Mississippi Today

Bill to arm school employees raises concerns about liability

Bill to arm school employees raises concerns about liability

Some school districts in Mississippi are worried about the financial and legal ramifications of a bill which would allow them to arm employees as a school safety measure.

Senate Bill 2079 would create a “School Safety Guardian Program,” an optional program that would authorize trained district employees to respond to school shootings. If a district chooses to participate and nominates a school employee (who must have an enhanced concealed carry permit), the employee would participate in a training course from the Department of Public Safety and undergo multiple screenings before being dubbed a “School Guardian.” A House addition to the bill would allow either school employees or outside people to serve in this role, a provision Public Safety Commissioner Sean Tindell said he would prefer removed.

The proposed program, largely borne of concern regarding the rising rate of school shootings nationally, is intended to provide school districts with another way to increase school security. The risks associated with the program, including accidents related to carrying a gun and potential increases in insurance costs will likely prevent most districts from participating, though some districts have already expressed interest.

Marcus Burger of Ross and Yerger, a local insurance agency, said one insurance carrier has already expressed to him it does not plan to cover any liability related to the program. He doesn’t expect to see mainstream insurance carriers offer policies until the program has been around for a few years to give carriers a better understanding of the risks. When Kansas passed a law in 2013 to allow armed teachers (with no special training) on school campuses, the state’s primary liability insurance carrier declined to cover districts with armed employees. Burger added some higher-risk carriers may offer coverage, potentially for a higher premium.

Enhanced concealed carry permit holders are already allowed to bring guns onto school campuses, but, a Mississippi Department of Education official told Mississippi Today in December, after the policy garnered attention last summer, that school districts had concerns about the added liability of more guns on campuses and the impact it would have on their insurance costs.

READ MORE: How is Mississippi responding to the threat of school shootings?

School shootings have been on the rise nationally over the last decade, with 93 incidents in the 2020-2021 school year. Mississippi’s most notable school shooting occurred in 1997 at Pearl High School. More broadly, the Clarion Ledger reported there have been at least 25 incidents involving guns and students in Mississippi over the last 40 years.

Twenty-eight states already allow school staff to be armed in some capacity according to a RAND Corp. report, but fewer have training programs targeting active shooter response.

In Florida, where a “guardian” program was adopted after the 2018 shooting at Stoneman Douglas High School, the state added liability protections to their professional liability policy for teachers who participated in the program. When the protections were added, the Florida Department of Education asked their Legislature for $200,000 to cover the additional cost – it is unclear if they received it.

In Texas, the number of districts participating in their guardian program has risen significantly since 2018, from 303 to 445. A Texas Association of School Boards 2022 report said most districts were only allowing “commissioned peace officers,” a broader term for people with any type of law enforcement experience, as school guardians.

Jim Keith, a school board attorney whose firm represents over 20 districts across Mississippi, said some districts he works with are interested in adopting the guardian program but he does not expect it to be widespread.

Some education officials and school leaders have said school resource officers, or police officers that work in or for schools, would be preferable to the guardian program, but acknowledged this program could fill a gap for some rural or financially stressed districts that lack qualified applicants or can’t afford full-time school resource officers.

Lauderdale County School District Superintendent John-Mark Cain said his district works with the local sheriff’s office to put a school resource officer on every campus, but he knows other districts that do take advantage of state law as it currently stands to arm staff.

“The district sees (school resource officers) as the most opportune situation since we have that great partnership. However, we do understand that certain districts do not have that luxury, and those local boards will have to work with their attorney and their insurance to essentially measure that liability and that risk,” Cain said.

Research on the impacts of school resource officers has not shown them to be effective at preventing shootings and they are linked with increased suspensions and arrests, but have been effective at stopping fights.

Mississippi’s proposed program includes legal protections for the guardians from both civil and criminal liability if they are actively responding to a shooter or other safety threat. The bill specifies guardians can still be sued if they fail to carry out their official duties.

Keith said in his reading of the bill, the civil protections for guardians would also extend to the school district. Keith added he is concerned about what exactly will fall under a guardian’s official duties.

He said it needs to be clear “what those requirements are going to be to enable someone who is a guardian to make sure that they are acting within the course and scope of those duties. Because if they act outside it, then they lose their immunity, which means the school district could possibly lose its immunity.”

Tindell, whose department is overseeing the program, said that he understands this concern but does not expect guardians to have rigidly outlined duties.

“The primary duty is to protect the school from an active shooter and protect the students,” he said. “I think if they’re doing anything outside of that, that would be outside of the scope of their duties.”

Some have also expressed concern about accidents occurring with the guardian’s gun, which Rep. John Hines, D-Greenville, brought up during debate on the House floor. Rep. Nick Bain, R-Corinth, who was presenting the bill, said the school district and teacher would be liable in cases of accidents and the immunity provision in the bill would not apply.

“If a teacher accidentally discharges a firearm because the gun falls out of the holster or there’s a scuffle between students and they try to break it up and a student grabs the teacher’s weapon and somebody else that’s not involved gets shot, what’s the course (sic) of action for that?” Hines told Mississippi Today after the debate.

Hines also expressed concern about the provision of the bill that requires guardians to have their gun on their person at all times, referring to it as “overkill.”

Tindell said this provision is important so that guardians are quickly able to respond if an active shooter situation arises, but that he would also be amenable to amendments allowing for the gun to be locked up at certain times. Tindell also highlighted that the bill requires a school shooting response plan and chain of command to be created and uniformly implemented across the state.

Like Hines,school leaders are worried about the increased risk that comes with more guns on school property. James Waldington, superintendent of the Greenwood-Leflore Consolidated School District, said he worries daily about guns being brought to campus by students, shooters and school resource officers.

“Although I feel the bill is being discussed as another level of protection for our students (and) staff and I sincerely applaud that effort, to add another dimension to the educational environment where a loaded weapon is present is concerning, to say the least,” he said.

The bill has passed both houses of the Legislature with a sizable majority, and currently heads to a conference committee to work out the differences between the two versions. Sen. Angela Hill, R-Picayune, authored the bill and said the differences between the two versions are relatively minor.

It’s likely Gov. Tate Reeves will sign the bill, as he included a version of the program in his legislative budget recommendations from November of last year.

When asked about possible increases in the cost of liability insurance for districts related to this program, Hill said she was not familiar with this concern but that similar programs had been adopted in other states “and they still have liability insurance.”

Hill said she chose to author this bill because the superintendent of her district asked for it.

“Many of these campuses are rural, they’re spread out, the response time to have additional law enforcement is sometimes unacceptable,” she said. “Some school districts feel like they need more qualified people to be able to respond as a part of their security team.”

Ken Barron, superintendent of the Yazoo County School District, said the district has its own police force to provide security, but that he might be interested in adding this program on top.

“I could see this possibly being a benefit with the right parameters in place,” he said.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Mississippi Today

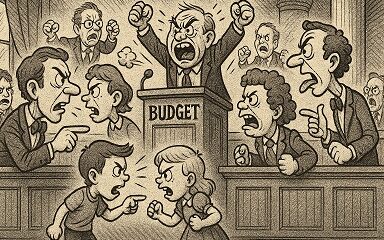

Speaker White wants Christmas tree projects bill included in special legislative session

House Speaker Jason White sent a terse letter to Lt. Gov. Delbert Hosemann on Thursday, saying House leaders are frustrated with Senate leaders refusing to discuss a “Christmas tree” bill spending millions on special projects across the state.

The letter signals the two Republican leaders remain far apart on setting an overall $7 billion state budget. Bickering between the GOP leaders led to a stalemate and lawmakers ending their regular 2025 session without setting a budget. Gov. Tate Reeves plans to call them back into special session before the new budget year starts July 1 to avoid a shutdown, but wants them to have a budget mostly worked out before he does so.

White’s letter to Hosemann, which contains words in all capital letters that are underlined and italicized, said that the House wants to spend cash reserves on projects for state agencies, local communities, universities, colleges, and the Mississippi Department of Transportation.

“We believe the Senate position to NOT fund any local infrastructure projects is unreasonable,” White wrote.

The speaker in his letter noted that he and Hosemann had a meeting with the governor on Tuesday. Reeves, according to the letter, advised the two legislative leaders that if they couldn’t reach an agreement on how to disburse the surplus money, referred to as capital expense money, they should not spend any of it on infrastructure.

A spokesperson for Hosemann said the lieutenant governor has not yet reviewed the letter, and he was out of the office on Thursday working with a state agency.

“He is attending Good Friday services today, and will address any correspondence after the celebration of Easter,” the spokesperson said.

Hosemann has recently said the Legislature should set an austere budget in light of federal spending cuts coming from the Trump administration, and because state lawmakers this year passed a measure to eliminate the state income tax, the source of nearly a third of the state’s operating revenue.

Lawmakers spend capital expense money for multiple purposes, but the bulk of it — typically $200 million to $400 million a year — goes toward local projects, known as the Christmas Tree bill. Lawmakers jockey for a share of the spending for their home districts, in a process that has been called a political spoils system — areas with the most powerful lawmakers often get the largest share, not areas with the most needs. Legislative leaders often use the projects bill as either a carrot or stick to garner votes from rank and file legislators on other issues.

A Mississippi Today investigation last year revealed House Ways and Means Chairman Trey Lamar, a Republican from Sentobia, has steered tens of millions of dollars in Christmas tree spending to his district, including money to rebuild a road that runs by his north Mississippi home, renovate a nearby private country club golf course and to rebuild a tiny cul-de-sac that runs by a home he has in Jackson.

There is little oversight on how these funds are spent, and there is no requirement that lawmakers disburse the money in an equal manner or based on communities’ needs.

In the past, lawmakers borrowed money for Christmas tree bills. But state coffers have been full in recent years largely from federal pandemic aid spending, so the state has been spending its excess cash. White in his letter said the state has “ample funds” for a special projects bill.

“We, in the House, would like to sit down and have an agreement with our Senate counterparts on state agency Capital Expenditure spending AND local projects spending,” White wrote. “It is extremely important to our agencies and local governments. The ball is in your court, and the House awaits your response.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

Mississippi Today

Advocate: Election is the chance for Jackson to finally launch in the spirit of Blue Origin

Editor’s note: This essay is part of Mississippi Today Ideas, a platform for thoughtful Mississippians to share fact-based ideas about our state’s past, present and future. You can read more about the section here.

As the world recently watched the successful return of Blue Origin’s historic all-women crew from space, Jackson stands grounded. The city is still grappling with problems that no rocket can solve.

But the spirit of that mission — unity, courage and collective effort — can be applied right here in our capital city. Instead of launching away, it is time to launch together toward a more just, functioning and thriving Jackson.

The upcoming mayoral runoff election on April 22 provides such an opportunity, not just for a new administration, but for a new mindset. This isn’t about endorsements. It’s about engagement.

It’s a moment for the people of Jackson and Hinds County to take a long, honest look at ourselves and ask if we have shown up for our city and worked with elected officials, instead of remaining at odds with them.

It is time to vote again — this time with deeper understanding and shared responsibility. Jackson is in crisis — and crisis won’t wait.

According to the U.S. Census projections, Jackson is the fastest-shrinking city in the United States, losing nearly 4,000 residents in a single year. That kind of loss isn’t just about numbers. It’s about hope, resources, and people’s decision to give up rather than dig in.

Add to that the long-standing issues: a crippled water system, public safety concerns, economic decline and a sense of division that often pits neighbor against neighbor, party against party and race against race.

Mayor Chokwe Antar Lumumba has led through these storms, facing criticism for his handling of the water crisis, staffing issues and infrastructure delays. But did officials from the city, the county and the state truly collaborate with him or did they stand at a distance, waiting to assign blame?

On the flip side, his runoff opponent, state Sen. John Horhn, who has served for more than three decades, is now seeking to lead the very city he has represented from the Capitol. Voters should examine his legislative record and ask whether he used his influence to help stabilize the administration or only to position himself for this moment.

Blaming politicians is easy. Building cities is hard. And yet that is exactly what’s needed. Jackson’s future will not be secured by a mayor alone. It will take so many of Jackson’s residents — voters, business owners, faith leaders, students, retirees, parents and young people — to move this city forward. That’s the liftoff we need.

It is time to imagine Jackson as a capital city where clean, safe drinking water flows to every home — not just after lawsuits or emergencies, but through proactive maintenance and funding from city, state and federal partnerships. The involvement of the U.S. Environmental Protection Agency in the effort to improve the water system gives the city leverage.

Public safety must be a guarantee and includes prevention, not just response, with funding for community-based violence interruption programs, trauma services, youth job programs and reentry support. Other cities have done this and it’s working.

Education and workforce development are real priorities, preparing young people not just for diplomas but for meaningful careers. That means investing in public schools and in partnerships with HBCUs, trade programs and businesses rooted right here.

Additionally, city services — from trash collection to pothole repair — must be reliable, transparent and equitable, regardless of zip code or income. Seamless governance is possible when everyone is at the table.

Yes, democracy works because people show up. Not just to vote once, but to attend city council meetings, serve on boards, hold leaders accountable and help shape decisions about where resources go.

This election isn’t just about who gets the title of mayor. It’s about whether Jackson gets another chance at becoming the capital city Mississippi deserves — a place that leads by example and doesn’t lag behind.

The successful Blue Origin mission didn’t happen by chance. It took coordinated effort, diverse expertise and belief in what was possible. The same is true for this city.

We are not launching into space. But we can launch a new era marked by cooperation over conflict, and by sustained civic action over short-term outrage.

On April 22, go vote. Vote not just for a person, but for a path forward because Jackson deserves liftoff. It starts with us.

Pauline Rogers is a longtime advocate for criminal justice reform and the founder of the RECH Foundation, an organization dedicated to supporting formerly incarcerated individuals as they reintegrate into society. She is a Transformative Justice Fellow through The OpEd Project Public Voices Fellowship.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.![]()

Mississippi Today

On this day in 1959, students marched for integrated schools

April 18, 1959

About 26,000 students took part in the Youth March for Integrated Schools in Washington, D.C. They heard speeches by Martin Luther King Jr., A. Phillip Randolph and NAACP leader Roy Wilkins.

In advance of the march, false accusations were made that Communists had infiltrated the group. In response, the civil rights leaders put out a statement: “The sponsors of the March have not invited Communists or communist organizations. Nor have they invited members of the Ku Klux Klan or the White Citizens’ Council. We do not want the participation of these groups, nor of individuals or other organizations holding similar views.”

After the march, a delegation of students went to present their demands to President Eisenhower, only to be told by his deputy assistant that “the president is just as anxious as they are to see an America where discrimination does not exist, where equality of opportunity is available to all.”

King praised the students, saying, “In your great movement to organize a march for integrated schools, you have awakened on hundreds of campuses throughout the land a new spirit of social inquiry to the benefit of all Americans.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.![]()

-

Mississippi Today6 days ago

Mississippi Today6 days agoLawmakers used to fail passing a budget over policy disagreement. This year, they failed over childish bickering.

-

Mississippi Today6 days ago

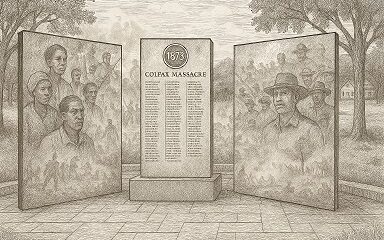

Mississippi Today6 days agoOn this day in 1873, La. courthouse scene of racial carnage

-

Local News7 days ago

Local News7 days agoAG Fitch and Children’s Advocacy Centers of Mississippi Announce Statewide Protocol for Child Abuse Response

-

Local News6 days ago

Local News6 days agoSouthern Miss Professor Inducted into U.S. Hydrographer Hall of Fame

-

News from the South - Alabama News Feed4 days ago

News from the South - Alabama News Feed4 days agoFoley man wins Race to the Finish as Kyle Larson gets first win of 2025 Xfinity Series at Bristol

-

News from the South - North Carolina News Feed7 days ago

News from the South - North Carolina News Feed7 days agoHelene: Renewed focus on health of North Carolina streams | North Carolina

-

News from the South - Alabama News Feed5 days ago

News from the South - Alabama News Feed5 days agoFederal appeals court upholds ruling against Alabama panhandling laws

-

Our Mississippi Home7 days ago

Our Mississippi Home7 days agoFood Chain Drama | Our Mississippi Home