Mississippi Today

Bill to fully fund public education heads to House for consideration. Here’s what the changes would mean.

Bill to fully fund public education heads to House for consideration. Here’s what the changes would mean.

The Mississippi Senate on Tuesday unanimously approved two bills to change the state’s school funding formula and “fully fund” the new version, but the bills may face challenges in the House and from the governor.

The funding formula used to allocate money to public schools, the Mississippi Adequate Education Program, was established by the Legislature in 1997 and has been consistently underfunded every year since 2008. MAEP funding provides the state’s share of funding for the basic operations of local school districts, ranging from teacher salaries to textbooks to utilities.

In broad strokes, the proposed changes would change the amount some districts pay towards the formula and adjust the way inflation is calculated. Every school district except five (Carroll County, Coahoma County, Laurel, Holly Springs, and Wilkinson County) would receive more money than last year from the state under the new formula, but the state would make a one-time allocation to those five districts for the first year the new formula is enacted.

READ MORE: Senate, Hosemann want to spend $181 million more to ‘fully fund’ public education in Mississippi

Chickasaw County School District Superintendent John Ellison called the new plan “a step in the right direction.”

“We got so far from full funding, it was almost like ‘How are we ever going to get there?’ So to me this was kind of a meet in the middle,” he said. “It probably has lowered the ceiling some on what full funding of MAEP looks like, but at the same time, it’s given most of us an increase in funding for next year, so that’s always a good thing for us. The other positive, too, is if they change the formula to where it’s more likely to be fully funded, then we know what to bank on each year.”

The changes to the formula do not alter the calculation of the base student cost, or the amount of money that is necessary to “adequately” educate a student, which some advocates have lauded. The base student cost is recalculated every four years and receives an adjustment for inflation each year in the intervening years — this inflation adjustment is one of the two aspects of the formula that the Senate plan changes. Under the new plan, inflation will be calculated using a 20-year average instead of current inflation rates, and the amount of costs subject to the inflation adjustment will be reduced.

Senate Education Committee Chairman Dennis DeBar, R-Leaksville, said the changes in inflation calculation will provide more stability for both the Legislature and school districts. Since the year-to-year cost of full funding will fluctuate less with the shift to a 20-year average, it will be easier for the Legislature to anticipate how much fully funding MAEP will cost.

“By fully funding it, which is what districts are mostly going to be keen on, I think districts can work with fluctuations in actual inflation as long as we are fully funding it,” he told Mississippi Today.

The bill would also change the portion that must be covered locally. Under the current formula, there is a provision known as the “27% rule,” which states that no school district shall bear more than 27% of the cost of public education for its schools. The new proposal would alter the percentage to 29.5%. This change would slightly increase the contribution by wealthier districts, since their property taxes generate more funds and they are the districts who benefit from this cap.

DeBar said for full funding of MAEP to be possible, some districts need to be more honest about the level of local funding they already provide, since most school districts levy property taxes above the required amount.

“In any scenario that increases the 27% threshold, by any degree, even if it’s just 2.5%, what you’re saying is, those property-wealthy districts that were benefiting from this loophole are going to benefit a little less,” said Zahava Stadler of New America, a national think tank. “It frees up state money … to be sent to districts that actually need the aid.”

Stadler said while she sees this change as positive progress, the existence of the 27% rule is still very unusual nationally. She said most states only pay the portion of their formula that local districts cannot cover through property taxes, or guarantee to cover a much smaller portion of the cost.

DeBar said this revision of the formula is “the beginning,” and the formula should be reviewed for tweaks more often, possibly each time the base student cost is recalculated.

“It’s going to be hard to make changes to the formula if we’re not fully funding it upfront,” he said.

For school districts, the biggest impact of the funding increase will be the ability to avoid budget cuts or update neglected facilities.

Adrian Hammitte, superintendent of the Jefferson County School District, said this money will save his district from making cuts to protect new curriculum resources and allow him to address damages to buildings from severe weather events over the last few years.

“Those additional funds will help us to continue to make sure that students have a safe, warm, and welcoming school environment,” he said.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Mississippi Today

On this day in 1966, Milton Olive III awarded Medal of Honor

April 21, 1966

Milton Olive III became the first Black soldier awarded the Congressional Medal of Honor in the Vietnam War.

Olive had known tragedy in his life, his mother dying when he was only four hours old. He spent his early youth on Chicago’s South Side and then moved to Lexington, Mississippi, where he stayed with his grandparents.

In 1964, he attended one of the Mississippi Freedom Schools, and he joined the work in Freedom Summer, registering Black voters. Concerned that he might be killed, his grandmother sent him back to Chicago, where he joined the military on his 18th birthday.

“You said I was crazy for joining up,” he wrote. “Well, I’ve gone you one better. I’m now an official U.S. Army Paratrooper.”

He joined the U.S. Army’s 173rd Airborne Brigade and became known as “Preacher” for his quiet demeanor and his tendency to avoid cursing. On Oct. 22, 1965, helicopters dropped Olive and the 3rd Platoon of Company B into a dense jungle near Saigon. They returned fire on the Viet Cong, who retreated. As the soldiers pursued the enemy, a grenade was thrown into the middle of them. Olive grabbed the grenade and fell on it, absorbing the blast with his body.

“It was the most incredible display of selfless bravery I ever witnessed,” the platoon commander said.

Olive saved his fellow soldier’s lives. Then-President Lyndon B. Johnson presented the medal to his father and stepmother, and he has since been honored with a park and a junior college named for him.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.![]()

Mississippi Today

Podcast: Mississippi Democratic legislative leader says GOP bickering prevents work on transformative issues

Mississippi House Minority Leader Robert Johnson discusses the 2025 legislative session that was derailed by Republican infighting with Mississippi Today’s Geoff Pender and Bobby Harrison, and outlines issues he’d like to see addressed in a pending special session.

READ MORE: As lawmakers look to cut taxes, Mississippi mayors and county leaders outline infrastructure needs

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

Mississippi Today

‘Trainwreck on the horizon’: The costly pains of Mississippi’s small water and sewer systems

This is the first of a two-part story.

“This state ain’t nothing but a big Jackson,” Central District Public Service Commissioner De’Keither Stamps said during a December meeting that harkened back to his time as a capital city councilman. “We got a whole statewide trainwreck that’s on the horizon.”

Over a thousand drinking water systems, most of them small, and hundreds of additional sewer systems operate in Mississippi. Nearly 60 percent of those water systems, according to the Environmental Protection Agency, have committed a violation in the last three years, and one in three sewer systems in the state have violated pollution limits in just the last year.

In 2014, a couple in DeSoto County, the wealthiest part of the state, sent a letter with photos of their yard to the Mississippi Department of Environmental Quality. Tarnishing their garden were small clumps of feces and wads of wet toilet paper stuck together.

“When having company with children playing in our backyard last summer, suddenly, water and sewage began rushing out of the back flow valve, into the flower bed, across our yard and into the backyard where the children were playing,” the Olive Branch couple wrote. “Everyone had to come inside due to the sewage rushing in our yard…This went on for several hours.”

The culprit, MDEQ later identified, was the malfunctioning collection system at the Belmor Lakes Subdivision sewage treatment facility, which serves about 200 people. The couple continued sending complaints the next four years, while the state sent repeated notices of violation to the plant’s operator. The facility allowed sewage overflows from at least 2011 to 2020, records show, and it remains out of compliance to this day.

Another facility, at the Openwood Plantation in Vicksburg, exceeded fecal coliform limits as early as 2004. A 2011 inspection noted the plant’s effluent structure “has been leaking for at least two years, still not repaired.” The next year, a neighbor complained to MDEQ about a funky smelling green liquid on their property. The agency found not only was the treatment plant responsible, but it also leaked raw sewage that flowed into a local recreational lake. Over two decades after the initial violation, the facility still regularly exceeds, by significant degrees, water pollution limits for chemicals such as E.coli, chlorine and ammonia nitrogen.

Small water and sewer systems around Mississippi have for years struggled to stay afloat because of, to some degree, the nature of being a small water or sewer system. Now, as they try to correct deficiencies during a time of growing regulations and higher costs, many cash-strapped systems are facing the hard reality of needing to raise rates for necessary services in the country’s second poorest state.

“System officials think that part of the job is to hold rates at a low level, and that doesn’t necessarily jive with what the need is,” said Bill Moody, director of the Bureau of Water Supply at the Mississippi State Department of Health.

Moody spoke anecdotally of system owners who bragged about keeping rates low, unaware of the revenue shortfall they would soon have.

A 2023 EPA report on funding needs for drinking water systems found that, over the next 20 years, Mississippi will have an $8.1 billion need. That equals $2,751 per Mississippian, the fourth largest per capita need of any state. Small systems in the state had a per capita need 26% higher than that, the report’s data shows, equalling $3,456 per person.

The United States, and especially Mississippi, suffers from what industry wonks call “fragmentation.” Compared to other countries, the U.S. has a spread out population, meaning its utilities are spread out, too. But by having so many water and sewer systems serving small pockets of people, scant infrastructure funding is spread to the point it loses spending power.

“ The problems the city of Jackson has had, for instance, is replayed over and over and over again in these smaller systems,” said MDEQ executive director Chris Wells. “ What you have is these small systems that, for one reason or other, aren’t properly functioning.”

For instance, Wells explained, a developer with no utility experience might build and operate a sewage lagoon to serve a subdivision. Sometimes the developer moves or dies and passes the reins onto the homeowners association.

“We’ve had situations where the person who built the lagoon or the treatment system literally disappears, abandons the system,” Wells said.

While consolidating small systems would help, experts say, some are so far behind that their customers’ bills will go up regardless.

!function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}();

“It gets a little depressing, I don’t know what the answer is,” Greg Pierce, a water policy expert at the University of California, Los Angeles said. “Usually these systems are under-maintained. They have low rates, but they also have low quality and low reliability.”

Each year, the Health Department takes the temperature of the state’s drinking water systems. In the last two years, the agency found 83 providers that were in “poor” condition. While the median population for a water system in Mississippi is around 1,400 people, that number drops to 422 for the “poor” performing systems, about 80% of which serve under a 1,000 people.

In the small town of Utica, for instance, the Reedtown Water Association has frequent power outages and boil water notices. Stamps, the Public Service commissioner for the area, said necessary repairs would cost $4 million to $5 million, “an amount far beyond what the water association and its (1,200) customers can afford.”

One water association with just 829 customers – Cascillia, in Tallahatchie County – had 83 violations in just the last 5 years, including exceeding arsenic limits in 2023. Several other small water systems (such as the Moore Bayou Water Association in Coahoma County, or Truelight Redevelopment in Sharkey County) are considered “serious violators” by the EPA for, in part, not meeting limits on disinfectant byproducts that were set in 2006. Of the state’s 19 “serious violators,” more than half serve 1,200 or fewer people. The EPA defines a small water system as serving 3,300 people or fewer.

Smaller systems struggle nationwide. A 2018 study from researchers at the University of California, Irvine and Columbia University found that systems in rural areas around the country see “substantially” more violations than those in urban areas.

Wells, of MDEQ – which oversees sewer compliance – said it’s a challenge motivating struggling systems to meet permit limits. The state can technically take over a system, but MDEQ doesn’t have the resources to do so, and levying large fines can be counterproductive because ratepayers ultimately have to make up the difference.

“Every dollar that we take in penalties is one less dollar that the community has to spend toward the upgrades that they need to make,” he said.

Wells described that, for some repeat offenders, sending them violation notices is like “trying to get blood out of a turnip.” While MDEQ works with systems to correct deficiencies, he said, sometimes the best answer is a third-party utility coming in to save the day.

The American Society of Civil Engineers’ 2024 “Infrastructure Report Card” estimated that Mississippi, between all its water and sewer systems, needed $9.4 billion in investments over the next 20 years.

“The capacity of drinking water systems in the state is mediocre,” the report says, adding that “wet weather conditions, inconsistent maintenance, and a lack of rehabilitation pose extreme threats to the state’s wastewater infrastructure.”

Between the historic amounts of federal funding from the American Rescue Plan Act and the Infrastructure Investment and Jobs Act, Mississippi received roughly $1.2 billion for water and wastewater improvements, or just 13% of the state’s projected need.

Especially with large expenses looming to meet the new national standards for PFAs, some small systems are looking to consolidate to ease financial headaches. The Oxford Eagle reported last year, for instance, that the Punkin Water Association would soon join the city of Oxford’s service area after years of water quality issues.

But given the spacial challenges of connecting far apart systems – especially in Mississippi, which, according to Census data, has the fourth most rural population of any state – some say there are limits to how much water providers can actually unify.

“When it comes to the physical pipes in the ground, you can’t move them,” said Mildred Warner, a professor of city and regional planning at Cornell University, explaining that many systems can only consolidate in terms of management.

Mississippi is experimenting with consolidating management for some of its small, privately owned water and sewer systems. In 2021, a company called Great River began buying struggling systems around the state. A subsidiary of the national firm Central States Water Resources, the company focuses on struggling, poorly financed systems that most large utility firms wouldn’t touch. Now operating in 11 states, the company has access to more resources than what a small operator would, and can reduce overall costs by spreading them out throughout its service area.

In Mississippi, part of the PSC’s job is to make sure private utilities that have a monopoly over a given service area, like Great River, only charge customers for what their services are worth, plus enough profit to stay in business. Given the challenges of some small systems in the state, the PSC welcomed the company’s help. But Great River, as is common when a large private utility takes over, quickly imposed steep rate increases to fund its repairs.

As Great River’s ratepayers plead with the PSC to soften the financial blow, the condition of some Mississippi water and sewer providers suggest those basic services will have to cost much more than they used to, especially for customers of small systems.

Part two of this story will further explore the Great River’s impact on ratepayers, and what the future holds for small water and sewer systems struggling to stay afloat.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.![]()

-

News from the South - Alabama News Feed7 days ago

News from the South - Alabama News Feed7 days agoFoley man wins Race to the Finish as Kyle Larson gets first win of 2025 Xfinity Series at Bristol

-

News from the South - Alabama News Feed7 days ago

News from the South - Alabama News Feed7 days agoFederal appeals court upholds ruling against Alabama panhandling laws

-

News from the South - Missouri News Feed4 days ago

News from the South - Missouri News Feed4 days agoDrivers brace for upcoming I-70 construction, slowdowns

-

News from the South - North Carolina News Feed6 days ago

News from the South - North Carolina News Feed6 days agoFDA warns about fake Ozempic, how to spot it

-

Mississippi Today4 days ago

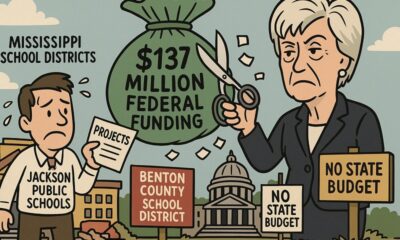

Mississippi Today4 days agoSee how much your Mississippi school district stands to lose in Trump’s federal funding freeze

-

News from the South - Virginia News Feed5 days ago

News from the South - Virginia News Feed5 days agoLieutenant governor race heats up with early fundraising surge | Virginia

-

News from the South - Missouri News Feed6 days ago

News from the South - Missouri News Feed6 days agoAbandoned property causing issues in Pine Lawn, neighbor demands action

-

News from the South - West Virginia News Feed7 days ago

News from the South - West Virginia News Feed7 days agoHeart disease survivor spends 15th birthday raising money for American Heart Association