Magnolia Tribune

Biden’s math of just taxing the rich doesn’t add up

There is simply not enough income at the top of the distribution to cover federal deficits.

Despite the headlines, the President’s 2024 Budget demonstrates how challenging it is to raise significant new tax revenue from a small minority of wealthy taxpayers. The budget raises about $1.8 trillion from non‐corporate taxpayers over ten years. Yet, following all the rhetoric about the rich not paying their fair share, it should be striking that across more than twenty new and expanded taxes, the administration’s plan does not even raise enough revenue from wealthy taxpayers to cover new spending proposed in Biden’s budget, let alone the projected $20 trillion deficit over the next ten years.

So, what’s going on? By promising the American people he would only raise taxes on people earning over $400,000, President Biden has made his budget math next to impossible. There is simply not enough income at the top of the distribution to cover the projected federal budget deficit, let alone a significant expansion in federal spending over the next decade.

What’s left to tax?

Using IRS data, we can illustrate the difficulty of raising a lot more revenue from a narrow segment of the population.

In 2020, the IRS reported that there were 164 million individual tax returns filed, with $12.6 trillion in Adjusted Gross Income (AGI). AGI includes wages, capital gains, and personal business income, in addition to other forms of income and adjustments for things like student loan interest and retirement contributions. This IRS data can show an upper bound on how much revenue could be extracted from the highest‐income taxpayers.

The IRS reports statistics by different income groups, separating taxpayers into buckets with AGIs of $200,000, $500,000, $1 million, and $10 million, among others. Table 1 shows four income groups and information from 2020 on how much total income was earned and taxes paid by each group.

For example, $2.9 trillion in total AGI was reported by taxpayers earning over $500,000, and they paid a total of $722 billion in federal income taxes, leaving them with about $2.2 trillion after‐tax income. There were 1.8 million tax returns above $500,000 or about one percent of all returns.

In the most extreme case of the federal government taxing all income over $500,000 at a 100 percent tax rate—confiscating every dollar earned past this point—not all of the $2.2 trillion is available to tax. The graduated income tax system is such that raising the top tax rate only increases taxes on the income in that tax bracket and above. Essentially, everyone’s income below the maximum rate is taxed the same. If Congress wants to raise taxes only on people earning over $500,000, the system of progressive rates effectively exempts the first $500,000 earned from additional taxes.

The IRS data show that for the $500,000 and above group, there is $2 trillion in taxable income above the $500,000 threshold. These high‐income taxpayers pay an average income tax rate of 25 percent, so they already paid roughly $500 billion in taxes on their above‐threshold income. Thus, only about $1.5 trillion remains after taxes (and is available for additional taxes), across all taxpayers earning more than $500,000.

If Congress confiscated every dollar earned by individuals and businesses past their first $500,000, it would still be about $200 billion short of covering the cost of next year’s projected $1.7 trillion deficit—unrealistically assuming no behavioral or other economic effects from taxing 100 percent of earnings.

Table 1 shows how the math of taxing the rich gets even more challenging the more income Congress exempts, showing figures for only raising taxes on people earning over $1 million or $10 million. Lowering the income threshold to $200,000 can expand income available for Congress to tax, but it is still not a realistic way to raise significant additional revenue. Common sense and economic incentives tell us that Congress cannot raise income tax rates anywhere close to 100 percent and still bring in any new revenue. Therefore, even a substantial fraction of the available income earned above $200,000 would not cover currently projected deficits.

Where’s the rest of the money going to come from?

Political rhetoric about raising taxes on the rich primarily serves as a distraction from the United States’ fiscal reality. If spending is not constrained, large and growing deficits will remain even after taxes are raised on corporations and the wealthy. The only way to significantly increase revenue is by raising taxes on a broader swath of middle‐income Americans.

Talking points like those President Biden routinely uses about the rich not paying their fair share in taxes have historically provided political cover to raise taxes on other segments of the population. Tax historian Joseph Thorndike explains how high marginal income tax rates in the New Deal era were used “to help justify regressive consumption taxes on alcohol and tobacco, which supplied anywhere from a third to half of federal revenue during the early 1930s.” Again, in the 1940s, Thorndike explains that high marginal tax rates of 90 plus percent (even though few people paid these rates) were used to provide political cover for a “dramatic downward expansion of the income tax.” Narrow taxes on the rich are leveraged into mass taxes on everyone.

As I’ve written elsewhere, every other large modern welfare state funds its higher levels of government spending with high taxes on a broad swath of the population. This is not because politicians in those countries do not want to tax the rich; it is because there is not enough money at the top of the income distribution to fund their desired spending levels.

It is often reported as irresponsible or implausible to suggest reducing federal spending as the key mechanism to stabilize the budget. However, it is accepted at face value that we can raise more than $2 trillion in additional annual revenue from the highest‐income one percent of American taxpayers. “Tax the rich” is not a serious budget proposal, and it should be treated as irresponsible and implausible.

This column first appeared in the Cato Institute.

The post Biden’s math of just taxing the rich doesn’t add up appeared first on Magnolia Tribune.

…

By: Adam Michel

Title: Biden’s math of just taxing the rich doesn’t add up

Sourced From: magnoliatribune.com/2023/03/24/bidens-math-of-just-taxing-the-rich-doesnt-add-up/?utm_source=rss&utm_medium=rss&utm_campaign=bidens-math-of-just-taxing-the-rich-doesnt-add-up

Published Date: Fri, 24 Mar 2023 12:00:14 +0000

Magnolia Tribune

Staring mortality in the face at Christmas

My friend Jarrod is dying after an eight year battle with cancer. He’s lived a life worth celebrating, one that has drawn people to Christ.

I was going about my business this week when I received a text that stopped me in my tracks. A college friend was being moved to hospice care.

Jarrod Egley was diagnosed with colorectal cancer in early 2017. In the fall of 2018, tests revealed the cancer had spread to his lungs and Jarrod’s cancer was classified as Stage IV.

For almost eight years from the date of the original diagnosis, he’s fought. Through surgeries, radiation, endless rounds and cycles of chemotherapy, and experimental immunotherapies, he’s fought.

Last year, I flew out to California and spent some time with Jarrod and his wife, Emily. We sat outside one night. He acknowledged to me that it was not a question of ‘if’, but ‘when’ the cancer would claim his life. I told him I was sorry, because what else is there to say?

We talked about our faith, about the trials of Job, about Jacob wrestling with God, about Paul’s affliction. But mostly we reflected on our time together in school, on the good things, and the mundane things, that happened since.

Jarrod and I met at Tulane University. One Sunday morning in the Spring of my freshman year, I rose from my dorm room bed, dressed, and began walking down Saint Charles Avenue in New Orleans with no particular agenda. I walked until I came across First Baptist Church and the thought flickered in the vacuous recesses of my brain to enter.

Some would say it was a lark. The Calvinist in me says providence. The walk that morning changed the trajectory of my time at Tulane and my life on the whole. Intervarsity Christian Fellowship and the Baptist Collegiate Ministry became central to my life and put me in regular league with Jarrod. I met him first at the BCM and we ultimately ended up attending church together.

Jarrod was a faithful servant on and off campus. He helped organize a group of us that would weekly make our way down to the Esplanade seawall on the backside of the French Quarter to feed the homeless. On Friday nights, he could be found at chapel with a small cadre of students foregoing Bourbon Street for early 2000s worship music.

Jarrod was a loyal friend in those years. Never rude or biting. Not prone to an insult for an easy laugh. Persistently encouraging. An engineering student, his mind worked linearly and was oriented to problem solving. There were never a lot of wasted words — always a lot of deliberative questions when he disagreed or did not understand a point. He exhibited intelligence, empathy, and the kind of moral conviction that sets someone apart.

He also had a wry and dry sense of humor and a penchant for beating people at Madden football. He was fair-to-midland on the ultimate frisbee pitch. Along the way, there were crawfish boils, Mardi Gras outtings, poorly attended Tulane football games, and more than a decent amount of wing eating.

After college, I lost touch with Jarrod. He moved back to his home state of California. He got married to his college sweetheart, who could not have anticipated her husband’s journey, but has been a steady and constant helpmate throughout. Jarrod became a very successful engineer and a bourbon connoisseur. One of his bucket list trips took him to Kentucky, where he got to meet and became friends with bourbon “Hall of Famer” Freddie Johnson of Buffalo Trace acclaim.

Sitting in his backyard nearly 20 years after graduating from Tulane, I saw many of the same qualities I had grown to admire when we were students together. I saw a husband who doted on and supported Emily’s passions. But I also saw someone whose body had been beaten to hell and back, who was tired, and who, like Jacob, had been wrestling with God. We quickly fell back into friendship, which perhaps is the mark of good friendship.

We all have aspirations in our youth — for the kind of spouse or parent we might be, for what we might accomplish, for what we might experience. Along the way, dreams are satisfied, modified, or they die on the vine. The clock inevitably works against all of us. That night in Oceanside, California, Jarrod, a numbers guy, saw that time was not on his side. He believed, as we all would, that he still had more to give, more impact to be made, and more things to see and experience.

After that trip, Jarrod and I stayed in touch, most frequently triggered by news of his cancer. It has been mostly the bad variety in recent months. Now spread throughout his body, down to his bones, he has lived in constant pain for months. Not even a steady diet of morphine and an implanted pain pump solve for it. Jarrod’s been hospitalized twelve times just in 2023.

But his matter of fact sense of humor and way of seeing the world remains in tact. So too does his faith that despite these trials, he has always been safe in the hands of Christ.

There are people in the world who believe that life is random, disordered, and without reason. I am not among them. I think my friend is staring mortality in the face at Christmas for a reason.

For thousands of years before Christ came, there was darkness and despair. Sin and shame gripped the hearts of men. Until one holy night, God, in His infinite love, mercy and wisdom, sent His son to save. Jesus is the light of the world and the hope of man. He has won victory over death and Jarrod’s will not be the exception. Jesus came for Jarrod, and for you.

For thousands of years since Jesus’s death, burial, and resurrection, His disciples have been used as divine instruments to point the way to God. Jarrod is among them. If life expectancies were the measure, Jarrod would be at the midway point for most people. He’s made a lifetime of impact for the Kingdom and on other people.

So, to my friend Jarrod, you were placed here with a purpose. You have run your race. You are loved. And when this chapter closes, you will hear “well done, my good and faithful servant.” There is no greater evidence of a life well lived.

While Jarrod and Emily have been fortunate to have health insurance, their portion of the medical bills so far in 2023 have eclipsed $30,000, and Emily is facing additional uncovered expenses during Jarrod’s hospice care, including a night nurse that costs over $400 a night. If you would like to help defray the cost, a contribution can be made at their Go Fund Me page.

The post Staring mortality in the face at Christmas appeared first on Magnolia Tribune.

…

By: Russ Latino

Title: Staring mortality in the face at Christmas

Sourced From: magnoliatribune.com/2023/12/16/staring-mortality-in-the-face-at-christmas/?utm_source=rss&utm_medium=rss&utm_campaign=staring-mortality-in-the-face-at-christmas

Published Date: Sat, 16 Dec 2023 15:05:22 +0000

Did you miss our previous article…

https://www.biloxinewsevents.com/magnolia-mornings-december-15-2023/

Magnolia Tribune

Magnolia Mornings: December 15, 2023

Important state and national stories, market and business news, sports and entertainment, delivered in quick-hit fashion to start your day informed.

In Mississippi

1. Laurin St. Pe’ named CEO of Singing River Health System

The Board of Trustees of Singing River Health System announced the immediate appointment of Laurin St. Pe’ as the Chief Executive Officer on Thursday.

“We are thrilled to announce Laurin St. Pe as the new CEO of Singing River,” said Steve Ates, Board President in a statement. “His wealth of healthcare experience and proven track record make him the ideal leader to steer our health system toward its next phase of growth and success.”

St. Pe’, who has been serving as Interim CEO since July 2023, said he is honored to assume the role of CEO at Singing River. He has worked at Singing River as Administrator of Singing River Health System’s Pascagoula Hospital and Gulfport Hospital, in addition to overseeing program service lines throughout the entire system to his subsequent appointment as Chief Operating Officer of Singing River.

The health system says St. Pe played a crucial role in the financial revitalization of Singing River Health System while steering the organization toward financial stability.

2. Gulfport-Biloxi airport, Stennis evacuated after threats

The Gulfport-Biloxi International Airport was evacuated on Thursday morning “out of an abundance of caution,” airport officials said, after receiving an emailed threat to certain transportation entities across the state.

The airport was thoroughly security swept, cleared and reopened in just over two hours. Gulfport-Biloxi is now operating regularly.

The threat was also sent to Stennis International Airport. Their staff and personnel were also evacuated until the facilities could be swept and cleared.

Any passenger whose travel was affected by the evacuation is encouraged to contact their respective air carrier.

3. Cassidy arrested in Iowa for beheading Satanic Temple statue

Former Mississippi congressional and legislative candidate Michael Cassidy was arrested this week in Iowa for beheading a statue at the state’s Capitol erected by The Satanic Temple.

Cassidy reportedly decapitated the statue and turned himself to police on Thursday. He was charged with fourth degree criminal mischief. He then started an online legal defense fund where he’s raised upwards of $20,000 as of Thursday night, according to his X account.

4. “Serial fraudster” ordered to cease offering investments into companies

According to the Mississippi Secretary of State’s office, on October 26, 2023, Secretary Michael Watson and the Securities Division issued an order against Stephone N. Patton. The SOS says Patton is a serial fraudster with multiple criminal convictions in Mississippi and Florida.

Through business filings with the SEC and Mississippi, Patton has held himself to be the CEO of various companies, including Star Oil and Gas Company, Inc., North Gulf Energy Corporation, Inc., Patton Oilfield Services, Inc., and Patton Farms, LLC.

The SOS says using these business filings and company websites, Patton claimed to have raised hundreds of billions of dollars through investment opportunities. Through investigative efforts and collaboration with the SEC, the SOS discovered none of Patton’s companies are operational, have any assets, or generate any revenues. Account records show Patton spent investors’ funds almost as soon as he received them on personal expenses. The total amount of known investments made to Patton’s fraudulent companies is over $80,000. Further, none of Patton’s investment offerings have been registered or notice filed with the Mississippi Secretary of State’s Office.

The SOS order requires Patton to cease and desist from offering investments with his companies, requiring Patton to permanently deactivate his companies’ websites to prevent any further dissemination of his false or misleading information. Patton is also ordered to pay an administrative penalty of $25,000 to the Mississippi Secretary of State’s Office for these violations, in addition to restitution owed to all his Mississippi investors.

National News & Foreign Policy

1. Congressional retirements mounting as 2024 election cycle nears

Retirement and departure announcements are piling up ahead of the start to the 2024 election cycle. The New York Times has developed a Retirement Tracker that currently shows 22 Democrats and 11 Republicans who are in Congress now will not be seeking re-election next year.

“Dozens of members of Congress have announced plans to leave their seats in the House of Representatives, setting a rapid pace for congressional departures, with more expected as the 2024 election draws closer,” the NY Times reports. “Given Republicans’ razor-thin House majority, the wave of exits has the potential to lead to a significant shake-up next year.”

You can find the tracker here.

2. Texas, Daily Wire, The Federalist sue U.S. State Department over media censorship

The U.S. State Department’s Global Engagement Center has come under fire as Texas Attorney General Ken Paxton along with The Daily Wire and The Federalist have filed a federal lawsuit alleging that the department funded technology that could “render disfavored press outlets unprofitable.” They claim that the department has helped social media – Facebook, YouTube and X (formerly Twitter) – to censor free speech while funding technologies used to censor right-leaning news outlets such as theirs.

New Civil Liberties Alliance is representing The Daily Wire and The Federalist. Paxton and the outlets claim the Global Disinformation Index (GDI), a British think tank, received a $100,000 grant from the State Department in 2021, and NewsGuard, which rates the “misinformation” levels of news outlets, received $25,000 from the State Department in 2020, according to the lawsuit.

According to the State Department’s website, the Global Engagement Center’s mission is to direct, lead, synchronize, integrate, and coordinate U.S. Federal Government efforts to recognize, understand, expose, and counter foreign state and non-state propaganda and disinformation efforts aimed at undermining or influencing the policies, security, or stability of the United States, its allies, and partner nations.

As reported by Reuters, the lawsuit cited a GDI-produced list from December 2022 that ranked The Daily Wire and The Federalist as among the 10 “riskiest sites” for news while the least-risky included The New York Times, Associated Press and NPR. Reuters notes that the lawsuit alleges such “blacklists” are reducing revenues to The Daily Wire and The Federalist along with their visibility on social media and ranking results from browser searches.

Sports & Entertainment

1. SEC releases 2024 schedules

Wednesday evening, the Southeastern Conference released the 2024 football schedules for its member schools, including of interest in the Magnolia State the schedules for Ole Miss and Mississippi State.

It is the first schedule that includes new conference members University of Oklahoma and University of Texas, bringing the conference to 16 schools. Each SEC team will play eight conference football games plus at least one required opponent from the ACC, Big Ten, Big 12, Pac 12 or major independent, each team will have two open dates.

The 2024 season will be the first year the SEC will play a schedule without divisional competition since 1991. The top two teams in the league standings based on winning percentage will play in the 33rd SEC Football Championship Game in Mercedes-Benz Stadium in Atlanta on Saturday, December 7.

2. White, Jesiolowski, Jones honored by MAIS

The Midsouth Association of Independent Schools (MAIS) in Mississippi, comprised of non-public schools, announced this week that Madison-Ridgeland Academy’s senior quarterback John White was named the 6A Player of the Year while Hartfield’s Reed Jesiolowski and Hartfield Chris Jones were named the MAIS 6A Offensive and Defensive Players of the Year, respectively.

All three have committed to play college football at the University of Mississippi.

White is Mississippi’s all-time leader in career passing yards with 15,259 yards, a record he broke during the 2023 season.

MAIS, like the Mississippi High School Activities Association (MHSAA) for public schools, is broken down into classifications, from 1A to 6A. However, MHSAA added a 7A this season.

Markets & Business

1. Consumer retail sales up as energy, gas prices move down

The U.S. Bureau of Labor Statistics reported this week that the Consumer Price Index rose 0.1% in November after being unchanged in October. Retail sales rose 0.3% in November after rising 0.2% in October, meaning consumers continue to spend at the start of the holiday season.

The CPI or inflation rate is 3.1%, higher than the Federal Reserve target of 2% but below the 9% peak in 2022 which reached a 40-year high.

As for the energy index, BLS reported that it fell 2.3% in November after decreasing 2.5% in October. The gasoline index decreased 6% in November, following a 5% decrease in the previous month.

The index for fuel oil fell in November, decreasing 2.7%. However, the natural gas index rose 2.8% over the month after rising 1.2% the previous month. The index for electricity also rose 1.4% in November, after increasing 0.3% in October.

The energy index fell 5.4% over the past 12 months. The gasoline index decreased 8.9%, the natural gas index declined 10.4%, and the fuel oil index fell 24.8% over this 12-month span.

2. Week’s market rally continues into Friday

At close of trading on Thursday, the U.S. markets continued the week’s rally, pushing the Dow up 158 points to 37,248 while the Nasdaq and S&P also made gains, 27 points and 12 points, respectively, to close at 14,761 and 4,719.

The record high for the Dow on Thursday moved futures up 102 points.

According to CNBC, the major averages are headed for their seventh straight positive week. As of Thursday, the Dow is higher on the week by 2.8%. The S&P 500 is up by 2.5%, while the Nasdaq Composite rose 2.5% this week.

Stocks rallied after the Federal Reserve left rates unchanged this week while members look towards cuts in the new year and beyond.

The post Magnolia Mornings: December 15, 2023 appeared first on Magnolia Tribune.

…

By: Magnolia Tribune

Title: Magnolia Mornings: December 15, 2023

Sourced From: magnoliatribune.com/2023/12/15/magnolia-mornings-december-15-2023/?utm_source=rss&utm_medium=rss&utm_campaign=magnolia-mornings-december-15-2023

Published Date: Fri, 15 Dec 2023 13:00:00 +0000

Magnolia Tribune

New water rates expected in Jackson come 2024; those who don’t pay face shut off

Interim Third-Party Director Ted Henifin said this week that only about 59% of the City of Jackson’s water customers are paying their bills.

JXN Water has announced new rates and fees coming in 2024. Those who are not paying will be at risk of shut offs.

The company, which was established by federal appointed interim Third-Party Director Ted Henifin, has been overseeing the city’s water system for the better part of a year.

Officials estimated that the average cost for water in the city was $76 per month for residents. Henifin clarified that JXN water will not attempt to recoup any charges prior to November 29, 2022, and will work with those who have failed to pay since that time.

He said only about 59 percent of the city’s water customers are paying their bills.

“You can’t forgive bills, so we have to be creative in how we part that,” said Henifin in reference to Mississippi’s laws that prevent giving away water.

According to a release by JXN Water announcing the rate changes, residents in single family households with small meters that use up to 748 gallons daily would see a bill increase of roughly .30 cents per day. Research indicates that the average U.S. family uses 300 gallons per day.

SNAP customers will have a new rate tier that could lower their bill by up to .69 cents per day, on average.

“Those who need to save the most benefit from saving money by drinking tap water. This new rate structure makes water affordability possible for 12,500 JXN Water customers who receive SNAP benefits,” said Henifin in the release.

Read more about the anticipated rate changes here.

New fees will also be implemented, including a new service fee of $50, service deposit of $100, returned check fee of $25, service restoration fee of $100, and meter tampering charge of $500.

JXN Water has continued to encourage residents to use the water, with Henifin going on the record in a federal status hearing saying that the water “was safe to drink.”

More conversation regarding the billing process is expected to come at next week’s Jackson City Council meeting.

The post New water rates expected in Jackson come 2024; those who don’t pay face shut off appeared first on Magnolia Tribune.

…

By: Sarah Ulmer

Title: New water rates expected in Jackson come 2024; those who don’t pay face shut off

Sourced From: magnoliatribune.com/2023/12/15/new-water-rates-expected-in-jackson-come-2024-those-who-dont-pay-face-shut-off/?utm_source=rss&utm_medium=rss&utm_campaign=new-water-rates-expected-in-jackson-come-2024-those-who-dont-pay-face-shut-off

Published Date: Fri, 15 Dec 2023 20:00:00 +0000

-

Mississippi Today6 days ago

Mississippi Today6 days agoLawmakers used to fail passing a budget over policy disagreement. This year, they failed over childish bickering.

-

Mississippi Today6 days ago

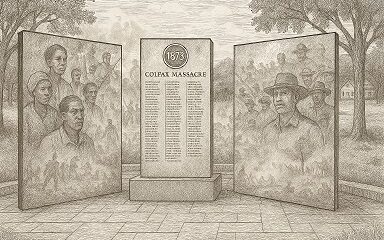

Mississippi Today6 days agoOn this day in 1873, La. courthouse scene of racial carnage

-

Local News7 days ago

Local News7 days agoAG Fitch and Children’s Advocacy Centers of Mississippi Announce Statewide Protocol for Child Abuse Response

-

Local News6 days ago

Local News6 days agoSouthern Miss Professor Inducted into U.S. Hydrographer Hall of Fame

-

News from the South - Alabama News Feed4 days ago

News from the South - Alabama News Feed4 days agoFoley man wins Race to the Finish as Kyle Larson gets first win of 2025 Xfinity Series at Bristol

-

Our Mississippi Home7 days ago

Our Mississippi Home7 days agoFood Chain Drama | Our Mississippi Home

-

News from the South - North Carolina News Feed7 days ago

News from the South - North Carolina News Feed7 days agoHelene: Renewed focus on health of North Carolina streams | North Carolina

-

News from the South - Alabama News Feed5 days ago

News from the South - Alabama News Feed5 days agoFederal appeals court upholds ruling against Alabama panhandling laws