News from the South - Florida News Feed

Francine likely to become Cat 2 hurricane before landfall

SUMMARY: The Deep Tropics are seeing two notable areas of potential storm development, with one highlighted in red having a 70% chance of becoming a tropical storm within a week, potentially intensifying into a hurricane. Currently, Tropical Storm Francine has sustained winds of 65 mph and is expected to strengthen as it moves north, with forecasts predicting landfall as a Category 2 hurricane near New Orleans. The storm may bring significant rainfall of 15-25 inches and a storm surge of 5-10 feet. As the hurricane progresses, Florida’s rain chances will decrease, shifting moisture northward into Georgia.

Tropical Storm Francine formed in the Gulf of Mexico on Monday, and millions of people from Texas to Louisiana along parts of the U.S. Gulf Coast are bracing for a potentially life-threatening hurricane strike this week.

Get your tropical weather forecast each day during hurricane season from the FOX 35 Storm Team. We’ll issue a new hurricane update each day, and more frequently when needed.

Subscribe to FOX 35 News: https://www.youtube.com/channel/UCuXT13wiqK56NR7QSfDWpvg?sub_confirmation=1

More weather videos: https://www.youtube.com/playlist?list=PLzmRitN2dDZvVfv7Akm3yobzA3KU8d0Or

Tropical maps and models: https://www.fox35orlando.com/orlando-hurricane

Watch more FOX 35 News video: https://fox35orlando.com/

Watch FOX 35 News live: https://fox35orlando.com/live

Download our free FOX 35 Storm Team weather app: https://www.fox35orlando.com/apps

More FOX 35 weather coverage: https://www.fox35orlando.com/weather

Get our newsletter: https://www.fox35orlando.com/email

News from the South - Florida News Feed

How Trump’s mass deportation plans could impact Florida

SUMMARY: President-elect Donald Trump’s mass deportation plan, which aims to remove undocumented migrants, could significantly impact Florida. While Trump vows to begin deportations on day one, Florida’s state leaders, including House Speaker Daniel Perez and Senate President Ben Albritton, have stated that immigration policy is a federal issue, not within the state’s purview. Florida Democrats, like Rep. Marie Woodson, express concerns about the plan’s potential for racial profiling and economic disruption. With over 1 million undocumented residents in Florida, the deportations could hurt the state’s workforce, particularly in hospitality and construction, affecting local economies.

Donald Trump says his mass deportation plan is coming on his first day as president. It could have huge impacts on Florida’s hospitality, construction, and agriculture sectors.

News from the South - Florida News Feed

Florida man survives killer bee attack while trimming trees: 'Pain was just excruciating'

SUMMARY: In Brevard County, John Christian fell 30 feet from a crane after being attacked by killer bees, suffering over 100 stings. Allergic to bee venom, he described the pain as excruciating, likening it to being set on fire. Thankfully, he survived the fall and stings, thanks to the quick response of his employees, who rushed him to the hospital. A bee expert confirmed that the attack could have been fatal. Now recovering at home, John expresses gratitude for his team and plans to ensure their safety with protective gear during tree trimming. He advises avoiding swarming bees, as they can hide massive nests nearby.

A Brevard County man is recovering after a vicious killer bee attack. Jon Christian was trimming trees for work in Floral City when thousands came in for the kill. He owns Melbourne-based All Florida Land Services and travels across the state for jobs.

Subscribe to FOX 35 Orlando: https://bit.ly/3ACagaO

Watch FOX 35 Orlando LIVE newscasts: https://www.FOX35Orlando.com/live

Download FOX 35 news & weather apps: https://www.fox35orlando.com/apps

FOX 35 Orlando delivers breaking news, live events and press conferences, investigations, politics, entertainment, business news and local news stories and updates from Orlando, Orlando metro, and across Florida.

Watch more from FOX 35 on YouTube

Newest videos: https://www.youtube.com/myfoxorlando/videos

Most viewed/viral videos: https://www.youtube.com/watch?v=jgNn6rfByAM&list=PLzmRitN2dDZvlKw0C1IH3nLFGlbqgvp5C

We Love Florida: https://www.youtube.com/playlist?list=PLzmRitN2dDZuWecugac4QebPGp5-HZ5XP

Central Florida’s True Crime Files: https://www.youtube.com/watch?v=QAxwHLIeahA&list=PLzmRitN2dDZvk9zWypuHs9n38zuwnUSpx

More news stories: http://www.FOX35Orlando.com

Watch FOX 35 News live: https://fox35orlando.com/live

FOX 35 News newsletter: https://www.fox35orlando.com/email

Follow FOX 35 Orlando on Facebook: https://www.facebook.com/FOX35Orlando

Follow FOX 35 Orlando on Twitter: https://twitter.com/fox35orlando

Follow FOX 35 Orlando on Instagram: https://www.instagram.com/fox35orlando

News from the South - Florida News Feed

St. Petersburg City Council votes to repair Tropicana Field’s roof | Florida

SUMMARY: The St. Petersburg City Council approved spending $55 million to repair Tropicana Field, including $26.3 million for roof replacement, after Hurricane Milton damaged it in October. Insurance and FEMA funds will cover some costs. However, Rays co-President Brian Auld doubts the repairs will be ready by 2026. The council delayed a vote on $333.5 million in bonds for a new $1.2 billion stadium, scheduled for 2028. The Rays argue the delay jeopardizes the project, having already spent $50 million. The team will play next season at George Steinbrenner Field in Tampa, paying $15 million to the Yankees.

The post St. Petersburg City Council votes to repair Tropicana Field’s roof | Florida appeared first on www.thecentersquare.com

-

Local News6 days ago

Local News6 days agoCelebrate the holidays in Ocean Springs with free, festive activities for the family

-

News from the South - Georgia News Feed6 days ago

News from the South - Georgia News Feed6 days ago'Hunting for females' | First day of trial in Laken Riley murder reveals evidence not seen yet

-

News from the South - Alabama News Feed7 days ago

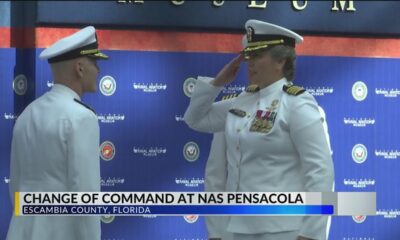

News from the South - Alabama News Feed7 days agoFirst woman installed as commanding officer of NAS Pensacola

-

Kaiser Health News4 days ago

Kaiser Health News4 days agoA Closely Watched Trial Over Idaho’s Near-Total Abortion Ban Continues Tuesday

-

Mississippi Today6 days ago

Mississippi Today6 days agoOn this day in 1972

-

News from the South - Alabama News Feed3 days ago

News from the South - Alabama News Feed3 days agoTrial underway for Sheila Agee, the mother accused in deadly Home Depot shooting

-

News from the South - Georgia News Feed2 days ago

News from the South - Georgia News Feed2 days agoJose Ibarra found guilty in murder of Laken Riley | FOX 5 News

-

News from the South - Alabama News Feed2 days ago

News from the South - Alabama News Feed2 days agoAlabama's weather forecast is getting colder, and a widespread frost and freeze is likely by the …