Mississippi News

Mississippi lawmakers reach deal to cut, but not eliminate income tax

Mississippi lawmakers reach deal to cut, but not eliminate income tax

House and Senate leaders reached agreement Saturday afternoon on a proposal that falls short of eliminating the income tax as Speaker Philip Gunn and Gov. Tate Reeves have demanded, but still provides the largest tax cut in state history.

While the plan does not eliminate the personal income tax as Gunn has tried to do for the past two years, he said the proposal was too good to pass up.

“This is the first step in income tax elimination, but it is a key first step,” said Gunn, adding he would continue to work for total elimination.

READ MORE: Another day, another tax cut proposal in Mississippi Legislature

The plan would immediately eliminate the 4% tax bracket starting in 2023 at a cost of about $185 million to the state budget and then over the next three years step down the remaining tax bracket from 5% to 4%. Under the plan, Gunn said the first $18,000 for a single tax filer will be exempt from taxation and the first $36,000 for a married couple.

The overall cost of the program to the state budget will be about $525 million annually when fully enacted.

“This tax cut is the largest in Mississippi’s history. It is also responsible,” said Lt. Gov. Delbert Hosemann, who presides over the Senate and has led the effort to prevent the complete elimination of the income tax this year. “Our constituents expect us to fund core government services in infrastructure, education, healthcare, and other areas. Our budget experts have assured us we can continue to do this and significantly ease the tax burden on hard-working Mississippians.”

House and Senate leaders have been at loggerheads about the scope of tax cuts during the 2022 legislative session. Gunn and his leadership team have been adamant that a plan should be passed during the ongoing session that is scheduled to end April 3 to phase out the state’s income tax that accounts for about one-third or nearly $2 billion in general fund revenue.

In recent days, Reeves has chimed in saying he would “do whatever it takes” to ensure that a plan is put in place this year to eliminate the income tax.

Against that backdrop and proclamations by Gunn and Reeves that the income tax elimination needed to be committed to this year, Saturday’s compromise came as a stunner.

“We have been talking about this for awhile,” said Senate Finance Chair Josh Harkins, R-Flowood. “It got to the point where there was a deadline.”

With an 8 p.m. Saturday deadline looming to reach agreement on a tax cut under the legislative rules, House and Senate negotiators announced a meeting Saturday afternoon where they unveiled the four-year plan to cut, but not eliminate the income tax.

The agreement does contain language saying it is the intent of legislators to look at the state’s revenue situation again by 2026 to see if additional tax cuts could be enacted.

House Ways and Means Chair Trey Lamar, R-Senatobia, said if state tax collections continue to grow, legislators could opt to continue cuts in the income tax and that it could be completely eliminated in 10 to 12 years.

But if legislators take no action, the tax rate will remain at 4%.

Gunn said he anticipates the governor will sign the legislation and, like, him continue to work to eliminate the income tax. When the plan is fully phased in, Gunn said Mississippi will have the 5th lowest marginal rate of the 41 states with a personal income tax.

The House and Senate are expected to vote on the plan as early as Sunday afternoon.

When fully enacted in four years, the plan will provide savings of $417 annually for a single tax filer earning $40,000 and $834 for a married couple earning $80,000, Gunn said.

Harkins called the plan historic. Harkins and Hosemann have opposed efforts to eliminate the personal income tax this year, but proposed cuts.

While the state has experienced unprecedented revenue collections, they pointed out state Economist Corey Miller has said much of that growth has been spurred by $35 billion in federal COVID-19 federal relief funds. They have said they opposed completion elimination during a time of economic uncertainty caused by multiple factors, including supply chain issues, inflation and Russia’s invasion of Ukraine.

Harkins said the issue of income tax elimination or additional cuts in the tax rate could be addressed in future years.

While leaders compromised on the tax cut plan, they still were working during the weekend to reach agreement on a state budget and the expenditure of $1.8 billion in federal COVID-19 relief funds.

Those federal funds are expected to be spent in multiple areas, including helping local governments with water and sewer needs and shoring up state agencies, such as the child foster care system, mental health facilities and prisons – all facing federal lawsuits or the possibility of federal lawsuits because of substandard conditions.

Because of those issues and other issues facing the state, such as the underfunding of education entities, some have argued that the state cannot afford a large tax cut despite the current revenue surplus.

Gunn said he is optimistic that the Legislature can pass a budget by Tuesday, clearing the way for the session to end on time by next weekend.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Mississippi News

Attorneys file motion to delay Jackson bribery trial

SUMMARY: In connection with the Jackson bribery scandal, attorneys for federal officials and local leaders filed a motion to postpone the trial to allow time for extensive evidence review, including hours of recordings and thousands of pages of documents. Key figures charged include Hinds County DA Jody Owens, Jackson Mayor Chokwe A. Lumumba, and Councilman Aaron Banks, each facing multiple counts of conspiracy related to bribery and fraud. The scandal involves alleged bribes amounting to over $80,000 related to a downtown development project, facilitated by individuals posing as real estate developers working with the FBI.

The post Attorneys file motion to delay Jackson bribery trial appeared first on www.wjtv.com

Mississippi News

Family of Dexter Wade rallies outside JPD nearly two years after his death

SUMMARY: Nearly two years after Dexter Wade’s death, his family continues seeking justice. On November 20, Dexter Wade Day was observed in Jackson, declared by Councilman Kenneth Stokes. Wade, hit by a Jackson police cruiser in March 2023, was later found in a pauper’s grave in Hinds County, and his mother, Bettersten Wade, was unaware of his death until August 2023. She believes his death was covered up. No arrests have been made, and authorities consider it an accident. Jackson Police Chief Joseph Wade expressed condolences and shared updates on new policies to prevent similar tragedies.

The post Family of Dexter Wade rallies outside JPD nearly two years after his death appeared first on www.wjtv.com

Mississippi News

Man shot while helping with stalled vehicle in Jackson

SUMMARY: A man was shot in Jackson, Mississippi, while attempting to assist a person with a stalled vehicle on State Street at Beasley Road around 4:00 p.m. on November 20. Detective Tommie Brown reported that the victim was working on the vehicle when the suspect approached, questioned him, and then opened fire. The assailant fled the scene in a vehicle. Fortunately, the victim sustained non-life-threatening injuries and was taken to a local hospital. The Jackson Police Department is seeking information about the incident and encourages anyone with details to contact them or Crime Stoppers.

The post Man shot while helping with stalled vehicle in Jackson appeared first on www.wjtv.com

-

Our Mississippi Home7 days ago

Our Mississippi Home7 days agoCreate Art from Molten Metal: Southern Miss Sculpture to Host Annual Interactive Iron Pour

-

Local News6 days ago

Local News6 days agoCelebrate the holidays in Ocean Springs with free, festive activities for the family

-

News from the South - Georgia News Feed6 days ago

News from the South - Georgia News Feed6 days ago'Hunting for females' | First day of trial in Laken Riley murder reveals evidence not seen yet

-

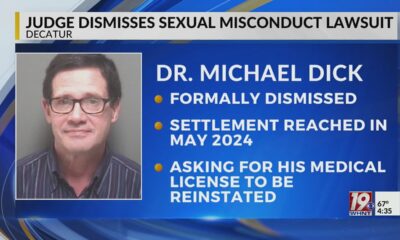

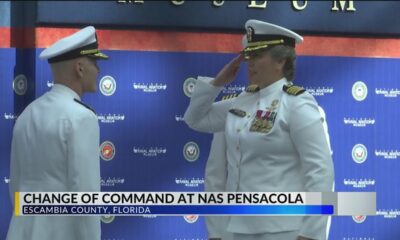

News from the South - Alabama News Feed6 days ago

News from the South - Alabama News Feed6 days agoFirst woman installed as commanding officer of NAS Pensacola

-

Kaiser Health News4 days ago

Kaiser Health News4 days agoA Closely Watched Trial Over Idaho’s Near-Total Abortion Ban Continues Tuesday

-

Mississippi Today6 days ago

Mississippi Today6 days agoOn this day in 1972

-

News from the South - Alabama News Feed2 days ago

News from the South - Alabama News Feed2 days agoTrial underway for Sheila Agee, the mother accused in deadly Home Depot shooting

-

News from the South - Alabama News Feed2 days ago

News from the South - Alabama News Feed2 days agoAlabama's weather forecast is getting colder, and a widespread frost and freeze is likely by the …