Mississippi Today

All 8 remaining playoff quarterbacks came through Manning academy

All 8 remaining playoff quarterbacks came through Manning academy

Question: What do all eight starting quarterbacks remaining in the NFL playoffs have in common, other than an intense spotlight shining on them this weekend?

Answer: While still in college, all eight worked as counselors in the Manning Passing Academy (MPA) in Thibodaux, La. Count ’em, eight: Dak Prescott, Dallas Cowboys; Trevor Lawrence, Jacksonville Jaguars; Jalen Hurts, Philadelphia Eagles; Brock Purdy, San Francisco 49ers; Daniel Jones, New York Giants; Joe Burrow, Cincinnati Bengals; Patrick Mahomes, Kansas City Chiefs; and Josh Allen Buffalo Bills.

Several of those, including Dak Prescott, were Manning campers before they became counselors later on.

“We’d love to take credit for all their success, but they were pretty good when we got them,” Archie Manning told Mississippi Today on Tuesday. Archie Manning and his sons Cooper, Peyton and Eli are all deeply involved in the camp, which is already sold out with a long waiting list for 2023.

Besides the eight quarterbacks, Kellen Moore, the coach who will call the Cowboys’ plays for Prescott, worked as an MPA counselor when he played at Boise State. Cincinnati Bengals head coach Zac Taylor was an MPA counselor in 2006 when he played at Nebraska.

What’s more, three of the four quarterbacks whose teams lost in the playoffs last weekend were also MPA counselors. The only outlier? Tom Brady.

Deadpanned Cooper Manning, “Tom just wasn’t good enough.”

The 26-year-old MPA welcomes approximately 1,200 campers each summer for four days of intensive instruction. Over the years, thousands of those campers have been Mississippians.

“We like to keep the coach/camper ratio at 10 to 1,” Archie Manning said. “So our coaching staff consists roughly of about 80 high school and college coaches and then about 40 counselors who are college quarterbacks.”

Many of the college quarterbacks, including Prescott, attended MPA multiple years. Philadelphia Eagles quarterback Jalen Hurts, a prime candidate for NFL MVP, was a three-year counselor, including two times when he was at Alabama and once when he was at Oklahoma.

“The portal has really changed things,” Archie Manning said. “When I was sending out invitations for our return counselors, 11 of 21 had changed schools.”

Asked if any of the counselor-turned-playoffs quarterbacks have surprised him, Archie Manning didn’t have to think long to answer. “It would have to be Brock Purdy,” Manning said. “I mean, my gosh, from last pick in the draft to doing what he’s doing right now in San Francisco. I knew he was pretty good, but this is something like Ole Miss getting the last bid to the NCAA Tournament and then going on to win the national championship.”

That’s exactly what happened with Ole Miss baseball last year. And Purdy, a rookie out of Iowa State, has quarterbacked the San Francisco 49ers to six straight victories since becoming a starter, throwing 16 touchdowns, just four interceptions. Purdy was a third string rookie before injuries to the top two 49ers quarterbacks elevated him to a starting role.

So, how did an Iowa State quarterback end up at a football camp in Thibodaux, La.? “I was flipping channels one Saturday and started watching an Iowa State game,” Archie Manning answered. “I just loved the way Brock played and made a note to invite him to the camp.”

Purdy accepted, as nearly all do. It has become almost like a badge of honor for college quarterbacks to be invited to be an MPA counselor.

Archie Manning says he stays in touch with all “our guys,” primarily with text messaging. “I congratulate them when they do well, and probably send as many or more notes when they have a bad game,” he said. “That’s the thing with quarterbacks. You’re going to have bad games. That’s the nature of it. You’re going to throw interceptions, and not all them will be your fault. Look at Dak in the last game of the regular season. I was so proud of him the way he came back in the playoffs Monday night.”

Prescott, Manning said, is one of his favorite quarterbacks to come through MPA. “Love Dak,” he said. “Love the way he plays, love his toughness, love the way he handles himself. Love everything about him.”

That doesn’t mean Archie and son Eli weren’t above playing a joke on Dak during one summer camp. “Papa John’s made us these bright red T-shirts for our counselors one year,” Archie Manning said. “Eli and I took the one for Dak and added some stripes to it and made it look like an Ole Miss game jersey.”

Prescott wore it – after removing the stripes.

Archie Manning recalls watching Trevor Lawrence in person for the first time at the MPA in 2019 when Lawrence was Clemson’s star quarterback. “What I remember is watching Trevor work out and throw and thinking, ‘This is what God drew up when he decided to make a perfect quarterback.’”

Cincinnati Bengals quarterback Joe Burrow was invited to MPA in the summer of 2019 just before his breakout National Championship season at LSU. Archie Manning also invited Amory native Jimmy Burrow, a college coach and Joe’s dad, to the camp that year.

“Jimmy wrote me a note the next week and told me how much they enjoyed it,” Archie Manning said. “He told me Joe told him on the way home that he believed he was the best quarterback at camp and he probably was. Joe has never lacked for confidence.”

“What I remember most about Joe, besides how good he was, was how his hair and his sunglasses had to be perfect,” Cooper Manning said. “Joe was always stylin’. Still is.”

One of the annual highlights of the camp is a Friday night throwing competition among the counselors. In 2017, the competition was delayed by a heavy rainstorm.

“Usually, in Thibodaux, when it rains like that there’s lots of lightning and they have to come off the field,” Archie Manning said. “That day, Josh Allen (then of Wyoming, now the Buffalo Bills) comes up to me in the locker room and says, ‘Mr. Manning, it’s not lightning. Let’s go out there and do this.’ Josh is so competitive. He couldn’t wait.

“So we go out there and it’s wet as can be, and I’ll never forget it. It’s hard to throw a wet ball because it gets slick and heavy, but Josh threw that thing like it was perfectly dry. I turned to Peyton and said, ‘Can you believe this guy?’ Peyton couldn’t believe it either. Never seen anybody throw a wet football like that.I always said Matt Stafford had the strongest arm I had ever seen, but then I saw Josh Allen throw it. Unbelievable.”

Cooper Manning concurs. “It was raining like crazy. Everything was soaked and wet. And there’s Josh, slinging it 80 yards.”

Of course, throwing at targets in shorts and t-shirts is not a good predictor or how someone will throw the football when the blitz is coming and huge, angry people are coming at you intent on rearranging your body parts.

Patrick Mahomes would be Exhibit A.

“I remember when Mahomes came,” Archie Manning said. “In the competition he was like just another guy. There were several who could throw it as well or better. When Pat really impresses is when he’s throwing on the move, improvising, extending plays. Nobody does it better. He just makes plays.”

Nine-time Pro Bowler Russell Wilson is another who attended MPA both as a camper and then a counselor. Wilson didn’t make the playoffs this year with the Denver Broncos, but Archie Manning well remembers when Wilson and the Seattle Seahawks trounced the Broncos and Peyton Manning in the 2014 Super Bowl. In fact, Archie remembers watching a mid-Super Bowl week TV interview with Wilson. “Russell was wearing a Manning Passing Academy t-shirt there at the Super Bowl,” Archie said. “That blew me away.”

Said Cooper Manning, “It has gotten to be almost like a fraternity, the guys who have been through MPA and are now some of the biggest stars in the sport. We’re proud of it, and we don’t take it for granted.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Mississippi Today

Speaker White wants Christmas tree projects bill included in special legislative session

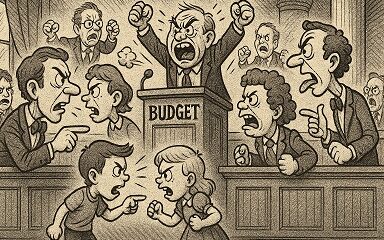

House Speaker Jason White sent a terse letter to Lt. Gov. Delbert Hosemann on Thursday, saying House leaders are frustrated with Senate leaders refusing to discuss a “Christmas tree” bill spending millions on special projects across the state.

The letter signals the two Republican leaders remain far apart on setting an overall $7 billion state budget. Bickering between the GOP leaders led to a stalemate and lawmakers ending their regular 2025 session without setting a budget. Gov. Tate Reeves plans to call them back into special session before the new budget year starts July 1 to avoid a shutdown, but wants them to have a budget mostly worked out before he does so.

White’s letter to Hosemann, which contains words in all capital letters that are underlined and italicized, said that the House wants to spend cash reserves on projects for state agencies, local communities, universities, colleges, and the Mississippi Department of Transportation.

“We believe the Senate position to NOT fund any local infrastructure projects is unreasonable,” White wrote.

The speaker in his letter noted that he and Hosemann had a meeting with the governor on Tuesday. Reeves, according to the letter, advised the two legislative leaders that if they couldn’t reach an agreement on how to disburse the surplus money, referred to as capital expense money, they should not spend any of it on infrastructure.

A spokesperson for Hosemann said the lieutenant governor has not yet reviewed the letter, and he was out of the office on Thursday working with a state agency.

“He is attending Good Friday services today, and will address any correspondence after the celebration of Easter,” the spokesperson said.

Hosemann has recently said the Legislature should set an austere budget in light of federal spending cuts coming from the Trump administration, and because state lawmakers this year passed a measure to eliminate the state income tax, the source of nearly a third of the state’s operating revenue.

Lawmakers spend capital expense money for multiple purposes, but the bulk of it — typically $200 million to $400 million a year — goes toward local projects, known as the Christmas Tree bill. Lawmakers jockey for a share of the spending for their home districts, in a process that has been called a political spoils system — areas with the most powerful lawmakers often get the largest share, not areas with the most needs. Legislative leaders often use the projects bill as either a carrot or stick to garner votes from rank and file legislators on other issues.

A Mississippi Today investigation last year revealed House Ways and Means Chairman Trey Lamar, a Republican from Sentobia, has steered tens of millions of dollars in Christmas tree spending to his district, including money to rebuild a road that runs by his north Mississippi home, renovate a nearby private country club golf course and to rebuild a tiny cul-de-sac that runs by a home he has in Jackson.

There is little oversight on how these funds are spent, and there is no requirement that lawmakers disburse the money in an equal manner or based on communities’ needs.

In the past, lawmakers borrowed money for Christmas tree bills. But state coffers have been full in recent years largely from federal pandemic aid spending, so the state has been spending its excess cash. White in his letter said the state has “ample funds” for a special projects bill.

“We, in the House, would like to sit down and have an agreement with our Senate counterparts on state agency Capital Expenditure spending AND local projects spending,” White wrote. “It is extremely important to our agencies and local governments. The ball is in your court, and the House awaits your response.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

Mississippi Today

Advocate: Election is the chance for Jackson to finally launch in the spirit of Blue Origin

Editor’s note: This essay is part of Mississippi Today Ideas, a platform for thoughtful Mississippians to share fact-based ideas about our state’s past, present and future. You can read more about the section here.

As the world recently watched the successful return of Blue Origin’s historic all-women crew from space, Jackson stands grounded. The city is still grappling with problems that no rocket can solve.

But the spirit of that mission — unity, courage and collective effort — can be applied right here in our capital city. Instead of launching away, it is time to launch together toward a more just, functioning and thriving Jackson.

The upcoming mayoral runoff election on April 22 provides such an opportunity, not just for a new administration, but for a new mindset. This isn’t about endorsements. It’s about engagement.

It’s a moment for the people of Jackson and Hinds County to take a long, honest look at ourselves and ask if we have shown up for our city and worked with elected officials, instead of remaining at odds with them.

It is time to vote again — this time with deeper understanding and shared responsibility. Jackson is in crisis — and crisis won’t wait.

According to the U.S. Census projections, Jackson is the fastest-shrinking city in the United States, losing nearly 4,000 residents in a single year. That kind of loss isn’t just about numbers. It’s about hope, resources, and people’s decision to give up rather than dig in.

Add to that the long-standing issues: a crippled water system, public safety concerns, economic decline and a sense of division that often pits neighbor against neighbor, party against party and race against race.

Mayor Chokwe Antar Lumumba has led through these storms, facing criticism for his handling of the water crisis, staffing issues and infrastructure delays. But did officials from the city, the county and the state truly collaborate with him or did they stand at a distance, waiting to assign blame?

On the flip side, his runoff opponent, state Sen. John Horhn, who has served for more than three decades, is now seeking to lead the very city he has represented from the Capitol. Voters should examine his legislative record and ask whether he used his influence to help stabilize the administration or only to position himself for this moment.

Blaming politicians is easy. Building cities is hard. And yet that is exactly what’s needed. Jackson’s future will not be secured by a mayor alone. It will take so many of Jackson’s residents — voters, business owners, faith leaders, students, retirees, parents and young people — to move this city forward. That’s the liftoff we need.

It is time to imagine Jackson as a capital city where clean, safe drinking water flows to every home — not just after lawsuits or emergencies, but through proactive maintenance and funding from city, state and federal partnerships. The involvement of the U.S. Environmental Protection Agency in the effort to improve the water system gives the city leverage.

Public safety must be a guarantee and includes prevention, not just response, with funding for community-based violence interruption programs, trauma services, youth job programs and reentry support. Other cities have done this and it’s working.

Education and workforce development are real priorities, preparing young people not just for diplomas but for meaningful careers. That means investing in public schools and in partnerships with HBCUs, trade programs and businesses rooted right here.

Additionally, city services — from trash collection to pothole repair — must be reliable, transparent and equitable, regardless of zip code or income. Seamless governance is possible when everyone is at the table.

Yes, democracy works because people show up. Not just to vote once, but to attend city council meetings, serve on boards, hold leaders accountable and help shape decisions about where resources go.

This election isn’t just about who gets the title of mayor. It’s about whether Jackson gets another chance at becoming the capital city Mississippi deserves — a place that leads by example and doesn’t lag behind.

The successful Blue Origin mission didn’t happen by chance. It took coordinated effort, diverse expertise and belief in what was possible. The same is true for this city.

We are not launching into space. But we can launch a new era marked by cooperation over conflict, and by sustained civic action over short-term outrage.

On April 22, go vote. Vote not just for a person, but for a path forward because Jackson deserves liftoff. It starts with us.

Pauline Rogers is a longtime advocate for criminal justice reform and the founder of the RECH Foundation, an organization dedicated to supporting formerly incarcerated individuals as they reintegrate into society. She is a Transformative Justice Fellow through The OpEd Project Public Voices Fellowship.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.![]()

Mississippi Today

On this day in 1959, students marched for integrated schools

April 18, 1959

About 26,000 students took part in the Youth March for Integrated Schools in Washington, D.C. They heard speeches by Martin Luther King Jr., A. Phillip Randolph and NAACP leader Roy Wilkins.

In advance of the march, false accusations were made that Communists had infiltrated the group. In response, the civil rights leaders put out a statement: “The sponsors of the March have not invited Communists or communist organizations. Nor have they invited members of the Ku Klux Klan or the White Citizens’ Council. We do not want the participation of these groups, nor of individuals or other organizations holding similar views.”

After the march, a delegation of students went to present their demands to President Eisenhower, only to be told by his deputy assistant that “the president is just as anxious as they are to see an America where discrimination does not exist, where equality of opportunity is available to all.”

King praised the students, saying, “In your great movement to organize a march for integrated schools, you have awakened on hundreds of campuses throughout the land a new spirit of social inquiry to the benefit of all Americans.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.![]()

-

Mississippi Today6 days ago

Mississippi Today6 days agoLawmakers used to fail passing a budget over policy disagreement. This year, they failed over childish bickering.

-

Mississippi Today6 days ago

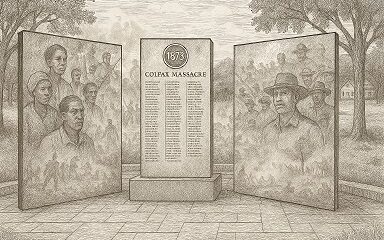

Mississippi Today6 days agoOn this day in 1873, La. courthouse scene of racial carnage

-

Local News7 days ago

Local News7 days agoAG Fitch and Children’s Advocacy Centers of Mississippi Announce Statewide Protocol for Child Abuse Response

-

Local News6 days ago

Local News6 days agoSouthern Miss Professor Inducted into U.S. Hydrographer Hall of Fame

-

News from the South - Alabama News Feed4 days ago

News from the South - Alabama News Feed4 days agoFoley man wins Race to the Finish as Kyle Larson gets first win of 2025 Xfinity Series at Bristol

-

Our Mississippi Home7 days ago

Our Mississippi Home7 days agoFood Chain Drama | Our Mississippi Home

-

News from the South - North Carolina News Feed7 days ago

News from the South - North Carolina News Feed7 days agoHelene: Renewed focus on health of North Carolina streams | North Carolina

-

News from the South - Alabama News Feed5 days ago

News from the South - Alabama News Feed5 days agoFederal appeals court upholds ruling against Alabama panhandling laws