News from the South - Florida News Feed

Miami-Dade police officer involved in the Tyreek Hill incident identified | Quickcast

SUMMARY: In Miami, an internal investigation is ongoing regarding the police confrontation with Dolphins player Tyreek Hill, where he was forcibly removed from his car outside Hard Rock Stadium. Miami-Dade police identified Officer Danny Torres, who remains on administrative duties. Meanwhile, Miami Beach police are investigating a shooting incident on the Julia Tuttle Causeway, with a woman hospitalized in critical condition. Additionally, historic events include the first debate between Vice President Kamala Harris and former President Donald Trump, and SpaceX’s successful launch of the Polaris Dawn crew, aiming for record heights and commercial spacewalks.

In today’s Quickcast:

The Miami-Dade Police Department has identified one of the officers involved in the detainment of Miami Dolphins star receiver Tyreek Hill.

MDPD said, “Officer Danny Torres, 27-year tenure, remains in administrative duties, as the Internal Affairs investigation is still ongoing. We will provide further information once it becomes available pending the outcome of the investigation.”

Hill’s agent, Drew Rosenhaus, called for the officers involved to be fired.

“For me, personally, I believe the police officers that did that to Tyreek shouldn’t be in that position — they should be let go,” Rosenhaus told ESPN.

On Monday, the department released bodycam video of the officers detaining Hill.

The video shows a motorcycle police officer dragging Hill, 30, out of his black McLaren sports car by his arm and head and forcing him face-first onto the ground after Hill put up the window of his car during a traffic stop before Sunday’s game. A senior law enforcement source told CBS News Miami that Hill, a five-time All-Pro wide receiver, was stopped for reckless driving.

As the video shows, the altercation between the officers and Hill escalated quickly. The officers cursed at Hill but he did not resist their physical force or strike at them. He told one officer, “Don’t tell me what to do.”

Video shows that two motorcycle officers went after Hill after he appeared to speed past them in his car on the roadway entering Hard Rock Stadium in light traffic. They turned on their lights and pulled Hill over. One knocked on the driver’s window and told him to put it down, which Hill did and handed him his driver’s license.

“Don’t knock on my window like that,” Hill told the officer repeatedly.

“I have to knock to let you know I am here,” the officer told Hill while repeatedly asking why the player didn’t have his seatbelt on.

“Just give me my ticket, bro, so I can go. I am going to be late. Do what you gotta do,” Hill told the officer while putting his darkly tinted window back up.

“Keep your window down,” the officer told him, again tapping on the glass. Hill can still be seen inside.

Hill cracked the window and said, “Don’t tell me what to do.” He put the window back up. The officer again told Hill to put it back down or “I am going to get you out of the car. As a matter of fact, get out of the car.”

The officer then demanded Hill open the door. Another officer stepped up and said, “Get out of the car or I will break that … window,” using an obscenity.

The door opened and the second officer reached in and grabbed Hill by the arm and the back of the head as the player said, “I am getting out.”

The second officer forced Hill face-first onto the ground. Three officers pulled Hill’s arms behind his back as Hill yelled into his cell phone, “I am getting arrested, Drew.” He was speaking to the team’s director of security, Drew Brooks, who soon showed up at the scene. Drew Rosenhaus, his agent, also showed up.

The officers handcuffed Hill and one put a knee in the middle of his back. “If we tell you to do something, do it.”

“Take me to jail, brother, do what you gotta do,” Hill replied.

“We are,” an officer said.

“You crazy,” Hill said to the officer.

The officers then pull him to his feet as Hill said, “Why you beating on my window like you are all crazy for?”

The officers stood Hill up and walked him to the sidewalk. One officer told him to sit on the curb. Hill said to the officer he just had surgery on his knee.

An officer then jumped behind him and put a barhold around Hill’s upper chest or neck. He pulled Hill into a seating position.

Catch the Quickcast with Najahe Sherman weekdays at 4PM ET streaming on the CBS Miami app and CBSMiami.com

#florida #miami #miamidade #localnews #local #community #politicalnews

News from the South - Florida News Feed

St. Petersburg City Council votes to repair Tropicana Field’s roof | Florida

SUMMARY: The St. Petersburg City Council approved spending $55 million to repair Tropicana Field, including $26.3 million for roof replacement, after Hurricane Milton damaged it in October. Insurance and FEMA funds will cover some costs. However, Rays co-President Brian Auld doubts the repairs will be ready by 2026. The council delayed a vote on $333.5 million in bonds for a new $1.2 billion stadium, scheduled for 2028. The Rays argue the delay jeopardizes the project, having already spent $50 million. The team will play next season at George Steinbrenner Field in Tampa, paying $15 million to the Yankees.

The post St. Petersburg City Council votes to repair Tropicana Field’s roof | Florida appeared first on www.thecentersquare.com

News from the South - Florida News Feed

Holiday shopping scams to watch out for

SUMMARY: As holiday shopping increases, cybersecurity officials warn of a rise in online scams, particularly on social media. There has been a staggering 495% increase in scams related to Black Friday and Christmas shopping. Cybercriminals are exploiting fake websites and impersonating legitimate businesses to steal money and personal information, with electronics being the most targeted items. Artificial intelligence is enhancing the realism of scams, making them harder to identify. Experts advise consumers to be cautious, check seller history, and rely on credit cards over gift cards or cryptocurrencies for safer transactions.

Experts warn to watch out for holiday shopping scams.

News from the South - Florida News Feed

Pet Alliance begins construction on new Orlando shelter after devastating fire

SUMMARY: The Pet Alliance in Orlando is building a new shelter after the previous adoption center was destroyed by a fire in 2021. The new facility, located on South John Young Parkway, will feature 25,000 sq ft of indoor and outdoor spaces, including a state-of-the-art veterinary area. This new shelter will allow the organization to double its medical capacity, providing enhanced care for animals. The facility aims to quickly adopt out dogs and cats, typically within nine days, and will also help rescue animals from overcrowded shelters. This marks a major step forward for the Pet Alliance’s mission.

The Pet Alliance of Greater Orlando has broken ground on a state-of-the-art animal shelter, three years after a fire destroyed its original adoption center. The new facility, located along South John Young Parkway, will span 25,000 square feet and include indoor and outdoor spaces designed to enhance care for cats and dogs.

Subscribe to FOX 35 Orlando: https://bit.ly/3ACagaO

Watch FOX 35 Orlando LIVE newscasts: https://www.FOX35Orlando.com/live

Download FOX 35 news & weather apps: https://www.fox35orlando.com/apps

FOX 35 Orlando delivers breaking news, live events and press conferences, investigations, politics, entertainment, business news and local news stories and updates from Orlando, Orlando metro, and across Florida.

Watch more from FOX 35 on YouTube

Newest videos: https://www.youtube.com/myfoxorlando/videos

Most viewed/viral videos: https://www.youtube.com/watch?v=jgNn6rfByAM&list=PLzmRitN2dDZvlKw0C1IH3nLFGlbqgvp5C

We Love Florida: https://www.youtube.com/playlist?list=PLzmRitN2dDZuWecugac4QebPGp5-HZ5XP

Central Florida’s True Crime Files: https://www.youtube.com/watch?v=QAxwHLIeahA&list=PLzmRitN2dDZvk9zWypuHs9n38zuwnUSpx

More news stories: http://www.FOX35Orlando.com

Watch FOX 35 News live: https://fox35orlando.com/live

FOX 35 News newsletter: https://www.fox35orlando.com/email

Follow FOX 35 Orlando on Facebook: https://www.facebook.com/FOX35Orlando

Follow FOX 35 Orlando on Twitter: https://twitter.com/fox35orlando

Follow FOX 35 Orlando on Instagram: https://www.instagram.com/fox35orlando

-

Our Mississippi Home7 days ago

Our Mississippi Home7 days agoCreate Art from Molten Metal: Southern Miss Sculpture to Host Annual Interactive Iron Pour

-

Local News5 days ago

Local News5 days agoCelebrate the holidays in Ocean Springs with free, festive activities for the family

-

News from the South - Georgia News Feed6 days ago

News from the South - Georgia News Feed6 days ago'Hunting for females' | First day of trial in Laken Riley murder reveals evidence not seen yet

-

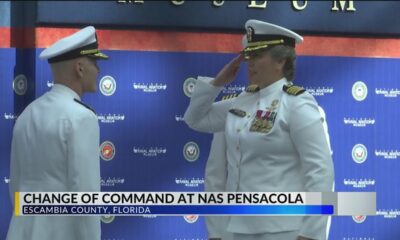

News from the South - Alabama News Feed6 days ago

News from the South - Alabama News Feed6 days agoFirst woman installed as commanding officer of NAS Pensacola

-

Kaiser Health News3 days ago

Kaiser Health News3 days agoA Closely Watched Trial Over Idaho’s Near-Total Abortion Ban Continues Tuesday

-

Mississippi Today5 days ago

Mississippi Today5 days agoOn this day in 1972

-

News from the South - Alabama News Feed2 days ago

News from the South - Alabama News Feed2 days agoTrial underway for Sheila Agee, the mother accused in deadly Home Depot shooting

-

News from the South - Alabama News Feed2 days ago

News from the South - Alabama News Feed2 days agoAlabama's weather forecast is getting colder, and a widespread frost and freeze is likely by the …