Mississippi Today

Another Midwest drought is causing transportation headaches on the Mississippi River

For the third year in a row, extreme drought conditions in the Midwest are drawing down water levels on the Mississippi River, raising prices for companies that transport goods downstream and forcing governments and business owners to seek alternative solutions.

Extreme swings between drought and flooding have become more frequent in the region, scientists say, as climate change alters the planet’s weather patterns and inches the average global temperature continually upwards.

“Without question, it’s discouraging that we’re in year three of this. Because that is quite unique to have multiple years in a row of this,” said Mike Steenhoek, executive director of the Soy Transportation Coalition, a trade organization representing Midwest soy growers. “We’re obviously trending in the wrong direction.”

Since 2022, much of the Midwest has experienced some level of drought, with the driest conditions concentrated in Iowa, Missouri, Nebraska and Kansas. Record rainfall in June and during part of July temporarily broke that dry spell, forecasters say, only for drought conditions to reemerge in recent weeks along the Ohio River basin, which typically supplies more water to the Mississippi than any other major tributary.

Water levels have been dropping in the lower Mississippi since mid-July, federal data show, reaching nearly seven feet below the historic average in Memphis on Sept. 13. In October 2023, water levels reached a record-low -11 feet in Memphis. Remnants of Hurricane Francine, which made landfall in Louisiana Wednesday night as a Category 2 storm, “will provide only temporary relief,” the National Oceanic and Atmospheric Administration said in a news release Wednesday.

“Rainfall over the Ohio Valley is also not looking to be widespread and heavy enough to generate lasting effects and anticipate that much of the rainfall will soak into the ground with little runoff,” the agency said in the release.

At the Vicksburg, Mississippi, gauge, the river has dropped from 28 feet in July to just four feet on Sept. 13. For reference, the flood stage in Vicksburg is 43 feet. NOAA projects that the river level there will only climb up slightly, to about seven feet, over the next couple weeks.

Those conditions have raised prices for companies transporting fuel and grain down the Mississippi in recent weeks, as load restrictions force barge operators to limit their hauls, which squeezes their profit margin. Barge rates from St. Louis reached $24.62 a ton in late August and $27.49 per ton by the following week, according to the U.S. Department of Agriculture.

Steenhoek said barge prices during the first week of September were 8 percent higher than the same week last year and 57 percent higher than the three-year average. “It does change that supply demand relationship,” he said, “because now all of a sudden you’re having to transport a given amount of freight with less capacity.”

A river in flux

Aaron Wilson, Ohio’s state climatologist and a professor at Ohio State University, said the whiplash between this summer’s record wet months and September’s drought conditions appears to fit what could be an emerging climate trend observed by researchers.

The Midwest region has generally gotten wetter over the decades. The Fifth National Climate Assessment, released last year, reported that annual precipitation increased by 5 to 15 percent across much of the Midwest in the 30-year period leading up to 2021, compared to the average between 1901 and 1960.

But evidence also suggests the Midwest is experiencing more frequent swings between extreme wet and extreme dry seasons, with climate models predicting that the trend will persist into the future, said Wilson, who was the lead author of the assessment’s Midwest chapter.

“This was front and center for us,” he said. “One of the main things that we talked about were these rapid oscillations … between wet to dry and dry to wet extremes.”

Research also suggests that seasonal precipitation is trending in opposite directions, and will continue to do so in the coming decades, Wilson added. “And so what you get is too much water in the winter and spring and not enough during the growing season,” he said, referring to summer months.

If that evidence holds true, it could have notable impacts on U.S. food exports moving forward.

Future impacts on shipping

Transporting goods, including corn, soy and fuel, on the Mississippi is more efficient pound for pound than ground transportation, business groups say, and gives the U.S. an edge in a competitive global market. According to the Waterways Council, a trade association for businesses that use the Mississippi River, a standard 15-barge load is equivalent to 1,050 semi trucks or 216 train cars — meaning domestic farmers and other producers can save significant time and money moving their goods by boat.

The majority of U.S. agricultural exports rely on the Mississippi to reach the international market, as farmers move their crops to export hubs on the Gulf Coast, said Debra Calhoun, senior vice president of the Waterways Council. “More than 65 percent of our national agriculture products that are bound for export are moving on this inland waterway system,” she said. “So this system is critical to farmers of any size farm.”

The ramifications could be especially harmful to the soy industry, Steenhoek said, since about half of the soy grown in the U.S. is exported. By the last week of August, grain exports transported by barge fell 17 percent compared to the week before, according to a Thursday report released by the USDA.

Steenhoek said the increased costs to U.S. growers hurt their ability to compete globally. Any price increase to domestic grain could encourage international clients to instead buy from rival countries like Brazil or Argentina, he said.

While it’s typical for water levels on the Mississippi to drop during the fall months, Steenhoek said, the recent years of drought have been a real wakeup call for farmers to diversify their supply chains. Soy growers, he said, have since set up new supply chain agreements with rail lines and have even invested in new export terminals in Washington state and on the coast of Lake Michigan in Milwaukee.

Luckily, Calhoun said, disruptions to river transportation this year haven’t been nearly as bad as they were last year, when the Mississippi’s water levels reached record lows. Several barges were grounded last year and in 2022, she said, referring to when boats get stuck on the riverbed or in areas where sediment has built up. That hasn’t occurred so far this year.

She chalks that up to proactive efforts this year by companies and federal agencies, like the Army Corps of Engineers, to mitigate transportation disruptions.

George Stringham, chief of public affairs for the Corps’ St. Louis District, said they started dredging the river a few weeks earlier this year. “We started early to get ahead of things, in anticipation, after having two straight years of low water conditions,” said Stringham. Dredging involves moving sediment on the riverbed from areas where it can cause problems to boats to areas where it won’t.

Wilson, Ohio’s climatologist, said he has seen stronger cooperation among stakeholders in tackling this issue. “It’s a mix of climate scientists, social scientists and planners and emergency preparedness folks that are really coordinating this effort,” he said.

The result, Calhoun said, is that their coalition of groups have been able to handle the disruptions relatively well this year, which leaves her feeling cautiously optimistic. “It’s really hard, you know, to track this and try to figure out is it just normal? Is it getting much worse? Are we going to have to make significant changes, and if so, what would they be? But we’re not there yet,” she said.

This story is a product of the Mississippi River Basin Ag & Water Desk, an independent reporting network based at the University of Missouri in partnership with Report for America, with major funding from the Walton Family Foundation.

Missississippi Today environmental reporter Alex Rozier contributed to this report.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

Mississippi Today

Proposed legislation aims to protect Mississippi River fisheries

Proposed legislation aims to protect Mississippi River fisheries

A new congressional bill aims to improve fisheries and environmental quality in the Mississippi River basin with a federally funded commission.

“This is a bill that’s way past its due,” said U.S. Rep. Troy Carter Sr. D-Louisiana, who is co-sponsoring the Mississippi River Basin Fishery Commission Act of 2025 with U.S. Rep. Mike Ezell R-Mississippi. It was introduced Feb. 24 in the House Committee on Natural Resources.

The goal is to fund grants for habitat restoration, fisheries research and the mitigation of invasive species.

It aims to support the growth of the fishing industry throughout the basin, as well as reinforce partnerships between local, state and federal agencies involved in the management of the river and its tributaries. The commission would be federally funded, and draw down on federal dollars to support restoration projects and fisheries management.

“The Mississippi, a mighty, mighty estuary, is not only a major tool for moving commerce back and forth, but it’s also a place where people make a living, fishing on the river,” Carter said. “This bill endeavors to make sure that we are protecting that asset.”

While commercial fishing has declined in recent decades, and updated research is necessary to establish the exact value of recreational, commercial and subsistence fishing in the Mississippi River, one study valued it as a billion dollar industry.

“The Mississippi River Basin is not just a geographical feature — it’s the backbone of our economy, a provider of jobs, and a sanctuary for our nation’s anglers and wildlife,” Ezell said in a news release. “This commission will ensure we’re taking a proactive approach to conservation, management, and sustainability, securing this resource for generations to come. Healthy fisheries mean a stronger economy and better opportunities for those who depend on the river for their livelihoods. This is about securing our natural resources while supporting hardworking families.”

The river has long faced challenges, such as industrial and agricultural pollution, habitat destruction and prolific spread of invasive species. Part of the difficulty in addressing these problems comes from the sheer size of the basin, with its geography covering over a third of the continental United States.

“For decades, states have struggled to find dedicated resources to adequately manage large river species that cross many state, federal, and tribal jurisdictions,” Ben Batten, deputy director of Arkansas Game and Fish Commission and chair of the Mississippi Interstate Cooperative Resource Association, said in a press release.

Large river species, such as invasive carp, are a problem the new commission would address, building on the work of the interstate cooperative, a multistate, multi-agency organization formed in 1991 that has focused on reducing invasives. The four varieties of carp originating from Asia – silver carp, black carp, grass carp and bighead carp – have spread at alarming rates and harm existing fisheries.

Communication amongst the numerous jurisdictions in the basin — states, cities, towns and tribal entities — can be difficult. Collaborative groups encourage more cohesive policy between basin states, such as the Mississippi River Cities and Towns Initiative and the Upper Mississippi River Basin Association, and there have been efforts to pass a river compact.

The United States and Canada share a partnership through the Great Lakes Fishery Commission. The Mississippi River Basin Fishery Commission would be part of the Department of the Interior, and include other agencies, like the U.S. Geological Survey, Fish and Wildlife Service and Army Corps of Engineers.

Due in large part to a lack of standardized testing, and often limited resources, health experts and government agencies often offer conflicting advice as to whether fish from the Mississippi River are safe to eat. Fish advisories warning against consumption of fish in one area may not exist in neighboring states, varying from one side of the river to the other.

The bill authors request $1 million to launch the commission in 2026, then $30 million each year for the following three years

While many fish the Mississippi River for sport rather than to eat, some rely on the river as a source of food.

General health advice for eating fish caught from the Mississippi does exist, such as throwing back the biggest and fattiest fish, washing them before fileting, and broiling or grilling the catch to avoid certain pollutants.

Halle Parker and Mississippi Today contributed to this story. This story is a product of the Mississippi River Basin Ag & Water Desk, an independent reporting network based at the University of Missouri in partnership with Report for America, with major funding from the Walton Family Foundation.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

Mississippi Today

The 19th Explains: What parents need to know about the measles vaccine

The 19th Explains: What parents need to know about the measles vaccine

This story was originally reported by Barbara Rodriguez of The 19th. Meet Barbara and read more of their reporting on gender, politics and policy.

A measles outbreak involving more than 150 infected people in Texas has put a spotlight on the role of vaccines in treating preventable diseases — especially as childhood vaccination rates have declined for several years. A school-aged child who was not vaccinated and had no known underlying conditions died from the outbreak, according to Texas health officials.

Parents and caregivers, in particular mothers, make important health decisions for their families. Though it can impact people of different ages, measles is considered a childhood disease and unvaccinated children under 5 years old are among those who are most at risk for severe illness. Here’s what parents need to know about measles and vaccines.

What is measles? How serious is it?

Measles is a highly contagious airborne disease that spreads when an infected person breathes, coughs or sneezes. If you do not have immune protection from measles and you come into contact with a person who has been infected — or even if you enter a room where an infected person was in the previous two hours — it is highly likely you will get infected.

According to the American Academy of Pediatrics, symptoms for measles include:

- fever

- cough

- runny nose

- red, watery eyes

- a skin rash

Measles can make people very sick: 1 in 20 people get pneumonia; 1 to 3 in 1,000 people get brain swelling (encephalitis); and 1 in 1,000 people die. Children who are infected with measles typically stay home from school. And since symptoms can emerge over several weeks, parents could be out of work for a prolonged period of time to care for their child and keep them in isolation.

The recent death of a child who was infected with measles in Texas is the first measles death in the United States in a decade and the first measles death involving a child since 2003.

(Jan Sonnenmair/Getty Images)

How do you prevent measles?

Vaccination is the key to measles prevention. Routine childhood vaccination provides 97 percent protection from measles through the measles, mumps and rubella (MMR) vaccine. Following the childhood vaccination schedule, which is reviewed by multiple medical organizations, helps prevent hospitalization, long-term injuries and death.

Because the disease is so contagious, community protection from measles requires at least 95 percent immunity to prevent outbreaks.

How often do measles outbreaks happen in the United States?

The widespread use of vaccines has meant that measles has not been common in the United States — so much so that it was declared eliminated from the country in 2000.

That has changed as parents increasingly decline to vaccinate their children, with emerging instances of measles outbreaks, which involve three or more cases. In 2019, there was an uptick in measles cases, with a major outbreak reported in New York. In 2023, there were four outbreaks. In 2024, there were 16 outbreaks. Three months into 2025, there have been three outbreaks reported.

Measles still regularly occurs in many parts of the world, said Dr. Lori Handy, associate director of the Vaccine Education Center at Children’s Hospital of Philadelphia. There has always been a risk that an unvaccinated child in the United States could be infected with measles from an international traveler who enters the United States. But the risk is greater now amid lower vaccination rates in kindergarten-age children.

“As a parent, it’s important to update that framework — that this is no longer the rare, ‘international traveler brings measles back home to a highly vaccinated country.’ This is now people within our own country have measles, and we have an under-vaccinated population, and so we are likely to see more spread in more regions,” she said.

I am vaccinating my child according to the childhood vaccination schedule. How worried should I be about outbreaks?

It depends on the age of your child and whether they are old enough to get the MMR vaccine. The first dose is administered between 12 and 15 months old and is 93 percent effective against measles. The second dose, which is administered between 4 and 6 years old, can add an additional 4 percent of immunity.

If you and your family are fully vaccinated, you can go about your routine activities, according to Handy. If you are vaccinated but you have a young child who is not old enough to receive an MMR shot, you should make sure that the people around the child are vaccinated. People transmit measles to other people only when they are showing symptoms of the viral infection.

“A fully vaccinated parent has a very, very low risk of getting infected with the measles

virus, and therefore should not be a risk to their infant,” Dr. John Swartzberg, clinical professor emeritus at the UC Berkeley School of Public Health, said in an email.

It is important to be aware of outbreaks in your region. Handy said if you live in an outbreak area, be very cautious about bringing a young child who is not yet vaccinated to crowds — or avoid it if at all possible. If you find out your child has been exposed, immediately call their pediatrician to learn about post-exposure care that can be taken to prevent infection.

At a community level, ensure your friends and family are aware of outbreaks and the importance of vaccination to protect themselves, their children and their community.

(Jan Sonnenmair/Getty Images)

Can my child receive an MMR shot early?

Some children who are traveling abroad can get an MMR shot as early as six months old, but it could still require two doses later. Parents should consult their pediatrician.

Handy added that there can be unusual circumstances; she gave the example of a parent with an 11-month-old traveling into a state or region with an outbreak for a social event like a wedding. That child is on the cusp of being old enough to receive the first dose of the MMR vaccine and may be able to get the shot early even though they’re not traveling abroad.

“That’s kind of the one-on-one conversation families will have to have with their care provider,” she said.

Swartzberg said that the most important thing a parent can do is make sure everyone who lives in or visits their home is vaccinated against measles.

“If someone is ill with a respiratory infection in the household, they should wear an N95

mask and stay away from the infant,” he added.

Children who have received their first MMR shot can receive the second as early as 28 days after the first dose, which may be the best option for people who live in or travel to outbreak areas or are traveling internationally. Handy said a second MMR dose helps individuals who may not have responded to the first dose. About 7 out of 100 people do not become immune after one dose; the second dose brings this down to 3 out of 100.

Handy again recommends that parents talk to their pediatricians about the best course of action.

“Related to the immunization schedule, I think the most practical information that people should have is that the way it’s designed right now is to give your child the best protection at the earliest time we can safely give vaccines. And with that in mind, deviation from that should be the exception,” she said.

I’m an adult but I’m not sure about my vaccination status. How can I check if I’ve had the measles vaccine?

If you were born before 1957, you have immunity due to the natural spread occurring then. If you were born after 1957 and have access to your records, check these. Most individuals vaccinated after that time will be protected except for a group of people who received a certain type of vaccine prior to 1968. If you do not have access to your records, you can ask your doctor to check your immunity through bloodwork to see if you need a dose of the vaccine.

The MMR vaccine gives long-lasting protection. No booster is needed, including for parents of young children, said Dr. William Schaffner of Vanderbilt University.

“The vaccine is extraordinarily effective,” he said.

I’m pregnant. What should I know about measles?

To date, most adults have received the MMR vaccine. A person who did not get the vaccine during childhood should make a plan to get it before they become pregnant by at least a month. If they do not, they should wait until after their pregnancy because the MMR vaccine is a live virus vaccine.

(Jan Sonnenmair/Getty Images)

Amid the declining rates of childhood vaccination and the measles outbreak, how should I discuss this topic with my family, friends and community if I’m not sure about their vaccination status?

Handy said that while she hopes parents and others make decisions about vaccination based on the science and one-on-one conversations with their health care providers, she knows people can be convinced to get vaccines because of their social groups. She encourages parents to have honest conversations with fellow parents.

“Help people realize, ‘This is important to me. This is what I do,’” she said. “A lot of people have a lot of questions, and they kind of want to understand what’s socially normal here.”

Handy said parents can also direct fellow parents to medical professionals.

“Recommend they talk with their health care provider to figure out, ‘Where’d you get that information? And how is that helping or potentially harming your child?’” she said. “Because your health care provider is keeping up on all of the science behind vaccines and kind of can help with myths or questions.”

Schaffner also encouraged open conversations between parents, particularly those having play dates. His biggest concern is in outbreak regions for now.

“You’re entitled to ask those other moms or dads, for that matter: ‘If your Susie wants to play with my Johnny, is your Susie vaccinated?’” he said.

Department of Health and Human Services Secretary Robert F. Kennedy Jr. has a history of anti-vaccine activism that came up during his Senate confirmation hearings What has he said about the outbreak?

Kennedy’s political ascension as a one-time presidential candidate and now as the head of the federal health department comes from a platform of promising to “Make America Healthy Again” through policy that purports to address children’s health issues. The messaging has resonated with some parents, while others are skeptical given Kennedy’s lack of formal medical and science training and years of anti-vaccine activism.

During his first public remarks on the Texas outbreak, Kennedy said measles outbreaks are “not unusual” — a description that drew criticism from some health experts because the number of cases related to this outbreak is particularly high. Kennedy also did not mention vaccination.

A few days later, Kennedy posted an op-ed where he more clearly acknowledged the severity of the outbreak and the need for vaccination.

“Parents play a pivotal role in safeguarding their children’s health. All parents should consult with their healthcare providers to understand their options to get the MMR vaccine. The decision to vaccinate is a personal one. Vaccines not only protect individual children from measles, but also contribute to community immunity, protecting those who are unable to be vaccinated due to medical reasons.”

There is a lot of information being shared online about vaccines. Where can I get factual information?

Handy recommended that parents review information available on the Vaccine Education Center at Children’s Hospital of Philadelphia, which provides information on vaccine science, including its safety. She also noted the American Academy of Pediatrics has guides on vaccination, as does the American Academy of Family Physicians.

“Parents can look to those sites and see, where are those organizations potentially diverging from some other messaging in MAHA?” she said. “We really should be looking to those who have spent decades, if not centuries, protecting children and rely on that information.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

Mississippi Today

Latest Mississippi inmate to flee prison is another repeat escapee

Weeks after the escape of two men from separate Mississippi prisons, the search continues for a 71-year-old man convicted of capital murder who escaped the Mississippi State Penitentiary earlier in the week.

Nevin Whetstone, who is serving life for the 1983 murder of Loretta Darlene Steele in Lee County, was last seen Tuesday, prison officials said.

This is not the first time he has escaped incarceration. Whetstone received a one-year sentence for escaping from the Sunflower County Jail. He also tried to escape Parchman in 1988 with another man by climbing a fence behind a reception unit, according to the Associated Press.

A spokesperson for the Mississippi Department of Corrections declined to comment Wednesday about details of how Whetstone escaped, how prison staff discovered his absence and whether a lack of staffing was a contributing factor.

Staffing has been a problem at Parchman and across the state’s prisons for years. The agency’s 2023 annual report, the most recent published online, lists 275 filled security positions at Parchman, but 430 positions are authorized. That resulted in an inmate to staff ratio of 8.6.

Whetstone has been in prison since 1984 after pleading guilty. Because he was sentenced before July 1994, his life sentence is parole eligible.

In 2023, he was denied parole and given five years before he can be considered again, in 2028, according to an advocate who has worked with him. To date, Whetstone has been denied parole at least eight times. An MDOC spokesperson did not confirm whether Whetstone is parole eligible.

Whetstone has been housed in Unit 31, Parchman’s medical unit, according to prison records. The advocate added that he has used a walker, which an MDOC spokesperson declined to comment about.

Whetstone’s escape comes months after at least two prison escapes in December.

On Christmas Eve, Drew Johnson escaped the South Mississippi Correctional Facility and was found a day later in Greene County. The 33-year-old is serving a life sentence for murder, and after the escape he was moved to Walnut Grove Correctional Facility.

Gregory Trigg, sentenced to 61 years on nine counts including armed robbery, kidnapping and burglary committed in the Jackson metro area, escaped Parchman Dec. 9 and was found days later in Tulsa, Oklahoma. The 46-year-old was returned to prison and moved to Walnut Grove.

This year, a bill has been proposed to require local law enforcement and the Mississippi Bureau of Investigation to be immediately notified about any prison or jail escape and once the person is apprehended. The legislation awaits a vote by the Senate.

In the past decade, there have been at least 50 people in MDOC prisons and assigned to community work and restitution centers who have escaped, with a majority returned to custody afterward. About half of those escapes have been since 2020.

Whetstone is among those who have escaped Mississippi prisons more than once.

Trigg, who escaped last year, previously escaped from the Scott County Jail in 2017 while he was being held there on a court order, according to a MDOC news release from the time.

Former Parchman inmate Ryan Young, who fled from court in Meridian in December 2023, was arrested five days later in Texas.

He previously escaped the prison in 2017 with James Sanders. Young was found in Mound Bayou and Sanders was arrested in Arkansas. Not long after their return to prison, Sanders was moved to East Mississippi Correctional Facility, and Young went to Walnut Grove.

Michael Wilson, who is serving a life sentence for nine charges including two murders, escaped SMCI in 2018 and was found a day later on the Coast. Years later in 2022, he escaped the Central Mississippi Correctional Facility and was found in Harrison County. His convictions are in Harrison and Jackson counties.

“While understaffing has not been directly attributed to the July 5 escape, it could be a contributing factor that ultimately affects public safety,” MDOC said in a July 2018 statement following Wilson’s escape.

“The department is committed to finding ways to address the understaffing problem, but until the wages, the necessary security positions are restored, and working conditions of the correctional officers improve, the state correctional system will continue to be at a disadvantage in carrying out its public safety mission.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

-

News from the South - Louisiana News Feed1 day ago

News from the South - Louisiana News Feed1 day agoRemarkable Woman 2024: What Dawn Bradley-Fletcher has been up to over the year

-

News from the South - Florida News Feed5 days ago

News from the South - Florida News Feed5 days ago4 killed, 1 hurt in crash after car attempts to overtake another in Orange County, troopers say

-

News from the South - Oklahoma News Feed6 days ago

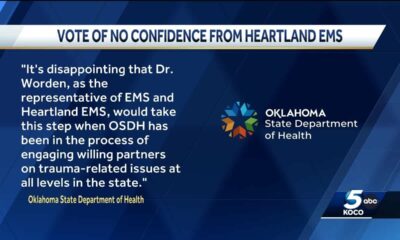

News from the South - Oklahoma News Feed6 days agoOklahoma Department State Department of Health hit with no confidence vote

-

News from the South - Virginia News Feed6 days ago

News from the South - Virginia News Feed6 days agoStorm chances Wednesday, rollercoaster temperatures this weekend

-

Mississippi Today5 days ago

Mississippi Today5 days agoJudge’s ruling gives Legislature permission to meet behind closed doors

-

News from the South - Arkansas News Feed6 days ago

News from the South - Arkansas News Feed6 days agoBeautiful grilling weather in Arkansas

-

News from the South - Virginia News Feed4 days ago

News from the South - Virginia News Feed4 days agoProbation ends in termination for Va. FEMA worker caught in mass layoffs

-

Kaiser Health News7 days ago

Kaiser Health News7 days agoA Runner Was Hit by a Car, Then by a Surprise Ambulance Bill