Mississippi Today

Early education expert: It’s time to provide paid family leave to help protect babies

Early education expert: It’s time to provide paid family leave to help protect babies

Editor’s note: This essay is part of Mississippi Today Ideas, a new platform for thoughtful Mississippians to share fact-based ideas about our state’s past, present and future. You can read more about the section here.

Mississippi leaders say they are taking steps to protect the lives of our babies. One way they can do that is by ensuring they get a healthy, strong start.

About 100 babies are born in Mississippi each day — about one per county. Each of these new lives is full of potential and as a state we have a responsibility to support them during this crucial stage. From the very beginning, early relationships with parents and caregivers shape brain connections that lay the foundation for lifelong learning and relationships.

Given the importance of this window of time, it is exciting that the Mississippi Legislature has passed a bill that is pending the signature of Gov. Tate Reeves to provide six weeks of paid leave to state employees who are primary caregivers of newborns or adopted children. While research shows that at least eight weeks of paid leave for new or adoptive parents can strengthen babies’ brain development, reduce infant mortality, and improve overall child health outcomes, six weeks will still be beneficial. Additionally, any amount of leave can ease the burden on the child care system while also enhancing employee retention and productivity. By allowing families to spend time with their newborns during this pivotal time, Mississippi can create lasting benefits for both children and the workforce.

I was fortunate to have eight weeks of paid leave with my children, followed by an additional month at half pay. This time together was invaluable for my children’s development, school readiness and overall health. Today, they are thriving– emotionally stable, socially engaged and eager learners in first and fifth grade.

However, not all children receive this time with and support from a parent or caregiver. In Mississippi, only 20% of workers have access to paid leave, and many mothers return to work just two weeks after giving birth.

This early separation can take a serious toll since the first eight weeks of life are a crucial period for brain growth and bonding. By two weeks, babies recognize their parents’ voices; by five weeks, they respond to faces with excitement; and by eight weeks, they find comfort in familiar caregivers. These early interactions lay the foundation for lifelong emotional and cognitive development, making paid leave not just a benefit, but a necessity for families and the future of our children.

Paid leave is more than just a brain-boosting tool—it’s a proven way to save infant lives. In 2024, Mississippi ranked last nationally in infant mortality, highlighting an urgent need for solutions. Research shows that 10 weeks of paid maternity leave is linked to about a 10% reduction in neonatal, infant and under-5 mortality.

Paid leave gives parents the time to attend critical medical appointments, receive guidance from doctors on how to care for and protect their babies, ensure proper vaccinations, and respond to health concerns before they become life-threatening. By providing paid leave, Mississippi can take a crucial step toward improving infant survival rates.

I believe that any amount of paid leave is valuable for children, but at least eight weeks of leave ensures that our babies remain safe and healthy when parents return to work. The CDC recommends that infants get most of their necessary vaccines at eight weeks–not before – and without these vaccinations they are not able to attend child care programs since they are susceptible to dangerous diseases. Without any paid leave, however, many parents must choose between caring for and protecting their newborn’s health and avoiding financial hardship—a choice no parent should have to make.

Paid leave can also assist with Mississippi’s critical child care shortage. Many mothers struggle to find available infant care, forcing them to reduce work hours or leave their jobs entirely. According to Mississippi State University’s Systems Change Lab, in 2023 there were only enough child care slots for about two-thirds of Mississippi children. Infant care, the most limited and expensive form of care, is particularly scarce.

Paid leave alleviates pressure on the child care system by reducing immediate demand for infant slots and allowing families time to secure the best arrangements for their needs.

My own experience with paid leave allowed me to care for my newborns, ensure they received necessary vaccinations, and transition them into child care so I could return to work. Without this opportunity, I might have had to leave a job I loved, costing my employer money to recruit and train my replacement. Instead, I was able to return and contribute to my team. By offering paid leave to state employees, the state can retain new parents and save these same costs.

By offering paid leave, we can protect our state’s babies while also saving money and boosting efficiency by retaining state employees. More importantly, we can allow families to care for their newborns in ways that lay a strong foundation for their future– building their brains, supporting their health, and encouraging wellbeing—without jeopardizing their livelihoods.

Now is the time for the state to make this commitment for the sake of Mississippi and our babies.

Biz Harris is the executive director of the Mississippi Early Learning Alliance. She is also an alumna of Teach for America’s Mississippi Delta Region where she began her career in education as a teacher in Marks.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

Mississippi Today

Podcast: Is the Mississippi Legislature any closer to a tax cut/elimination/increase deal?

Senate Finance Chairman Josh Harkins gives an update on where negotiations stand on tax overhaul proposals in the Mississippi Legislature, and his thoughts on the differing Senate and House proposals that would include cutting or eliminating the personal income tax and raising taxes on gasoline.

READ MORE: As lawmakers look to cut taxes, Mississippi mayors and county leaders outline infrastructure needs

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

Mississippi Today

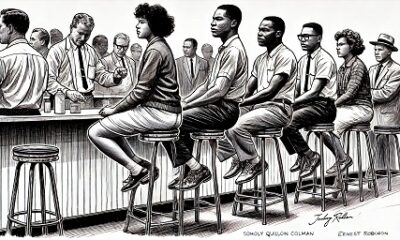

On this day in 1960

On this day in 1960

March 16, 1960

Inspired by the Greensboro sit-in a month earlier, Black students staged sit-ins at whites-only lunch counters in eight downtown stores in Savannah, Georgia.

Students Carolyn Quilloin Coleman, Joan Tyson Hall and Ernest Robinson stepped into Levy’s Department Store, shopping before entering the segregated Azalea Room. The server ordered them to leave, but they attempted to order anyway. Police hauled them to jail, where they sang, “We Shall Overcome.”

Robinson recalled looking at his hand where he scrawled the words of a Psalm: “Yea, though I walk through the valley of the shadow of death, I will fear no evil: for thou art with me; thy rod and thy staff they comfort me.”

“That verse uplifted us,” Coleman told the Savannah Morning News. “We were very familiar with what had happened to Emmett Till, a 14-year-old student who was killed in Mississippi for allegedly whistling at a White girl across the street. While we thought that we were safe in Savannah, we knew that anything could happen.”

In response, Black leaders W.W. Law, Hosea Williams and Eugene Gadsden organized a boycott of city businesses and led voter registration drives that brought changes to city government. Seven months later, Savannah repealed its ordinance requiring segregated lunch counters. The boycott continued until all facilities were desegregated in October 1963.

Months later, Martin Luther King Jr. arrived to hail the passing of Jim Crow ways. The Levy’s Department Store building now houses the Savannah College of Art and Design’s Jen Library, and a historic marker now honors the students’ fight for freedom.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

Mississippi Today

The quiet part out loud: Mississippi political leaders tolerate tax burden on poor

The quiet part out loud: Mississippi political leaders tolerate tax burden on poor

Former Gov. Haley Barbour finally said the quiet part out loud.

During a recent speech to the Mississippi State University Stennis Institute of Government and Capitol Press Corps, the former two-term governor and master communicator said taxing groceries was a good thing because everybody has to eat.

Barbour reasoned that it is important for all people to have skin in the game — to pay taxes — because “otherwise, they will vote to pave the streets with gold if they don’t have to pay anything.”

Various conservative politicians and other policymakers espouse the Barbour philosophy that a tax on food is fair and necessary. To ensure that poor people pay taxes, too, they advocate for a grocery tax that absorbs a much greater percentage of the income of low income families.

The quiet part out loud is a reference to the fact that as governor from 2004 until 2012, Barbour blocked legislative efforts to eliminate the grocery tax and offset that lost revenue, at least in part by increasing the tax on cigarettes. Barbour vetoed two bills in 2006: one to eliminate the highest in the nation 7% tax on food and the other to cut in half the levy on groceries.

Veto messages are where governors articulate their reasoning for opposing legislation. In neither veto of the grocery tax cut bills did the governor talk about “fairness.”

Instead, he talked about the fact that the combination of cutting or eliminating the grocery tax and increasing the cigarette tax was not revenue neutral. The legislation, Barbour argued at the time, would produce less revenue for the state.

He maintained that it sent the wrong message to cut taxes at a time when he was going to Congress to try to secure federal funds to help with the recovery from the devastation caused by Hurricane Katrina. And in fairness to the governor, Hurricane Katrina was the seminal event of Barbour’s tenure as governor and one of the seminal events in the state’s history, and his ability to obtain those funds was paramount for the success of the Gulf Coast and south Mississippi.

So it is fair to say Katrina was heavy on Barbour’s mind in 2006 when the Legislature sent him the bills to cut the grocery tax.

It is clear, though, that Mississippi’s political leadership still has similar views as Barbour on the grocery tax. Since Barbour has left office, there have been two major reductions in the income tax: one in 2016 when Phil Bryant was governor and another in 2022 when Tate Reeves was governor.

There has been no cut in the grocery tax during that time.

This year the Senate proposes another major cut in the income tax and a reduction in the grocery tax from 7 cents to 5 cents on every dollar purchase of groceries.

There are efforts by the House leadership and Reeves to completely eliminate the income tax. In addition, the House tax cut plan essentially would trim the grocery tax to 5.5%. The House plan in most instances also would raise the sales tax on most other retail items from 7% to 8.5%.

And there are retail items other than groceries that most all people need. After all, most everyone, including poor people who might not pay an income tax, must buy clothes, household utensils and numerous other retail items that under the House plan would cost more because of the increase in the sales tax.

In short, there are many opportunities other than the grocery tax to collect taxes from poor people.

But just to recap:

• Only 12 states tax food like Mississippi does.

• Mississippi not only has the highest state-imposed tax on food, but also has one of the country’s highest sales taxes on other retail items.

• Mississippi has one of the lowest income taxes in the country and it is getting even lower thanks to the 2022 tax cut that is still being phased in.

The aforementioned tax structure results in Mississippi’s low-wage earners paying a greater percentage of their income in state and local taxes than do the state’s more affluent residents, a 2024 study found.

The report by the Institute of Taxation and Economic Policy found that Mississippi has the nation’s 19th-most regressive tax system where low-income residents are forced to pay a larger percentage of their income in taxes than the state’s wealthier citizens.

The study shows the income tax is the only component of the Mississippi tax system that requires the wealthy to pay more than the poor.

And even though Mississippi has the nation’s highest percentage of poor people, the quiet part that needs to be told louder is that our leaders are working to make the tax structure even more regressive.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

-

News from the South - Oklahoma News Feed6 days ago

News from the South - Oklahoma News Feed6 days agoLong Story Short: Bill to Boost Rural Mental Health and Diversion Programs Advances

-

News from the South - North Carolina News Feed7 days ago

News from the South - North Carolina News Feed7 days agoLumbee tribe may finally receive long-sought federal recognition

-

News from the South - Oklahoma News Feed5 days ago

News from the South - Oklahoma News Feed5 days agoBlood stain leads to 2 arrests in 1997 Oklahoma cold case

-

News from the South - Alabama News Feed6 days ago

News from the South - Alabama News Feed6 days agoCannabis cultivator celebrates Alabama licensing ruling

-

Mississippi Today4 days ago

Mississippi Today4 days agoOn this day in 1965

-

News from the South - Alabama News Feed7 days ago

News from the South - Alabama News Feed7 days agoSevere storms in Alabama's forecast Saturday with multiple threats including a tornado risk.

-

News from the South - Oklahoma News Feed7 days ago

News from the South - Oklahoma News Feed7 days agoFormer DHS worker charged with kidnapping says ‘another personality’ caused her to take the child

-

News from the South - Oklahoma News Feed7 days ago

News from the South - Oklahoma News Feed7 days agoMan shot and killed by police in south Guthrie