News from the South - Missouri News Feed

After battery plant fire, southeast Missouri town alarmed about potential contamination

After battery plant fire, southeast Missouri town alarmed about potential contamination

by Allison Kite, Missouri Independent

February 17, 2025

FREDERICKTOWN — Jennifer Torr was at a coffee shop next door to the the Critical Mineral Recovery battery recycling plant when it caught fire in October, sending a tower of smoke into the air.

She had no idea when she and her husband, Darin, bought their blueberry farm a few miles north of town that the facility might one day pose a danger. But when she saw the building erupt in flames, she immediately thought, “we have to get out of this area.”

“I remember my husband and I getting in our vehicle and texting my kids, ‘You guys need to pack some bags,’” Torr said in an interview.

By the time they got back to the farm just over eight miles away, her family members were covering their faces to guard against the smell and fumes from the fire while they packed their car.

Since the fire, Torr and other residents have been organizing to bring their concerns to Madison County and state officials about the battery plant and a cobalt mine on the other side of town. Fredericktown lies at the heart of Missouri’s old Lead Belt. After generations of contamination from lead mining, residents worry now that battery development and recycling poses yet another health hazard.

“Will my grandchildren be sitting here and saying, ‘My grandma tried to stop this 60 years ago and now we’re all sick because nobody would listen?’” Kimi Royer asked her state legislator, Republican Rep. Dale Wright of Farmington, on a visit to Jefferson City earlier this month.

It took days for firefighters to fully extinguish the blaze at Critical Mineral Recovery, which recycled lithium-ion batteries. The facility opened at the edge of Fredericktown in 2023. Now, only its burnt husk remains.

Parts of Fredericktown were evacuated when the facility went up in flames, and families who lived across from the plant were displaced. Lawsuits filed by neighbors of the plant say the explosion caused respiratory problems and post-traumatic stress disorder and raised heavy metals levels in some residents’ blood.

Al Watkins, an attorney for Critical Mineral Recovery, said the company shares residents’ concerns about the effect of the fire on their health and property values.

At the opposite end of town, U.S. Strategic Metals hopes to mine cobalt, stirring fears of the kind of environmental contamination the community suffered from lead mining, which ended in the area in the 1960s.

Residents said in interviews earlier this month that they understand the need for the battery recycling plant and the mine. Cobalt is essential for battery production, and precious materials can be recovered from lithium-ion batteries.

“We’re not opposed to having this industry,” Torr said. “What we’re opposed to is having this placed in areas where they’re going to be next to people, communities where there’s schools and residential areas people are living.”

Melissa Vatterott, policy and strategy director for the Missouri Coalition for the Environment, has helped residents from the Fredericktown area push legislation at the Missouri Capitol that would require cobalt mines and battery plants be set back at least a mile from residential areas.

Vatterott noted communities, like Fredericktown, have seen adverse health effects from mining in the past.

“We should not be allowing more mining of a mineral for which the federal government has no standards for safe mining and make these same communities susceptible again to health harms,” she said.

The legislation would also require a permit for subsurface cobalt mining. The state currently requires land reclamation permits to mine minerals at the surface, but according to the Missouri Department of Natural Resources, the state doesn’t require a land reclamation permit for underground mining.

U.S. Strategic Metals mine has permits to govern wastewater discharges and mine waste.

“We want to make sure that if we’re going to be doing mining of some of these minerals, which we need to be doing, that we’re doing it responsibly,” said Democratic Rep. Eric Woods of Kansas City, the bill’s sponsor.

State Sen. Jamie Burger, a Republican who represents the communities near the mine and battery plant, is among the lawmakers who have heard concerns from the community about their safety.

“People were displaced from their homes, which is not good — ever,” Burger said. “…Then I also heard from people that want that to be rebuilt for job creation.”

Burger said he wanted to see what a one-mile setback would look like for the mine and battery plant. He said he thought the mining could be done in a safe manner and provide quality jobs for the area.

A new industry in town

For decades, lead mining was a pivotal industry for southeast Missouri. But it came at a high price.

Workers at mines across Madison County produced lead for more than 200 years, resulting in more than a dozen stacks of waste that has eroded and left lead in soil and water around the county. Contaminated soil was used for foundation bases, fill and topsoil, contaminating residents’ properties.

The entirety of Madison County is a Superfund site under cleanup by the U.S. Environmental Protection Agency.

Now, U.S. Strategic Metals hopes to mine cobalt at one of the old lead mine sites.

The mine, situated at the edge of Fredericktown, sits on what U.S. Strategic Metals says is one of the largest reserves of cobalt in North America. Cobalt, an essential component of lithium-ion batteries, can be detrimental to human health.

The EPA is reviewing whether cobalt and cobalt compounds might cause cancer. But inhaling cobalt particles can cause damage to the respiratory system, blood and the thyroid.

Aside from the impacts of cobalt, Fredericktown residents are worried about potential health impacts from stirring up the lead and other contaminants at the site.

GET THE MORNING HEADLINES.

“When something is in a Superfund, you don’t come in and dirty it up even more,” said Walter Schwartz, who lives near the mine, adding that he’s worried the mine will bring groundwater, soil and air pollution.

According to a request for a permit filed with the Missouri Department of Natural Resources, U.S. Strategic Metals hopes to build a plant to process materials from mining tailings, the leftover material from lead mining. Then, the company plans to mine fresh material from underground.

The Department of Natural Resources said it’s still waiting for further air quality information regarding cobalt from the company necessary to process the permit application.

The company did not return multiple requests for comment.

Residents near the mine have complained that following U.S. Strategic Metals’ takeover in 2018, blasts from the mine shook their homes, causing drywall and foundation damage.

Schwartz moved to the area in 2022 from Michigan and is turning it into his “sanctuary,” planting fruit trees and raising chickens in his backyard. When blasts from the mine started shaking his house, causing a shelf to fall from the wall, he became worried about his investment.

“I’m looking at a bleak future of pollution and property value running down,” he said.

The Department of Natural Resources said it had received complaints from area residents and referred them to the Missouri Department of Public Safety.

While U.S. Strategic Metals seeks a permit to expand, it’s facing accusations from the EPA of violating the Clean Water Act.

The agency sued in early 2024, accusing operators of the mine of allowing pollutants — including cobalt, copper, lead and nickel — to leave the site. The lawsuit, filed in U.S. District Court for the Eastern District of Missouri also accuses mine operators Environmental Operations Inc.; Missouri Cobalt LLC; and Missouri Mining Investments LLC, of allowing stormwater runoff to discharge through a channel not authorized by the site permit and into a nearby creek.

During an inspection by the Missouri Department of Natural Resources, the lawsuit says, officials saw muddy red water leaving the site and entering Goose Creek.

Lawyers for the mine did not return a request for comment.

Jonathan Klusmeyer, a spokesman for the Environmental Protection Agency, said the agency has identified metals contamination downstream of several mine waste sites in Madison County and is assessing potential cleanup strategies. He said the agency conducts free domestic well water testing for related contamination and provides alternate drinking water for affected residents.

The EPA, Klusmeyer said, does expect the return of mining operations to have an effect on the Superfund site because the operator will be required to work with the EPA and state on plans to recover critical minerals from capped mine waste. That will “prevent recontamination of the site, protect workers during the process, restore the caps and site drainage, test and verify the effectiveness of decontamination efforts and manage any generated residues,” Klusmeyer said.

After the fire

Critical Mineral Recovery was only open a year before it caught fire in October.

In a filing with the U.S. Securities and Exchange Commission, the company said it “anticipates rebuilding the facility with a significant expansion at the same location as the previously recycling facility on 32 acres of land in Fredericktown.”

But Critical Mineral Recovery’s attorney, Albert Watkins, said in an email that the “property at which the fire occurred will be rebuilt, but not for the same purpose as originally intended.”

“The significant expansion refers to the Fredericktown area, for which evaluation of options is under way,” Watkins said.

Wakins said the company shares residents’ concerns about the impact of the fire on their health and wants to rebuild “in a more remote location away from residences and schools and more densely populated areas.”

Following the fire, he said the company provided financial support to displaced families, but declined to say how much.

Royer has led efforts to get community members to urge county or state officials to adopt legislation to insulate Frederickstown from the effects of the mine and battery plant. She traveled to Jefferson City earlier this month to present a stack of signatures on a petition asking lawmakers to support legislation that would prohibit mining, refining, manufacturing or recycling certain minerals, including cobalt and lead, within one mile of residences, schools, wildlife refuges, surface water, state or federal parks or conservation areas.

Lawmakers from the area told The Independent they’re evaluating the community’s concerns.

Wright, the Republican state legislator from Farmington, said he thought a one-mile setback sounded “pretty reasonable.” He was seeking more information from the state on mining regulations and planned to speak with Woods, the bill’s sponsor, before committing to support it.

“We want to make sure that people are kept safe,” said state Sen. Mike Henderson, a Republican whose district reaches close to Fredericktown. “We also want to make sure we keep jobs in the community.”

Henderson said residents came to him concerned about safety and the air quality. He noted one resident had to evacuate with three small children.

“It’s not a good situation,” Henderson said. “No one’s trying to say it is. I think right now, we’re just trying to work our way through it to see what takes place from here.”

YOU MAKE OUR WORK POSSIBLE.

Missouri Independent is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Missouri Independent maintains editorial independence. Contact Editor Jason Hancock for questions: info@missouriindependent.com.

The post After battery plant fire, southeast Missouri town alarmed about potential contamination appeared first on missouriindependent.com

News from the South - Missouri News Feed

Remarkable Women: Ashley Swip honored for work with Three Little Birds 4 Life

SUMMARY: Ashley Swift has been honored as this year’s Remarkable Woman by Fox 2 in St. Louis for her impactful work with her nonprofit, Three Little Birds 4 Life, which she founded after her brother’s death from melanoma in 2010. The organization aims to support cancer patients and their families by providing meals and care packages, while also launching a new peer-to-peer mentoring program. Their major fundraising event, the Jam Down Rockets, will take place on April 11th in Edwardsville, Illinois. Proceeds will support their community center and enhance services for families in need. Individual and table tickets are available for the event.

Ashley Swip was honored as the 2015 Remarkable Woman for Fox 2 and St. Louis 11, celebrated for her work as the founder of Three Little Birds 4 Life.

The non-profit organization, inspired by Swip’s late brother Tyler, aims to grant wishes to young adults with cancer in the St. Louis area. Tyler’s battle with melanoma and his love for the Bob Marley song Three Little Birds inspired the creation of the organization, which seeks to provide hope and memorable experiences for those facing similar challenges.

News from the South - Missouri News Feed

Missouri House backs return to presidential primary

by Shane LaGesse, Missouri Independent

April 1, 2025

The Missouri House on Monday advanced legislation that would reinstate state-run presidential preference primaries and extend the no-excuse absentee voting period from two to six weeks.

Supporters of House Bill 126 cited a widespread positive response to the recently enacted no-excuse voting period as a motivating factor. They also noted negative feedback on the 2024 party-run caucuses, which replaced the state-run primaries after they were eliminated as part of a law passed in 2022.

The no-excuse absentee voting period has been in effect since August 2022 and allows voters to cast their ballot in elections in person or by mail starting two weeks before Election Day.

Supporters of the bill said they hoped that extending the no-excuse voting period would further alleviate stress on election workers and encourage voters to cast their ballot.

The state of Missouri ran March presidential primaries from 2000 until 2020. A 2022 law signed by former Gov. Mike Parson eliminated them. In 2024, the Republican Party held in-person caucuses in Missouri to select their delegates, while Democrats opted for a hybrid caucus with in-person voting and a mail-in ballot.

Low participation in these caucuses, alongside vocal blowback from residents who preferred the state-run primaries, were cited as motivators for reinstating the primaries.

“I believe it’s a lot simpler for our residents of our state going to cast a ballot like they do it in every other way for their preference for the presidential primary,” said state Rep. Brad Banderman, a Republican St. Clair.

Under the bill primaries would be held on the first Tuesday of March during presidential election years. The estimated cost to the state for conducting the primaries is $8 million.

The bill’s supporters also noted that unlike previous years, where the primary results have not been binding to party delegates, both political parties have agreed to adhere to the results for the first ballot at their respective party conventions.

The House needs to approve the legislation one more time before it heads to the Senate.

This story originally appeared in the Columbia Missourian. It can be republished in print or online.

Missouri Independent is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Missouri Independent maintains editorial independence. Contact Editor Jason Hancock for questions: info@missouriindependent.com.

The post Missouri House backs return to presidential primary appeared first on missouriindependent.com

News from the South - Missouri News Feed

Ballot language for Missouri anti-abortion amendment doesn’t mention abortion ban

by Anna Spoerre, Missouri Independent

March 31, 2025

A revamped constitutional amendment moving forward in the Missouri House would ban nearly all abortions in Missouri. But most voters likely wouldn’t know that just by reading the drafted ballot language.

The Republican-backed amendment, if passed out of the legislature and approved by voters, would outlaw abortion with limited exceptions for medical emergencies and survivors of rape and incest prior to 12 weeks gestation.

The amendment seeks to overturn an abortion-rights amendment approved by voters in November that legalize abortions up until the point of fetal viability. This made Missouri the first state to overturn an abortion ban after lawmakers enacted a trigger law in 2022 that banned the procedure with exceptions only for medical emergencies.

While the proposed ballot language would ask voters if they want to repeal Article I, Section 36 of the constitution —the current abortion-rights amendment — it does not directly ask voters if they want to ban or outlaw most abortions.

Instead, it would ask voters if they want to “guarantee access to care for medical emergencies, ectopic pregnancies, and miscarriages,” a right that is already guaranteed under the current constitutional amendment.

Missourians would also be asked if they want to “ensure women’s safety during abortion,” “ensure parental consent for minors,” allow abortions for medical emergencies, fetal anomalies, rape and incest” and “protect children from gender transitions.”

If approved by both the House and Senate, Missourians could be asked to weigh in on reinstating an abortion ban as soon as a special election the governor could call this year, or during the 2026 midterm election.

The legislation approved by a House committee Monday, is the second iteration of legislation filed by state Rep. Melanie Stinnett, a Republican from Springfield.

Stinnett’s initial language included a criticized police reporting requirement for survivors of sexual violence. Two out of every three sexual assaults are not reported to police, according to the Rape, Abuse and Incest National Network and the Bureau of Justice Statistics.

That requirement was removed in Monday’s version.

Missouri health department rejects Planned Parenthood plan to start medication abortions

On Thursday, House Speaker Jon Patterson, a Republican from Lee’s Summit, said while he anticipates the GOP will continue to refine the exact language to put before voters, he doesn’t foresee the rape and incest exceptions being cut out in later debate.

“That’s something that the people spoke on,” Patterson said. “That’s something that all the legislators recognize is something that we have to keep.”

The new legislation, like its predecessor, proposes a ban on gender-affirming health care for minors. It also seeks to reinstate state regulations on abortion providers and facilities, including admitting privileges at a local hospital, licensing requirements and inspections.

The amendment would allow abortions in cases of fetal anomaly, which the legislation defines as “a structural or functional abnormality in the unborn child’s gestational development that would make life outside the womb impossible.”

The bill specifies that this would include ectopic pregnancies but exclude a fetal diagnosis of a disability.

State Rep. Raychel Proudie, a Democrat from Ferguson, raised concerns with this language on Monday. She questioned how the amendment would apply to a fetal diagnosis where a newborn could survive birth, but would die shortly after, including in cases of anencephaly, a fetal birth defect in which part of the brain or skull don’t develop properly.

The new proposal also looks to require that any legal challenges to the state law around reproductive health care be heard in Cole County.

After the abortion-rights amendment passed in November, Planned Parenthood and the ACLU of Missouri sued the state, arguing several abortion regulations on the books were now unconstitutional. That case is being tried in Jackson County, where one of the state’s several Planned Parenthood clinics is located.

Missouri Attorney General Andrew Bailey has been unable to convince the judge to move the case to Cole County, where a judge last year attempted to remove the abortion-rights amendment from the ballot.

During Monday’s hearing, state Rep. Pattie Mansur, a Democrat from Kansas City, said she found it noteworthy that in Missouri, a 17-year-old girl could be legally married but would still need permission from her parents for an abortion.

The House Committee on Children and Families previously spent four hours debating the initial bill, including testimony from Missourians who accused lawmakers of attempting to overturn the will of the people.

Republicans have continued to defend their decision to spend much of the legislative session on an abortion amendment by arguing that Missourians were misinformed on what they were voting on in November — a reasoning that continues to draw fury from abortion-right supporters both in the legislature and in their districts.

“The most disappointing piece of that is the Republican’s consistent insistence on defying the will of the voters in this state,” House Minority Leader Ashley Aune, a Democrat from Kansas City, told reporters last week. “Whether it’s on abortion or paid sick leave and minimum wage, the first order of business this year has been to undo what Missourians went to the ballot box to vote for.”

Aune also took notice of how late into session the proposed amendment was making its way out of committee.

“It seems to me that the reason this has been slow rolled is that there simply is not consensus on the other side of the aisle on what language to end up with, how far to go or not, what they think that they can get passed by the voters or not,” Aune said Thursday. “That is likely causing a lot of contention in their caucus right now, and I’m not mad about that.”

But there didn’t seem to be much disagreement come Monday between GOP members of the House Committee on Children and Families who passed the revised language after just a few minutes of discussion.

“It was time to get this moving,” state Rep. Holly Jones, a Republican from Eureka who chairs the committee, told her colleagues Monday.

The Senate version of the legislation, sponsored by state Sen. Adam Schnelting, a Republican from St Charles, passed out of committee in early March but has yet to be heard on the Senate floor.

Abortion within the state remains out of reach for many Missourians, despite voters in November codifying the right to reproductive health care in the state constitution.

This includes the most common type of abortion. Medication abortions remain inaccessible through Planned Parenthood in Missouri after the state rejected complication plans submitted by the clinics outlining continued care for patients in the case they had any adverse effects from the medication.

The rejection notice sent by the Missouri Department of Health and Senior Services was based on criteria set in an emergency rule published Thursday by the Missouri Secretary of State’s Office that included a requirement that clinics must provide the names of any physicians who prescribe abortion medication.

In response, Planned Parenthood on Friday filed a motion asking that a Jackson County judge block the state statute that requires the clinics submit an abortion medication plan. As of Monday, three Planned Parenthood clinics — in Kansas City, Columbia and St. Louis — had started seeing some patients for procedural abortions again.

YOU MAKE OUR WORK POSSIBLE.

Missouri Independent is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Missouri Independent maintains editorial independence. Contact Editor Jason Hancock for questions: info@missouriindependent.com.

The post Ballot language for Missouri anti-abortion amendment doesn’t mention abortion ban appeared first on missouriindependent.com

-

News from the South - Florida News Feed6 days ago

News from the South - Florida News Feed6 days agoFamily mourns death of 10-year-old Xavier Williams

-

News from the South - Alabama News Feed7 days ago

News from the South - Alabama News Feed7 days ago1 Dead, Officer and Bystander Hurt in Shootout | March 25, 2025 | News 19 at 9 p.m.

-

News from the South - Alabama News Feed5 days ago

News from the South - Alabama News Feed5 days agoSevere storms will impact Alabama this weekend. Damaging winds, hail, and a tornado threat are al…

-

News from the South - Alabama News Feed4 days ago

News from the South - Alabama News Feed4 days agoUniversity of Alabama student detained by ICE moved to Louisiana

-

News from the South - Louisiana News Feed6 days ago

News from the South - Louisiana News Feed6 days agoSeafood testers find Shreveport restaurants deceiving customers with foreign shrimp

-

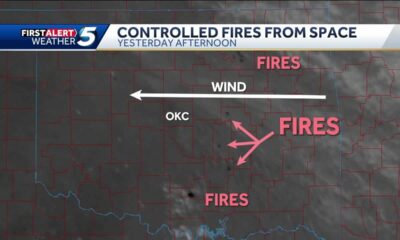

News from the South - Oklahoma News Feed3 days ago

News from the South - Oklahoma News Feed3 days agoTornado watch, severe thunderstorm warnings issued for Oklahoma

-

News from the South - Oklahoma News Feed6 days ago

News from the South - Oklahoma News Feed6 days agoWhy are Oklahomans smelling smoke Wednesday morning?

-

News from the South - West Virginia News Feed6 days ago

News from the South - West Virginia News Feed6 days agoRoane County Schools installing security film on windows to protect students