgage rate landscape is undergoing a rapid transformation now that inflation is cooling. For starters, there has been a notable drop in mortgage rates over the past few weeks, with rates hitting a two-year low on Wednesday. This shift has already begun to stir excitement, as more affordable borrowing costs open doors for those previously priced out of homeownership.

The Federal Reserve also conducted its first rate cut since 2020 on September 18, reducing the federal funds rate by an unexpected 50 basis points. Most analysts expected the Fed rate cut to be just 25 basis points, making this decision larger and more impactful than anticipated.

This move is expected to put additional downward pressure on interest rates across the board, including mortgages, and may present an opportunity for borrowers to lock in more favorable rates. But how exactly will this substantial Fed rate cut impact mortgages? Below, we’ll break down what you should know.

See how low of a mortgage rate you could lock in here today.

Here’s how the Fed’s big rate cut affects mortgages

The Federal Reserve’s decision to implement a 50 basis point rate cut has injected a new layer of complexity into the mortgage market. While the impact of a standard 25 basis point reduction has likely been factored into current mortgage rates, which are sitting at an average of 6.15%, it’s unclear exactly how mortgage rates will respond to this larger rate cut.

One outcome could be that the larger rate cut will cause mortgage rates to fall even further in the coming days and weeks, building on the recent trend of declining rates. This could create a more favorable environment for borrowers, with the possibility of mortgage rates dipping to levels not seen in years.

However, it’s crucial to understand that the Federal Reserve’s actions, while significant, are not the sole factor influencing mortgage rates. The mortgage market is a complex ecosystem affected by various economic indicators. Long-term bonds, particularly the 10-year Treasury yield, also play a pivotal role in determining mortgage rates. So while the Fed’s rate cut will likely push these yields lower, other factors can also sway bond yields and, consequently, mortgage rates.

The mortgage industry itself may also play a role in tempering any dramatic rate drops. For example, lenders might be hesitant to lower rates too quickly or too far as they balance their desire to attract borrowers with the need to maintain profitability. This could result in a more gradual decline in mortgage rates rather than an immediate, sharp drop.

For potential homebuyers or those considering refinancing, the Fed’s larger-than-expected rate cut presents both opportunities and potential challenges. On one hand, the prospect of lower mortgage rates is certainly appealing. Lower rates translate to more affordable monthly payments and increased buying power, potentially allowing borrowers to qualify for larger loans or more desirable properties.

The bottom line

The Federal Reserve’s unexpected 50 basis point rate cut will likely have a noticeable effect on the mortgage market, but its exact impact remains uncertain. While lower rates may materialize in the short term, a range of factors will influence how mortgage rates move in the future. So, homebuyers and homeowners who plan to refinance should carefully consider their options, recognizing that waiting for the perfect moment could be risky in an unpredictable market. Securing a favorable rate now may be the best course of action instead, especially with rates already at a two-year low.

The allure of lower rates could also bring its own set of complications, however. If mortgage rates decline even further, it’s likely to attract more buyers to the market. This increased demand could lead to heightened competition for available properties, potentially driving up home prices and offsetting some of the benefits of lower interest rates.

Those waiting for rates to bottom out before making a move may also find themselves in a precarious position. Timing the market is notoriously difficult, and there’s a risk that rates could begin to rise again before you can act. After all, economic conditions can shift rapidly, which could reverse the current downward trend in rates.

Lenders are also more likely to see an uptick in inquiries and applications in the wake of the Fed’s decision. This increased volume could lead to longer processing times and potentially stricter underwriting standards, so borrowers should be prepared for this possibility and consider getting pre-approved or starting the application process early.

Find out how low your mortgage loan rate could be now.

Catch the Quickcast with Najahe Sherman weekdays at 4PM ET streaming on the CBS Miami app and CBSMiami.com

#florida #miami #miamidade #localnews #local #community #politicalnews

News from the South - Florida News Feed

Jim talks with Rep. Robert Andrade about his investigation into the Hope Florida Foundation

SUMMARY: Jim discusses Rep. Robert Andrade’s investigation into the Hope Florida Foundation with him, focusing on the misuse of $5 million intended for charity that was allegedly redirected to political action committees. Andrade aims to uncover why this occurred and the assurances provided by attorney Jeff Aaron and chief of staff James Um. The investigation raises concerns about accountability in the governor’s office, with Andrade questioning the legitimacy of Hope Florida’s claims of assisting families and highlighting a lack of metrics to measure their success. Amid resignations from Hope Florida leadership, Andrade plans further hearings, asserting the issue transcends partisan politics.

The chairman of a foundation tied to Hope Florida — Florida First Lady Casey DeSantis’ signature welfare-assistance program — said under oath last Tuesday that “mistakes were made” with the foundation’s record-keeping, as a skirmish over the group’s finances continued to escalate.

News from the South - Florida News Feed

Countries shore up their digital defenses as global tensions raise the threat of cyberwarfare

SUMMARY: Hackers linked to Russia’s government targeted municipal water plants in rural Texas last spring, testing vulnerabilities in U.S. infrastructure. These attacks highlight growing global cyber threats amid escalating tensions, with experts warning of a digital arms race. As geopolitical conflicts rise, countries like China, Russia, Iran, and North Korea strengthen cyber cooperation. Despite these threats, former President Trump’s actions, such as reducing cybersecurity resources, have raised concerns. Meanwhile, experts stress the need for stronger cyber defenses and collaboration between governments and businesses to counter growing risks. The situation underscores the increasing role of cybersecurity in national security.

The post Countries shore up their digital defenses as global tensions raise the threat of cyberwarfare appeared first on www.news4jax.com

News from the South - Florida News Feed

15 years after Deepwater Horizon oil spill, lawsuits stall and restoration is incomplete

SUMMARY: Fifteen years after the Deepwater Horizon spill, its effects persist in the Gulf Coast. BP paid billions in damages, funding coastal restoration projects, but health-related lawsuits from cleanup workers and locals have struggled in court, with few compensations. Environmental efforts have made progress, with over 300 restoration projects worth $5.38 billion. However, a flagship land-creation project in Louisiana has stalled, sparking controversy over its effects on local industries. Additionally, the Trump administration plans to expand offshore drilling despite warnings about the legacy of the spill. Environmental advocates remain concerned about the future of the Gulf’s restoration.

The post 15 years after Deepwater Horizon oil spill, lawsuits stall and restoration is incomplete appeared first on www.clickorlando.com

-

News from the South - Alabama News Feed6 days ago

News from the South - Alabama News Feed6 days agoFoley man wins Race to the Finish as Kyle Larson gets first win of 2025 Xfinity Series at Bristol

-

News from the South - Alabama News Feed6 days ago

News from the South - Alabama News Feed6 days agoFederal appeals court upholds ruling against Alabama panhandling laws

-

News from the South - North Carolina News Feed5 days ago

News from the South - North Carolina News Feed5 days agoFDA warns about fake Ozempic, how to spot it

-

News from the South - Virginia News Feed4 days ago

News from the South - Virginia News Feed4 days agoLieutenant governor race heats up with early fundraising surge | Virginia

-

News from the South - Oklahoma News Feed3 days ago

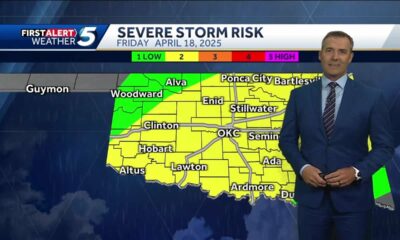

News from the South - Oklahoma News Feed3 days agoThursday April 17, 2025 TIMELINE: Severe storms Friday

-

News from the South - Arkansas News Feed6 days ago

News from the South - Arkansas News Feed6 days agoTwo dead, 9 injured after shooting at Conway park | What we know

-

News from the South - Missouri News Feed5 days ago

News from the South - Missouri News Feed5 days agoAbandoned property causing issues in Pine Lawn, neighbor demands action

-

News from the South - Missouri News Feed3 days ago

News from the South - Missouri News Feed3 days agoDrivers brace for upcoming I-70 construction, slowdowns