Mississippi News

5 things to know about the Great Mississippi Tax Cut Battle of 2022

5 things to know about the Great Mississippi Tax Cut Battle of 2022

An internecine Republican standoff over tax cuts has begun at the Mississippi Capitol, with a lot of other legislation likely to be held captive as the leadership in the House and Senate square off.

As the Senate this week sent the House an austere income tax cut plan, the House after two years of pushing to eliminate personal income taxes altogether was digging in on its position. This had lawmakers and lobbyists trying to nurse along other legislation fretting it would get killed or held hostage in the crossfire.

Republican House Speaker Philip Gunn wants a total state tax structure overhaul — a phase-out of the personal income tax coupled with an increase in sales taxes, a position championed by national and state conservative tax think tanks.

Republican Lt. Gov. Delbert Hosemann wants a more careful, measured tax cut. He says the House overhaul is foolhardy during uncertain, volatile economic times.

READ MORE: With Senate set to pass its income tax cut, House hasn’t budged on its desire for elimination

Here are five things to know about the Great Tax Cut Battle of 2022 (and a recap of the two plans is at the bottom of this story).

1. Some sort of income tax cut is inevitable

With the House and Senate so far apart in their tax cut plans, one might assume they’d just walk away and let the session end with no cuts and vow to try again next year.

But the realpolitik is, that’s very unlikely. Re-election time is right around the corner, and none of the state’s political leaders wants a failure to cut taxes hung around their necks on the campaign trail — especially in a Republican primary.

For starters, Republican Gov. Tate Reeves says he also wants the income tax eliminated, and he would very likely call lawmakers back into session on taxes. In fact, such a move would be in his political wheelhouse. He could force the issue, then take credit for getting the Legislature off the dime. Neither Gunn nor Hosemann would want that.

Also, Gunn really wants to eliminate the income tax — like, really, really wants it. It’s unclear whether he will seek another term as speaker (or maybe run for governor), and he views phasing out the income tax as his legacy. He’s even been confabbing with Reeves on it, despite their usually rocky political relationship.

Hosemann hasn’t appeared too fired up about a tax cut. He could probably take it or leave it, but Gunn and Reeves aren’t likely to let it go, and putting the tax cut genie back in the bottle would be nearly impossible politically in ruby red Mississippi.

2. What would a massive Mississippi tax cut do economically?

Nobody knows.

It would appear that Mississippi lawmakers don’t know what they don’t know when it comes to the effects of income tax cuts, in particular a complete elimination of the tax, or even what the future holds for the state and national economy.

For starters, no two studies or analyses — and at this point there have been quite a few — show the same outcome. Heck, sometimes even the same analysis shows different results. The House and Senate have ping-ponged back and forth with Legislative Budget Office, state economist and other analyses or modeling of income tax elimination. For a while, LBO or the economist would present numbers, one chamber or another wouldn’t like the prognostication, so they’d have them redo it with different numbers.

The results are clear: Income tax elimination would tank the state budget, or it wouldn’t. It would either bring GDP, job and population growth, or not.

It should be noted, however, that state legislative and budgeting leaders have been pretty bad at revenue predictions in recent years. Apparently, they’re particularly bad at predicting revenue during pandemics and volatile economies, like now. For the last two fiscal years, they’ve been about $1 billion off — on a roughly $6 billion budget — on revenue guesstimating. Some of that is intentional low-balling, but some of it is just being wrong. It’s great the state has “extra” money, but not so great that their revenue cipherin’ is so bad, particularly when they’re using it to plot a sea change in state tax structure and rates.

Proponents of phasing out Mississippi’s income tax say it will kick the economy into overdrive, like it’s done in other states. Except it’s never been done in another state.

Of the nine states that have no income tax, eight never had one to start with. Most of them have hefty oil and gas, tourism or other large revenue streams, or else they’ve got high sales or property taxes. Alaska is the only state to ever eliminate an existing income tax. It did so in the 1980s — in one fell swoop, not a phase-out — after the Trans-Alaska Pipeline System was completed and brought in billions of dollars of new revenue.

Other states in the mid-2000s either discussed or attempted to eliminate or drastically cut income taxes. But a debacle in Kansas doused that movement for a time and served as a cautionary tale of cutting taxes without cutting spending and banking on growth. But now other states, including West Virginia and Georgia, have been considering elimination of income taxes as many conservative think tanks promote the idea.

READ MORE: Kansas Republicans to Mississippi: Use us as a cautionary tale

3. The now-or-never tax cut argument

One of the most peculiar arguments about tax cuts, and the House elimination plan in particular, is that it’s now or never — Mississippi will never have this opportunity again.

Wait, what?

If a tax cut or elimination is truly doable and sustainable, and based on recurring revenue and sound economic policy, then it should be feasible — maybe even more feasible — next year. Or the next. Or the next.

Our full state coffers this year should be absolutely overflowing in subsequent years if revenue growth is not a one-off from the feds printing off trillions of dollars and if inflation is not going to eat our lunch. Maybe by then we’d have some, ahem, firmer revenue projections.

Some, including Gov. Reeves, argue that the future’s so bright, the House offsetting increase in sales taxes is unnecessary, we can just do away with income taxes and everything will be hunky dory. It should be noted that this would indicate an unusual acceptance by the state’s Republican leadership that the Democratic Washington administration and Congress will keep the economy percolating and inflation under control.

READ MORE: The Mississippi Republican income tax bet

The now-or-never argument would appear to be political — with an eye towards 2023 election — not fiscal.

One could argue that now might be the worst time in recent history to rework a state’s tax structure. We’re still in the midst of a global pandemic. The economy is distorted from trillions, with a T, of federal dollars being pumped in as stimulus. Inflation has spiked to a 40-year high and, oh yes, there’s a potential war brewing in Europe.

4. They’re cutting taxes, but not cutting spending

While Mississippi’s leaders are pushing tax cuts and arguing how big to make them, they’re not proposing any cut in spending of tax dollars.

It’s the opposite. The House and Senate have both passed measures at this point to spend hundreds of millions more a year on numerous programs and services. The largest so far is a more than $200 million a year teacher pay raise.

Senate leaders, including Hosemann, have noted this as another reason to keep tax cuts more modest. He notes Republicans have for years disparaged using “one-time” money for recurring expenses. He said the influx of money into the state budget is from Congress dumping trillions of federal dollars into the economy and “if ever there was one-time money in Mississippi, this is it.”

House leaders counter that the state economy was on the upswing before the pandemic and federal stimulus spending, and that state revenue almost never goes down. They say the state government can cut taxes and spend more.

5. There is some room for compromise

Lawmakers and political observers have noted the House and Senate appear leagues apart, perhaps too far to find compromise.

Gunn, Hosemann and their top lieutenants say there’s room for compromise — but they haven’t specified where that might be. Gunn has repeatedly said, “We’re not married to our plan,” but then he’s also made clear he’s pretty wedded to income tax elimination, not just cutting.

Both plans do include a cut in the sales tax on groceries. That’s one area the two could perhaps compromise. Both would cut the fee on car tags, but are drastically different there. The House would cut car tags in half, and subsidize the fees local governments have on tags (the bulk of the cost) with state tax dollars. The Senate plan would only cut the state general fund fee on tags, $5 for a new tag. It appears there could be room for negotiations there.

The Senate plan includes a one-time income tax rebate. This is a way lawmakers could ensure they’re not spending one-time money on a recurring expense. Perhaps the House could go along with such a plan.

The Senate plan raises no other taxes to offset its cuts. Reeves and others who otherwise support phasing out the income tax oppose raising other taxes. Perhaps the House would back off its sales tax increase?

But considering phase-out of the income tax appears to be a line in the sand for Gunn and the House, and perhaps Reeves, the amounts of exemptions could be lowered and phase-out extended. Instead of the House’s first-year exemptions on income tax of $40,000 for an individual and $80,000 for a couple could be lowered.

Also, one major sticking point appears to be the House’s “growth triggers” to phase out the tax after its initial cuts. It is set at 1.5% — meaning any revenue growth over 1.5% would be spent to buy down the income tax until it’s gone. Senate leaders argue this would not even cover inflation, which has averaged about 1.6% a year over many years and appears to be on a major upswing. That growth trigger could be raised, and/or the amount of growth going to eliminate the tax could be capped.

Or, the two could just agree on a plain-old tax cut, more along the lines of the Senate plan, but perhaps bigger. The House’s major talking point against the Senate plan is that it is a paltry cut that would only provide the average taxpayer a break of a couple of hundred dollars. They could agree to a larger cut, but given the Senate’s warnings that revenue could dip, inflation could skyrocket, etc., such a flat cut might be more risky along those terms.

A recap of the plans

The Senate’s tax cut plan would cost about $317 million a year, plus a one-time cost of $130 million. It would:

- Phase out the 4% state income tax bracket over four years. This would mean people would pay no state income tax on their first $26,600 of income, a savings of about $50 a year.

- Reduce the state grocery tax from 7% to 5%, starting in July.

- Provide up to a 5%, one-time income tax rebate in 2022 for those who paid taxes. The rebates would range from $100 to $1,000.

- Eliminate the state fee on car tags going into the general fund, which would be about $5 off the cost of a new tag, $3.75 for renewals.

The House’s $1.5 billion tax cut plan would:

- Eliminate taxes on the first $40,000 of income for an individual and $80,000 for a couple in 2023, saving individuals about $1,300 and couples about $2,600 a year.

- Phase out the income tax over the next decade or so, pending budget growth “triggers” of more than 1.5% a year are met.

- Increase the sales tax on most retail items from 7% to 8.5%, and cut the cost of car tags in half.

- Reduce the grocery tax eventually from 7% to 4%.

READ MORE: Inside the income tax cut battle between House and Senate leaders

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Mississippi News

Events happening this weekend in Mississippi: April 18-20

SUMMARY: This weekend (April 18-20), Mississippi offers a variety of events for all ages. In Jackson, enjoy Food Truck Friday, a jazz concert, free outdoor movie screenings, and multiple exhibitions including “Of Salt and Spirit” and “Hurricane Katrina: Mississippi Remembers.” For family fun, there’s an Easter Egg Hunt at the Ag Museum and “Bunnies & Butterflies” at MCM. Natchez features the Spring Pilgrimage, Lafayette’s 200th anniversary celebration, and a farmers market. In the Pine Belt, highlights include Live at Five, a Spring Candle-Making Workshop, and Easter events at the Hattiesburg Zoo. Don’t miss the Bluff City Block Party and more!

The post Events happening this weekend in Mississippi: April 18-20 appeared first on www.wjtv.com

Mississippi News

Events happening this weekend in Mississippi: April 11-13

SUMMARY: This weekend in Mississippi (April 11-13), enjoy a variety of events across the state. Highlights include the Eudora Welty Birthday Bash in Jackson, Trivia Night at the Mississippi Museum of Natural Science, and Boots & Bling Fundraiser in Natchez. For family fun, check out the Bunny Bonanza in Jackson or the Easter Egg Hunt in Clinton. The Natchez Concours d’Elegance Car Show and Stranger Than Fiction Film Festival offer cultural experiences, while the 12th Annual Dragon Boat Regatta in Ridgeland and the Hub City Classic Car Show in Hattiesburg provide exciting activities for all ages.

The post Events happening this weekend in Mississippi: April 11-13 appeared first on www.wjtv.com

Mississippi News

Ole Miss women get pair of double-doubles and roll to 83-65 March Madness win over Ball State

SUMMARY: Mississippi coach Yolett McPhee-McCuin found solace in returning to a different arena in Waco, Texas, following a disappointing previous tournament experience. The No. 5 seed Ole Miss Rebels redeemed themselves with an 83-65 victory over 12th-seeded Ball State in the NCAA Tournament’s first round. Starr Jacobs led the Rebels with 18 points and 11 rebounds, while Kennedy Todd-Williams and Madison Scott each scored 15 points. Ole Miss dominated rebounding, leading 52-32, and will face fourth-seeded Baylor next. Coach McPhee-McCuin noted the team’s evolution since their last visit and the significance of playing in Texas, where Jacobs feels at home.

The post Ole Miss women get pair of double-doubles and roll to 83-65 March Madness win over Ball State appeared first on www.wjtv.com

-

News from the South - Alabama News Feed6 days ago

News from the South - Alabama News Feed6 days agoFoley man wins Race to the Finish as Kyle Larson gets first win of 2025 Xfinity Series at Bristol

-

News from the South - Alabama News Feed7 days ago

News from the South - Alabama News Feed7 days agoFederal appeals court upholds ruling against Alabama panhandling laws

-

News from the South - Missouri News Feed4 days ago

News from the South - Missouri News Feed4 days agoDrivers brace for upcoming I-70 construction, slowdowns

-

News from the South - North Carolina News Feed6 days ago

News from the South - North Carolina News Feed6 days agoFDA warns about fake Ozempic, how to spot it

-

News from the South - Missouri News Feed6 days ago

News from the South - Missouri News Feed6 days agoAbandoned property causing issues in Pine Lawn, neighbor demands action

-

Mississippi Today4 days ago

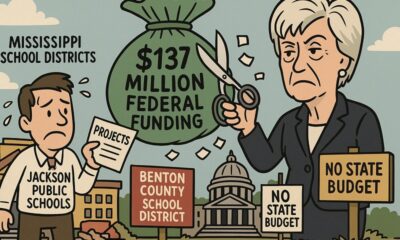

Mississippi Today4 days agoSee how much your Mississippi school district stands to lose in Trump’s federal funding freeze

-

News from the South - West Virginia News Feed7 days ago

News from the South - West Virginia News Feed7 days agoHeart disease survivor spends 15th birthday raising money for American Heart Association

-

News from the South - Virginia News Feed5 days ago

News from the South - Virginia News Feed5 days agoLieutenant governor race heats up with early fundraising surge | Virginia