News from the South - Georgia News Feed

Bill to ban unscrupulous parking lot sales of pets in Georgia now up to governor

Bill to ban unscrupulous parking lot sales of pets in Georgia now up to governor

by Jill Nolin, Georgia Recorder

March 21, 2025

A bill designed to make it harder for unscrupulous breeders to entice animal lovers into an impulse purchase is now on the governor’s desk.

The measure, House Bill 331, would ban the practice of selling dogs, cats and rabbits in parking lots, along the roadside, on sidewalks, at seasonal flea markets and other similar outdoor areas that tend to be hotspots for unlicensed breeders who prioritize profit over the wellbeing of the animals in their care.

The Senate sponsor, Grovetown Republican Sen. Lee Anderson, said the bill targets “bad actors” in Georgia.

“We need this bill so we can make sure all our pets are taken care of, and also it protects the companies that already do it the right way,” Anderson said, referring to breeders.

Supporters of the bill say it will reduce opportunities for illicit pet sales, which they argue is commonly tied with other illegal activity.

The original sponsor, Concord Republican Rep. Beth Camp, pitched the measure as both a consumer and animal protection bill, since animals purchased from illegitimate breeders often turn out not to be as advertised.

“These dogs oftentimes end up getting dumped, and they get dumped at animal shelters, which cost our counties money every single day. And it’s just heartbreaking,” Camp said recently to state senators.

Breeders would still be able to sell dogs, cats and rabbits from their home, business, a veterinarian’s office or other designated locations, like outside a police department.

“These individuals do not allow people to come to where these dogs live because they don’t want anyone to see where these animals live, because they’re living in deplorable, substandard conditions for anything that’s alive,” Camp said.

If approved, someone who violates the measure would be fined $100 for the first offense, $250 for the second and $500 for the third or subsequent offense. Each animal sold in violation of the measure would represent a separate offense, including if multiple animals were sold on the same day.

In January, the state Department of Agriculture seized 136 dogs from a puppy mill in south Georgia.

The bill may be serious, but it also brought a little levity to the day.

Anderson rested his case Friday by saying a vote for his bill would help keep Lt. Gov. Burt Jones out of the “doghouse.” Jones’ wife runs an animal rescue organization.

YOU MAKE OUR WORK POSSIBLE.

Georgia Recorder is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Georgia Recorder maintains editorial independence. Contact Editor John McCosh for questions: info@georgiarecorder.com.

The post Bill to ban unscrupulous parking lot sales of pets in Georgia now up to governor appeared first on georgiarecorder.com

News from the South - Georgia News Feed

Savannah State University police talk campus safety

SUMMARY: Savannah State University’s Police Chief Clarella Thomas, in her role for over a year, emphasizes enhancing campus safety protocols in light of recent school shootings. As a mother of college students, she understands parents’ concerns about safety. Encouraging the phrase “see something, say something,” she highlights community involvement in safety measures. Thomas’s team is upgrading emergency plans and promoting the emergency notification system, Everbridge. This summer, they’ll collaborate with external law enforcement for drills. Chief Thomas, alongside SSU’s new president, aims to improve security further, especially with the upcoming Orange Crush festival, restricting campus access to students only.

The post Savannah State University police talk campus safety appeared first on www.wsav.com

News from the South - Georgia News Feed

FSU shooting: Will the suspected gunman’s mother face charges?

SUMMARY: A 20-year-old Florida State University student, Phoenix Ikner, allegedly used a service weapon belonging to his mother, a sheriff’s deputy, to fatally shoot two men and injure six others at the university. Legal experts, including former Judge Elizabeth Scherer, indicated it’s too early to determine if his mother could face charges, depending on her knowledge of her son’s dangers and the weapon’s accessibility. While parents of juvenile shooters have faced charges in the past, the adult status of Ikner complicates potential liability. Investigators are still probing the case, with a motive yet to be disclosed.

The post FSU shooting: Will the suspected gunman's mother face charges? appeared first on www.wsav.com

News from the South - Georgia News Feed

ONLY ON 3: Man convicted of voluntary manslaughter says he deserves new trial

SUMMARY: Preston Oates, convicted of voluntary manslaughter and gun charges in the 2014 killing of Carlos Olivera, is seeking a new trial. Oates claims ineffective counsel, prosecutorial misconduct, and unexamined evidence during his trial. He continues to deny responsibility, arguing bias from law enforcement and improper handling of key evidence. Oates shot Olivera after a confrontation over a vehicle booting incident, with prosecutors stating he was the aggressor. Oates’ appeal was denied by the South Carolina Supreme Court, and his family and Olivera’s family were present at the hearing. The next hearing is scheduled for April 24.

The post ONLY ON 3: Man convicted of voluntary manslaughter says he deserves new trial appeared first on www.wsav.com

-

Mississippi Today6 days ago

Mississippi Today6 days agoLawmakers used to fail passing a budget over policy disagreement. This year, they failed over childish bickering.

-

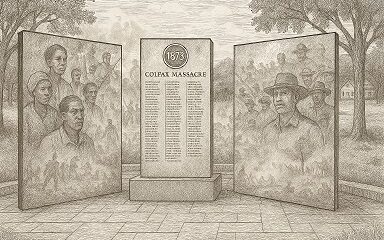

Mississippi Today6 days ago

Mississippi Today6 days agoOn this day in 1873, La. courthouse scene of racial carnage

-

Local News6 days ago

Local News6 days agoSouthern Miss Professor Inducted into U.S. Hydrographer Hall of Fame

-

News from the South - Alabama News Feed5 days ago

News from the South - Alabama News Feed5 days agoFoley man wins Race to the Finish as Kyle Larson gets first win of 2025 Xfinity Series at Bristol

-

News from the South - Alabama News Feed5 days ago

News from the South - Alabama News Feed5 days agoFederal appeals court upholds ruling against Alabama panhandling laws

-

News from the South - Florida News Feed7 days ago

News from the South - Florida News Feed7 days agoSevere weather has come and gone for Central Florida, but the rain went with it

-

News from the South - Alabama News Feed7 days ago

News from the South - Alabama News Feed7 days agoBellingrath Gardens previews its first Chinese Lantern Festival

-

News from the South - Texas News Feed6 days ago

News from the South - Texas News Feed6 days ago1 dead after 7 people shot during large gathering at Crosby gas station, HCSO says