Mississippi Today

House passes $1.1 billion income tax elimination-gas and sales tax increase plan in bipartisan vote

A bill that phases out the state income tax, cuts the state grocery tax and raises sales taxes and gasoline taxes passed the House of Representatives with a bipartisan vote on Thursday.

House Bill 1 — authored by Republican Rep. Trey Lamar of Senatobia and other House leaders – passed 88-24 with only Democratic House members voting against it. It now goes to the Senate for consideration.

Nine House Democrats joined with the GOP majority to support the plan, and seven Democrats voted “present,” meaning they did not vote yes or no.

“A lot of my Republicans were speaking as one as a caucus that this is important to them and to their constituents,” House Speaker Jason White told reporters after the bill passed. “I think it’s a good, strong vote for us and it’ll be a strong position for me as speaker to advocate for its passage and advancement on the other (Senate) end of the building.”

The plan would over time cut about $1.1 billion from the state’s current $7 billion general fund money. Proponents say economic growth would cover the loss and not result in major cuts to government services or spending. Critics believe lawmakers should be cautious with long-term tax cuts and restructuring in the middle of an unstable economy, or oppose a shift to more “regressive” taxation that could hit lower income people harder.

The legislation would reduce the income tax rate from 4% to 3% next year. Then, it would reduce the rate by .3% each additional year until the tax is eliminated in 10 years.

The plan would add a 1.5% sales tax for local governments, unless they opt out, increasing the state’s net sales tax from 7% to 8.5%.

The plan would over a decade reduce the tax on unprepared food from 7% to 2.5%, but the new local sales tax would still be levied on food, for a net 4% grocery tax once fully enacted.

The sales taxes collected by counties would go toward local road maintenance.

Some Democratic members, including House Minority Leader Robert Johnson III of Natchez, raised concerns that the measure does not contain enough safeguards to ensure that state government funds all of its needs and that the sales tax hike would negatively impact poorer Mississippians.

“This is putting a burden on working people,” Johnson told Mississippi Today.

Democratic Rep. Omeria Scott of Laurel introduced an amendment to immediately cut the grocery tax, instead of gradually reducing it over time, but Republican members defeated the amendment.

The legislation also adds a new 5% tax on gasoline sales, which would go toward the Mississippi Department of Transportation’s budget for road and bridge infrastructure.

The tax is expected to generate $400 million a year. Currently, Mississippi has an 18.4 cents-a-gallon flat tax on gasoline — a flat rate no matter the cost of a gallon. Transportation leaders have for years said they need an indexed tax that would rise with the cost of gasoline in order to generate enough money to keep up road maintenance.

Using current average gasoline price in Mississippi of $2.62 a gallon, the proposed new tax would cost consumers 13 more cents a gallon.

Willie Simmons, a Democrat who is the central district transportation commissioner, and Brad White, executive director of the Mississippi Department of Transportation, in a joint statement thanked House leadership for having substantive discussions about infrastructure funding, though they didn’t specifically endorse the legislation.

“HB1 accomplishes a significant net tax cut for the people of Mississippi while still taking strides to make our transportation dollars both reliable and adequate,” the two transportation leaders said.

Both White and Lamar have said they believe Reeves supports the tax cut plan, but the governor’s office has not responded to questions about his stance on the House’s legislation.

Reeves in past years has opposed what he called “tax swaps,” tax cut proposals that sought to decrease the overall tax burden, yet raised another type of tax such as the latest House proposal. He’s also opposed past efforts to raise the gasoline tax.

Reeves, in 2021 notably opposed an effort led by Lamar and former House Speaker Philip Gunn that sought to eliminate the income tax and cut the sales tax on groceries in half while increasing the sales tax on other items by 2.5 cents on the dollar.

“I wouldn’t want to be a Republican that votes to increase taxes substantially for certain segments of the public,” Reeves said during a 2021 news conference. “… I personally support tax cuts, not tax swaps or tax transfers or tax increases … I don’t think we ought to sit here and pick and choose who to take money from. I think we ought to take less from everybody.”

Before Reeves can consider the proposal, though, it would have to pass the GOP-majority Senate which, in the past, has been more cautious with its tax cut plans and not agreed to totally abolish the income tax. In 2022 the chambers agreed and passed a large tax cut that is still being phased in.

Republican Lt. Gov. Delbert Hosemann, the Senate’s presiding officer, previously said he will push a plan this year that immediately lowers the state’s 7% sales tax on grocery items to 5% and trims the state’s 4% income tax down to 3% over the next four years, though no senator has yet introduced such a bill.

Speaker White told reporters that he was willing to negotiate with Senate leaders on a tax cut package, but his ultimate goal is to send legislation to Reeves that would abolish the income tax.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

Mississippi Today

IHL raises two presidents’ salaries

The presidents of the University of Southern Mississippi and Mississippi Valley State University received raises at the end of last year, according to meeting minutes from the Institutions of Higher Learning Board of Trustees’ November executive session.

The raises, which took effect earlier this month, appear to have been granted after trustees discussed the job performances of USM President Joe Paul and MVSU President Jerryl Briggs, minutes show.

“University presidents across the state and throughout the country are facing substantive challenges in an increasingly competitive environment, and it is important that good work in that environment is recognized and rewarded,” an IHL spokesperson wrote in a statement.

The third highest-paid college president in the state, Paul is now making $700,000 a year, a $50,000 raise over his previous salary, meeting minutes show. The raise came from the state-funded portion of Paul’s salary while the USM Foundation will continue to pay him an annual supplement of $200,000.

“I am thankful for the confidence and support of the IHL Board of Trustees, and I look forward to leading my alma mater for the next four years,” Paul said in a statement. “Meg and I have committed to contributing this salary increase and more to the USM Foundation and the Southern Miss Athletic Foundation over the time of my contract.”

Briggs will now make $310,000 a year, an increase of $10,000 in state funds. He will continue to receive a $5,000 supplement from the MVSU J.H. White Foundation. The IHL board renewed Briggs’ contract two years ago but did not grant him a raise.

“I am deeply grateful for the support of the IHL Board and our university community,” Briggs said in a statement. “At Mississippi Valley State University, we remain steadfast in our commitment to fiscal responsibility, fostering enrollment growth, and expanding access to higher education opportunities for individuals in the Mississippi Delta and beyond. Together, we are truly ‘In Motion!’”

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

Mississippi Today

On this day in 1931

Jan. 17, 1931

Born in Arkabutla, Mississippi, James Earl Jones moved to his grandparents’ farm in Michigan at age 5.

He had a stutter so severe, he hardly spoke. An English teacher realized his gift for writing poetry and had him recite poetry in front of the class, overcoming his stuttering.

At the University of Michigan, he was majoring in pre-med when he discovered drama. After training troops in the Korean War, he starred in “Othello” at the Ramsdell Theatre in Michigan. In 1967, he starred opposite actress Jane Alexander in “The Great White Hope,” loosely based on heavyweight champion Jack Johnson and society’s demand for a white boxer that would defeat Johnson. The play began at the Arena Stage in Washington, D.C., before moving to Broadway, where the play, Jones and Alexander all won Tonys. In the film adaptation, Jones won a Golden Globe and an Oscar nomination.

He went on to play Shakespeare on Broadway and win another Tony, three Emmys and an honorary Oscar prior to his 2024 death. The first celebrity guest on “Sesame Street,” he may be best known for providing the voice for Darth Vader in the Star Wars movies and for Mufasa in Disney’s “The Lion King.”

He saw the two biggest challenges to society as health and sanity. “I won’t say racism,” he said. “I say sanity because racism is a form of insanity.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

Mississippi Today

Supreme Court seems open to age checks for online porn, though some free-speech questions remain

WASHINGTON (AP) — The Supreme Court on Wednesday seemed open to a Texas law aimed at blocking kids from seeing online pornography, though the justices could still send it back to a lower court for more consideration of how the age verification measure affects adults’ free-speech rights.

Texas is among more than a dozen states with such laws aimed at blocking young children and teenagers from viewing pornography. The states argue the laws are necessary as online porn, including hardcore obscene material, has become almost instantaneous to access on smartphones online.

Chief Justice John Roberts, a member of the court’s conservative majority, raised similar concerns. “Technological access to pornography has exploded, right?” he said.

The Free Speech Coalition, an adult-entertainment industry trade group, says the Texas law wrongly affects adults by requiring them to submit personal identifying information online, making it vulnerable to hacking or tracking. The adult-content website Pornhub has stopped operating in several states, citing the technical and privacy hurdles in complying with the laws.

The Free Speech Coalition agrees that children shouldn’t be seeing pornography, but it argues the new law is so broadly written it could also apply to sexual education content or simulated sex scenes in movies.

The law also leaves a loophole by focusing on porn sites rather than the search engines often used to find porn, the group says in court documents. Content filtering is a better alternative to online age checks, it says.

Justice Amy Coney Barrett appeared skeptical, pointing to the growing number of ways kids can get online.

“Content filtering for all those different devices, I can say from personal experience, is difficult to keep up with,” said Barrett, who has seven children.

This isn’t the first time the Supreme Court has confronted the issue. In 1996, the court struck down parts of a law banning explicit material viewable by kids online. In 2004, a divided Supreme Court ruled against a different federal law aimed at stopping kids from being exposed to pornography but said less restrictive measures like content filtering are constitutional.

Texas argues that technology has improved significantly in the last 20 years, allowing online platforms to quickly and easily check users’ ages with a quick picture, making it more like ID checks at traditional stores that were upheld by the Supreme Court in the 1960s.

The states won in the 5th Circuit Court of Appeals, where a divided panel overturned a lower court and allowed the age verification requirement to go into effect. The Supreme Court previously refused an emergency appeal asking to put the age verification on hold while the legal fight continues.

Still, some of the nine justices worried that the lower court hadn’t applied a strict enough legal standard in determining whether the Texas law and others like that could run afoul of the First Amendment.

“How far can a state go in terms of burdening adults showing how old they are?” Justice Ketanji Brown Jackson asked.

Justice Elena Kagan raised the concerns of a possible “spillover dangers” on other laws touching on free speech, whichever way the court rules.

Some of the justices appeared interested in the Democratic Biden administration’s position that they should send the case back to the 5th Circuit for more consideration. The court could even say that such laws, when carefully written, could pass a higher standard since everyone agrees keeping porn away from kids is a worthy goal, said Principal Deputy Solicitor General Brian Fletcher.

Other states with similar laws include Tennessee, Arkansas, Indiana, Kansas, Louisiana, Mississippi, Montana, Oklahoma, Utah and Virginia.

The Texas law carries fines of up to $10,000 per violation that could be raised to up to $250,000 per violation by a minor.

The court is expected to decide the case by June.

Follow the AP’s coverage of the U.S. Supreme Court at https://apnews.com/hub/us-supreme-court.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.![]()

-

The Conversation3 days ago

The Conversation3 days agoVaccine hesitancy among pet owners is growing – a public health expert explains why that matters

-

News from the South - South Carolina News Feed5 days ago

News from the South - South Carolina News Feed5 days ago24 dead as fire crews try to corral Los Angeles blazes before winds return this week

-

News from the South - Georgia News Feed6 days ago

News from the South - Georgia News Feed6 days agoMAP: Emergency room visits for respiratory illnesses are soaring in these states

-

News from the South - Georgia News Feed5 days ago

News from the South - Georgia News Feed5 days ago16 dead, 16 missing as fire crews try to corral Los Angeles blazes before winds return this week

-

News from the South - Florida News Feed4 days ago

News from the South - Florida News Feed4 days agoAsian stocks follow Wall Street’s retreat, oil prices surge

-

News from the South - Texas News Feed5 days ago

News from the South - Texas News Feed5 days agoSurplus could fuel ‘life-changing decisions’ for Texans

-

News from the South - Florida News Feed2 days ago

News from the South - Florida News Feed2 days agoSpeaker Johnson removes chair of powerful House Intelligence Committee

-

News from the South - Florida News Feed4 days ago

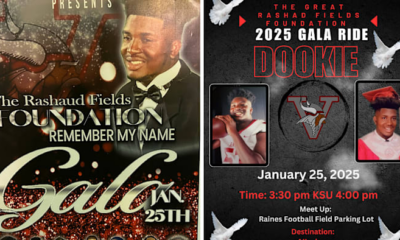

News from the South - Florida News Feed4 days agoMother of Jacksonville teen killed hours after high school graduation aims to keep his memory alive with special event